India Industrial Conveyor Systems Market Size, Share, Trends and Forecast by Type, Load Capacity, Operation Type, End Use Industry, and Region, 2025-2033

India Industrial Conveyor Systems Market Overview:

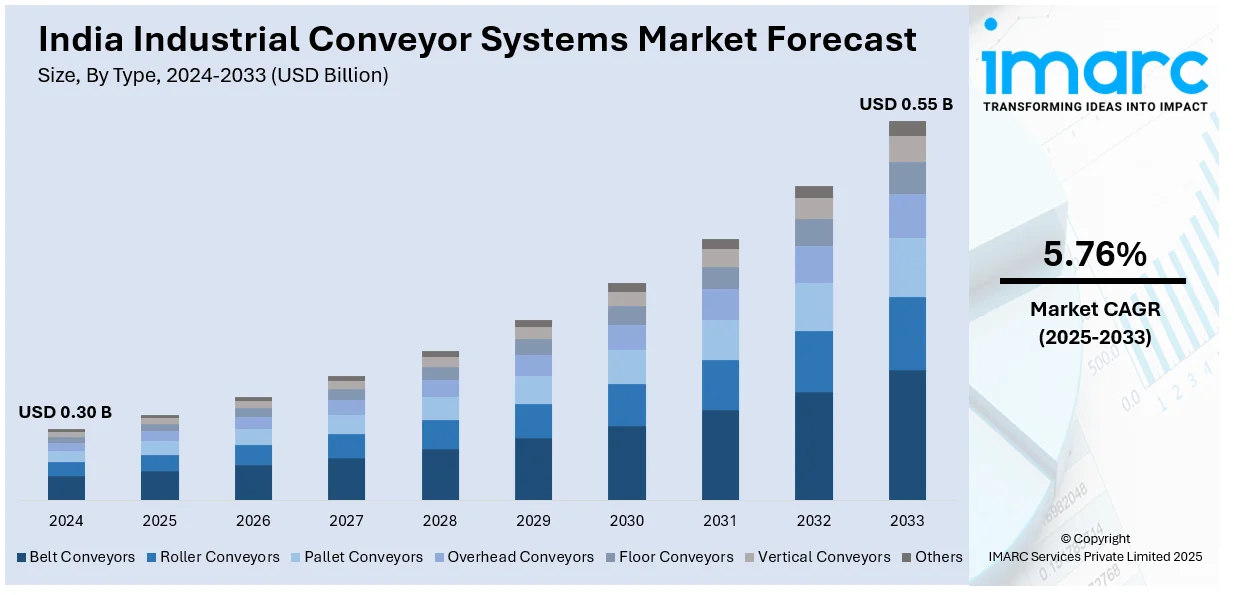

The India industrial conveyor systems market size reached USD 0.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.55 Billion by 2033, exhibiting a growth rate (CAGR) of 5.76% during 2025-2033. The market is witnessing growth fueled by rising automation, growing e-commerce and warehousing industries, and heightening focus on sustainable, energy-efficient technologies that improve operating efficiency, cut costs, and address changing industry needs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.30 Billion |

| Market Forecast in 2033 | USD 0.55 Billion |

| Market Growth Rate 2025-2033 | 5.76% |

India Industrial Conveyor Systems Market Trends:

Increasing Adoption of Automated Conveyor Systems

Industries in India are quickly implementing automated conveyor systems to improve their efficiency of operation and minimize their dependence on labor. For instance, in May 2023, Bastian Solutions announced its first conveyor manufacturing factory in Bangalore, India, strengthening its "Make in India" technology portfolio and providing six different conveyor models across different industries. Moreover, automotive, pharmaceutical, and e-commerce sectors are leading this charge by adding automation to production and logistics workflows. Automated conveyors provide greater throughput, real-time monitoring, and predictive maintenance to ensure optimized material handling functions. The integration of Industry 4.0 technologies, such as sensors, Internet of Things (IoT), and artificial intelligence (AI), increases system functions further. Such systems maximize resource efficiency, reduce downtime, and give actionable data to make informed decisions. Also, automated sortation systems are increasingly being adopted by big warehouses and distribution facilities to process and deliver orders quicker. As businesses focus on efficiency and scalability, demand for automated conveyor systems in manufacturing facilities as well as logistics centers is likely to increase. This is further reinforced by government policies supporting technological innovations in industrial automation.

To get more information on this market, Request Sample

Growth in E-Commerce and Warehousing Sector

The thriving e-commerce industry in India has created a huge demand for effective material handling solutions, resulting in a growth in the installation of conveyor systems. As consumers expect quicker delivery, warehouses and fulfillment centers are adopting conveyor belts for quick sorting, packaging, and dispatch processes. These systems provide smooth handling of bulk orders, minimizing operation time and errors. Large e-commerce players are investing in cutting-edge distribution centers with automated conveyor networks to keep up with competitive delivery times. For example, in February 2024, ATS Group launched advanced automated conveyor solutions such as high-speed elevators, telescopic belt conveyors, and the A-Kart high transfer cut to boost productivity across industries in India. Furthermore, last-mile delivery companies are also embracing conveyor-based sorting systems to optimize parcel handling. The growth of omnichannel retailing has also fueled the need for flexible conveyor solutions that enable both online and offline order fulfillment. As Tier-II and Tier-III cities also experience rising penetration of e-commerce, development of mega regional warehouses with high-technology conveyor systems will be in growing demand, stimulating operational effectiveness within supply chains.

Sustainability and Energy-Efficient Conveyor Solutions

Sustainability is fast becoming a major concern in India's industrial conveyor systems market as companies are switching to energy-saving solutions. Companies are designing systems with energy-conserving features, such as variable frequency drives (VFDs), regenerative braking, and low-friction bearings. The technologies save energy and reduce cost of operations without compromising on high productivity. Solar-powered conveyor systems are also in the making, especially in mining and warehousing applications, toward increased adoption of renewable energy. Moreover, biodegradable and recyclable materials are being utilized in the manufacture of conveyor belts to minimize environmental footprint. Real-time energy monitoring systems allow businesses to monitor and streamline energy consumption, adhering to sustainability objectives. As more industries undergo tightened environmental policies, there is increased demand for green conveyor systems. Companies are also concentrating on waste and emission reduction by implementing closed-loop material handling operations. This trend will also continue to fuel innovation in green conveyor design and manufacturing.

India Industrial Conveyor Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, load capacity, operation type, and end use industry.

Type Insights:

- Belt Conveyors

- Roller Conveyors

- Pallet Conveyors

- Overhead Conveyors

- Floor Conveyors

- Vertical Conveyors

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes belt conveyors, roller conveyors, pallet conveyors, overhead conveyors, floor conveyors, vertical conveyors, and others.

Load Capacity Insights:

- Light-Duty Conveyors

- Medium-Duty Conveyors

- Heavy-Duty Conveyors

A detailed breakup and analysis of the market based on the load capacity have also been provided in the report. This includes light-duty conveyors, medium-duty conveyors, and heavy-duty conveyors.

Operation Type Insights:

- Automated Conveyors

- Semi-Automated Conveyors

- Manual Conveyors

The report has provided a detailed breakup and analysis of the market based on the operation type. This includes automated conveyors, semi-automated conveyors, and manual conveyors.

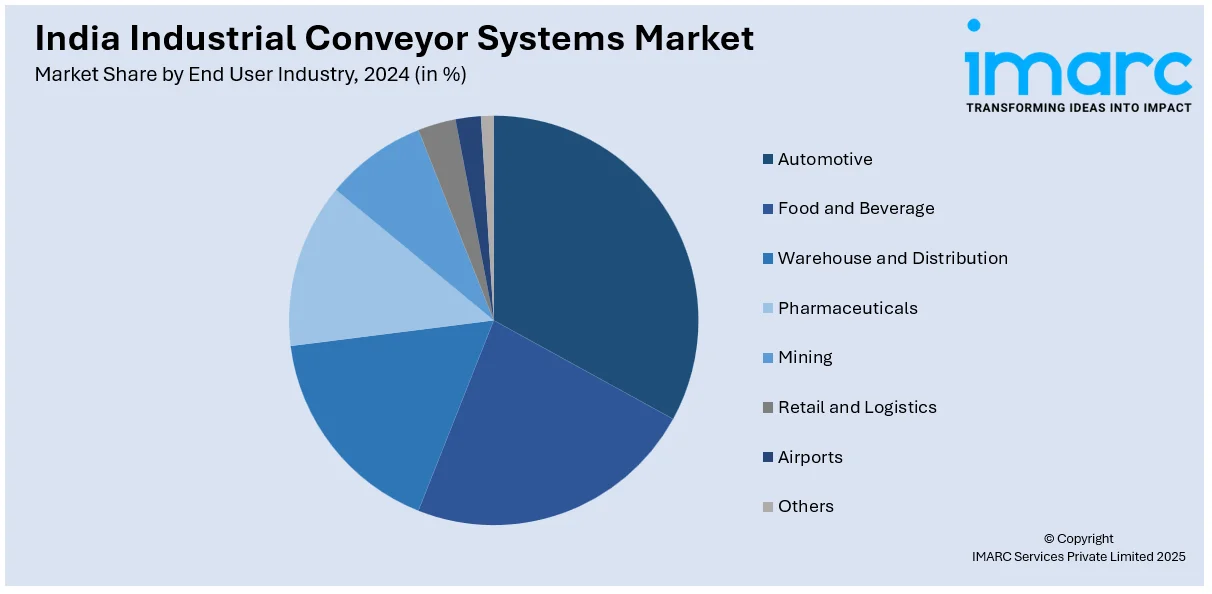

End Use Industry Insights:

- Automotive

- Food and Beverage

- Warehouse and Distribution

- Pharmaceuticals

- Mining

- Retail and Logistics

- Airports

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, food and beverage, warehouse and distribution, pharmaceuticals, mining, retail and logistics, airports, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Conveyor Systems Market News:

- In November 2024, NMDC Ltd has set up a 'Transformation and Innovation' vertical to launch cutting-edge industrial conveyor systems and material handling technologies in India. Some of the key innovations are RopeCon Conveyor Systems, in-pit crushing and conveying systems, and sandwich belt conveyors, with an aim to drive operational efficiency and sustainability.

- In August 2024, ATC Chains India, a prominent producer of modular belts, has launched its new series of in-house manufactured conveyor belts. Renowned for their durability and customization, these belts are suitable for food, automotive, and packaging industries with guaranteed performance, quick delivery, and lower maintenance costs.

India Industrial Conveyor Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Belt Conveyors, Roller Conveyors, Pallet Conveyors, Overhead Conveyors, Floor Conveyors, Vertical Conveyors, Others |

| Load Capacities Covered | Light-Duty Conveyors, Medium-Duty Conveyors, Heavy-Duty Conveyors |

| Operation Types Covered | Automated Conveyors, Semi-Automated Conveyors, Manual Conveyors |

| End Use Industries Covered | Automotive, Food And Beverage, Warehouse And Distribution, Pharmaceuticals, Mining, Retail And Logistics, Airports, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial conveyor systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial conveyor systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial conveyor systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial conveyor systems market in India was valued at USD 0.30 Billion in 2024.

The India industrial conveyor systems market is projected to exhibit a (CAGR) of 5.76% during 2025-2033, reaching a value of USD 0.55 Billion by 2033.

Increased manufacturing, mining, food processing, and e-commerce activity is driving demand for industrial conveyor systems in India. Amplifying labor costs, a requirement for operational efficiency, and increasing warehousing infrastructure enhance adoption. Integration of technology, such as internet of things (IoT)-based systems and smart automation also enhances growth in industries requiring high-volume, time-critical material handling solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)