India Hospital Beds Market Size, Share, Trends and Forecast by Product Type, Technology, Application, Treatment, Sector, and Region, 2025-2033

India Hospital Beds Market Overview:

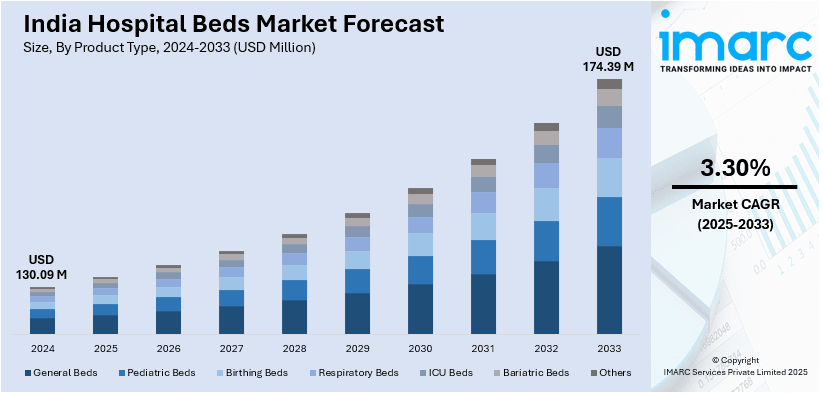

The India hospital beds market size reached USD 130.09 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 174.39 Million by 2033, exhibiting a growth rate (CAGR) of 3.30% during 2025-2033. The market is fueled by the growing development of healthcare infrastructure, rising patient volumes, and heightening demand for quality health care services. The growing incidence of chronic diseases, government healthcare programs, and the expansion of private hospitals are increasing the India hospital beds market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 130.09 Million |

| Market Forecast in 2033 | USD 174.39 Million |

| Market Growth Rate 2025-2033 | 3.30% |

India Hospital Beds Market Trends:

Shift Toward Electric and Automated Hospital Beds

The growing trend influencing the India hospital beds market outlook is the increasing demand for electric and automated hospital beds. These hospital beds with advanced features such as height adjustment and an adjustable backrest and leg rest, controlled electronically for the convenience of caregivers to reposition the patient for comfort and treatment. Further, electric beds may also provide such built-in features as patient monitors, weight sensors, and remote-controlled operations; these features are expected to enhance the quality of care to patients and better efficiency to the staff. The shift toward technological advancement in the bed structure is augmented by a growing interest for better patient comfort, minimizing manual intervention for healthcare providers, and enhancing hospital workflows. As hospitals and healthcare facilities start to look more into better patient care delivery, there is a surge in the demand for electric beds, especially in private hospitals or healthcare institutions that are into cutting-edge technologies. With a rapid transformation of patient treatment techniques taking place in the Indian healthcare industry, the trend is set to expand and ensure a more viable, flexible, and comfortable approach for patients.

To get more information on this market, Request Sample

Growing Demand for Specialized Hospital Beds

There is growing need for customized hospital beds in India, triggered by the rise in particular medical conditions and treatment that necessitate personalized care. For example, ICU beds, orthopedic beds, children's beds, and bariatric beds are on the rise as hospitals endeavor to offer individualized care for various patient requirements. ICU beds are designed with features such as patient monitoring, respiratory care systems, and pressure-reducing mattresses that are required for critically ill patients. Orthopedic beds with adjustable parameters are used to comfort and support recovery for musculoskeletal patients. Bariatric beds with a higher weight capacity are increasingly important as obesity becomes more prevalent in India. According to the industry reports, India requires an extra 2.4 million (24 lakh) hospital beds to achieve the suggested ratio of 3 beds for every 1,000 people, increasing the demand for healthcare real estate. As of now, India is believed to have around 70,000 hospitals, with 63 percent being privately owned, according to a report by global real estate consultant Knight Frank and Berkadia, a US firm. These specialized beds enable healthcare facilities to provide higher-quality care, maintain patient comfort, and lower the risk of complications. As the need for healthcare becomes increasingly specialized, demand for these types of beds will continue to expand, driving the India hospital beds market growth.

Focus on Infection Control and Antimicrobial Bed Solutions

Infection prevention methods are becoming an important trend in India hospital beds market. With the increase in hospital-acquired infections (HAIs) and stricter hygienic norms, the demand for beds with infection-prophylactic capabilities has been on the rise. Manufacturers have begun working on introducing antimicrobial coated and treated materials as part of bed frames, mattresses, and accessories to reduce infection risk to some extent. Copper, silver-treated fabrics, and foam treated with antimicrobials are the up-and-coming design materials for beds that counter the spread of bacteria, viruses, and fungi in hospitals. This is especially the case in critical care units, operating rooms, and other high-risk zones where hygiene is instrumental in the recovery of patients. Moreover, awareness of hygiene practices, especially post-COVID-19, is driving the adoption of antimicrobial solutions in hospitals. The demand for antimicrobial hospital beds will have an upward trend in India with growing infection control concerns.

India Hospital Beds Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, technology, application, treatment, and sector.

Product Type Insights:

- General Beds

- Pediatric Beds

- Birthing Beds

- Respiratory Beds

- ICU Beds

- Bariatric Beds

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes general beds, pediatric beds, birthing beds, respiratory beds, ICU beds, bariatric beds, and others.

Technology Insights:

- Electrical

- Semi-Electric

- Mechanical

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes electrical, semi-electrical, mechanical, and others.

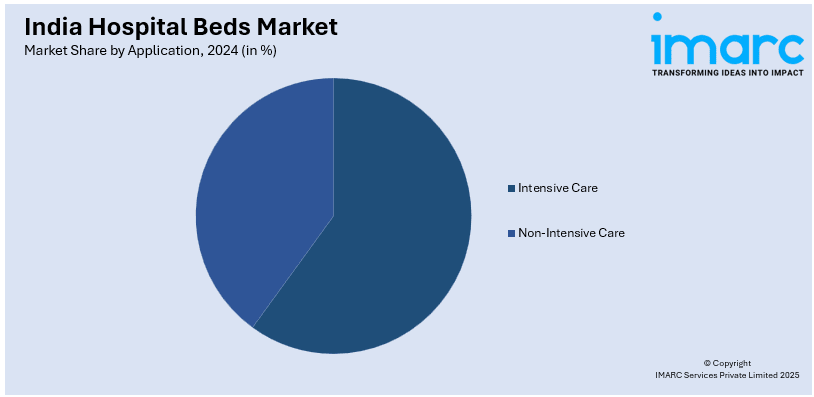

Application Insights:

- Intensive Care

- Non-Intensive Care

The report has provided a detailed breakup and analysis of the market based on the application. This includes intensive care and non-intensive care.

Treatment Insights:

- Acute Care

- Long-Term Care

- Critical Care

- Others

The report has provided a detailed breakup and analysis of the market based on the treatment. This includes acute care, long-term care, critical care, and others.

Sector Insights:

- Private

- Public

The report has provided a detailed breakup and analysis of the market based on the sector. This includes private and public.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hospital Beds Market News:

- In February 2023, Stryker, a top medical technology firm globally, unveiled the SmartMedic platform during the 29th Annual Conference of the Indian Society of Critical Care Medicine held in Indore. SmartMedic is a platform for patient care that improves the capabilities of current ICU beds in hospitals. This approach aims to track fluctuations in patient weight, oversee patient repositioning from nursing stations, and assist healthcare personnel in conducting X-rays on patients in the ICU, eliminating the need for patient relocation.

- In February 2023, Godrej & Boyce, the main company of the Godrej Group, revealed that its division Godrej Interio, a top furniture solutions brand in India for home and institutional markets, introduced an innovative healthcare birthing bed – ‘Solace’. The Solace Bed is an innovative idea that supports effortless movement and allows switching between various positions throughout the Labour, Delivery, Recovery, and Postpartum (LDRP) process.

India Hospital Beds Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | General Beds, Pediatric Beds, Birthing Beds, Respiratory Beds, ICU Beds, Bariatric Beds, Others |

| Technologies Covered | Electrical, Semi-Electric, Mechanical, Others |

| Applications Covered | Intensive Care, Non-Intensive Care |

| Treatments Covered | Acute Care, Long-Term Care, Critical Care, Others |

| Sectors Covered | Private, Public |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hospital beds market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hospital beds market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hospital beds industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hospital beds market in India was valued at USD 130.09 Million in 2024.

The India hospital beds market is projected to exhibit a CAGR of 3.30% during 2025-2033, reaching a value of USD 174.39 Million by 2033.

The market is driven by a rising population, an increase in healthcare needs due to chronic illnesses, and the expansion of hospitals and healthcare facilities. The growing demand for better patient care services, along with rising healthcare investments, plays a significant role in boosting the hospital bed market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)