India Home Automation Systems Market Size, Share, Trends and Forecast by Application, Type, and Region, 2025-2033

India Home Automation Systems Market Overview:

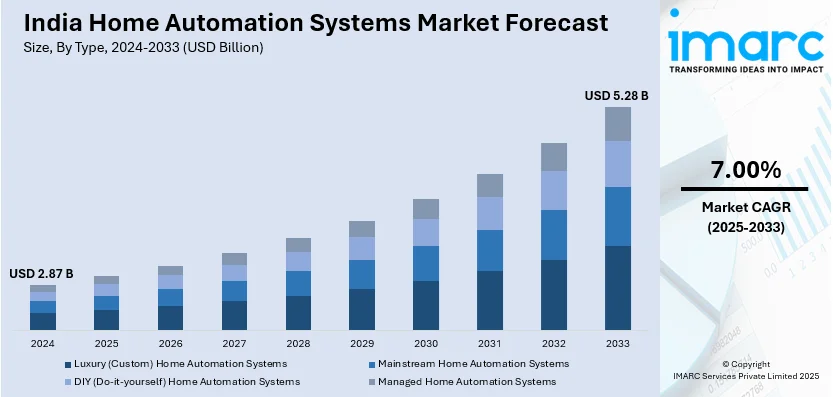

The India home automation systems market size reached USD 2.87 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.28 Billion by 2033, exhibiting a growth rate (CAGR) of 7.00% during 2025-2033. The market is growing based on increasing adoption of smart homes, growing disposable income, and government support for digital infrastructure. Security, lighting, and climate control solution demand is increasing driven by IoT integration, energy efficiency requirements, and urbanization.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.87 Billion |

| Market Forecast in 2033 | USD 5.28 Billion |

| Market Growth Rate 2025-2033 | 7.00% |

India Home Automation Systems Market Trends:

Rising Adoption of IoT-Enabled Smart Home Solutions

The increasing penetration of the Internet of Things (IoT) is driving the adoption of smart home automation systems substantially in India. Consumers are now integrating IoT-supported devices including smart lighting, security cameras, thermostats, and voice-activated assistants for enhanced energy-saving feature and ease of use. The widespread availability of mobile apps and fast rise in affordability of high-speed internet are also driving market growth. Besides this, major technology firms are actively launching AI-powered automation solutions that enable homeowners to remotely monitor as well as control appliances via voice commands or smartphones. In addition to this, compatibility with cloud-based platforms ensures seamless integration of multiple smart devices, creating interconnected home ecosystems. With urbanization and digital transformation initiatives gaining momentum, the demand for IoT-based automation is expected to rise. For instance, industry reports indicate that, as of 2025, 542.74 Million individuals, i.e., 37.1% of the total population in India is urban. Moreover, real estate developers are also incorporating smart home technologies in residential projects to attract tech-savvy buyers, reinforcing the market’s expansion. The increasing focus on home security and energy efficiency further strengthens this trend.

To get more information on this market, Request Sample

Government Initiatives and Energy Efficiency Regulations

The Indian government’s emphasis on smart cities and energy-efficient solutions is significantly influencing the home automation systems market. Initiatives such as the Smart Cities Mission and policies promoting sustainable energy consumption are encouraging the integration of automated lighting, HVAC systems, and energy management solutions. For instance, in 2015, the government of India introduced its Smart Cities Mission (SCM) to improve quality of city life. By 2024, 91% projects have been completed with a total investment of USD 16.84 Billion. Furthermore, regulatory frameworks are also mandating higher energy efficiency standards for household appliances, driving the demand for automation technologies that optimize electricity usage. Consumers are increasingly adopting smart meters and automated climate control systems to reduce energy bills and comply with emerging efficiency guidelines. Additionally, government incentives for renewable energy adoption, such as rooftop solar panels with smart energy management, are further supporting market growth. Industry players are developing automation solutions that align with these regulations, ensuring long-term market sustainability. As energy conservation gains priority, home automation technologies that enable real-time monitoring and optimization of power consumption are expected to witness strong demand.

India Home Automation Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on application and type.

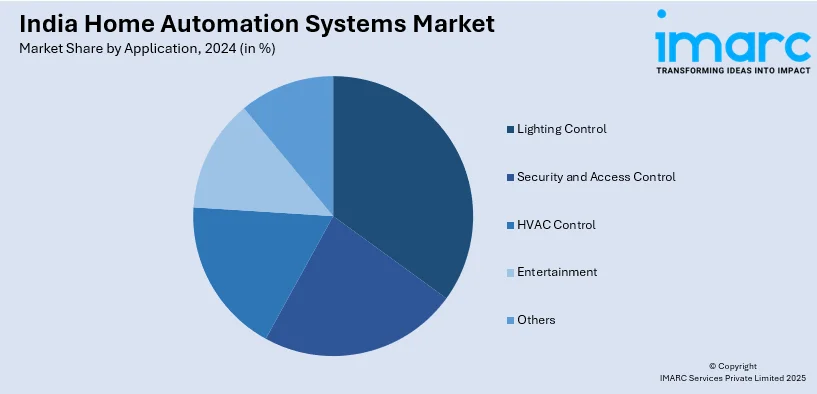

Application Insights:

- Lighting Control

- Security and Access Control

- HVAC Control

- Entertainment

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes lighting control, security and access control, HVAC control, entertainment, and others.

Type Insights:

- Luxury (Custom) Home Automation Systems

- Mainstream Home Automation Systems

- DIY (Do-it-yourself) Home Automation Systems

- Managed Home Automation Systems

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes luxury (custom) home automation systems, mainstream home automation systems, DIY (do-it-yourself) home automation systems, and managed home automation systems.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Home Automation Systems Market News:

- In September 2024, ABB India introduced its new smart home automation system ABB-free@home, which comes with advanced interoperability. This leading-edge and extensive wireless solution is developed to significantly improve security, comfort, and energy-efficiency for the residential sector.

- In July 2024, Schneider Electric India unveiled its home energy management services, encompassing its upgraded range of smart home automation Wiser 2.0 that provides expandable and convenient automation along with improved energy management abilities.

India Home Automation Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Lighting Control, Security and Access Control, HVAC Control, Entertainment, Others |

| Types Covered | Luxury (Custom) Home Automation Systems, Mainstream Home Automation Systems, DIY (Do-it-yourself) Home Automation Systems, Managed Home Automation Systems |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India home automation systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India home automation systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India home automation systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The home automation systems market in India was valued at USD 2.87 Billion in 2024.

The India home automation systems market is projected to exhibit a CAGR of 7.00% during 2025-2033, reaching a value of USD 5.28 Billion by 2033.

The home automation systems market in India is growing because of increasing disposable incomes, rising demand for smart homes, and advancements in IoT technology. Growing awareness about energy efficiency, convenience, and security also boosts adoption. The expansion of urban areas, technological innovations, and the desire for seamless connectivity and control are further propelling the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)