India Hygienic Products Market Size, Share, Trends, and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

India Hygienic Products Market Overview:

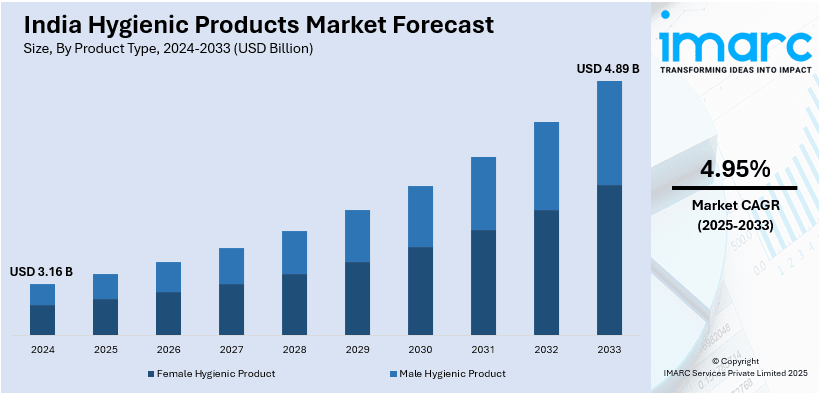

The India hygienic products market size reached USD 3.16 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.89 Billion by 2033, exhibiting a growth rate (CAGR) of 4.95% during 2025-2033. The market is driven by rising health awareness, improved sanitation infrastructure, government initiatives like Swachh Bharat, and growing disposable income. Rapid urbanization, lifestyle changes, and increased access to hygiene education further boost the India hygienic products market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.16 Billion |

| Market Forecast in 2033 | USD 4.89 Billion |

| Market Growth Rate 2025-2033 | 4.95% |

India Hygienic Products Market Trends:

Rising Health and Hygiene Awareness

Increased awareness about personal health and hygiene, particularly after the COVID-19 pandemic, has significantly boosted the demand for hygienic products in India. Consumers now recognize the importance of maintaining cleanliness to prevent infections and promote overall well-being. This shift is evident across all age groups and socioeconomic segments, with greater emphasis on using products like hand sanitizers, disinfectants, and personal wipes, creating a positive India hygienic products market outlook. Campaigns by health organizations and media coverage on hygiene practices have played a vital role in reshaping public behavior, leading to a surge in daily hygiene product usage in homes, workplaces, schools, and public spaces across the country. For instance, in October 2024, Swiggy launched a new program called the 'Swiggy Seal,' intended to enhance food quality and hygiene standards in 650 cities throughout India. This initiative focuses on Swiggy's restaurant partners, aiming to uphold quality in food preparation and packaging, as per a PTI report. The launch of the 'Swiggy Seal' began in Pune and will expand to more cities starting in November.

To get more information on this market, Request Sample

Government Initiatives and Sanitation Campaigns

Programs like Swachh Bharat Abhiyan and National Rural Health Mission have significantly improved hygiene infrastructure and awareness in both urban and rural India. These initiatives have emphasized the importance of cleanliness, sanitation, and the regular use of hygienic products. Additionally, public-private partnerships and policy support for manufacturing and distributing hygiene-related goods have enhanced accessibility and affordability. The government's push toward building toilets, improving waste management, and educating people on handwashing and menstrual hygiene has created a strong foundation for hygienic product adoption. These efforts continue to fuel the India hygienic products market share, especially in tier 2, tier 3 cities and rural areas. For instance, in March 2025, In March 2025, Diageo India launched two Water, Sanitation, and Hygiene (WASH) projects in Ponda, Goa, in collaboration with BharatCares, benefiting 85 students and faculty. The initiatives focus on improving drinking water and sanitation facilities at local schools and supporting community health and education as part of Diageo's commitment to sustainable growth.

India Hygienic Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Female Hygienic Product

- Male Hygienic Product

The report has provided a detailed breakup and analysis of the market based on the product type. This includes female hygienic product and male hygienic product.

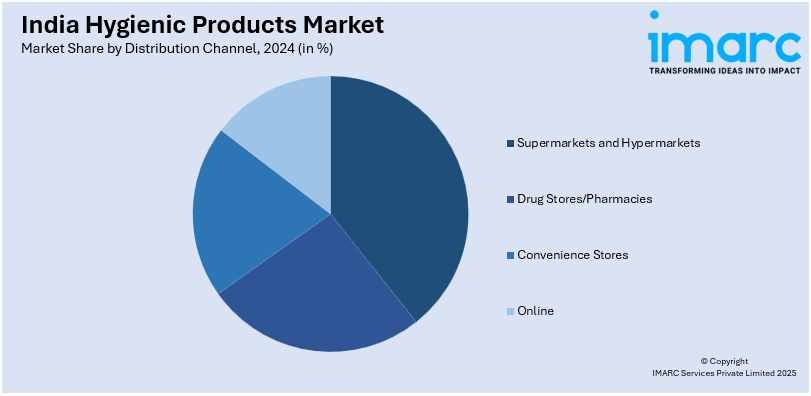

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Drug Stores/Pharmacies

- Convenience Stores

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, drug stores/pharmacies, convenience stores, and online.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hygienic Products Market News:

- In December 2024, Sirona announced its partnership with AP Dhillon for 'The BrownPrint' 2024 India Tour as the official Toilet Hygiene Partner. The brand will provide PeeBuddy hygiene products outside female washrooms at all venues, ensuring women's access to clean facilities during concerts and promoting comfort and well-being at public events.

- In February 2024, the Indian Navy and the Navy Welfare and Wellness Association (NWWA) announced its partnership with Pee Safe to provide active female sailors with women's hygiene products. This collaboration is part of a Memorandum of Understanding between the Indian Navy and NWWA to assist the Navy's 'Women in White' wellness program, which also includes Pee Safe.

India Hygienic Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Female Hygienic Product, Male Hygienic Product |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Drug Stores/Pharmacies, Convenience Stores, Online |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India hygienic products market performed so far and how will it perform in the coming years?

- What is the breakup of the India hygienic products market on the basis of product type?

- What is the breakup of the India hygienic products market on the basis of distribution channels?

- What is the breakup of the India hygienic products market on the basis of region?

- What are the various stages in the value chain of the India hygienic products market?

- What are the key driving factors and challenges in the India hygienic products market?

- What is the structure of the India hygienic products market and who are the key players?

- What is the degree of competition in the India hygienic products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hygienic products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hygienic products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hygienic products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)