India Induction Cooktop Market Size, Share, Trends and Forecast by Product, Application, Distribution Channel, and Region, 2025-2033

India Induction Cooktop Market Overview:

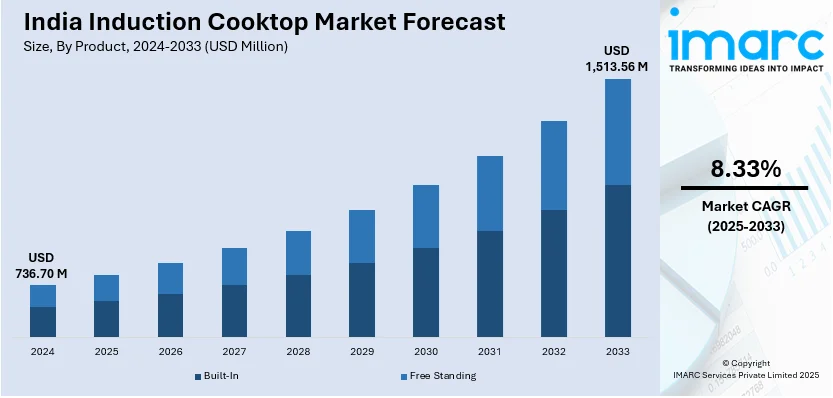

The India induction cooktop market size reached USD 736.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,513.56 Million by 2033, exhibiting a growth rate (CAGR) of 8.33% during 2025-2033. The market is witnessing growing primarily due to increasing urbanization and rising disposable income and growth of e-commerce and expansion of organized retail. Product innovations and associated product affordability are also acting as other major growth-inducing factors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 736.70 Million |

| Market Forecast in 2033 | USD 1,513.56 Million |

| Market Growth Rate (2025-2033) | 8.33% |

India Induction Cooktop Market Trends:

Increasing Urbanization and Rising Disposable Income

The rapid urbanization in India is significantly influencing the adoption of induction cooktops, particularly in metropolitan and tier-1 cities. For instance, in January 2024, The World Bank reports India's rapid urbanization, projecting 600 million people, or 40% of the population, will reside in towns and cities by 2036, highlighting significant demographic shifts. With households changing to nuclear-family-style lifestyles, there is a growing demand for small, energy-efficient, and easy-to-use cooking appliances. Induction cooktops save more time, allow more precise temperature control, and have better safety features than traditional gas stoves, making them the choice of urban consumers. Increasing disposable income, in turn, is acting as fuel for the market in which flowers consumers' purchasing decisions toward advanced kitchen appliances that provide convenience and efficiency. With the growing middle-class population in India, a clear shift toward modern kitchen solutions is contributing to the demand for induction cooktops. Smart induction cooktops are increasingly in style among tech-savvy consumers for their premium quality and special features like touchscreen controls, multiple preset cooking modes, and integration with smart home devices. Government encouragement for energy-efficient appliances is also lending momentum to this market. The drive for power-based cooking solutions resonates with Indian sustainability programs giving households further incentive to shift from conventional gas stoves to induction cooktops. The increased availability of pocket-friendly models in both online and offline retail channels shall also allow for widespread adoption, putting induction cooktops on the path to becoming the kitchen appliance of choice in urban India.

To get more information on this market, Request Sample

Growth of E-Commerce and Expansion of Organized Retail

The increasing penetration of e-commerce platforms and the expansion of organized retail are key factors accelerating the growth of the induction cooktop market in India. Leading e-commerce giants such as Amazon, Flipkart, and Tata Cliq offer a wide variety of induction cooktops across different price ranges, making them accessible to consumers across urban and semi-urban areas. These platforms provide attractive discounts, easy financing options, and customer reviews, influencing purchasing decisions and boosting online sales. Organized retail chains, including Reliance Digital, Croma, and Spencer’s, are also playing a pivotal role in driving market penetration. These stores allow customers to experience product demonstrations, compare features, and make informed purchasing decisions. The growing preference for organized retail formats, coupled with strategic partnerships between induction cooktop manufacturers and major retail chains, is strengthening market reach. For instance, in February 2025, TTK Prestige announced its plans for a 30% store expansion over four years, expecting income tax relief to boost consumer spending. Moreover, brands are leveraging digital marketing and influencer collaborations to enhance product visibility and educate consumers about the benefits of induction cooking. The increasing integration of online and offline retail strategies, such as click-and-collect services and exclusive online launches, is further supporting market expansion. As digital commerce continues to grow, it is expected to remain a major distribution channel for induction cooktops in India.

India Induction Cooktop Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, application, and distribution channel.

Product Insights:

- Built-In

- Free Standing

The report has provided a detailed breakup and analysis of the market based on the product. This includes Built-In and Free Standing.

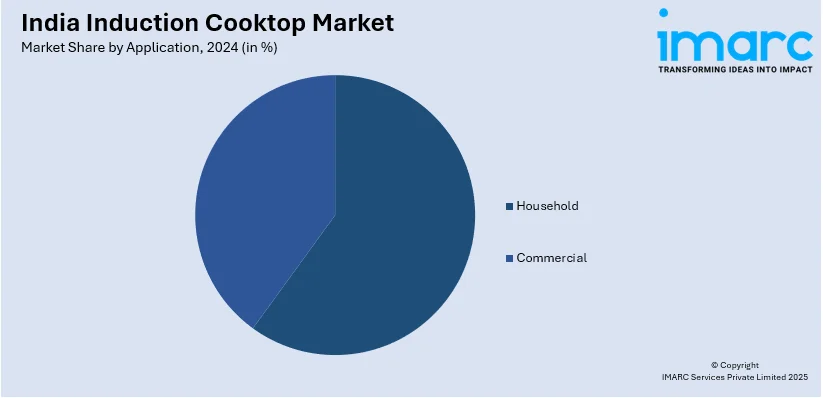

Application Insights:

- Household

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes household and commercial.

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Specialty Stores

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, specialty stores, and online.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Induction Cooktop Market News:

- In September 2024, the well-known Korean brand DAEWOO announced the introduction of two new induction cooktops in India: the Push Button Induction Cooktop and the Touch Button Induction Cooktop. The new products aim to address the growing need for energy-efficient and convenient cooking options in contemporary kitchens

- In March 2023, Crompton Greaves and Butterfly Gandhimathi Appliances announced a merger to enhance market execution and product innovation, including induction cooktops. MD Shantanu Khosla emphasized its strategic importance in unlocking revenue and cost synergies, achieving economies of scale, and driving nationwide growth, strengthening the combined entity’s presence in India’s kitchen appliances market.

India Induction Cooktop Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Built-In, Free Standing |

| Applications Covered | Household, Commercial |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Specialty Stores, Online |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India induction cooktop market performed so far and how will it perform in the coming years?

- What is the breakup of the India induction cooktop market on the basis of product?

- What is the breakup of the India induction cooktop market on the basis of application?

- What is the breakup of the India induction cooktop market on the basis of distribution channel?

- What is the breakup of the India induction cooktop market on the basis of region?

- What are the various stages in the value chain of the India induction cooktop market?

- What are the key driving factors and challenges in the India induction cooktop?

- What is the structure of the India induction cooktop market and who are the key players?

- What is the degree of competition in the India induction cooktop market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India induction cooktop market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India induction cooktop market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India induction cooktop industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)