India Industrial Enzymes Market Size, Share, Trends and Forecast by Product, Source, Application, and Region, 2025-2033

India Industrial Enzymes Market Overview:

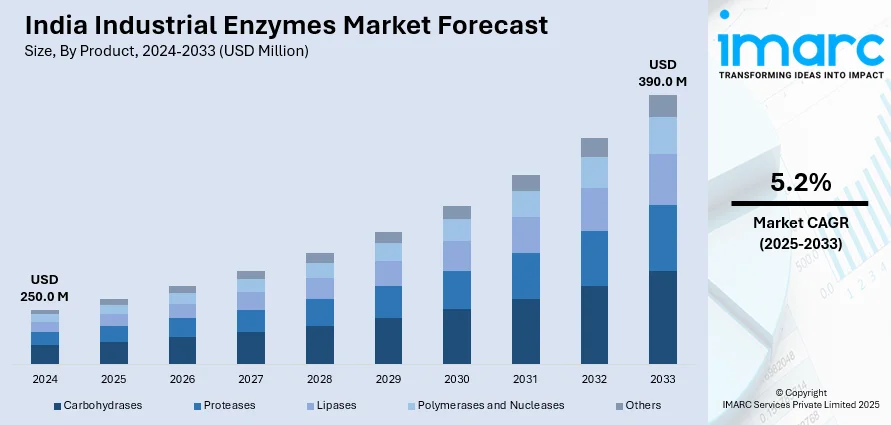

The India industrial enzymes market size reached USD 250.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 390.0 Million by 2033, exhibiting a growth rate (CAGR) of 5.2% during 2025-2033. The increasing demand for bio-based products, expanding applications in food and beverage, textiles, and biofuel industries, continual advancements in enzyme engineering, implementation of government initiatives promoting industrial biotechnology, and growing awareness of sustainable manufacturing processes are some of the major factors augmenting India industrial enzymes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 250.0 Million |

| Market Forecast in 2033 | USD 390.0 Million |

| Market Growth Rate 2025-2033 | 5.2% |

India Industrial Enzymes Market Trends:

Rising Adoption of Enzymes in Biofuel Production

The demand for biofuels in India is increasing due to government initiatives promoting ethanol blending and alternative energy sources. According to a report by IEA on February 2024, the demand for biofuel is expected to rise by 38 Billion liters over the next five years, which is a nearly 30% increase over the previous five years. The need for biofuel is expected to increase by 23% to 200 billion liters by 2028. The majority of the demand for new biofuels comes from developing nations, particularly India, Indonesia, and Brazil. Moreover, enzymes such as cellulases, amylases, and xylanases are crucial in breaking down complex plant materials into fermentable sugars, enhancing ethanol yields, and reducing production costs. In addition to this, the National Bio-Energy Mission and the Ethanol Blended Petrol (EBP) program mandate higher ethanol blending targets, accelerating enzyme adoption in biofuel refineries, which is providing an impetus to India industrial enzymes market growth. Also, Indian companies are investing in enzyme-enhanced bioconversion processes to improve efficiency in second-generation biofuel production, which utilizes non-food biomass like agricultural residues. Furthermore, continual advances in enzyme engineering leads to the development of thermostable and acid-stable enzyme variants, optimizing performance in diverse feedstocks and process conditions. With India's abundant biomass availability and government incentives for biofuel production, enzyme suppliers are expanding local manufacturing to meet growing demand.

To get more information of this market, Request Sample

Expansion of Enzyme Applications in Textile Processing

The growth of the Indian textile industry is positively impacting India industrial enzymes market outlook. According to IBEF, India ranks third globally in terms of textile exports and is the world's second-largest manufacturer of textiles and clothing, making up 4.6% of worldwide trade. As sustainability and efficiency become priorities, textile manufacturers are turning to enzyme-based solutions to reduce chemical usage, lower water consumption, and minimize environmental impact. The industry's shift toward enzymatic processing is accelerating demand for industrial enzymes such as cellulases, pectinases, amylases, and catalases, which offer superior fiber treatment while enhancing fabric softness, color vibrancy, and durability. Enzymes such as cellulases, pectinases, amylases, and catalases improve fiber quality while reducing water consumption and effluent toxicity. Enzyme suppliers are developing customized enzyme formulations tailored to specific fabric types, enhancing softness, color retention, and durability. The rise of natural and organic textile production further accelerates enzyme usage, as enzymatic processes support chemical-free treatments in cotton and wool processing. In line with this, the growing demand for enzyme-based textile innovations such as enzymatic denim finishing, and low-temperature processing is driving research and commercialization efforts. With major textile hubs such as Tamil Nadu and Gujarat promoting sustainable practices, industrial enzyme consumption in the textile sector is set to increase, creating new opportunities for enzyme manufacturers.

India Industrial Enzymes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, source, and application.

Product Insights:

- Carbohydrases

- Amylases

- Cellulase

- Others

- Proteases

- Lipases

- Polymerases and Nucleases

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes carbohydrases (amylases, cellulase, and others), proteases, lipases, polymerases and nucleases, and others.

Source Insights:

- Plants

- Animals

- Microorganisms

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes plants, animals, and microorganisms.

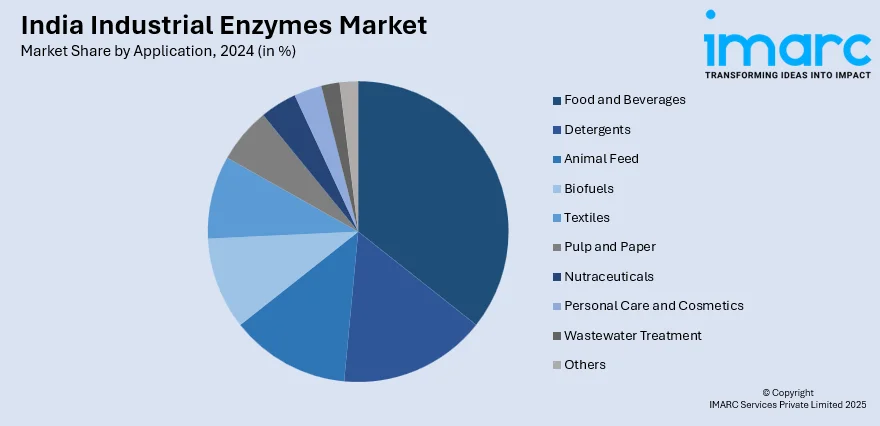

Application Insights:

- Food and Beverages

- Detergents

- Animal Feed

- Biofuels

- Textiles

- Pulp and Paper

- Nutraceuticals

- Personal Care and Cosmetics

- Wastewater Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverages, detergents, animal feed, biofuels, textiles, pulp and paper, nutraceuticals, personal care and cosmetics, wastewater treatment, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Enzymes Market News:

- On September 1, 2024, the Department of Biotechnology (DBT) announced plans to establish enzyme-manufacturing facilities to enhance second-generation (2G) ethanol production, aiming to reduce import dependence. The initial facility is proposed for Manesar, Haryana, to deliver enzymes to 2G bio-ethanol plants in Punjab, Uttar Pradesh, and an existing plant in Haryana. This initiative aligns with the BioE3 policy, which promotes biotechnology-centric manufacturing in India.

India Industrial Enzymes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Sources Covered | Plants, Animals, Microorganisms |

| Applications Covered | Food and Beverages, Detergents, Animal Feed, Biofuels, Textiles, Pulp and Paper, Nutraceuticals, Personal Care and Cosmetics, Wastewater Treatment, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial enzymes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial enzymes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial enzymes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India industrial enzymes market was valued at USD 250.0 Million in 2024.

The India industrial enzymes market is projected to exhibit a CAGR of 5.2% during 2025-2033, reaching a value of USD 390.0 Million by 2033.

The India industrial enzymes market is driven by growing demand for sustainable and efficient manufacturing in sectors like food, textiles, and pharmaceuticals. Increased focus on eco-friendly processes, innovation in enzyme technology, and a shift toward biotechnology-based solutions are encouraging wider adoption of industrial enzymes across various industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)