India Industrial Exhaust Systems Market Size, Share, Trends, and Forecast by Type, End-Use Industry, and Region, 2025-2033

India Industrial Exhaust Systems Market Size and Share:

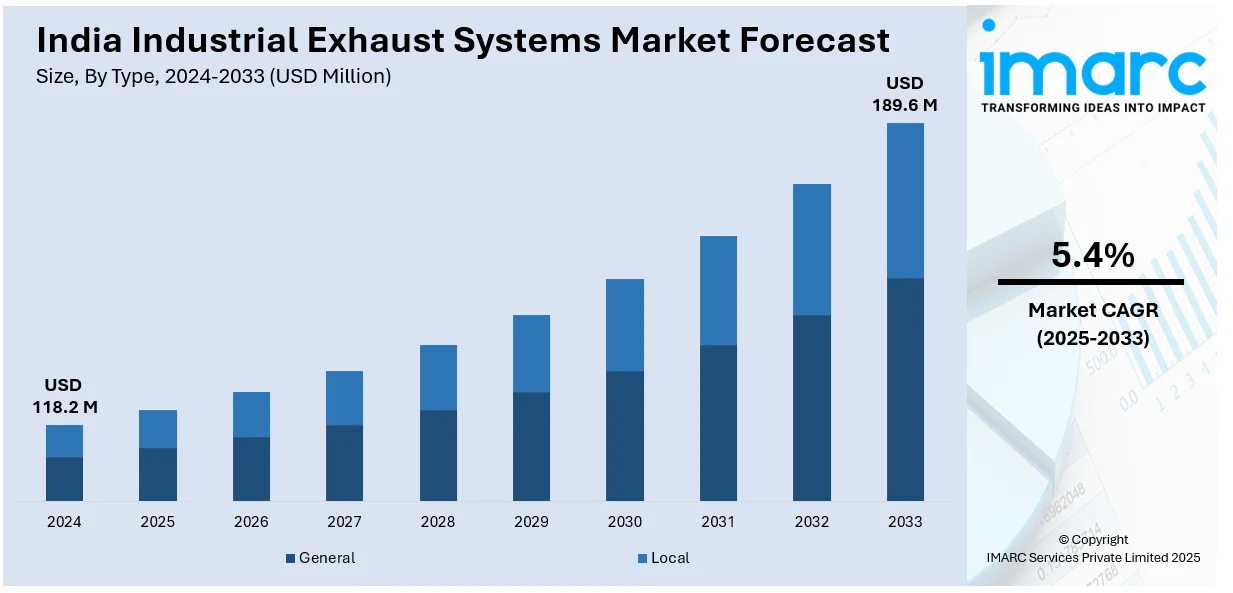

The India industrial exhaust systems market size reached USD 118.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 189.6 Million by 2033, exhibiting a growth rate (CAGR) of 5.4% during 2025-2033. The market is expanding due to stricter environmental regulations, rapid industrialization, and growing demand for energy-efficient air filtration solutions. Industries are adopting advanced exhaust technologies to reduce emissions, improve workplace safety, and comply with pollution control standards, driving sustained market growth across key manufacturing sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 118.2 Million |

| Market Forecast in 2033 | USD 189.6 Million |

| Market Growth Rate (2025-2033) | 5.4% |

India Industrial Exhaust Systems Market Trends:

Growing Emphasis on Air Quality Regulations and Compliance

The increasing focus on industrial air pollution control is significantly shaping the Indian industrial exhaust systems market. With stricter environmental regulations imposed by agencies such as the Central Pollution Control Board (CPCB) and the National Green Tribunal (NGT), industries are required to install advanced exhaust systems to comply with emission standards. For instance, in December 2024, the Central Pollution Control Board (CPCB) mandated OCEMS installation for 17 heavily polluting industries and waste processing units to facilitate continuous, around-the-clock pollutant tracking in real time. Additionally, manufacturing units, power plants, and chemical processing facilities are investing in high-efficiency exhaust systems equipped with advanced filtration technologies to reduce particulate matter, volatile organic compounds (VOCs), and harmful gases. The rise in industrialization has also led to growing awareness of workplace air quality, pushing companies to adopt exhaust solutions that not only control emissions but also improve employee safety. Industries are shifting toward energy-efficient and low-maintenance exhaust systems that optimize airflow management while reducing operational costs. Moreover, industries dealing with hazardous fumes, such as pharmaceuticals and metal processing, are integrating multi-stage filtration and catalytic converters to meet emission norms effectively. With regulatory enforcement becoming stricter, the demand for high-performance industrial exhaust systems will continue to rise across multiple sectors.

To get more information of this market, Request Sample

Expansion of Industrial and Infrastructure Sectors Driving Demand

The expansion of India's industrial and infrastructure sectors is fueling the demand for industrial exhaust systems across multiple industries. With rapid urbanization, government-led initiatives and the expansion of industrial corridors, new manufacturing plants, power facilities, and processing units are being established nationwide. For example, according to industry reports, more than 40% of India's population is estimated to live in cities by the year 2030, showing a significant increase from rural to urban residence. Additionally, these industries require customized exhaust solutions to manage pollutants and maintain compliance with environmental standards. The construction boom is also driving demand for dust and fume extraction systems, particularly in cement, steel, and heavy machinery industries. Moreover, the growing pharmaceutical, textile, and automotive industries are investing in industry-specific exhaust solutions to improve indoor air quality, protect sensitive processes, and ensure worker safety. The expansion of renewable energy projects and battery manufacturing facilities is further contributing to the adoption of advanced exhaust systems for emission control. As industries scale up operations, the demand for durable, high-capacity, and regulatory-compliant exhaust systems will continue to rise, making this a key driver for market growth.

India Industrial Exhaust Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and end-use industry.

Type Insights:

- General

- Local

The report has provided a detailed breakup and analysis of the market based on the type. This includes general and local.

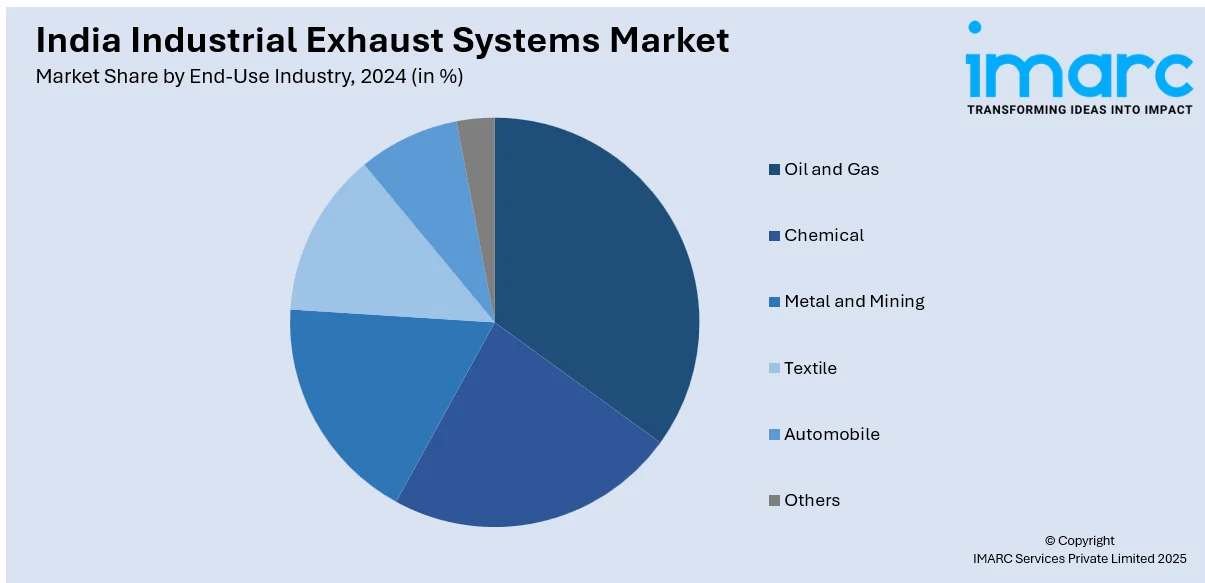

End-Use Industry Insights:

- Oil and Gas

- Chemical

- Metal and Mining

- Textile

- Automobile

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes oil and gas, chemical, metal and mining, textile, automobile, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Exhaust Systems Market News:

- In March 2025, Malpani Group announced a 10-year lease agreement with Tata Autocomp Katcon Exhaust Systems Pvt Ltd for 77,800 sq ft in Malpani Industrial and Logistics Park, Chakan, valued at ₹40 crore, with operations set to commence in March 2025, reinforcing its role as a key industrial hub.

India Industrial Exhaust Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | General, Local |

| End-Use Industries Covered | Oil and Gas, Chemical, Metal and Mining, Textile, Automobile, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India industrial exhaust systems market performed so far and how will it perform in the coming years?

- What is the breakup of the India industrial exhaust systems market on the basis of type?

- What is the breakup of the India industrial exhaust systems market on the basis of end-use industry?

- What is the breakup of the India industrial exhaust systems market on the basis of region?

- What are the various stages in the value chain of the India industrial exhaust systems market?

- What are the key driving factors and challenges in the India industrial exhaust systems market?

- What is the structure of the India industrial exhaust systems market and who are the key players?

- What is the degree of competition in the India industrial exhaust systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial exhaust systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial exhaust systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial exhaust systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)