India Homecare Medical Equipment Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

India Homecare Medical Equipment Market Overview:

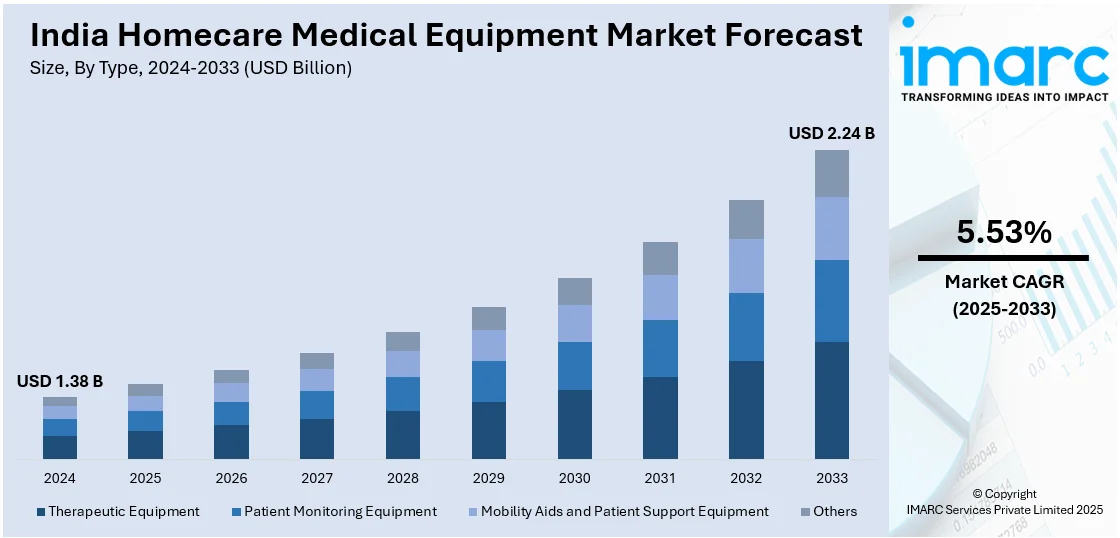

The India homecare medical equipment market size reached USD 1.38 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.24 Billion by 2033, exhibiting a growth rate (CAGR) of 5.53% during 2025-2033. The rising geriatric population, increasing prevalence of chronic diseases, growing preference for home-based healthcare solutions, advancements in portable medical devices, government support for home healthcare, and expanding telemedicine adoption are impelling market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.38 Billion |

| Market Forecast in 2033 | USD 2.24 Billion |

| Market Growth Rate 2025-2033 | 5.53% |

India Homecare Medical Equipment Market Trends:

Growing Demand for Portable and Wearable Medical Devices

The rising demand for home-based healthcare solutions in India is driving the adoption of portable and wearable medical devices, enabling real-time health monitoring and reducing hospital visits. With chronic diseases on the rise, the market for home-use medical devices is expanding rapidly. The prevalence of COPD in India stands at 7.4%, fueling a 20% annual increase in demand for portable oxygen concentrators and CPAP machines from 2023 to 2025. Wearable health monitoring devices, including ECGs, glucose monitors, and blood pressure monitors, are also gaining traction due to the increasing incidence of diabetes and hypertension. Additionally, advancements in AI-powered and IoT-enabled homecare devices are enhancing remote patient management by allowing seamless data sharing with healthcare providers. With India’s digital health market projected to reach US$ 9 billion by 2025, the adoption of connected homecare solutions is set to accelerate, making remote healthcare more efficient and accessible.

To get more information on this market, Request Sample

Expansion of Telemedicine and Remote Patient Monitoring (RPM) Solutions

Telemedicine and remote patient monitoring (RPM) are transforming India's homecare medical equipment market, enhancing healthcare accessibility, particularly in rural regions. The surge in teleconsultations is fueling the adoption of homecare devices integrated with telehealth platforms, enabling virtual consultations and real-time health tracking. Government initiatives such as the Ayushman Bharat Digital Mission (ABDM) are further accelerating telehealth adoption, improving medical access in remote areas, and boosting demand for home-based monitoring devices. India is facing a rising chronic disease burden, with around 77 million diabetics and 220 million hypertension patients, the demand for RPM-enabled glucose meters, blood pressure monitors, and ECG devices is projected to increase. These trends reflect India’s strategic shift toward digital and portable homecare solutions, making healthcare more efficient, patient-centric, and accessible across diverse demographics.

India Homecare Medical Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Therapeutic Equipment

- Patient Monitoring Equipment

- Mobility Aids and Patient Support Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes therapeutic equipment, patient monitoring equipment, mobility aids and patient support equipment, and others.

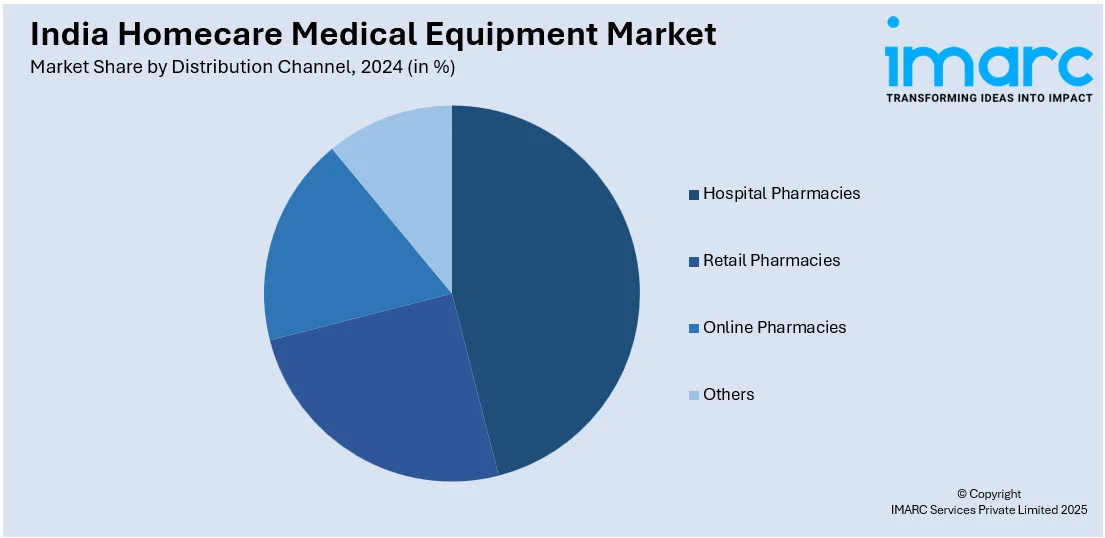

Distribution Channel Insights:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospital pharmacies, retail pharmacies, online pharmacies, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Homecare Medical Equipment Market News:

- May 2024: OMRON Healthcare India collaborated with AliveCor India to launch the first home BPM+ECG monitoring device for early CVD detection and management. The cooperation intends to raise cardiovascular health awareness and avoid occurrences by providing AI-powered portable ECG equipment.

- April 2024: Indian Hospital and Heart Institute teamed with Critical Care Unified (CCU), a home healthcare firm, to provide home care services in Mangalore. The facility offers complete, one-stop solutions for patients' requirements, including an in-home ICU, cancer, cardiac, and stroke care, oxygen and medical equipment, etc.

India Homecare Medical Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Therapeutic Equipment, Patient Monitoring Equipment, Mobility Aids and Patient Support Equipment, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India homecare medical equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India homecare medical equipment market on the basis of type?

- What is the breakup of the India homecare medical equipment market on the basis of distribution channel?

- What are the various stages in the value chain of the India homecare medical equipment market?

- What are the key driving factors and challenges in the India homecare medical equipment market?

- What is the structure of the India homecare medical equipment market and who are the key players?

- What is the degree of competition in the India homecare medical equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India homecare medical equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India homecare medical equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India homecare medical equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)