India Herbal Supplement Market Size, Share, Trends and Forecast by Product, Form, Application, Distribution Channel, End User, and Region, 2025-2033

India Herbal Supplement Market Overview:

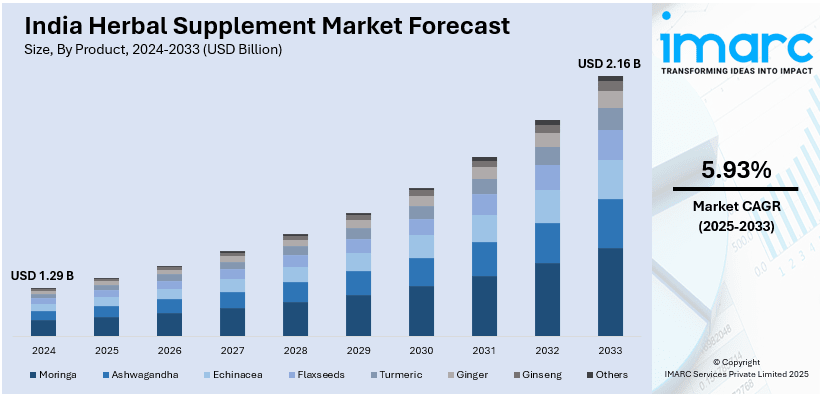

The India herbal supplement market size reached USD 1.29 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.16 Billion by 2033, exhibiting a growth rate (CAGR) of 5.93% during 2025-2033. The India herbal supplement market share is expanding, which can be primarily accredited to government initiatives, overall e-commerce growth, rising health awareness, and the growing geriatric population across India.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.29 Billion |

| Market Forecast in 2033 | USD 2.16 Billion |

| Market Growth Rate 2025-2033 | 5.93% |

India Herbal Supplement Market Trends:

Expanding Geriatric Population

Older adults are increasingly seeking natural remedies to manage age-related health issues, driving herbal supplement demand. With India’s senior population projected to reach 193.4 million by 2031, the need for effective wellness solutions is rising. Herbal supplements are preferred for their minimal side effects and long-term health benefits among aging individuals. Common concerns like joint pain, weak immunity, and cognitive decline are fueling greater adoption of herbal products. Ayurvedic formulations and traditional herbs like ashwagandha and ginseng are becoming a preferred choices for elderly consumers. Rising disposable incomes allow seniors to invest more in preventive healthcare solutions including herbal supplements. Government initiatives promoting herbal remedies are further increasing awareness and supporting the India herbal supplement market growth. Healthcare professionals are also recommending herbal products for elderly wellness and disease management. The shift toward holistic healing is encouraging older consumers to replace synthetic drugs with herbal alternatives. Manufacturers are developing age-specific formulations to cater to the unique health needs of senior citizens. The growing influence of Ayurveda and traditional medicine is strengthening consumer trust in herbal supplements.

To get more information on this market, Request Sample

Rising Number of E-commerce Platforms

The growth of e-commerce is major factor influencing the India herbal supplement market outlook by making products more accessible and convenient for customers. Online platforms are becoming as important sales channels, with the e-commerce sector in India expected to reach US$ 325 billion by 2030. These platforms successfully accommodate a variety of customer preferences by providing a large selection of herbal supplements. Digital marketplaces enhance customer trust in purchases by offering thorough product descriptions, reviews, and professional suggestions. Online buyers are increasingly buying herbal supplements again because of discounts, subscription plans, and loyalty schemes. Manufacturers may now approach consumers directly, cutting expenses, thanks to the growth of direct-to-consumer (D2C) brands. Online herbal supplement purchasing is becoming even more trustworthy thanks to quick delivery services and simple return policies. Customizing shopping experiences with mobile applications and AI-powered suggestions is boosting engagement and conversion rates. The accessibility of herbal supplements on well-known e-commerce sites is increasing market reach and brand awareness. Online sales of herbal supplements are being significantly boosted by influencer endorsements and social media marketing. By providing specialized, niche items, e-commerce allows smaller herbal enterprises to compete with larger businesses. The market is expanding as a result of online health and wellness awareness efforts that inform customers about the advantages of herbal supplements.

India Herbal Supplement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product, form, application, distribution channel, and end user.

Product Insights:

- Moringa

- Ashwagandha

- Echinacea

- Flaxseeds

- Turmeric

- Ginger

- Ginseng

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes moringa, ashwagandha, echinacea, flaxseeds, turmeric, ginger, ginseng, and others.

Form Insights:

- Tablets

- Capsules

- Soft Gels

- Liquid

- Powder and Granules

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes tablets, capsules, soft gels, liquid, powder and granules.

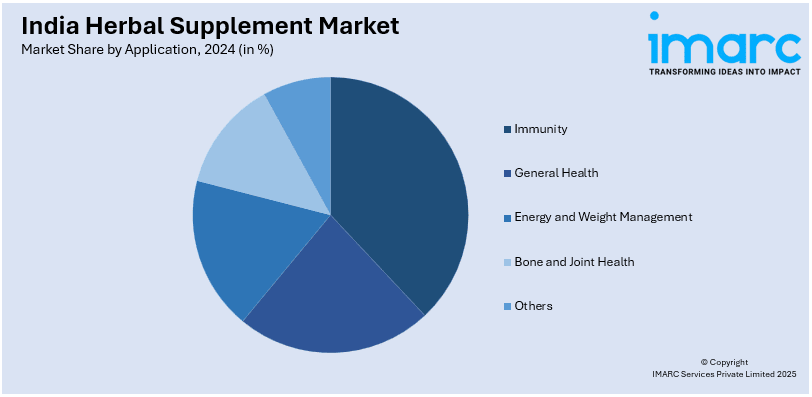

Application Insights:

- Immunity

- General Health

- Energy and Weight Management

- Bone and Joint Health

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes immunity, general health, energy and weight management, bone and joint health, and others.

Distribution Channel Insights:

- Pharmacies and Drug Stores

- Online

- Supermarkets and Hypermarkets

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes pharmacies and drug stores, online, supermarkets and hypermarkets, and others.

End User Insights:

- Adult

- Geriatric

- Pregnant Females

- Children

- Infants

The report has provided a detailed breakup and analysis of the market based on the end user. This includes adult, geriatric, pregnant females, children, and infants.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Herbal Supplement Market News:

- In March 2025, Steadfast Nutrition introduced a Shilajit supplement blending Himalayan-sourced shilajit, 24K gold, and Ayurvedic herbs like ashwagandha, kali musli, and gokhru. Each serving delivers 850 mg of shilajit, 60 mg of ashwagandha, 45 mg of kali musli and gokhru, and 0.2 mg of gold. Designed to boost vitality, energy, and fitness, it aligns with rising demand for natural health solutions.

- In August 2024, Denzour Nutrition, expanded into herbal nutraceuticals for wellness. Moving beyond sports supplements, it now offers Beetroot Extract, Denz-Oxy, Sleep-Denz, Moringa, Ashwagandha, and Nano Curcumin. Committed to organic, ethically sourced ingredients, it follows FSSAI standards, reflecting India’s rising demand for natural, plant-based health solutions.

India Herbal Supplement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Moringa, Ashwagandha, Echinacea, Flaxseeds, Turmeric, Ginger, Ginseng, Others |

| Forms Covered | Tablets, Capsules, Soft Gels, Liquid, Powder and Granules |

| Applications Covered | Immunity, General Health, Energy and Weight Management, Bone and Joint Health, Others |

| Distribution Channels Covered | Pharmacies and Drug Stores, Online, Supermarkets and Hypermarkets, Others |

| End Users Covered | Adult, Geriatric, Pregnant Females, Children, Infants |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India herbal supplement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India herbal supplement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India herbal supplement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The herbal supplement market in India was valued at USD 1.29 Billion in 2024.

The India herbal supplement market is projected to exhibit a CAGR of 5.93% during 2025-2033, reaching a value of USD 2.16 Billion by 2033.

The India herbal supplement market is driven by increasing health consciousness, a strong traditional medicine heritage (Ayurveda), rising disposable incomes, and the growing prevalence of lifestyle diseases. The expanding e-commerce sector further boosts product accessibility and consumer reach.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)