India Industrial Air Blowers Market Size, Share, Trends and Forecast by Type, Business Type, End User, and Region, 2025-2033

India Industrial Air Blowers Market Overview:

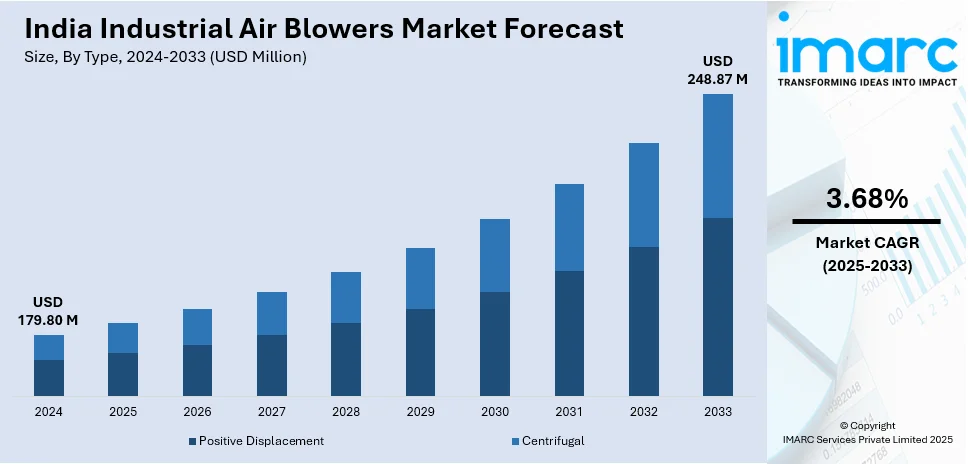

The India industrial air blowers market size reached USD 179.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 248.87 Million by 2033, exhibiting a growth rate (CAGR) of 3.68% during 2025-2033. The market is driven by rising demand for energy-efficient solutions, stringent government regulations on energy consumption, and the expansion of industries including manufacturing, wastewater treatment, and power generation. Technological advancements, infrastructure growth, and the need for durable, high-performance blowers in heavy industries further propel the India industrial air blowers market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 179.80 Million |

| Market Forecast in 2033 | USD 248.87 Million |

| Market Growth Rate 2025-2033 | 3.68% |

India Industrial Air Blowers Market Trends:

Increasing Demand for Energy-Efficient Air Blowers

The significant shift toward energy-efficient solutions, driven by rising energy costs and stringent government regulations on energy consumption, is significantly expanding the India industrial air blowers market share. In 2022-23, India's per capita energy consumption crossed 1,331 kWh, driven by demand growth and renewable energy capacity addition. The target for the nation is to reach 500 GW of non-fossil energy by 2030. The government has introduced policies such as 100% FDI in renewable energy, exemption of inter-state transmission charges, and paving the way for green energy trading, enabling this transition. With growing energy demands in industries, the requirement for energy-efficient air blowers in manufacturing plants and renewable energy projects will proliferate, which, in turn, will drive energy-efficient consumption and sustainability. Industries such as manufacturing, wastewater treatment, and power generation are increasingly adopting high-efficiency air blowers to reduce operational costs and minimize carbon footprints. Technological advancements, such as the integration of variable frequency drives (VFDs) and IoT-enabled smart blowers, are further enhancing energy efficiency by optimizing airflow and reducing power consumption. Additionally, the government’s push for sustainable industrial practices under initiatives is encouraging manufacturers to invest in eco-friendly air blowers. This trend is expected to continue as industries prioritize long-term cost savings and environmental compliance, making energy efficiency a key driver in the market’s growth.

To get more information on this market, Request Sample

Growing Adoption of Centrifugal Air Blowers in Heavy Industries

Centrifugal air blowers are gaining traction in India’s industrial sector, particularly in heavy industries such as steel, cement, and chemicals, due to their ability to handle high-pressure applications and large volumes of air. A research report by the IMARC Group suggests that the steel market in India was around 144.43 million tons in 2024. The market is expected to reach 256.73 million tons by 2033, registering a CAGR of 6.20% from 2025 to 2033. These blowers are preferred for their durability, low maintenance requirements, and ability to operate in harsh environments. Therefore, this is creating a positive India industrial air blowers market outlook. The expansion of infrastructure projects and the growth of the manufacturing sector are fueling the demand for centrifugal blowers, as they are essential for processes including combustion, ventilation, and material handling. Moreover, manufacturers are focusing on developing customized centrifugal blowers to meet specific industry needs, further enhancing their adoption. With India’s industrial sector poised for steady growth, the demand for centrifugal air blowers is expected to rise, making them a dominant segment in the market.

India Industrial Air Blowers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, business type, and end user.

Type Insights:

- Positive Displacement

- Centrifugal

The report has provided a detailed breakup and analysis of the market based on the type. This includes positive displacement and centrifugal.

Business Type Insights:

- Equipment Sales

- Services

A detailed breakup and analysis of the market based on the business type have also been provided in the report. This includes equipment sales and services.

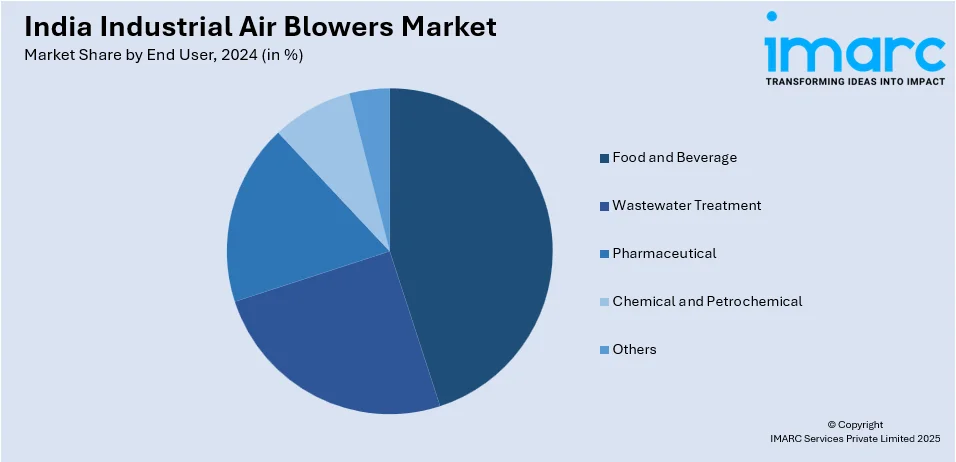

End User Insights:

- Food and Beverage

- Wastewater Treatment

- Pharmaceutical

- Chemical and Petrochemical

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes food and beverage, wastewater treatment, pharmaceutical, chemical and petrochemical, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Air Blowers Market News:

- August 13, 2024: Stellin Info Solutions introduced an entirely new advanced PMSM motor HVLS fan in India under the brand name Stellin Air, which serves incredible cooling for the industrial area while at the same time providing energy efficiency coupled with longer life. This new-model fan boasts an airflow capability of up to 230,000 cubic meters per hour and thus helps lower operating costs, especially for large-scale industrial applications. Such innovations are likely to take air blowers used in industries to another level and positively contribute to the cooling solutions being used in manufacturing units and warehouses as the demand for efficient ventilation rides the industrial rollercoaster.

India Industrial Air Blowers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Positive Displacement, Centrifugal |

| Business Types Covered | Equipment Sales, Services |

| End Users Covered | Food and Beverage, Wastewater Treatment, Pharmaceutical, Chemical and Petrochemical, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial air blowers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial air blowers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial air blowers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial air blowers market in India was valued at USD 179.80 Million in 2024.

The India industrial air blowers market is projected to exhibit a CAGR of 3.68% during 2025-2033, reaching a value of USD 248.87 Million by 2033.

The India industrial air blowers market is driven by rising demand for efficient ventilation, cooling, and material handling solutions across manufacturing, power, and processing industries. Growing focus on energy efficiency, adoption of advanced technologies, and increasing infrastructure development further boost the need for reliable, durable, and customized industrial air blower systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)