India High-Capacity Inverter Market Size, Share, Trends and Forecast by Type, Phase, Power Rating, Application, and Region, 2025-2033

India High-Capacity Inverter Market Overview:

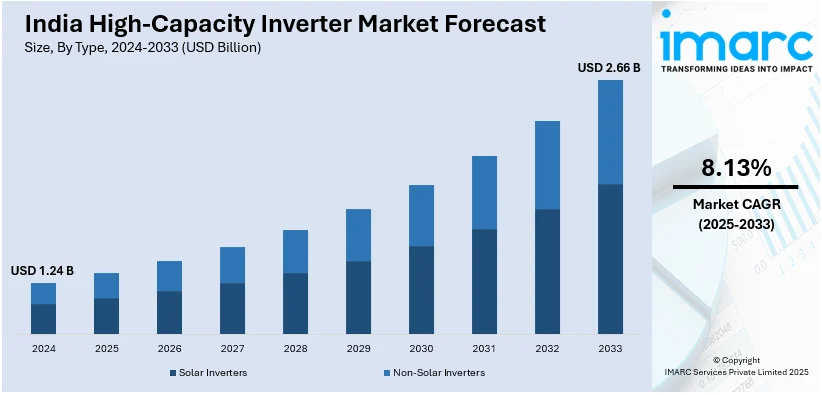

The India high-capacity inverter market size reached USD 1.24 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.66 Billion by 2033, exhibiting a growth rate (CAGR) of 8.13% during 2025-2033. The India high-capacity inverter market share is expanding, driven by the rising shift towards solar and wind power for electricity, along with the growing reliance of businesses on digital operations, cloud computing, and big data storage.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.24 Billion |

| Market Forecast in 2033 | USD 2.66 Billion |

| Market Growth Rate 2025-2033 | 8.13% |

India High-Capacity Inverter Market Trends:

Rising employment of renewable energy

The growing employment of renewable energy is offering a favorable India high-capacity inverter market outlook. With rising concerns over energy security and environmental sustainability, the government and private sector are investing heavily in renewable energy projects, creating the need for efficient power conversion systems. According to the information provided on the official website of the Press Information Bureau, from April to November 2024, India increased its renewable energy capacity by nearly 15 GW, which was nearly twice the 7.57 GW added in the same timeframe in 2023. As India seeks to enhance its renewable energy production, large-scale solar farms and industrial installations are becoming more popular, promoting the utilization of modern inverters. High-capacity inverters help to transform solar and wind energy into usable electricity, ensuring a reliable power supply. Furthermore, the growing electricity costs and frequent power outages are motivating businesses and people to invest in backup energy solutions, increasing high-capacity inverter sales. Inverter systems are becoming more appealing for renewable energy applications, as technology advances, including improved efficiency, remote monitoring, and seamless grid connectivity. The ongoing transition to electric mobility, coupled with the strong demand for dependable power storage solutions, is contributing to the market growth.

To get more information on this market, Request Sample

Expansion of data centers

The expansion of data centers is fueling the India high-capacity inverter market growth. Data centers require a stable and uninterrupted power supply to prevent downtime, making high-capacity inverters essential for managing power fluctuations and backup energy needs. With increasing investments in the information technology (IT) and telecom sectors, more companies are setting up large-scale data centers across India, driving the demand for efficient energy solutions. In February 2025, CtrlS Datacentres unveiled a new data center worth INR 4,000 Crore in Chennai, marking the company's fifth hyperscale facility in India. The plant was expected to draw around INR 50,000 Crore in indirect funding. It possessed a total IT load capacity of 72 MW. As these facilities utilize massive amounts of electricity, high-capacity inverters help to optimize power usage and reduce operational costs. Additionally, the rise of artificial intelligence (AI), 5G networks, and the Internet of Things (IoT) applications is creating the need for advanced data storage infrastructure, further promoting the usage of high-capacity inverters. Government initiatives promoting digitalization and smart city projects are also contributing to the broadening of data centers, offering more lucrative growth opportunities to inverter manufacturers. With frequent power outages and voltage fluctuations in various parts of India, businesses are wagering on robust backup solutions to ensure seamless operations.

India High-Capacity Inverter Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, phase, power rating, and application.

Type Insights:

- Solar Inverters

- Non-Solar Inverters

The report has provided a detailed breakup and analysis of the market based on the type. This includes solar inverters and non-solar inverters.

Phase Insights:

- Single-phase Inverters

- Three-phase Inverters

A detailed breakup and analysis of the market based on the phase have also been provided in the report. This includes single-phase inverters and three-phase inverters.

Power Rating Insights:

- Low-power Inverters

- Medium-power Inverters

- High-power Inverters

The report has provided a detailed breakup and analysis of the market based on the power rating. This includes low-power inverters, medium-power inverters, and high-power inverters.

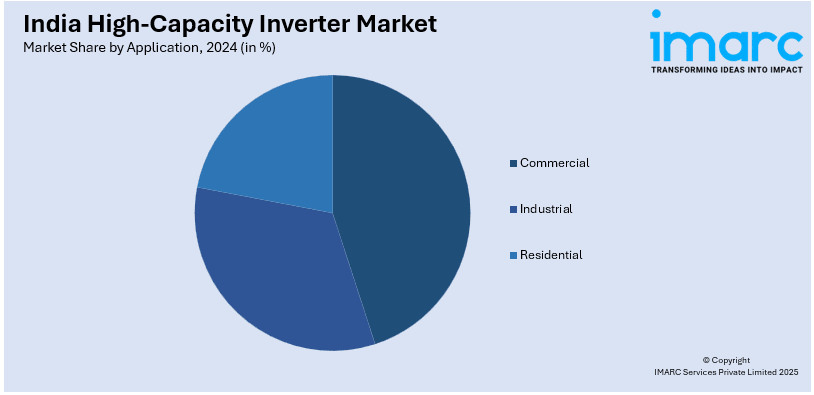

Application Insights:

- Commercial

- Industrial

- Residential

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, industrial, and residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India High-Capacity Inverter Market News:

- In October 2024, Power N Sun and Solplanet launched their latest Solplanet 350 kW string inverter ASW350K-HT at the ‘Renewable Energy India (REI) 2024’ event held in Greater Noida, India. The product inculcated superior reliability and dependability designed for extensive solar project setups. It emphasized cutting-edge technology created for high efficiency and dependability in big solar projects.

- In May 2023, Luminous Power Technologies introduced a new line of high-capacity inverters and icons in India. The high-capacity inverter was a silent efficient inverter and was intended to serve commercial spaces like offices, educational institutions, and restaurants, where loads exceeding 2KVA were required. The new products were promoted through the company's wide dealer network throughout the country.

India High-Capacity Inverter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solar Inverters, Non-Solar Inverters |

| Phases Covered | Single-phase Inverters, Three-phase Inverters |

| Power Ratings Covered | Low-power Inverters, Medium-power Inverters, High-power Inverters |

| Applications Covered | Commercial, Industrial, Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India high-capacity inverter market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India high-capacity inverter market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India high-capacity inverter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The high-capacity inverter market in India was valued at USD 1.24 Billion in 2024.

The India high-capacity inverter market is projected to exhibit a CAGR of 8.13% during 2025-2033, reaching a value of USD 2.66 Billion by 2033.

The India high-capacity inverter market is driven by rising power demand, increasing frequency of grid outages, and growth in commercial infrastructure. Government initiatives promoting renewable energy integration and advancements in inverter technology also contribute to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)