India Housing Loan Market Size, Share, Trends and Forecast by Type, Customer Type, Source, Interest Rate, Tenure, and Region, 2025-2033

India Housing Loan Market Overview:

The India housing loan market size reached USD 329.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 773.8 Billion by 2033, exhibiting a growth rate (CAGR) of 8.90% during 2025-2033. The market share is expanding, driven by the ongoing development of information technology (IT) parks and job hubs, which is encouraging migration to cities, along with the increasing implementation of affordable housing initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 329.9 Billion |

| Market Forecast in 2033 | USD 773.8 Billion |

| Market Growth Rate 2025-2033 | 8.90% |

India Housing Loan Market Trends:

Growing investments in urbanization projects

The rising expenditure on urbanization projects are offering a favorable India housing loan market outlook. As cities are expanding with improved connectivity, metro networks, and commercial hubs, more people want to buy homes in well-developed areas, driving the demand for housing loans. Government initiatives like Smart Cities Mission are supporting real estate growth, encouraging financial institutions and banks to provide appealing home loan choices. In August 2024, the Cabinet Committee on Economic Affairs (CCEA) of India, overseen by Prime Minister Narendra Modi, sanctioned 12 new smart city projects as part of the National Industrial Corridor Development Programme (NICDP) with a funding of INR 286.02 Billion (USD 3.41 Billion). These initiatives are anticipated to draw INR 1.52 Trillion (USD 18.12 Billion) in investments from major industries and micro, small and medium enterprises (MSMEs). With more high-rise apartments, gated communities, and affordable housing projects coming up, people have more choices, making home loans essential for buyers. The development of IT parks, business districts, and job hubs is also encouraging migration to cities, catalyzing the demand for home financing. As urbanization projects continue to broaden, the real estate value is increasing, making housing loans more essential for aspiring homeowners across India.

.webp)

To get more information on this market, Request Sample

Rising implementation of affordable housing initiatives

The increasing execution of affordable housing initiatives is fueling the India housing loan market growth. Government schemes offer subsidies on interest rates, reducing the financial burden on first-time homebuyers and encouraging more people to take housing loans. In July 2024, the Indian Finance Minister, Nirmala Sitharaman declared that the government was set to offer loans at reasonable rates for urban housing. The minister revealed proposals to create an efficient and transparent rental housing market, alongside efforts to enhance the availability of rental properties. With developers focusing on budget-friendly housing projects, banks and non-banking financial companies (NBFCs) are offering flexible loan options to cater to the high demand. State governments are also providing incentives, such as reduced stamp duty and tax benefits, making home loans more attractive. The availability of long repayment tenures and lower down payment requirements further motivates people to apply for home financing. As these initiatives continue to expand, they create a positive cycle. The increase in the number of affordable houses leads to more home loans, supporting real estate development and financial sector growth. With more people aspiring to own houses, economical housing schemes are playing a crucial role in shaping the market across India.

India Housing Loan Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, customer type, source, interest rate, and tenure.

Type Insights:

- Home Purchase

- Land/ Plot Purchase

- Home Construction

- Home Improvement

- Home Extension

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes home purchase, land/ plot purchase, home construction, home improvement, home extension, and others.

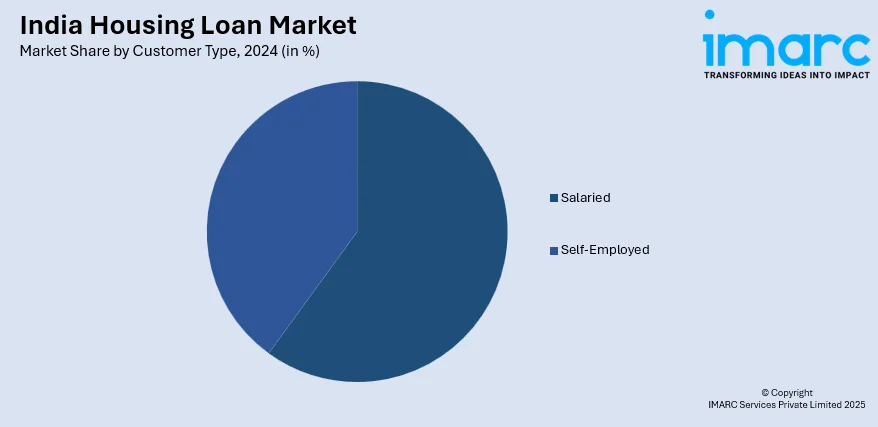

Customer Type Insights:

- Salaried

- Self-Employed

A detailed breakup and analysis of the market based on the customer type have also been provided in the report. This includes salaried and self-employed.

Source Insights:

- Bank

- Housing Finance Companies (HFCs)

The report has provided a detailed breakup and analysis of the market based on the source. This includes bank and housing finance companies (HFCs).

Interest Rate Insights:

- Below 10%

- Above 10%

The report has provided a detailed breakup and analysis of the market based on the interest rate. This includes below 10% and above 10%.

Tenure Insights:

- Below 5 Years

- 5 to below 10 Years

- 10 to 20 Years

- Above 20 Years

The report has provided a detailed breakup and analysis of the market based on the tenure. This includes below 5 years, 5 to below 10 years, 10 to 20 years, and above 20 years.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Housing Loan Market News:

- In March 2025, the Reserve Bank of India (RBI) updated regulations for priority sector loans, increasing limits for housing loans and expanding the criteria for classifying loans related to renewable energy (RE). The updated regulations will take effect starting April 1, 2025. For housing, loans of up to INR 50 lakh for centers with populations exceeding 50 Lakh can be categorized as a priority sector, with the maximum cost of the housing unit set at INR 63 Lakh.

- In October 2024, Weaver Services Pvt Ltd obtained complete ownership of Capital India Home Loans Ltd for a notable amount of INR 267 Crore. The main emphasis was aimed at enabling self-employed people in the unstructured sector, especially in Tier 2 and Tier 3 cities, to receive economic home loans. The firm intended to introduce new products and improve operational efficiency, establishing the company as a prominent player in the affordable housing finance industry in India.

India Housing Loan Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Home Purchase, Land/ Plot Purchase, Home Construction, Home Improvement, Home Extension, Others |

| Customer Types Covered | Salaried, Self-Employed |

| Sources Covered | Bank, Housing Finance Companies (HFCs) |

| Interest Rates Covered | Below 10%, Above 10% |

| Tenures Covered | Below 5 Years, 5 to below 10 Years, 10 to 20 Years, Above 20 Years |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India housing loan market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India housing loan market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India housing loan industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The housing loan market in India was valued at USD 329.9 Billion in 2024.

The India housing loan market is projected to exhibit a CAGR of 8.90% during 2025-2033, reaching a value of USD 773.8 Billion by 2033.

The market is driven by aspirations for property ownership, rising incomes, and structured repayment options. Younger professionals are increasingly considering home investment at earlier stages of life. Customizable loan offerings, wider reach of financial institutions, and flexibility in down payments make borrowing more accessible, while emotional value associated with owning a home continues to influence buying decisions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)