India Home Furniture Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

India Home Furniture Market Overview:

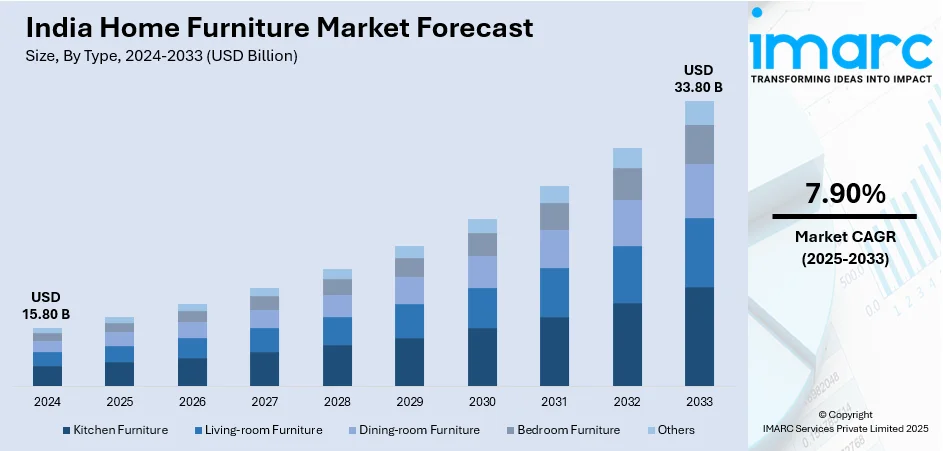

The India home furniture market size reached USD 15.80 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 33.80 Billion by 2033, exhibiting a growth rate (CAGR) of 7.90% during 2025-2033. E-commerce expansion is enhancing accessibility with customization and AR/VR tools, which is a key factor influencing India home furniture market share. Sustainable furniture adoption is also increasing as buyers prefer eco-friendly materials. Additionally, smart furniture innovations are gaining traction for modern, tech-integrated homes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.80 Billion |

| Market Forecast in 2033 | USD 33.80 Billion |

| Market Growth Rate (2025-2033) | 7.90% |

India Home Furniture Market Trends:

Increasing Housing Development

Rapid urbanization and government housing schemes are leading to higher homeownership across urban and semi-urban areas. Newly constructed residential projects require essential furniture, driving growth in the home furniture industry. Rising disposable incomes are encouraging homeowners to invest in premium, customized, and modular furniture solutions. Real estate developers are collaborating with furniture brands to offer fully furnished apartments and housing projects. The growing nuclear families are catalyzing the demand for compact, space-saving, and multifunctional furniture designs. Smart city projects and infrastructural developments are further fueling the need for modern home furnishings. Recognizing this trend, Nilkamal launched 'Nilkamal Homes' in October 2024, a retail brand focused on premium home furniture and décor, aiming to establish 60 stores in 35 cities. Builders are integrating interior design solutions, creating demand for stylish and ergonomic furniture options. Home renovation and remodeling activities are also fueling the India home furniture market outlook. The shift towards sustainable and eco-friendly furniture is influencing purchasing decisions among environmentally conscious buyers. Online furniture retailers are capitalizing on new housing developments by offering personalized and space-efficient designs, catering to evolving customer preferences.

To get more information on this market, Request Sample

Rising Number of E-Commerce Platforms

Online platforms are offering a vast range of furniture designs, materials, and price options, making shopping more convenient. Buyers can read reviews, compare products, and make informed purchasing decisions from their homes. Attractive discounts, seasonal sales, and easy financing options are encouraging higher furniture purchases online. Rapid doorstep delivery, hassle-free returns, and assembly services are enhancing shoppers’ confidence in online furniture shopping. Digital marketing and social media promotions are increasing brand visibility, driving higher customer engagement and conversions. Virtual reality (VR) and augmented reality (AR) tools are enabling buyers to visualize furniture before purchasing. Customization options on e-commerce websites are catering to evolving consumer preferences for personalized home furniture. With India's e-commerce industry anticipated to reach US$ 325 billion by 2030, as per IBEF, online furniture retailers are rapidly expanding their reach. Increasing smartphone and internet penetration is allowing brands to serve both urban and rural markets effectively. Domestic and international brands are leveraging e-commerce platforms to expand their customer base and market presence. Strategic partnerships between online marketplaces and manufacturers are ensuring better supply chain management and competitive pricing. The rise of direct-to-consumer (D2C) furniture brands is further strengthening the India home furniture market growth.

India Home Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Kitchen Furniture

- Living-room Furniture

- Dining-room Furniture

- Bedroom Furniture

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes kitchen furniture, living-room furniture, dining-room furniture, bedroom furniture, and others.

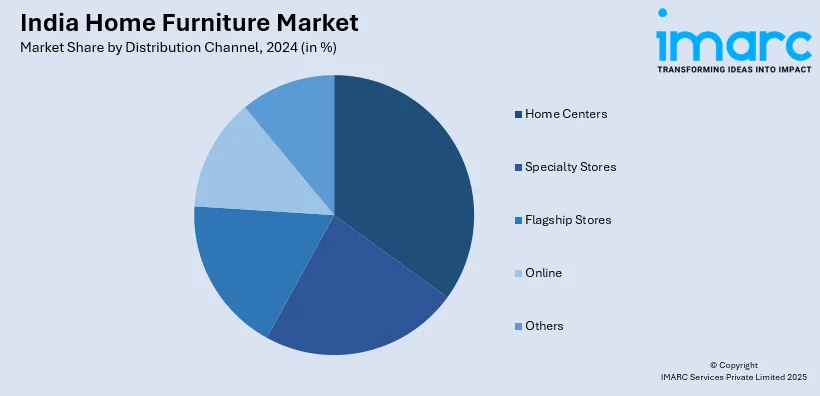

Distribution Channel Insights:

- Home Centers

- Specialty Stores

- Flagship Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes home centers, specialty stores, flagship stores, online, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Home Furniture Market News:

- In February 2025, IKEA announced its expansion in the Delhi-NCR with a small-format store and e-commerce operations starting March 1, 2025. Online sales will cover cities like Agra, Jaipur, and Lucknow. A 180,000 sq. ft. distribution center in Gurgaon, built with Rhenus, will support operations. CEO Susanne Pulverer highlights IKEA’s omni-channel approach to meet India's growing home furnishings demand.

- In December 2024, Japan’s leading furniture and home furnishing retailer, Nitori, entered the Indian market, with its first store at R City Mall, Ghatkopar, Mumbai. Spanning 32,000 sq. ft., the store offers a wide range of premium home furnishings including sofas, dining tables, kitchen cabinets, beds, curtains, carpets, bedding, and interior essentials.

India Home Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Kitchen Furniture, Living-room Furniture, Dining-room Furniture, Bedroom Furniture, Others |

| Distribution Channels Covered | Home Centers, Specialty Stores, Flagship Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India home furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India home furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India home furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India home furniture market was valued at USD 15.80 Billion in 2024.

The India home furniture market is projected to exhibit a CAGR of 7.90% during 2025-2033, reaching a value of USD 33.80 Billion by 2033.

The India home furniture market is driven by rising urbanization, growing middle-class incomes, and increased demand for organized retail and e-commerce. Consumers favoring stylish, multifunctional designs and sustainable materials, along with renovation activities and home ownership growth, also boost demand. Additionally, customization and online convenience further fuels market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)