India Home Insurance Market Size, Share, Trends and Forecast by Type, Provider, Premium, Mode of Purchase, and Region, 2025-2033

India Home Insurance Market Overview:

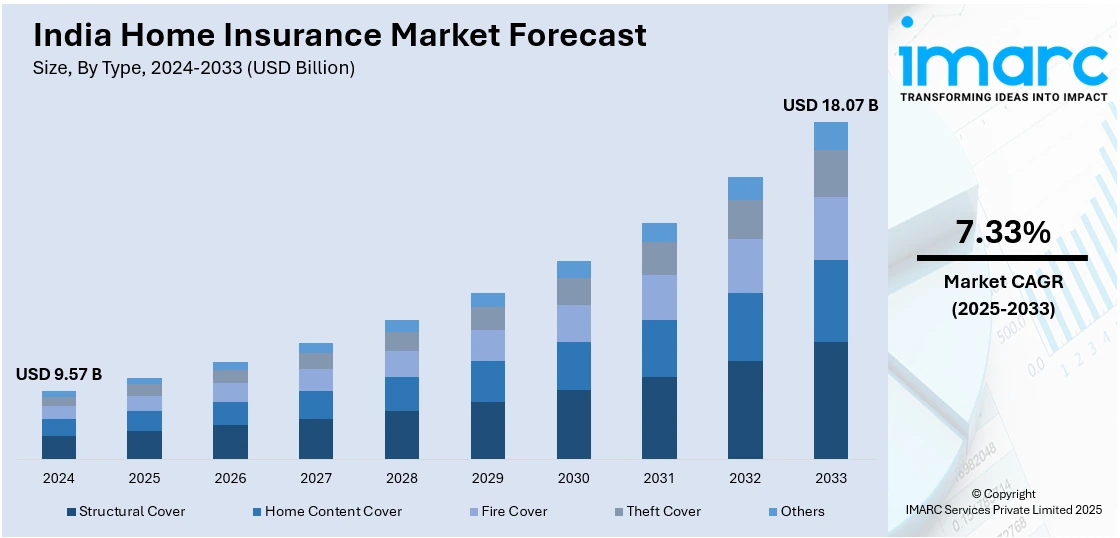

The India home insurance market size reached USD 9.57 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 18.07 Billion by 2033, exhibiting a growth rate (CAGR) of 7.33% during 2025-2033. The market is driven by rising property values, awareness of insurance benefits, escalating digital adoption for policy purchases, higher frequency of natural disasters, and regulatory support like IRDAI’s Bima Sugam platform, making home insurance more accessible, affordable, and essential for protecting physical and digital home assets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.57 Billion |

| Market Forecast in 2033 | USD 18.07 Billion |

| Market Growth Rate 2025-2033 | 7.33% |

India Home Insurance Market Trends:

Increasing Awareness of Insurance

There has been a significant change in the attitude toward insurance among Indian consumers. Historically, insurance penetration in India has been poor, with few people being aware of the protection and benefits of different insurance products. But through concerted efforts from the government, insurance firms, and financial institutions, there has been increasing awareness about the role of insurance. Programs like the Pradhan Mantri Fasal Bima Yojana and the National Health Protection Scheme have brought to the forefront the importance of insurance in risk management and financial planning. Furthermore, the rise of digital channels and insurtech platforms has made information more accessible, allowing consumers to compare policies and understand coverage options more effectively. This heightened awareness has translated into a propelling number of homeowners opting for insurance policies to safeguard their properties. The emphasis on customer experience and the availability of diverse home insurance options have further fueled this trend, contributing to the robust growth of the home insurance market in India.

To get more information on this market, Request Sample

Rising Incidence of Natural Disasters

India's geographical diversity makes it susceptible to a range of natural calamities, including floods, earthquakes, cyclones, and landslides. In recent years, there has been a significant rise in the frequency and severity of these events, leading to substantial property damage and financial losses.

The escalating impact of climate change has further intensified these risks, making certain regions more prone to extreme weather events. According to industry reports, natural disasters caused approximately 3000 deaths in the year 2024 in India. This heightened exposure has raised awareness among homeowners about the potential financial repercussions of natural disasters. Consequently, there is a higher recognition of the importance of securing home insurance policies that offer coverage against such unforeseen events. Insurance companies have responded to this increased demand by developing specialized products tailored to cover damages caused by specific natural disasters. These policies often include provisions for structural repairs, replacement of household contents, and temporary accommodation expenses, providing comprehensive financial protection to policyholders.

India Home Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, provider, premium, and mode of purchase.

Type Insights:

- Structural Cover

- Home Content Cover

- Fire Cover

- Theft Cover

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes structural cover, home content cover, fire cover, theft cover, and others.

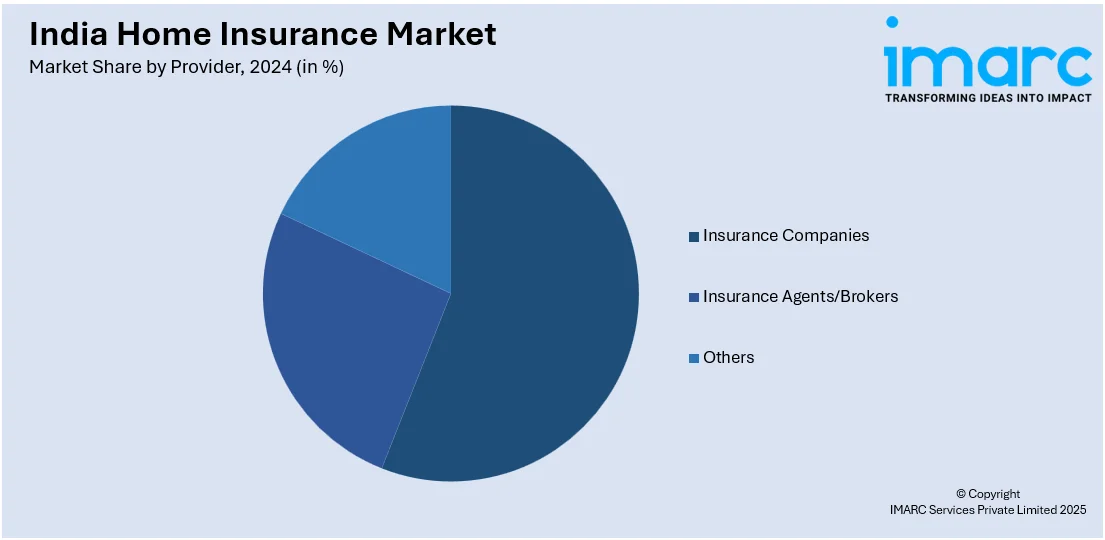

Provider Insights:

- Insurance Companies

- Insurance Agents/Brokers

- Others

A detailed breakup and analysis of the market based on the provider have also been provided in the report. This includes insurance companies, insurance agents/brokers, and others.

Premium Insights:

- Regular

- Single

A detailed breakup and analysis of the market based on the premium have also been provided in the report. This includes regular and single.

Mode of Purchase Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the mode of purchase have also been provided in the report. This includes offline and online.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Home Insurance Market News:

- March 2024: New India Assurance launched the Griha Suvidha Home Insurance policy, offering simplified coverage for home structures and contents. The IRDAI approved Bima Sugam, a digital marketplace aimed at streamlining insurance purchases and claims. These initiatives are enhancing accessibility, improving consumer trust, and driving demand for home insurance in India.

- August 2023: Housing.com partnered with BOXX and Bajaj Allianz General Insurance to launch Cyber Protect, a digital security plan aimed at protecting homebuyers from cyber fraud. This move addressed rising cyber threats in India, where over 500 million cyber-attack attempts were recorded in Q1 2023. By integrating cyber insurance into real estate transactions, the initiative is increasing awareness and adoption of home insurance, strengthening the market by offering bundled protection for both physical and digital assets.

India Home Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Structural Cover, Home Content Cover, Fire Cover, Theft Cover, Others |

| Providers Covered | Insurance Companies, Insurance Agents/Brokers, Others |

| Premiums Covered | Regular, Single |

| Modes of Purchase | Offline, Online |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India home insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India home insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India home insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The home insurance market in India was valued at USD 9.57 Billion in 2024.

The India home insurance market is projected to exhibit a CAGR of 7.33% during 2025-2033, reaching a value of USD 18.07 Billion by 2033.

Frequent incidents of floods, earthquakes, and cyclones in different parts of the country have highlighted the importance of home insurance. Additionally, the expansion of the middle class and rising disposable incomes are making people more willing to secure their homes and belongings. Financial institutions are also encouraging home insurance by bundling it with home loans, increasing its penetration.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)