India Home Furnishings Market Size, Share, Trends and Forecast by Product, Price, Distribution, and Region, 2025-2033

Market Overview:

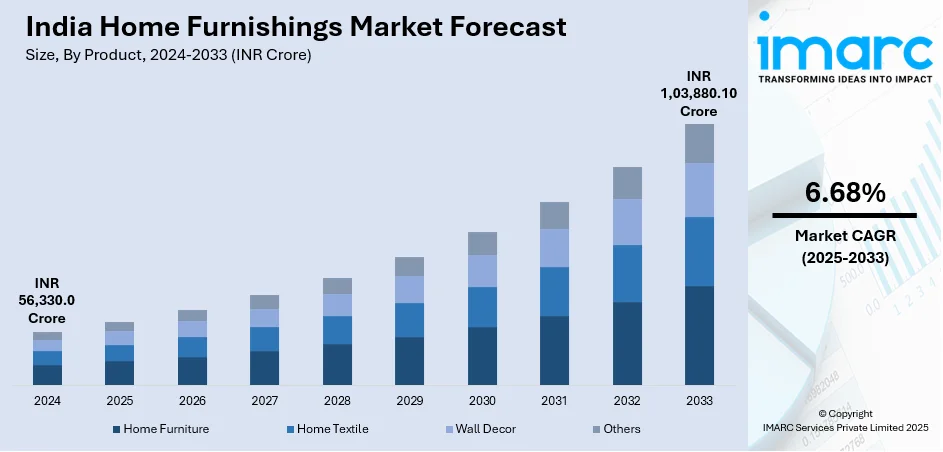

The India home furnishings market size reached INR 56,330.0 Crore in 2024. The market is projected to reach INR 1,03,880.10 Crore by 2033, exhibiting a growth rate (CAGR) of 6.68% during 2025-2033. The market growth is attributed to increasing disposable incomes, rising demand for luxury home furnishings, the growing popularity of online shopping, the expansion of interior design businesses, and government initiatives like "Make in India" to promote domestic manufacturing.

Market Insights:

- On the basis of product, the market has been categorized into home furniture, home textile, wall decor, and others.

- On the basis of price, the market has been categorized into mass and premium segments.

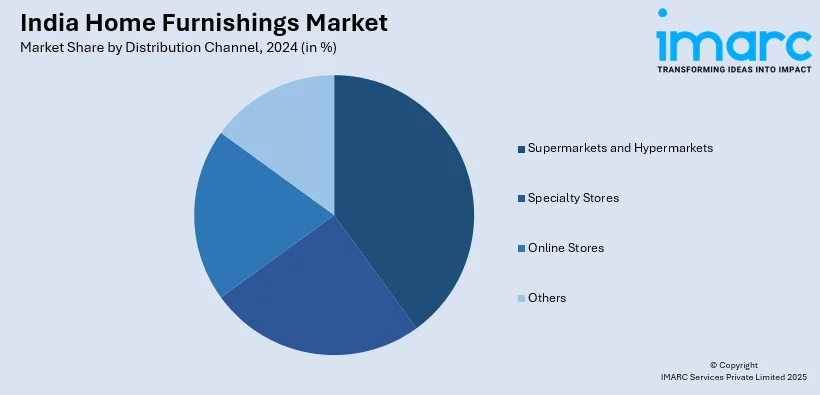

- On the basis of distribution channel, the market has been categorized into supermarkets and hypermarkets, specialty stores, online stores, and others.

- On the basis of region, the market has been categorized into North India, West and Central India, South India, and East India.

Market Size and Forecast:

- 2024 Market Size: INR 56,330.0 Crore

- 2033 Projected Market Size: INR 1,03,880.10 Crore

- CAGR (2025-2033): 6.68%

Home furnishings include furniture, appliances, rugs, cooking utensils, art objects, wall-to-wall carpeting, built-in ovens, ranges, and dishwashers. They aid in providing an appeal and comfortable ambiance to different spaces of a home, including the bedroom, living room, and dining room. There is currently a rise in the availability of innovative and affordable home furnishings across India.

To get more information on this market, Request Sample

India Home Furnishings Market Trends:

The thriving e-commerce industry on account of the increasing internet penetration and reliance on smartphones, tablets and laptops represents one of the key factors propelling the growth of the home furnishing market in India. Additionally, leading players operating in the country are focusing on visually attractive online product displays and aggressive promotional campaigns to widen their existing consumer base. They are also offering customization to customers, which enables them to request for a specific material and color of furniture upholstery to match their home décor. Apart from this, the Government of India is introducing campaigns like Make in India that aim at minimizing exports and encouraging domestic manufacturing of home furnishings to offer employment opportunities. In addition, it is implementing Amended Technology Upgradation Fund Scheme (ATUFS) to catalyze capital investments for technology up-gradation and modernization of the textile industry. This, along with the rising foreign direct investment (FDI) in the textile sector and the growing demand for bath and table linen, is augmenting the home furnishing market size in India. Moreover, there is an increase in the adoption of luxury home furnishings due to the rising disposable incomes of individuals. Factors, such as the increasing number of households and rapid expansion of interior design businesses across India, are also strengthening the market growth.

India Home Furnishings Opportunities and Consumer Trends:

The growing urban population in India, coupled with rapid urbanization, is pushing a shift towards modular, space-saving, and multifunctional designs that cater to small apartments and homes. Consumers in urban areas are seeking home furniture solutions that maximize living space while still offering high-quality aesthetics and functionality. The increasing trend toward sustainable and eco-friendly furnishings is also presenting ample opportunities for India home furnishings market growth. Consumers are increasingly looking for furniture made from materials like reclaimed wood, bamboo, and non-toxic finishes, which is helping drive the demand for eco-friendly products. Green certifications like FSC (Forest Stewardship Council) and Greenguard are becoming more sought after, especially among environmentally conscious consumers. Additionally, the rapid rise of e-commerce and online shopping has created a convenient platform for consumers to access a variety of home furnishings at competitive prices. Influencers, DIY trends, and social media have also significantly impacted consumer preferences and contributed to the India home furnishings market share, shaping the way individuals design their homes. With growing awareness of climate change and sustainability, consumers are more inclined to invest in eco-conscious designs. This has sparked the rise of brands focusing on environmental responsibility, leading to a surge in demand for green-certified, sustainable furniture solutions.

India Home Furnishings Challenges and Growth Drivers:

The market in India faces numerous challenges, including high raw material costs and a fragmented supply chain, which affect both product availability and pricing consistency. Many small-scale manufacturers struggle to keep up with larger, more efficient competitors, leading to discrepancies in product quality and delivery timelines. As per the India home furnishings market analysis, fluctuations in demand across rural and urban regions create challenges in inventory management and sales projections. However, several growth drivers are helping offset these challenges. Government initiatives such as “Make in India” and the Amended Technology Upgradation Fund Scheme (ATUFS) are providing vital support to the sector, promoting domestic production, reducing reliance on imports, and helping local businesses expand their capacity. Rising disposable incomes, especially among the growing middle class, are significantly increasing demand for both mass-market and premium furnishings and augmenting the home furnishing industry in India. Furthermore, rapid urbanization is resulting in a higher demand for space-saving, modular, and multifunctional furniture among consumers. As consumer preferences shift towards sustainable materials, including reclaimed wood, bamboo, and non-toxic finishes, the market sees an increasing interest in eco-friendly furnishings and green-certified products. The shift to customizable and smart furniture solutions is further driving consumer interest, encouraging innovation across the industry. Numerous innovations in design and production, along with the rise of online sales, are also adding momentum to the India home furnishings market demand.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India home furnishings market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product, price and distribution channel.

Breakup by Product:

- Home Furniture

- Home Textile

- Wall Decor

- Others

Breakup by Price:

- Mass

- Premium

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Latest News and Recent Developments:

- On January 20, 2025, CRAFT PARADISE, an online marketplace for furniture and home decor, announced its expansion and innovations aimed at transforming India’s home decor industry. The platform offers over 10,000 products from more than 100 sellers, providing a vast selection catering to different tastes and budgets while supporting small and medium enterprises (SMEs).

- On February 12, 2025, VFI Group launched Beyond Sleep, India's largest luxury mattress and furniture store, located in Gurgaon at DLF City Centre Mall. The 5,000 sq. ft. store features dedicated experience zones for customers to test and customize their selections and plans to open 100 stores across India within the year. With global and homegrown brands like Serta and Simmons Beautyrest, Beyond Sleep aims to become a Rs 1,000 Crore (USD 120 Million) brand within three years.

- On October 1, 2024, Nilkamal, a leading furniture brand in India, launched Nilkamal Homes, a retail brand focused on premium home furniture and décor. The company opened 60 stores across 35 cities and plans to expand with 50 more franchisee outlets in the next two years. With a reported revenue of INR 3,200 Crore (USD 384 Million) in the previous year, Nilkamal aims to strengthen its market presence by offering high-quality, durable, and functional products through both physical and online channels.

- On November 15, 2024, Nitori, Japan’s largest furniture and home-furnishing retail chain, announced its arrival in the Indian market with the opening of its first store at R City Mall in Mumbai in December 2024. The company, targeting 3,000 global stores by 2032, aims to achieve a sales target of approximately INR 1.65 Lakh Crore (USD 19.8 Billion) by the same year. With over 1,000 stores worldwide and a strong presence in Asia, Nitori’s expansion into India reflects the growing demand for quality furniture and home decor in the country.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Crore |

| Segment Coverage | Product, Price, Distribution Channel, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India home furnishings market was valued at INR 56,330.0 Crore in 2024.

We expect the India home furnishings market to exhibit a CAGR of 6.68% during 2025-2033.

The rising demand for luxury home furnishings, along with the increasing utilization of personalized home decor products, is primarily driving the India home furnishings market.

The sudden outbreak of the COVID-19 pandemic has led to the shifting consumer preferences from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of home furnishings across the nation.

Based on the product, the India home furnishings market can be categorized into home furniture, home textile, wall décor, and others. Currently, home furniture exhibits clear dominance in the market.

Based on the price, the India home furnishings market has been segmented into mass and premium, where mass currently holds the largest market share.

Based on the distribution channel, the India home furnishings market can be bifurcated into supermarkets and hypermarkets, specialty stores, online stores, and others. Among these, specialty stores account for the majority of the total market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where West and Central India currently dominates the India home furnishings market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)