India Hosiery Market Size, Share, Trends, and Forecast by Type, End Use, and Region, 2025-2033

India Hosiery Market Overview:

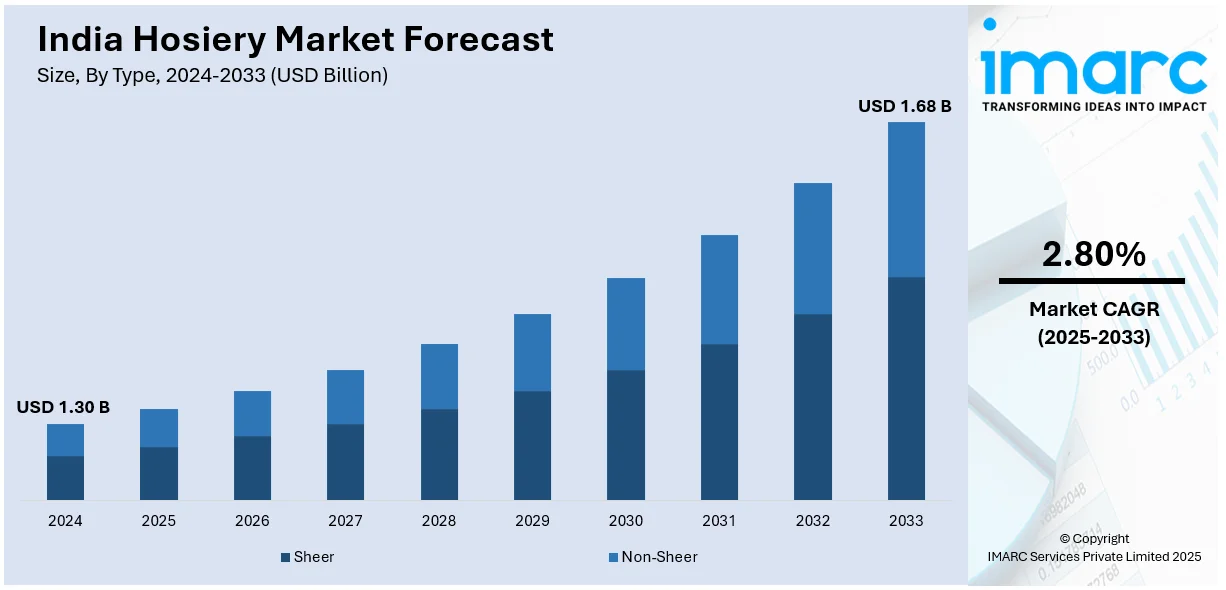

The India hosiery market size reached USD 1.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.68 Billion by 2033, exhibiting a growth rate (CAGR) of 2.80% during 2025-2033. The market is experiencing steady growth, driven by an increasing demand for premium and eco-friendly products. Additionally, rising consumer awareness of sustainability, along with innovations in material use, such as organic cotton and recycled fibers, is reshaping industry dynamics, especially within the men's and women's segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.30 Billion |

| Market Forecast in 2033 | USD 1.68 Billion |

| Market Growth Rate 2025-2033 | 2.80% |

India Hosiery Market Trends:

Rising Demand for Premium and Sustainable Hosiery

Indian consumers are increasingly seeking premium-quality hosiery products with enhanced comfort, durability, and sustainability. Brands are responding by incorporating organic cotton, bamboo fibers, and recycled materials into their offerings. For instance, in January 2025, Bonjour Socks introduced eco-friendly Bamboo Socks, made from sustainable bamboo fabric with antibacterial properties for odor resistance. Additionally, moisture-wicking, antibacterial, and seamless technologies are growing rapidly, particularly among urban consumers who value comfort and functionality. With increasing awareness of environmental issues, large brands are increasing their green product portfolios. This is also being led by international buyers, who are compelling Indian manufacturers to adopt green practices in order to compete in export markets. While high-end hosiery items are more expensive, changing consumer trends and growing disposable incomes are driving demand in urban markets. Manufacturers' challenge is to achieve cost-effectiveness without compromising on sustainability as raw material costs and regulatory costs continue to rise. Furthermore, with such challenges in their way, the premium and sustainable hosiery market is anticipated to achieve steady growth in the future.

To get more information on this market, Request Sample

Growth of E-commerce and Direct-to-Consumer (D2C) Sales

E-commerce has transformed India's hosiery market, providing brands with direct access to consumers and bypassing traditional distribution channels. Online marketplaces have become key sales platforms, particularly for mid-range and premium hosiery products. Simultaneously, leading brands and emerging players are investing in their own D2C websites, enabling personalized marketing, better consumer engagement, and higher profit margins. For instance, as per industry reports, India’s D2C brand market may surpass USD 61.3 Billion by FY27. Digital campaigns, influencer collaborations, and targeted promotions on social media are further driving online sales. The convenience of home delivery, easy returns, and multiple payment options has significantly increased consumer confidence in buying hosiery online. Despite the opportunities, online competition is intense, requiring brands to differentiate themselves through unique product offerings, superior quality, and competitive pricing. The increasing penetration of internet and smartphone users in Tier 2 and Tier 3 cities is expected to further boost online hosiery sales in the near future.

India Hosiery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Sheer

- Non-Sheer

The report has provided a detailed breakup and analysis of the market based on the type. This includes sheer and non-sheer.

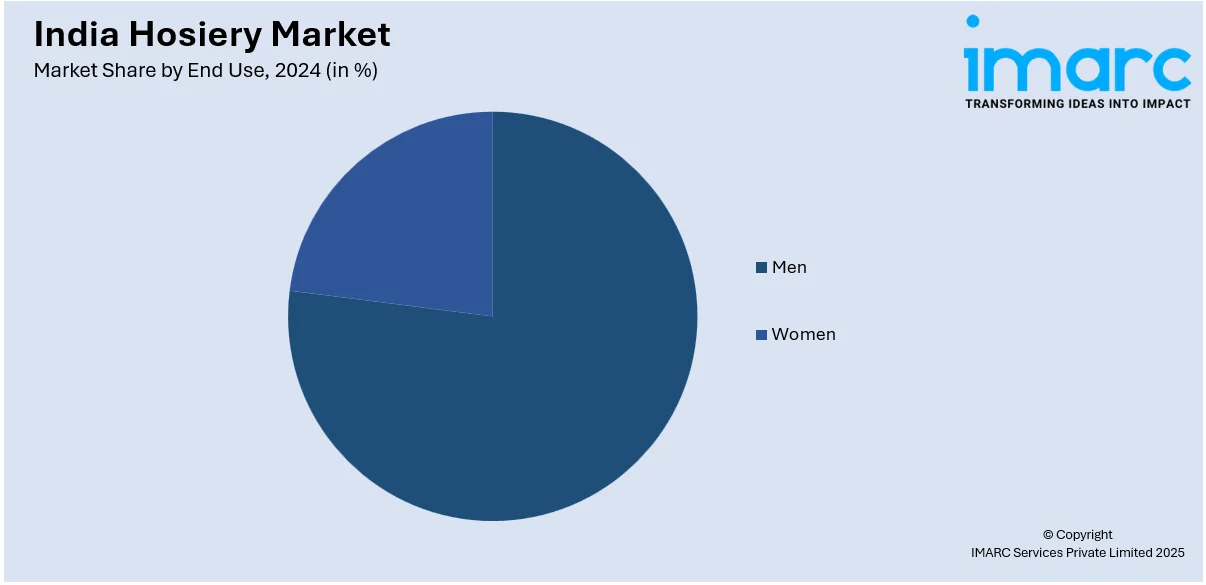

End Use Insights:

- Men

- Women

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes men and women.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hosiery Market News:

- In March 2024, Texcyle, an India-based company, announced the launch of its Bio-Elastane socks globally. The company aims to produce low-carbon, high-quality socks using organic cotton and recycled materials by sourcing ethical inputs and eliminating virgin plastic packaging.

- In February 2025, Lux Industries introduced Lux Nitro, its first premium men’s innerwear brand in 22 years. The brand blends high quality, cutting-edge technology, and contemporary style to appeal to young consumers with a new, dynamic market presence.

India Hosiery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sheer, Non-Sheer |

| End Uses Covered | Men, Women |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hosiery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hosiery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hosiery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India hosiery market reached a value of USD 1.30 Billion in 2024.

The market is projected to grow to USD 1.68 Billion by 2033, registering a CAGR of 2.80% during 2025-2033.

Key growth factors include rising demand for premium, eco-friendly hosiery, innovations in sustainable materials like bamboo and organic cotton, and the expansion of e-commerce and direct-to-consumer models—fueling India hosiery market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)