India Home Healthcare Monitoring Devices Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Home Healthcare Monitoring Devices Market Overview:

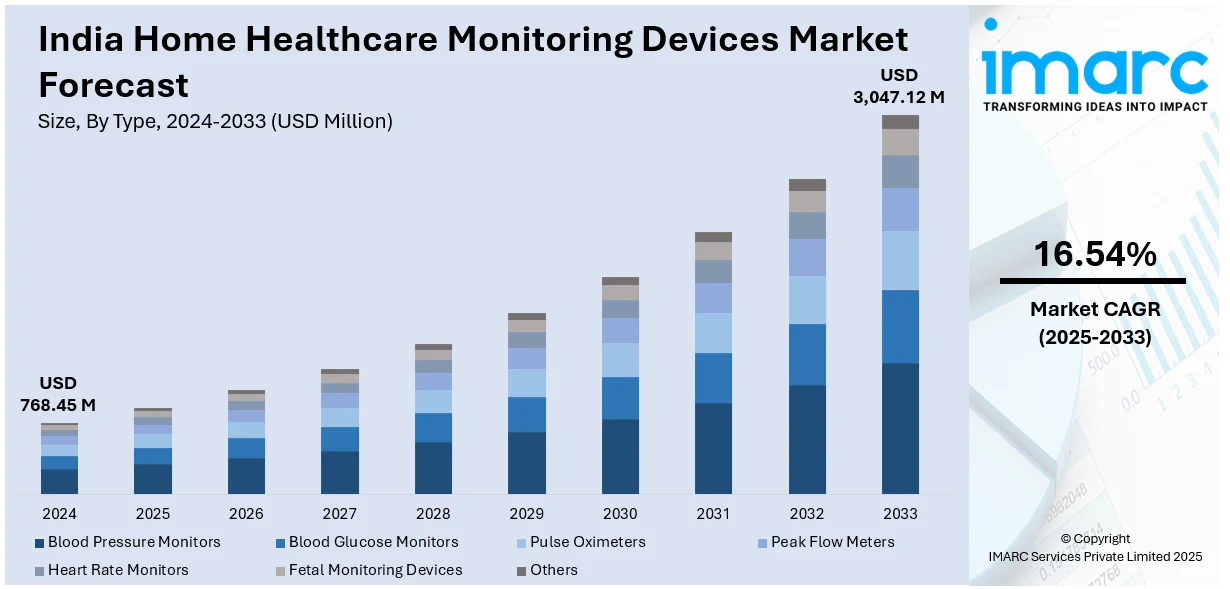

The India home healthcare monitoring devices market size reached USD 768.45 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,047.12 Million by 2033, exhibiting a growth rate (CAGR) of 16.54% during 2025-2033. The market is expanding due to rising chronic disease prevalence, increasing elderly population, and the widespread adoption of remote patient monitoring. Key segments include blood pressure monitors, glucose monitors, pulse oximeters, and wearable health devices, driven by technological advancements and affordability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 768.45 Million |

| Market Forecast in 2033 | USD 3,047.12 Million |

| Market Growth Rate 2025-2033 | 16.54% |

India Home Healthcare Monitoring Devices Market Trends:

Increasing Adoption of Remote Patient Monitoring Technologies

The India home healthcare monitoring devices market is witnessing significant growth due to the notable increase in utilization of remote patient monitoring (RPM) technologies. With the magnifying incidents of chronic diseases, mainly including cardiovascular disorders, hypertension, and diabetes, there is an intensifying need for continuous health monitoring solutions. For instance, as per a research article published in the Journal of Diabetology, in January 2024, around 77 Million people with age 20 to 79 are suffering with diabetes across India, and this number is anticipated to elevate to 134.2 Million by the year 2045. RPM devices, including wearable sensors, wireless blood pressure monitors, and smart glucose meters, enable real-time tracking of vital parameters, allowing healthcare providers to make timely clinical decisions. The incorporation of artificial intelligence (AI) and cloud-based platforms further enhances data analysis, improving patient outcomes. Government initiatives such as the Ayushman Bharat Digital Mission (ABDM) are supporting digital healthcare infrastructure, promoting the use of connected medical devices. Additionally, rising internet penetration and increased smartphone adoption have facilitated remote monitoring adoption. The affordability of these technologies, coupled with increasing awareness among consumers, is expected to further drive market expansion in the coming years.

To get more information on this market, Request Sample

Rising Need for Non-Invasive and Wearable Health Monitoring Devices

The need for non-invasive and wearable health monitoring devices is rising in India due to increasing consumer preference for convenient, user-friendly, and real-time health tracking solutions. Wearable technologies, such as smartwatches, fitness trackers, and biosensors, are gaining popularity for monitoring vital health parameters, including heart rate, oxygen saturation, and sleep patterns. These devices are particularly beneficial for individuals managing chronic conditions, as they offer continuous monitoring without requiring frequent hospital visits. Companies are investing in advanced sensor technology and AI-driven analytics to enhance the accuracy and functionality of wearable devices. The growing health-conscious population, increasing awareness of preventive healthcare, and the expansion of telemedicine services are further accelerating the demand. For instance, as per industry reports, telemedicine sector in India is estimated at USD 1.54 Billion in the year 2024, with anticipation of exhibiting a growth rate of 20.75% during 2026-2030. In line with this, telemedicine consultations account for around 10% yo 25% of consultations in hospitals. Additionally, favorable government policies and private sector investments in digital health solutions are expected to support market growth. As affordability improves and technology advances, the adoption of wearable health monitoring devices is projected to continue rising in India.

India Home Healthcare Monitoring Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Blood Pressure Monitors

- Blood Glucose Monitors

- Pulse Oximeters

- Peak Flow Meters

- Heart Rate Monitors

- Fetal Monitoring Devices

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blood pressure monitors, blood glucose monitors, pulse oximeters, peal flow meters, heart rate monitors, fetal monitoring devices, and others.

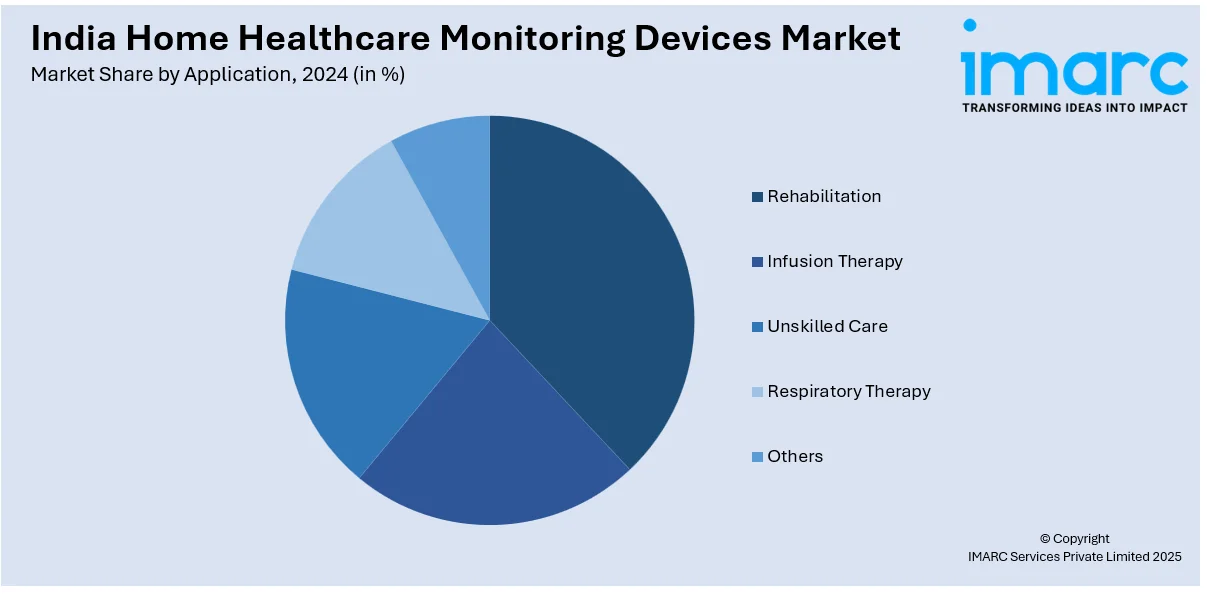

Application Insights:

- Rehabilitation

- Infusion Therapy

- Unskilled Care

- Respiratory Therapy

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes rehabilitation, infusion therapy, unskilled care, respiratory therapy, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Home Healthcare Monitoring Devices Market News:

- In January 2025, ResMed announced the launch its next-gen device for Continuous Positive Airway Pressure, named AirSense11, in India. This device is developed to make it convenient for people suffering with obstructive sleep apnea to initiate and manage therapy.

- In May 2024, OMRON Healthcare India announced a partnership with AliveCor India to offer innovative AI-powered handheld technology of ECG across Indian market and strengthen its foothold in the country. The device is first-of-its-kind in India that blends the abilities of blood pressure monitor technology with AliveCor ECG technology, facilitating management aa well as early detection of cardiovascular disorders at home.

India Home Healthcare Monitoring Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blood Pressure Monitors, Blood Glucose Monitors, Pulse Oximeters, Peak Flow Meters, Heart Rate Monitors, Fetal Monitoring Devices, Others |

| Applications Covered | Rehabilitation, Infusion Therapy, Unskilled Care, Respiratory Therapy, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India home healthcare monitoring devices market performed so far and how will it perform in the coming years?

- What is the breakup of the India home healthcare monitoring devices market on the basis of type?

- What is the breakup of the India home healthcare monitoring devices market on the basis of application?

- What is the breakup of the India home healthcare monitoring devices market on the basis of region?

- What are the various stages in the value chain of the India home healthcare monitoring devices market?

- What are the key driving factors and challenges in the India home healthcare monitoring devices market?

- What is the structure of the India home healthcare monitoring devices market and who are the key players?

- What is the degree of competition in the India home healthcare monitoring devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India home healthcare monitoring devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India home healthcare monitoring devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India home healthcare monitoring devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)