India Industrial Engines Market Size, Share, Trends and Forecast by Fuel Type, Power, End Use, and Region, 2025-2033

India Industrial Engines Market Overview:

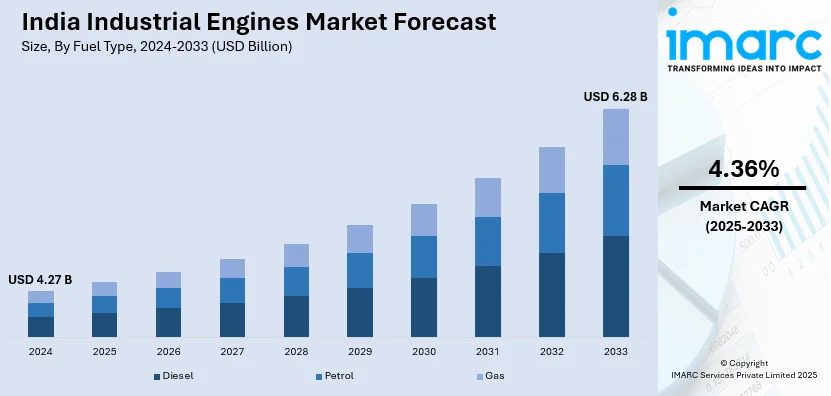

The India industrial engines market size reached USD 4.27 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.28 Billion by 2033, exhibiting a growth rate (CAGR) of 4.36% during 2025-2033. The market is driven by rapid industrialization, increasing demand for power generation, and expanding construction and agriculture sectors. Besides this, rising infrastructure projects, technological advancements in fuel efficiency, and favorable government initiatives supporting manufacturing growth are also propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.27 Billion |

| Market Forecast in 2033 | USD 6.28 Billion |

| Market Growth Rate 2025-2033 | 4.36% |

India Industrial Engines Market Trends:

Transition to Cleaner and Alternative Fuel Engines

India is accelerating its transition to cleaner and alternative fuel engines, focusing on reducing carbon emissions and decreasing dependence on traditional fossil fuels. This shift is driven by strong government initiatives, industry investments, and rapid technological advancements. The Indian government has set a target of achieving net-zero carbon emissions by 2070, promoting policies that encourage the production and adoption of liquefied natural gas (LNG) and ethanol-powered engines. In line with this, companies like Blue Energy Motors are making significant investments in LNG-powered trucks, with plans to raise USD 100 million by January 2025 to expand production capacity and triple sales to 3,000 LNG trucks within the next financial year. Simultaneously, advancements in engine technology are supporting this transition, with manufacturers developing engines compatible with alternative fuels. A notable example is Toyota’s 2023 launch of the Innova HyCross, which features a flex-fuel engine capable of running on ethanol and electricity, ensuring 40% of the journey is powered by ethanol while the rest relies on electric power. As India continues its push toward sustainability, the adoption of alternative fuel engines is expected to play a pivotal role in reducing the country’s carbon footprint and driving long-term energy security.

To get more information of this market, Request Sample

Integration of Digitalization and IoT in Industrial Engines

The integration of Internet of Things (IoT) technologies into industrial engines is transforming their efficiency, maintenance, and overall performance, aligning with India’s broader digitalization push. The Indian IoT market, valued at USD 1.4 billion in 2024, is projected to reach USD 3.6 billion by 2033, growing at a CAGR of 10.2% from 2025 to 2033. A key driver of this trend is predictive maintenance, where IoT-enabled sensors continuously monitor engine performance, fuel efficiency, and maintenance needs, allowing operators to proactively address issues, minimizing downtime and reducing operational costs. Additionally, remote monitoring and control have gained prominence, particularly as India's digital economy accounted for 11.74% of national income in 2022-23, equivalent to INR 31.64 lakh crore (~USD 402 billion) in GDP. Digitalization enables real-time monitoring and troubleshooting of industrial engines, benefiting sectors with geographically dispersed operations. Furthermore, IoT-powered data analytics enhance decision-making by optimizing performance, improving fuel efficiency, and reducing emissions. As digital technologies become more embedded in industrial engines, Indian manufacturers are gaining a competitive edge by offering smarter, more sustainable, and high-performance solutions.

India Industrial Engines Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on fuel type, power, and end use.

Fuel Type Insights:

- Diesel

- Petrol

- Gas

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes diesel, petrol, and gas.

Power Insights:

- 5 - 75 HP

- 76 - 350 HP

- 351 - 750 HP

- Above 751 HP

A detailed breakup and analysis of the market based on the power have also been provided in the report. This includes 5 - 75 HP, 76 - 350 HP, 351 - 750 HP, and above 751 HP.

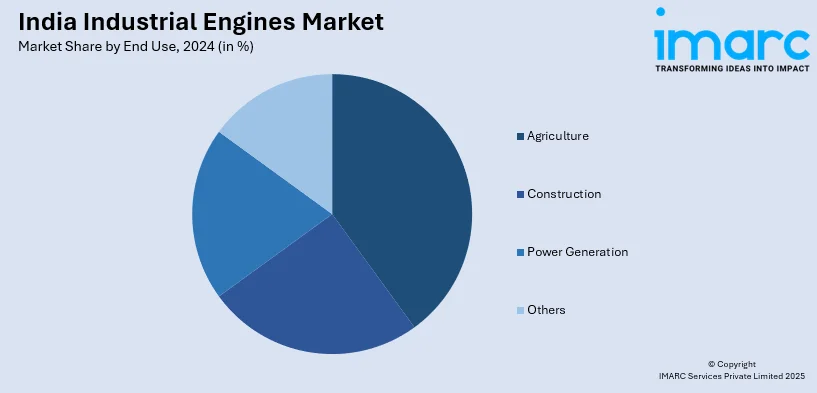

End Use Insights:

- Agriculture

- Construction

- Power Generation

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes agriculture, construction, power generation, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Engines Market News:

- February 2025: CNH unveiled a 2.8-litre TREM V-compliant engine for agricultural and construction equipment at its Greater Noida production site. The F28 engine, designed in Italy, has a 60% localization value, with 199 locally sourced parts and 75 imported. The engine is intended to fit under-hood applications and deliver maximum power while conforming to pollution standards.

- February 2025: CNH opened an engine facility in Greater Noida, India, with an annual production capacity of 20,000 units. The factory will produce the 2.8L F28 engine, with the objective of attaining 90% localization by the end of the year to increase cost competitiveness. The corporation has committed USD 15 million to localize the engine, which was designed in Europe, in order to minimize import reliance and increase cost effectiveness. The corporation intends to quadruple its tractor market share during the next five years.

- December 2024: Triton Electric Vehicle LLC, a New Jersey-based electric vehicle manufacturer, unveiled its "Made in India" hydrogen internal combustion engine. The new technology, developed in India, provides an environmentally beneficial, zero-carbon-emission alternative to conventional gasoline engines. The Triton EV's hydrogen engine provides improved efficiency without sacrificing power, leading in increased thermal efficiency and lower operating costs.

India Industrial Engines Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Diesel, Petrol, Gas |

| Powers Covered | 5 - 75 HP, 76 - 350 HP, 351 - 750 HP, Above 751 HP |

| End Uses Covered | Agriculture, Construction, Power Generation, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India industrial engines market performed so far and how will it perform in the coming years?

- What is the breakup of the India industrial engines market on the basis of fuel type?

- What is the breakup of the India industrial engines market on the basis of power?

- What is the breakup of the India industrial engines market on the basis of end use?

- What are the various stages in the value chain of the India industrial engines market?

- What are the key driving factors and challenges in the India industrial engines market?

- What is the structure of the India industrial engines market and who are the key players?

- What is the degree of competition in the India industrial engines market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial engines market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial engines market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial engines industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)