India Household Cleaners Market Size, Share, Trends and Forecast by Product, Ingredients, Distribution Channel, Income Group, Application, Premiumization, and Region, 2026-2034

India Household Cleaners Market Summary:

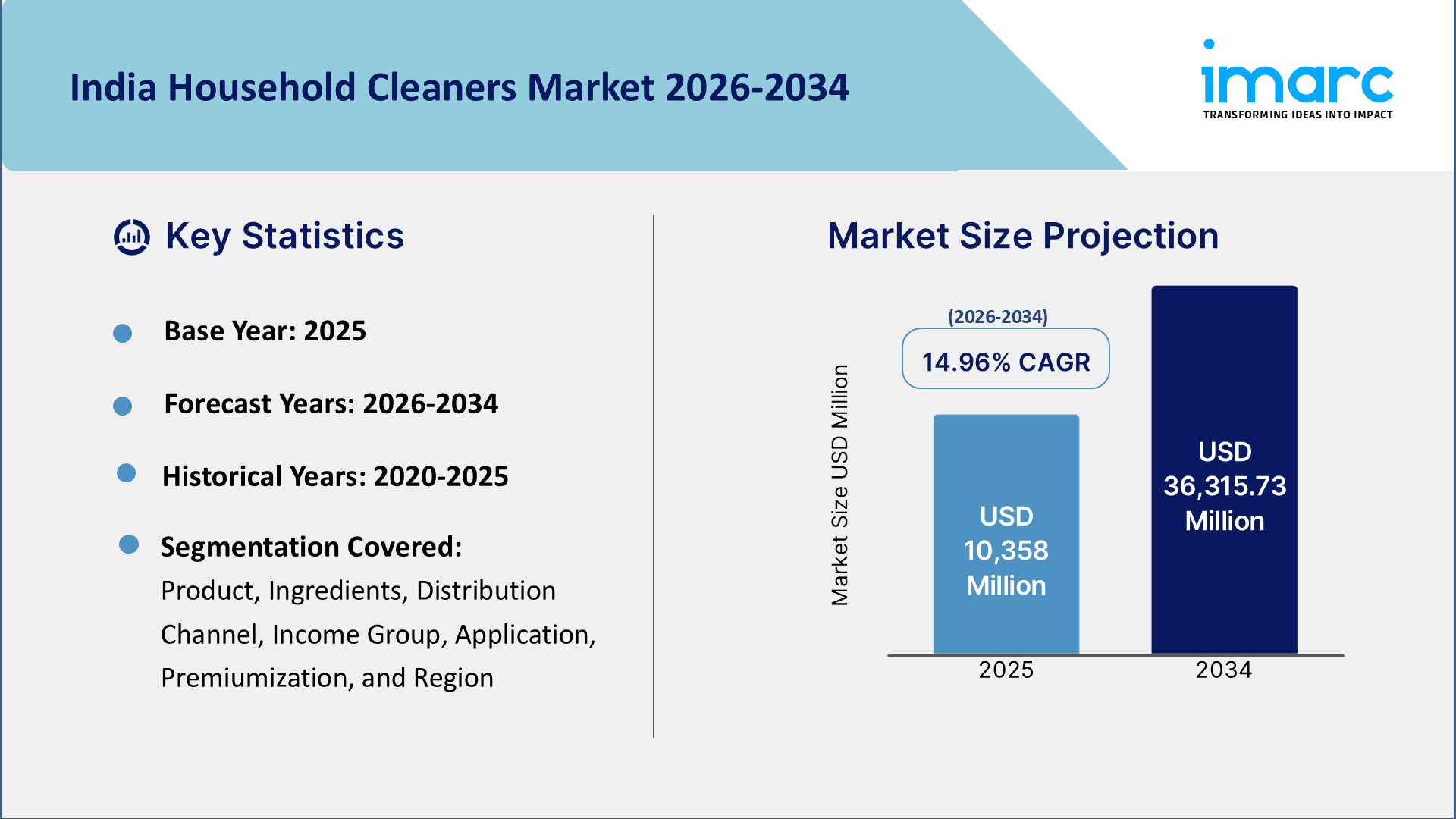

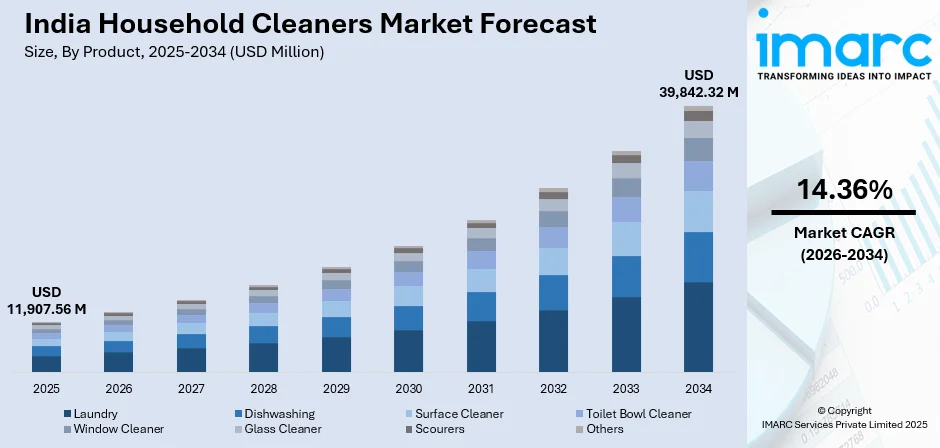

The India household cleaners market size was valued at USD 11,907.56 Million in 2025 and is projected to reach USD 39,842.32 Million by 2034, growing at a compound annual growth rate of 14.36% from 2026-2034.

The India household cleaners market is experiencing robust expansion driven by increasing consumer awareness toward maintaining household hygiene and the growing prevalence of health concerns. The market benefits from rapid urbanization, rising disposable incomes, and the expanding middle-class population that prioritizes branded cleaning products over traditional methods. The proliferation of organized retail formats and e-commerce platforms has enhanced product accessibility, enabling consumers to choose from diverse cleaning solutions across price segments.

To get more information on the market, Request Sample

Key Takeaways and Insights:

-

By Product: Laundry dominates the market with a share of 34% in 2025, driven by widespread daily usage, increased washing machine penetration, and consumer preference for fabric-specific cleaning solutions.

-

By Ingredients: Builders lead the market with a share of 27% in 2025, owing to essential cleaning requirements for construction and property maintenance across expanding residential and commercial sectors.

-

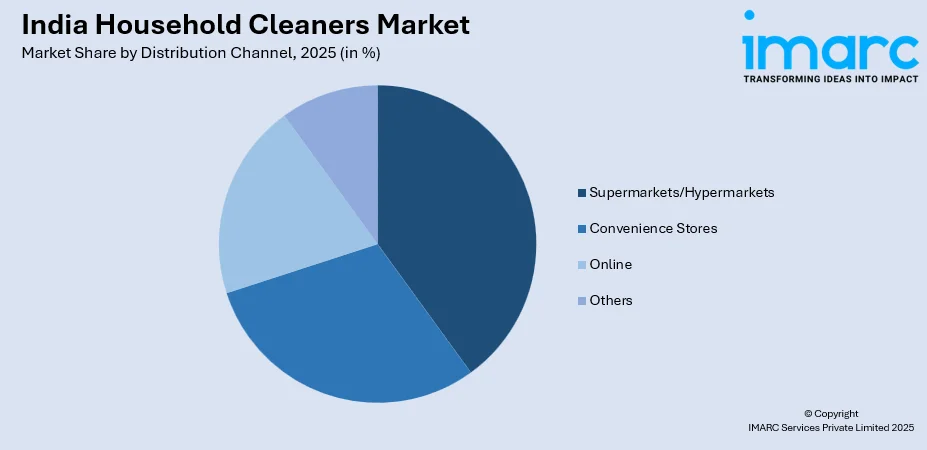

By Distribution Channel: Supermarkets/hypermarkets dominates the market with a share of 40% in 2025, attributable to organized retail expansion offering convenient one-stop shopping experiences.

-

By Income Group: Middle (INR 2.5 lacs-27.5 lacs) leads the market with a share of 49% in 2025, reflecting the growing middle-class preference for branded cleaners offering value for money.

-

By Application: Fabric dominates the market with a share of 31% in 2025, driven by diverse wardrobe requirements and escalating demand for effective fabric cleaning solutions.

-

By Premiumization: Economy leads the market with a share of 41% in 2025, as a significant population prioritizes affordability for daily cleaning necessities.

-

By Region: North India dominates the market with a share of 30% in 2025, supported by high population density and expanding urban consumption centers.

-

Key Players: The India household cleaners market features a competitive landscape with established multinational corporations and domestic brands offering diverse product portfolios across price segments and cleaning applications. Some of the key players operating in the market include, Hindustan Unilever Limited (Unilever), Rohit Surfactants Private Limited, Reckitt Benckiser (India) Limited (Reckitt Benckiser Group PLC), Procter & Gamble Hygiene and Healthcare Ltd. (Procter & Gamble), Jyothy Labs Limited, Nirma Limited, Fena (P) Limited, Dabur India Limited, S. C. Johnson Products Pvt. Ltd. (SC Johnson & Son Investment Ltd.), and Pitambari Products Private Limited.

To get more information on this market Request Sample

The household cleaners industry in India is witnessing strong growth driven by evolving consumer lifestyles and heightened hygiene awareness following recent health concerns. Urbanization, along with the rise of nuclear families and dual income households, is increasing demand for convenient and ready to use cleaning solutions that save time and effort. Reflecting this trend, Godrej Consumer Products Ltd. has launched its ProClean range of home cleaning products, positioned around everyday germ protection and ease of use, highlighting continued investment in hygiene focused product innovation. At the same time, consumers are showing growing preference for advanced formulations featuring eco friendly ingredients, antibacterial properties, and appealing fragrances. The rapid expansion of digital platforms is supporting direct to consumer sales, enabling brands to offer targeted product variants. Marketing initiatives and celebrity endorsements are further strengthening brand visibility and consumer trust across both urban and rural markets.

India Household Cleaners Market Trends:

Rise of Eco-Friendly and Plant-Based Cleaning Products

The market is witnessing a rapid consumer shift toward biodegradable, plant based, and non toxic cleaning solutions as environmental awareness increasingly influences purchasing decisions. In December 2025, Freshora, backed by actress and influencer Ekta Jain, launched India’s first eco friendly floor and multi surface cleaning tablet designed to dissolve in water and significantly reduce plastic waste, highlighting innovation in sustainable formats. Traditional ingredients such as neem, tulsi, lemon, and eucalyptus are being blended with enzyme-based solutions, essential oils, and recyclable packaging.

E-Commerce and Direct-to-Consumer Expansion

The expanding e-commerce ecosystem is transforming how consumers purchase household cleaners across the country. Online platforms offer wide product arrays ranging from detergents and disinfectants to specialized surface cleaners and eco-friendly options. In the 2025 festive season, quick commerce and D2C brands saw a notable boost in online sales as platforms enhanced deals and delivery options, underscoring how digital channels are accelerating product reach and consumer convenience. Direct-to-consumer brands are leveraging social media marketing, influencer collaborations, and AI-driven personalization to strengthen their online presence. Subscription-based services and auto-replenishment options are gaining traction among digital-native consumers seeking convenience.

Premiumization and Specialized Product Development

The industry is experiencing growing demand for premium and specialized cleaning products offering enhanced performance and additional benefits. For instance, Wipro Consumer Care & Lighting’s MaxKleen brand recently unveiled a 2-in-1 floor cleaner in 2025 that not only delivers disinfection but also repels insects using natural oils, highlighting how brands are innovating beyond basic cleaning to meet evolving household needs. Fragrance-infused cleaners inspired by natural oils are gaining market share as consumers seek emotional satisfaction from household care routines. Concentrated formulations and water-soluble pods are reducing packaging waste while improving storage convenience. Antibacterial and disinfectant products with prolonged surface protection are experiencing sustained demand following heightened health awareness.

Market Outlook 2026-2034:

The India household cleaners market is set for steady growth over the forecast period, driven by increasing hygiene awareness, rapid urbanization, and rising disposable incomes that boost spending on branded cleaning products. Expanding middle-class demographics and evolving lifestyles are fueling demand for convenient, multipurpose solutions, while consumer preference for quality, efficiency, and time-saving products further supports market expansion. Overall, these factors position the sector for sustained development and higher penetration of modern cleaning solutions. The market generated a revenue of USD 11,907.56 Million in 2025 and is projected to reach a revenue of USD 39,842.32 Million by 2034, growing at a compound annual growth rate of 14.36% from 2026-2034.

India Household Cleaners Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Laundry | 34% |

| Ingredients | Builders | 27% |

| Distribution Channel | Supermarkets/Hypermarkets | 40% |

| Income Group | Middle (INR 2.5 lacs-27.5 lacs) | 49% |

| Application | Fabric | 31% |

| Premiumization | Economy | 41% |

| Region | North India | 30% |

Product Insights:

- Laundry

- Dishwashing

- Surface Cleaner

- Toilet Bowl Cleaner

- Window Cleaner

- Glass Cleaner

- Scourers

- Others

The laundry dominates with a market share of 34% of the total India household cleaners market in 2025.

Laundry products dominate the Indian household cleaners market due to frequent daily use and growing washing machine penetration across urban and rural areas. In September 2025, Hindustan Unilever launched Surf Excel Matic Express, a fast-acting detergent delivering expert cleaning in just 15 minutes, supported by a campaign featuring cricketer Jasprit Bumrah. The segment includes powders, liquids, fabric softeners, and stain removers, with rising preference for liquid and eco-friendly formulations driving innovation and premiumization.

The varied wardrobe needs of Indian consumers, covering everyday apparel as well as traditional garments worn during festivals and special occasions, create sustained demand for effective fabric cleaning solutions. To tap this demand, brands are introducing specialized detergent variants designed for specific fabric types, washing methods, and fragrance preferences. At the same time, the expansion of middle-class households with rising disposable incomes is accelerating the shift from traditional cleaning methods to branded and value-added laundry detergents.

Ingredients Insights:

- Builders

- Solvents

- Surfactants

- Antimicrobials

- Others

The builders leads with a share of 27% of the total India household cleaners market in 2025.

The dominant position of builders reflects the critical cleaning needs associated with construction activities and ongoing property maintenance across rapidly expanding urban areas. Builders address diverse requirements for new developments, including heavy-duty cleaners for post-construction cleanup and specialized products for surface care. Accelerating urbanization and large-scale infrastructure development are increasing residential and commercial construction projects, thereby driving sustained demand for professional and industrial-grade cleaning solutions.

The segment is supported by rising real estate development in tier-one and tier-two cities, creating steady demand for industrial-strength cleaning solutions. Key customers include professional cleaning service providers catering to construction and facility management sectors. To meet these needs, manufacturers are innovating specialized products designed to tackle the unique cleaning challenges posed by various surface materials and the removal of construction debris, ensuring efficient and effective maintenance for diverse projects.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Convenience Stores

- Supermarkets/Hypermarkets

- Online

- Others

The supermarkets/hypermarkets dominates with a market share of 40% of the total India household cleaners market in 2025.

The leading share of supermarkets and hypermarkets highlights the convenience of one-stop shopping, allowing consumers to compare multiple brands and product variants. These modern retail formats provide extensive shelf space for household cleaners, enabling brands to display full product portfolios across price points. With India’s retail sector set to exceed $1.6 trillion by 2030, the expansion of organized retail in metropolitan and tier-two cities is increasing access to a wide range of cleaning products.

The segment benefits from promotional campaigns, product demonstrations, and bundled offers that encourage consumer trials and brand switching. Effective store placement and in-store marketing further influence purchase decisions at the point of sale. Meanwhile, the growing presence of modern retail chains in semi-urban areas is expanding organized retail reach, enabling access to new consumer segments beyond traditional trade networks. These factors collectively support the segment’s sustained growth and visibility.

Income Group Insights:

- Middle (INR 2.5 lacs- INR 27.5 lacs)

- Low (Less than INR 2.5 Lacs)

- High (Greater than INR 27.5 lacs)

The middle (INR 2.5 lacs- INR 27.5 lacs) leads with a share of 49% of the total India household cleaners market in 2025.

The strong dominance of the middle-income segment highlights their growing preference for branded cleaners over traditional methods, fueled by convenience, effective results, and value-for-money offerings. Middle-class consumers seek reliable performance across laundry, dishwashing, and surface cleaning products. Brands targeting this demographic focus on delivering high-quality formulations while maintaining accessible pricing, ensuring a balance between product efficacy and affordability to meet the expectations of this increasingly influential consumer group.

The rising middle-class population with higher disposable incomes is fueling market growth, as households shift from economy to mainstream branded cleaning products. Evolving lifestyles and heightened awareness of hygiene standards are boosting demand for specialized cleaning solutions among middle-income families. Strong brand loyalty in this segment offers manufacturers opportunities to launch product line extensions and premium variants, allowing them to cater to evolving preferences while strengthening their presence in the expanding middle-class market.

Application Insights:

- Fabric

- Kitchen

- Bathroom

- Floor

- Others

The fabric dominates with a market share of 31% of the total India household cleaners market in 2025.

The dominant position of fabric applications reflects the fundamental importance of clothing care in Indian households and the diverse wardrobe requirements spanning daily wear to traditional attire. Products including detergents, fabric softeners, and stain removers address the need for thorough cleaning, fabric maintenance, and quality preservation. The increasing penetration of washing machines is driving demand for specialized formulations optimized for machine washing. In September 2025, Jyothy Labs launched Dr. Wool, a liquid detergent specifically designed for woollens and delicates, expanding its fabric care portfolio and highlighting growing industry focus on specialized garment care solutions.

The segment is gaining from rising consumer awareness of fabric care practices and the availability of products tailored to different textiles. Premium fabric cleaners that protect colors, retain fragrance, and feature gentle formulations are increasingly preferred by quality-conscious buyers. Innovations in concentrated detergents and eco-friendly fabric care solutions are broadening choices across price points, enabling consumers to access specialized, sustainable, and effective options that cater to diverse laundering needs while enhancing overall product appeal.

Premiumization Insights:

- Economy

- Mid-Sized

- Premium

The economy leads with a share of 41% of the total India household cleaners market in 2025.

The dominant share of economy products highlights the price sensitivity of a large consumer segment that prioritizes affordability for everyday cleaning needs. Budget-friendly detergents, surface cleaners, and dishwashing liquids address this demand by offering effective solutions at accessible prices. Mass-market brands lead this segment through widespread distribution networks and value-focused packaging sizes, ensuring availability and convenience while maintaining cost-effectiveness for price-conscious households across urban, semi-urban, and rural markets.

The economy segment acts as the gateway for consumers to adopt branded cleaning products, especially in rural and semi-urban areas. Manufacturers use sachet packaging and small-format options to keep products affordable while maintaining brand visibility. Competition in this segment focuses on cost optimization, efficient distribution, and offering value-added formulations within strict price limits. These strategies help brands attract price-sensitive consumers and establish a foothold in emerging markets.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 30% share of the total India household cleaners market in 2025.

The leading position of North India stems from the region's high population density, expanding urbanization, and significant concentration of middle-class households driving consumer spending on household care products. The National Capital Region and surrounding states represent major consumption centers with well-developed organized retail infrastructure. Strong distribution networks of both traditional trade and modern retail formats ensure comprehensive market coverage across the region.

The region’s market is supported by local manufacturing facilities and regional distribution hubs, ensuring efficient product availability. Increasing disposable incomes and evolving lifestyles in tier-two and tier-three cities are extending growth opportunities beyond major metropolitan centers. Strong brand awareness and effective marketing, driven by concentrated media exposure and promotional campaigns, further reinforce consumer engagement, particularly in North Indian markets, enabling brands to capitalize on both urban and emerging regional demand.

Market Dynamics:

Growth Drivers:

Why is the India Household Cleaners Market Growing?

Rising Hygiene Awareness and Health Consciousness

Rising consumer awareness about household cleanliness and increasing health concerns are reshaping demand for cleaning products. A better understanding of hygiene and its role in preventing infections is driving the adoption of antibacterial and disinfectant formulations. Reckitt’s Dettol Banega Swasth India campaign has reached over 26 million children in 840,000 schools, promoting handwashing and cleanliness education. Health-focused marketing campaigns are reinforcing these behavior changes, while sustained attention to sanitation practices following recent health events continues to support market growth across multiple cleaning product categories.

Urbanization and Changing Consumer Lifestyles

Rapid urbanization and the rise of nuclear families are driving demand for convenient, time-saving cleaning solutions suited to fast-paced lifestyles. The increase in dual-income households is boosting preference for ready-to-use products that minimize cleaning effort and time. Higher disposable incomes allow greater spending on branded household care items that offer enhanced performance and convenience. Urban consumers are increasingly valuing product quality and brand reputation over price when choosing cleaning solutions, reflecting a shift toward more premium and reliable household care options.

Retail Expansion and E-Commerce Growth

The proliferation of organized retail formats and e-commerce platforms is transforming product accessibility and consumer purchase behavior across urban and rural markets. Modern retail chains offer extensive household cleaner selections enabling brand comparison and informed purchasing decisions. The India e-commerce market size was valued at USD 129.72 Billion in 2025 and is projected to reach USD 651.10 Billion by 2034, reflecting the rapid digital adoption that is enhancing online household cleaner sales. Online platforms provide convenience of home delivery, competitive pricing, and access to diverse product portfolios including niche and eco-friendly options. The direct-to-consumer model enables brands to reach consumers directly with personalized offerings and exclusive product variants.

Market Restraints:

What Challenges the India Household Cleaners Market is Facing?

Price Sensitivity and Competition from Unorganized Sector

A significant portion of the population remains highly price-sensitive, limiting adoption of premium branded products in favor of lower-cost alternatives or traditional cleaning methods. The unorganized sector continues competing effectively in price-sensitive segments through local manufacturing and distribution advantages. Brand differentiation challenges in commodity categories create pricing pressures affecting manufacturer margins.

Environmental and Regulatory Concerns

Growing awareness about environmental impacts of chemical cleaning products is creating consumer hesitation and regulatory scrutiny. Concerns about water pollution from detergent runoff and health effects of synthetic chemicals are influencing formulation requirements. Manufacturers face increasing pressure to reformulate products with biodegradable and non-toxic ingredients while maintaining cleaning effectiveness.

Rural Market Penetration Challenges

Distribution infrastructure limitations and lower disposable incomes in rural markets constrain branded product penetration beyond urban centers. Consumer preference for traditional cleaning methods and limited brand awareness present adoption barriers in rural geographies. Packaging and pricing strategies must address affordability constraints while ensuring viable unit economics for manufacturers.

Competitive Landscape:

The India household cleaners market features a competitive landscape characterized by the presence of established multinational corporations, domestic conglomerates, and emerging regional brands serving diverse consumer segments. Leading players leverage extensive distribution networks, brand equity, and marketing investments to maintain market positions across product categories. Innovation in formulations, packaging, and sustainability credentials serves as key competitive differentiators. The market is witnessing increased activity from direct-to-consumer brands and eco-friendly startups targeting environmentally conscious urban consumers. Strategic acquisitions and partnerships are enabling companies to expand product portfolios and geographic reach across India's diverse regional markets.

Some of the key players include:

- Hindustan Unilever Limited (Unilever)

- Rohit Surfactants Private Limited

- Reckitt Benckiser (India) Limited (Reckitt Benckiser Group PLC)

- Procter & Gamble Hygiene and Healthcare Ltd. (Procter & Gamble)

- Jyothy Labs Limited

- Nirma Limited

- Fena (P) Limited

- Dabur India Limited

- S. C. Johnson Products Pvt. Ltd. (SC Johnson & Son Investment Ltd.)

- Pitambari Products Private Limited

Recent Developments:

-

In April 2025, Unilever launched Cif Infinite Clean, an allinone probioticpowered home cleaning spray that uses natural probiotics to keep surfaces cleaner for up to 72 hours after application, meeting growing demand for nontoxic, longlasting cleaning solutions.

India Household Cleaners Market Report Scope:

|

Report Features |

Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Laundry, Dishwashing, Surface Cleaner, Toilet Bowl Cleaner, Window Cleaner, Glass Cleaner, Scourers, Others |

| Ingredients Covered | Builders, Solvents, Surfactants, Antimicrobials, Others |

| Distribution Channels Covered | Convenience Stores, Supermarkets and Hypermarkets, Online, Others |

| Income Groups Covered | Middle (INR 2.5 lacs- INR 27.5 lacs), Low (Less than INR 2.5 Lacs), High (Greater than INR 27.5 lacs) |

| Applications Covered | Fabric, Kitchen, Bathroom, Floor, Others |

| Premiumizations Covered | Economy, Mid-Sized, Premium |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Hindustan Unilever Limited (Unilever), Rohit Surfactants Private Limited, Reckitt Benckiser (India) Limited (Reckitt Benckiser Group PLC), Procter & Gamble Hygiene and Healthcare Ltd. (Procter & Gamble), Jyothy Labs Limited, Nirma Limited, Fena (P) Limited, Dabur India Limited, S. C. Johnson Products Pvt. Ltd. (SC Johnson & Son Investment Ltd.), Pitambari Products Private Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The household cleaners market in India was valued at USD 10,358 Million in 2025.

The India household cleaners market is expected to grow at a compound annual growth rate of 14.36% from 2026-2034 to reach USD 39,842.32 Million by 2034.

Laundry dominated the market with a 34% share, driven by widespread daily usage, increased washing machine penetration, and consumer preference for fabric-specific products across both urban and rural markets.

Key factors driving the India household cleaners market include rising hygiene awareness, rapid urbanization, expanding middle-class population, growing influence of organized retail and e-commerce platforms, and the launch of innovative, eco-friendly, and multipurpose cleaning products.

Major challenges include price sensitivity limiting premium product adoption, competition from unorganized sector players, environmental and regulatory concerns regarding chemical formulations, and rural market penetration constraints due to distribution and affordability barriers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)