India Industrial Bearings Market Size, Share, Trends and Forecast by Bearing Type, End-User Industry, and Region, 2025-2033

India Industrial Bearings Market Overview:

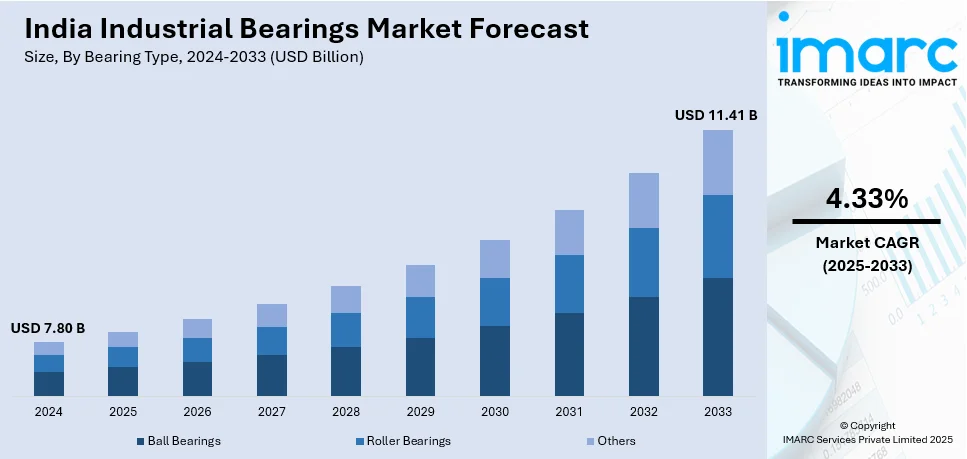

The India industrial bearings market size reached USD 7.80 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.41 Billion by 2033, exhibiting a growth rate (CAGR) of 4.33% during 2025-2033. The market is fueled by the increasing need for energy-efficient and high-performance bearings, driven by sectors such as automotive, renewable energy, and manufacturing. Government policies like "Make in India" and the initiative towards green energy, coupled with the growth of automation and smart manufacturing, also drive the India industrial bearings market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.80 Billion |

| Market Forecast in 2033 | USD 11.41 Billion |

| Market Growth Rate 2025-2033 | 4.33% |

India Industrial Bearings Market Trends:

Growing Demand for Energy-Efficient Bearings

The significant shift toward energy-efficient bearings, driven by the increasing emphasis on sustainability and cost optimization is significantly supporting the India industrial bearings market share. Industries such as manufacturing, automotive, and renewable energy are adopting advanced bearing technologies that reduce friction, minimize energy consumption, and enhance operational efficiency. According to a research report by the IMARC Group, the renewable energy market in India reached a value of USD 23.9 Billion in 2024. This market is expected to grow from USD 25.8 Billion in 2025 to USD 52.1 Billion by 2033, growing at a CAGR of 8.1% during the forecast period. As a result of the Indian government promoting green energy and energy-efficient practices, manufacturers have also started investing in bearings that meet international standards. In addition, in the last few decades, the emergence of electric vehicles (EVs) and wind energy projects, along with the growing trend toward their application have accelerated the need for high-load bearings that can work under harsh environmental conditions. This trend is expected to continue in the future with different industries working towards reducing carbon emissions and improving energy efficiency, which creates profit-making opportunities for the bearing manufacturers in India.

To get more information on this market, Request Sample

Expansion of Automation and Smart Manufacturing

The adoption of automation and smart manufacturing practices is reshaping the India industrial bearings market outlook. As industries embrace Industry 4.0 technologies, there is a growing need for precision-engineered bearings that can integrate with automated systems and IoT-enabled machinery. India's manufacturing sector is quickly embracing Industry 4.0 technologies, with artificial intelligence and machine learning expected to reach 40% of total manufacturing spending by 2025 compared to 20% in 2021 as per industry reports. The industrial automation market is expected to grow at a compound annual growth rate of 14.26% to USD 29.43 Billion by 2029, which will disrupt industries such as automotive, electronics, and pharma. However, the demand for high-performance industrial bearings will increase in line with the preponderance of smart factories, enabling automated machinery to achieve both efficiency and precision. In addition, bearings equipment equipped with sensors for real-time monitoring of performance, temperature, and vibration are gaining traction, particularly in sectors such as automotive, aerospace, and heavy machinery. This trend is driven by the need to minimize downtime, enhance productivity, and reduce maintenance costs. Furthermore, the Indian government's "Make in India" initiative has encouraged domestic manufacturing, leading to increased investments in advanced machinery and automation. As a result, bearing manufacturers are focusing on developing innovative, high-performance products to cater to the changing demands of automated and smart factories, positioning themselves for sustained growth.

India Industrial Bearings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on bearing type and end-user industry.

Bearing Type Insights:

- Ball Bearings

- Roller Bearings

- Others

The report has provided a detailed breakup and analysis of the market based on the bearing type. This includes ball bearings, roller bearings, and others.

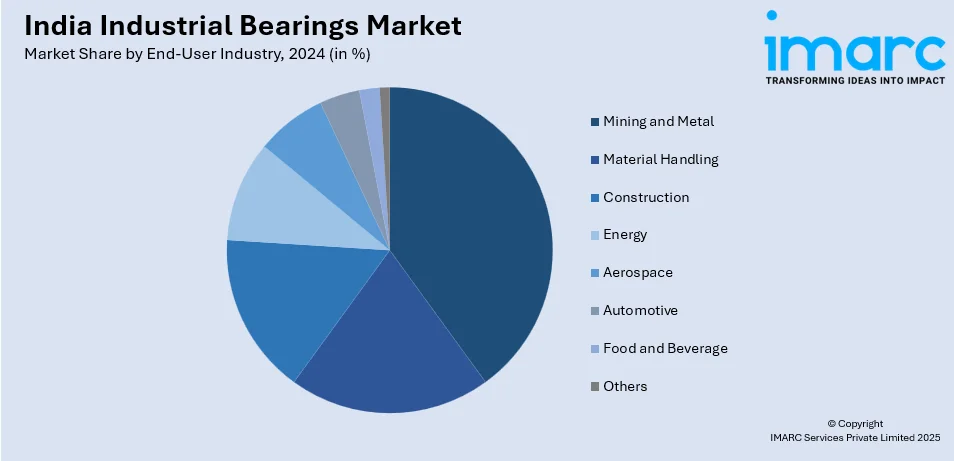

End-User Industry Insights:

- Mining and Metal

- Material Handling

- Construction

- Energy

- Aerospace

- Automotive

- Food and Beverage

- Others

A detailed breakup and analysis of the market based on the end-user industry have also been provided in the report. This includes mining and metal, material handling, construction, energy, aerospace, automotive, food and beverage, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Bearings Market News:

- September 18, 2024: NBC Bearings, the largest bearing maker in the country and a leading innovator in the area of industrial and electric vehicle bearings, stated that it would invest ₹750 Crores (approximately USD 91.46 Million) over the next four years to expand manufacturing capacity in India, with a large focus being placed on developing sensor-based and low-noise bearings to meet increasing demand.

India Industrial Bearings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Bearing Type Covered | Ball Bearings, Roller Bearings, Others |

| End-User Industries Covered | Mining and Metal, Material Handling, Construction, Energy, Aerospace, Automotive, Food and Beverage, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial bearings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial bearings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial bearings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial bearings market in India was valued at USD 7.80 Billion in 2024.

The India industrial bearings market is projected to exhibit a CAGR of 4.33% during 2025-2033, reaching a value of USD 11.41 Billion by 2033.

The industrial bearings market in India is growing due to expanding manufacturing activity, infrastructure upgrades, and the rise of electric vehicles. Sectors like renewable energy, rail, and aerospace also contribute. Supportive government programs and the shift toward locally made, energy-efficient machinery are further strengthening overall market momentum.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)