India Home Decor Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

India Home Decor Market Summary:

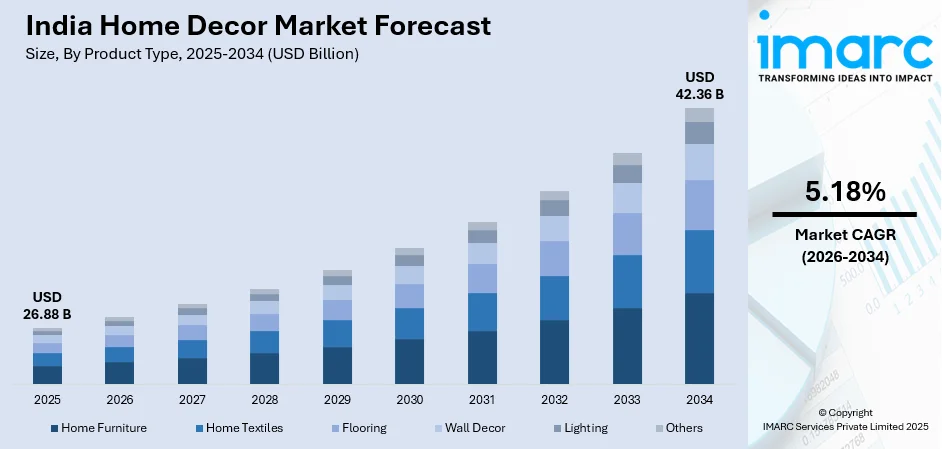

The India home decor market size was valued at USD 26.88 Billion in 2025 and is projected to reach USD 42.36 Billion by 2034, growing at a compound annual growth rate of 5.18% from 2026-2034.

The India home decor market is experiencing robust expansion, driven by rapid urbanization, rising disposable incomes, and the growing aspirations of the broadening middle-class population. Increasing consumer preferences for aesthetically appealing and functional living spaces are reshaping purchasing patterns across metropolitan and tier-II cities. The proliferation of e-commerce platforms has democratized access to diverse home decor products, enabling consumers in smaller towns to explore global trends.

Key Takeaways and Insights:

- By Product Type: Home furniture dominates the market with a share of 40.12% in 2025, owing to its central role in both functionality and aesthetics of living spaces. Rising demand for space-saving, multifunctional, and modular furniture designs in urban apartments is fueling the segment’s expansion.

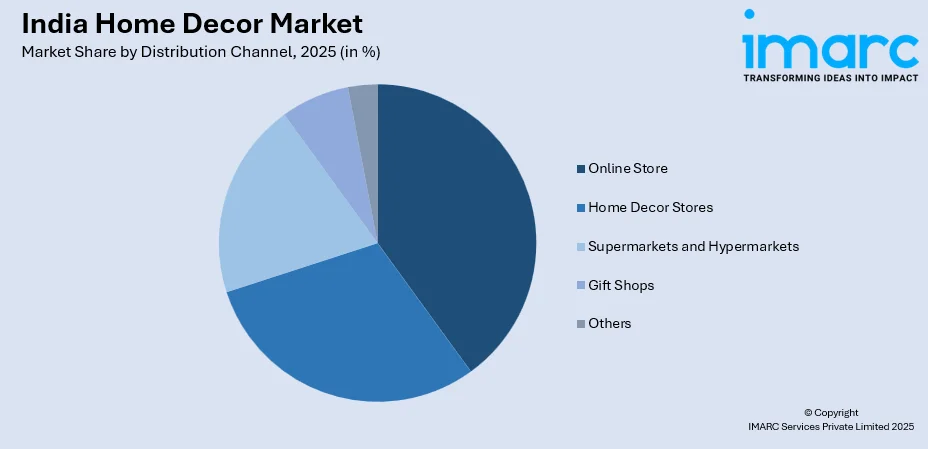

- By Distribution Channel: Online store leads the market with a share of 32.08% in 2025, This dominance is driven by increasing smartphone penetration, expanding internet connectivity, convenience of doorstep delivery, wider product selection, and competitive pricing offered by e-commerce platforms across urban and rural markets.

- By Region: North India represents the largest region with 33% share in 2025, driven by the concentration of urban population in Delhi-NCR, higher income levels, robust real estate development, and strong presence of organized retail and e-commerce infrastructure supporting home decor purchases.

- Key Players: Key players drive the India home decor market by expanding retail footprints, enhancing product portfolios, investing in e-commerce capabilities, and introducing innovative designs. Their focus on sustainability, customization options, and strategic partnerships strengthens market penetration across diverse consumer segments.

To get more information on this market Request Sample

The India home decor market is advancing, as consumers increasingly prioritize aesthetically pleasing and functional living environments that reflect personal style and modern sensibilities. Rising urbanization has created unprecedented demand for contemporary furniture, textiles, lighting, and decorative accessories that optimize compact living spaces prevalent in metropolitan apartments. The expanding middle class, projected to reach 61% of India's population by 2047, represents a significant consumer base with enhanced purchasing power for quality home furnishings. E-commerce transformation has revolutionized market accessibility, enabling brands to reach previously underserved tier-II and tier-III cities. Social media platforms continue to shape consumer preferences, with millions of Indian users drawing inspiration from global interior design trends. Sustainability consciousness is driving adoption of eco-friendly materials, including bamboo, jute, and reclaimed wood, as several households have transitioned towards environmentally conscious home decor products.

India Home Decor Market Trends:

Rising Preferences for Sustainable and Eco-Friendly Home Decor

The sustainability movement is transforming the India home decor market growth, as consumers increasingly prioritize environmentally responsible products. Increasing awareness about climate change and environmental impact is driving demand for furniture and accessories crafted from bamboo, jute, organic cotton, reclaimed wood, and recycled materials. Regional craftsmanship, featuring traditional materials from Assam, Tripura, and West Bengal, is gaining renewed popularity among eco-conscious urban buyers. Brands are responding by expanding their sustainable product portfolios, with manufacturers introducing low volatile organic compound (VOC) finishes that appeal to health-conscious homeowners.

Digital Transformation and Omnichannel Retail Expansion

The convergence of online and offline retail channels is reshaping how Indian consumers discover and purchase home decor products. As per IMARC Group, the India e-commerce market size was valued at USD 129.72 Billion in 2025. E-commerce platforms are deploying augmented reality (AR) tools enabling customers to visualize furniture placements before purchase, while established retailers are establishing experience centers in urban locations. This omnichannel approach enhances customer confidence, reduces return rates, and drives higher engagement across both digital and physical touchpoints.

Space-Saving and Multifunctional Furniture Designs

Shrinking apartment sizes in metropolitan areas are catalyzing demand for compact, multifunctional furniture solutions that maximize utility without compromising aesthetics. During the first quarter of 2023, there was a 20% decline in the average apartment sizes in the Mumbai Metro Region, driving innovations in space-efficient designs. Products, including hydraulic storage beds, sliding door wardrobes, foldable dining sets, and modular sofas, are experiencing strong sales growth. This trend reflects evolving urban lifestyles where functionality and versatility are prioritized alongside visual appeal.

Market Outlook 2026-2034:

The India home decor market demonstrates strong growth potential, supported by favorable demographic trends, expanding urbanization, and rising consumer sophistication. The market generated a revenue of USD 26.88 Billion in 2025 and is projected to reach a revenue of USD 42.36 Billion by 2034, growing at a compound annual growth rate of 5.18% from 2026-2034. Government housing initiatives continue to create fresh demand, as newly constructed residential units require complete furnishing solutions. International retailers are accelerating expansion plans, recognizing India's position as a key growth market with evolving consumer preferences. Technological integration, including smart furniture and Internet of Things (IoT)-enabled lighting solutions, represents emerging opportunities, while customization capabilities offered through digital platforms enable personalized decor experiences.

India Home Decor Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Home Furniture |

40.12% |

|

Distribution Channel |

Online Store |

32.08% |

|

Region |

North India |

33% |

Product Type Insights:

- Home Furniture

- Home Textiles

- Flooring

- Wall Decor

- Lighting

- Others

Home furniture dominates with a market share of 40.12% of the total India home decor market in 2025.

Home furniture serves as the foundation of the India home decor ecosystem, encompassing essential items, including beds, sofas, dining tables, wardrobes, and storage solutions that define living space functionality and aesthetics. The segment benefits from sustained demand generated by new household formation, urban migration, and renovation activities across residential properties. The urban population, as a percentage of the total population in India, was recorded at 36.87% in 2024, according to the World Bank collection of development indicators. Rising consumer preferences for branded, quality-assured furniture over traditional carpenter-made alternatives are strengthening organized retail penetration.

In India, the segment's growth trajectory is supported by evolving consumer preferences favoring modular and customizable furniture designs that accommodate diverse home layouts and personal styles. Mid-range products command significant market share, reflecting value-conscious purchasing behavior among the expanding middle class seeking durability alongside affordability. Premium home furniture offerings are experiencing accelerated growth, as dual-income households increasingly invest in Italian veneer finishes, smart-home integration features, and branded upholstery.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Home Decor Stores

- Supermarkets and Hypermarkets

- Online Store

- Gift Shops

- Others

Online store leads with a share of 32.08% of the total India home decor market in 2025.

Online stores have transformed home decor distribution by eliminating geographical barriers and enabling consumers across urban and rural India to access diverse product assortments previously available only in metropolitan showrooms. The segment's expansion is driven by increasing smartphone penetration, affordable data connectivity, and growing consumer comfort with digital transactions. E-commerce platforms offer compelling value propositions, including extensive catalogs, competitive pricing, convenient home delivery, and flexible payment options. Over 20 Million users in India purchased home decor products online in 2024, significantly expanding the market's digital footprint and accessibility.

Online stores continue to gain momentum, as platforms invest in technologies enhancing customer experience and reducing purchase hesitation traditionally associated with high-value home decor items. AR features enabling virtual product visualization, detailed imagery, customer reviews, and hassle-free return policies address traditional touch-and-feel barriers. Major e-commerce players, alongside specialized platforms, have made home decor accessible to tier-II and tier-III cities, democratizing market access. The Digital India initiative has broadened internet penetration, creating substantial infrastructure supporting continued online store growth.

Regional Insights:

- South India

- North India

- West and Central India

- East India

North India exhibits a clear dominance with a 33% share of the total India home decor market in 2025.

North India's market leadership reflects the region's concentration of economic activities, population density, and robust real estate development centered around the Delhi-NCR metropolitan cluster. In February 2025, IKEA launched online deliveries across Delhi-NCR and nine satellite cities in North India, including Jaipur, Lucknow, and Chandigarh, supported by a 180,000 square feet distribution center in Gurugram. The region encompasses major consumption hubs, including Delhi, Gurugram, Noida, Chandigarh, Lucknow, and Jaipur, each demonstrating strong demand for contemporary home decor products. Higher income levels and aspirational consumer behavior drive premium product adoption.

The region's market dynamics are characterized by diverse consumer preferences, spanning traditional designs favored in smaller cities to contemporary international aesthetics popular in metropolitan centers. Government housing schemes under Pradhan Mantri Awas Yojana have catalyzed mid-priced furniture purchases as newly constructed units require complete furnishing solutions. In the region, younger households increasingly favor lighter engineered-wood frames suitable for high-rise apartment elevators, reflecting practical adaptations to urban living conditions.

Market Dynamics:

Growth Drivers:

Why is the India Home Decor Market Growing?

Rapid Urbanization and Housing Development

India's accelerating urbanization trajectory represents a fundamental catalyst propelling home decor market expansion as millions of citizens migrate to cities annually seeking employment opportunities and improved living standards. The urban population transformation creates sustained demand for residential properties requiring complete furnishing and decoration, ranging from basic furniture essentials to aesthetic accessories that transform houses into personalized homes. New housing developments across the country, spanning affordable apartments to luxury residences, generate fresh demand for home decor products tailored to diverse budget levels and space configurations. Government initiatives, including the Pradhan Mantri Awas Yojana and Smart Cities Mission, have sanctioned millions of housing units across urban centers, creating a substantial and growing addressable market for home decor manufacturers and retailers.

E-commerce Expansion and Digital Adoption

The explosive growth of e-commerce infrastructure has democratized home decor access across India, enabling consumers in previously underserved markets to explore and purchase products that were historically available only in metropolitan showrooms. Digital platforms have eliminated geographical barriers, offering consumers in tier-II, tier-III cities, and beyond convenient access to extensive product catalogs spanning domestic and international brands. The proliferation of affordable smartphones, expanding internet connectivity, and growing digital payment adoption have created robust infrastructure supporting online home decor retail growth. In FY25, India's e-commerce market reached a GMV of around INR 1.19 Lakh Crore (USD 14 Billion), showing a 12% year-over-year increase, driven significantly by categories, including furniture and home decor. The Digital India initiative has increased internet penetration, establishing the foundational connectivity enabling e-commerce to flourish across diverse consumer segments nationwide.

Innovations in Products

Product innovations are significantly driving the India home decor market by aligning aesthetics with functionality, affordability, and evolving lifestyle needs. Manufacturers are introducing modular furniture, space-saving designs, and multifunctional decor solutions tailored to smaller urban homes. As per IMARC Group, the India modular furniture market size reached USD 3.71 Billion in 2024. Innovations in materials, such as engineered wood, eco-friendly composites, and smart fabrics, are improving durability while maintaining contemporary appeal. Technology integration, including smart lighting, adjustable fixtures, and digitally printed wallpapers, is enhancing customization and personalization options. Design innovations inspired by global trends blended with Indian craftsmanship are attracting style-conscious consumers. Additionally, improvements in manufacturing processes enable faster product cycles and competitive pricing. These innovations support frequent product refreshes, encourage replacement purchases, and appeal to both first-time buyers and premium customers, collectively expanding market reach and sustaining growth of the sector.

Market Restraints:

What Challenges is the India Home Decor Market Facing?

High Import Dependence for Premium Products

India's reliance on imports for premium home decor items, particularly luxury furniture and designer accessories, creates cost challenges and supply chain vulnerabilities that constrain market accessibility. Import duties and fluctuating foreign exchange rates elevate costs, making high-end decor products less attainable for average consumers while squeezing retailer margins.

Competition from Unorganized Sector

The largely fragmented and informal nature of the India home decor landscape, with numerous small workshops, local carpenters, and regional handicraft sellers, creates intense price competition that challenges organized players seeking scale and standardization. Unorganized vendors offer customization flexibility and competitive pricing that appeal to cost-conscious consumers, particularly in semi-urban and rural markets.

Raw Material Sourcing and Regulatory Compliance

In India, the home decor industry faces stringent regulations around material sourcing, particularly concerning timber that must comply with environmental standards, adding production costs and limiting material availability. New environmental regulations on sustainable material sourcing have impacted thousands of businesses, creating operational challenges and requiring significant compliance investments.

Competitive Landscape:

The India home decor market features a fragmented competitive landscape with domestic manufacturers, international retailers, and e-commerce platforms competing across diverse price segments and product categories. Market participants are pursuing differentiated strategies, including retail network expansion, e-commerce capability enhancement, product portfolio diversification, and sustainability integration. Established players leverage brand recognition and extensive distribution networks, while digital-native brands capitalize on technology-enabled customer engagement and data-driven personalization. Strategic acquisitions and partnerships are consolidating market positions, as evidenced by notable transactions creating combined entities with enhanced scale. Competition intensifies, as international brands accelerate India market entry, recognizing growth potential while domestic companies strengthen capabilities to defend market share.

Recent Developments:

- In March 2025, India Circus launched its 18th store in Lucknow at the historic Le Press building. The store features Indo-contemporary designs across home decor, furniture, and fashion categories, marking the brand's significant expansion in North India and demonstrating retail investment confidence in tier-II city markets.

India Home Decor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Home Furniture, Home Textiles, Flooring, Wall Decor, Lighting, Others |

| Distribution Channels Covered | Home Decor Stores, Supermarkets and Hypermarkets, Online Store, Gift Shops, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India home decor market size was valued at USD 26.88 Billion in 2025.

The India home decor market is expected to grow at a compound annual growth rate of 5.18% from 2026-2034 to reach USD 42.36 Billion by 2034.

Home furniture dominated the market with a share of 40.12%, driven by sustained demand for functional and aesthetically appealing furniture across residential segments and growing preference for branded products.

Key factors driving the India home decor market include rapid urbanization, rising disposable incomes, expanding middle-class population, broadening e-commerce platforms, social media influence, and government housing initiatives.

Major challenges include high import dependence for premium products, intense competition from the unorganized sector, regulatory compliance for material sourcing, supply chain vulnerabilities, and raw material cost fluctuations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)