India Industrial Flooring Market Size, Share, Trends and Forecast by Resin Type, Application, End-User Industry, and Region, 2025-2033

India Industrial Flooring Market Overview:

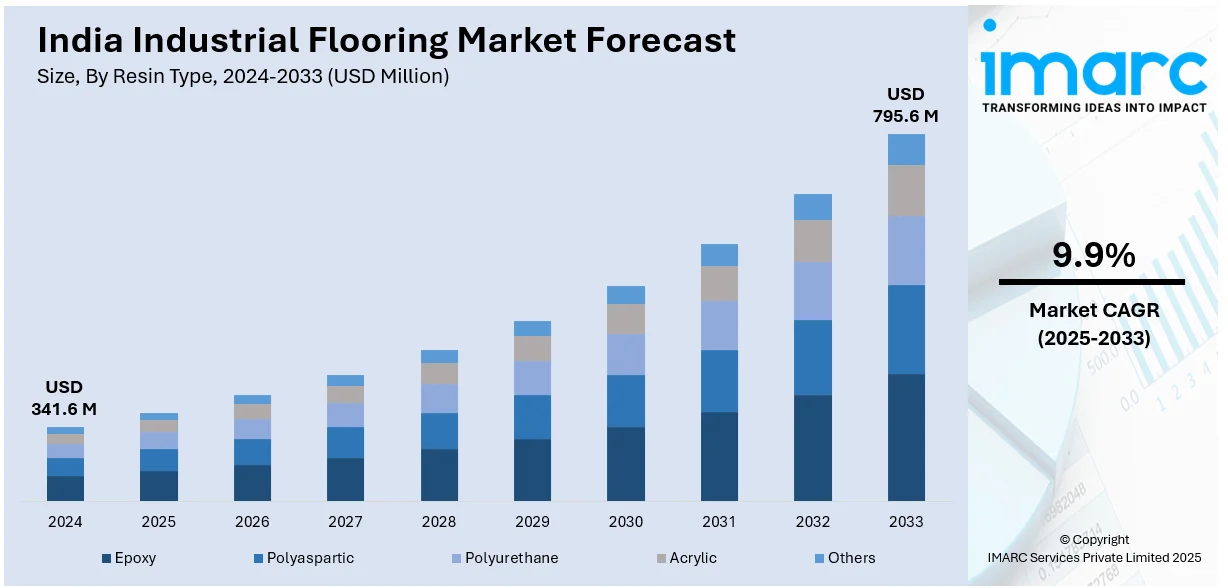

The India industrial flooring market size reached USD 341.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 795.6 Million by 2033, exhibiting a growth rate (CAGR) of 9.9% during 2025-2033. The market growth is driven by rapid industrialization, expanding manufacturing sectors, increasing demand for durable, cost-effective flooring solutions across industries like automotive, pharmaceuticals, and food processing, and ongoing advancements in epoxy, polyurethane, and concrete-based flooring technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 341.6 Million |

| Market Forecast in 2033 | USD 795.6 Million |

| Market Growth Rate 2025-2033 | 9.9% |

India Industrial Flooring Market Trends:

Rising Demand for High-Performance and Sustainable Flooring Solutions

The rising demand for high-performance and sustainable flooring solutions is boosting the India industrial flooring market share, as it meets the stringent environmental standards and demand for lasting non-maintenance surfaces. For example, in February 2024, INDIAWOOD 2024 was held at Bangalore International Exhibition Centre, that featured 950+ companies from 50+ countries, showcasing innovations in woodworking, modular furniture, and specialized flooring. The event emphasized technology integration and sustainability, aligning with industrial flooring market demands. Pharmaceutical facilities together with food processing facilities and automotive plants need floors which endure heavy traffic and resist chemicals while adapting to temperature changes. In addition to this, epoxy and polyurethane-based flooring solutions are increasing in popularity since these materials provide excellent resistance to wear and tear along with easy maintenance and full compliance with hygiene standards. Moreover, the market seeks sustainable flooring materials, so manufacturers actively conduct research about bio-based resins and low-volatile organic compounds (VOC) coatings and use flooring components from recycled materials. Besides this, sustainable development initiatives have led to the adoption of green installation methods for floor systems that decrease carbon emission levels. Furthermore, the industry is experiencing an increased demand because companies now focus on creating products that deliver top performance and sustainable practice along with cost-efficient solutions.

To get more information of this market, Request Sample

Growth in Smart and Anti-Microbial Flooring Technologies

The surge in smart and anti-microbial flooring systems is driving the India industrial flooring market growth because these technologies ensure the highest levels of hygiene and safety in healthcare and food and pharmaceutical manufacturing facilities. For instance, on July 5, 2024, ACS Technologies joined the 8th International Conference on sustainable flooring, discussing investment, design challenges, and quality assurance. Such events foster innovation and knowledge sharing, accelerating the adoption of advanced flooring technologies in India. In line with this, the manufacturing industry of electronics benefits from conductive and anti-static flooring which protects sensitive equipment from electrostatic discharge (ESD). Concurrently, the rising need for anti-microbial flooring exists in industries that need sterile areas to prevent bacterial and fungal growth through these floors, thus minimizing contamination risks. Additionally, flooring systems now get an advantage from anti-microbial agents used with silver ions in advanced coatings which boost hygiene functions while having extended durability. Apart from this, real-time monitoring systems that are integrated within smart flooring have become a focus for predictive maintenance purposes to provide affordable facility management solutions. As a result, the market is increasingly implementing smart and anti-microbial flooring technologies because industries focus on safety alongside efficiency and global standard compliance, thus enhancing the India industrial flooring market outlook.

India Industrial Flooring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on resin type, application, and end-user industry.

Resin Type Insights:

- Epoxy

- Polyaspartic

- Polyurethane

- Acrylic

- Others

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes epoxy, polyaspartic, polyurethane, acrylic, and others.

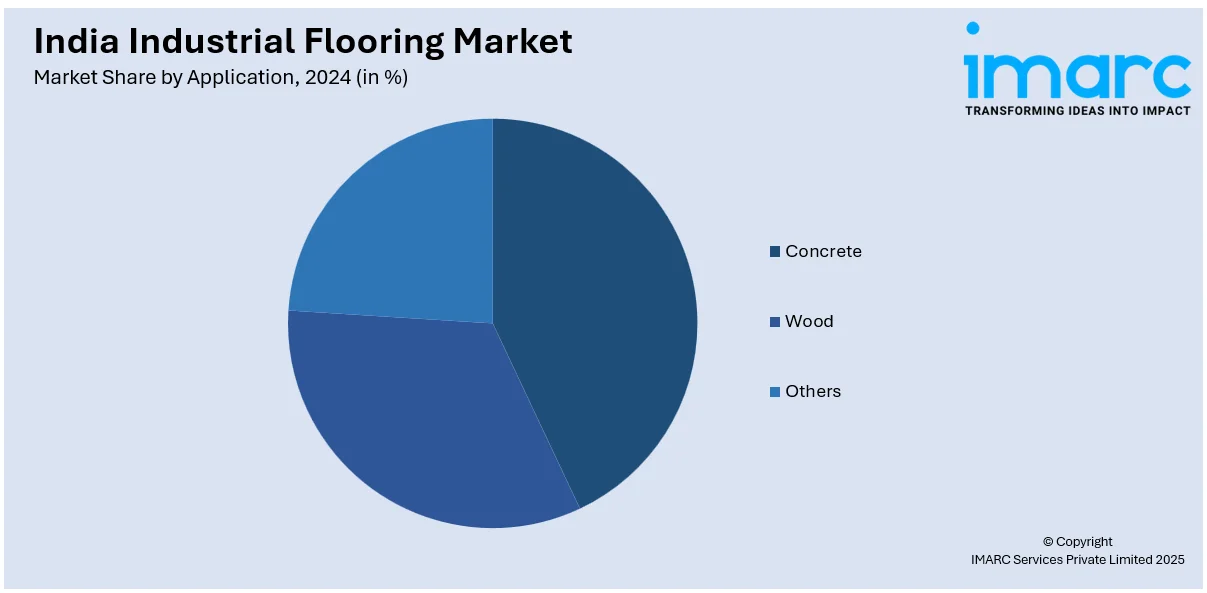

Application Insights:

- Concrete

- Wood

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes concrete, wood, and others.

End-User Industry Insights:

- Food and Beverage

- Chemical

- Transportation and Aviation

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user industry. This includes food and beverage, chemical, transportation and aviation, healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Flooring Market News:

- In October 2024, Ambuja Cements, a subsidiary of the Adani Group, announced plans to acquire Orient Cement for $451 million. This strategic move, approved by India's antitrust regulator in March 2025, aims to intensify competition with industry leader UltraTech Cement and expand Ambuja's market share. Such consolidation enhances production capacities and distribution networks, positively impacting the industrial flooring sector.

- In October 2024, The Adani Group entered discussions to purchase the Indian cement operations of Germany's Heidelberg Materials, in a deal valued at approximately $1.2 billion. This potential acquisition underscores Adani's commitment to strengthening its position in India's cement industry, which is integral to the supply chain of industrial flooring materials.

India Industrial Flooring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Epoxy, Polyaspartic, Polyurethane, Acrylic, Others |

| Applications Covered | Concrete, Wood, Others |

| End-User Industries | Food and Beverage, Chemical, Transportation and Aviation, Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India industrial flooring market performed so far and how will it perform in the coming years?

- What is the breakup of the India industrial flooring market on the basis of resin type?

- What is the breakup of the India industrial flooring market on the basis of application?

- What is the breakup of the India industrial flooring market on the basis of end-user industry?

- What is the breakup of the India industrial flooring market on the basis of region?

- What are the various stages in the value chain of the India industrial flooring market?

- What are the key driving factors and challenges in the India industrial flooring?

- What is the structure of the India industrial flooring market and who are the key players?

- What is the degree of competition in the India industrial flooring market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial flooring market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial flooring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial flooring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)