India Industrial Heat Recovery Market Size, Share, Trends and Forecast by Technology, Application, End Use Sector and Region, 2025-2033

India Industrial Heat Recovery Market Overview:

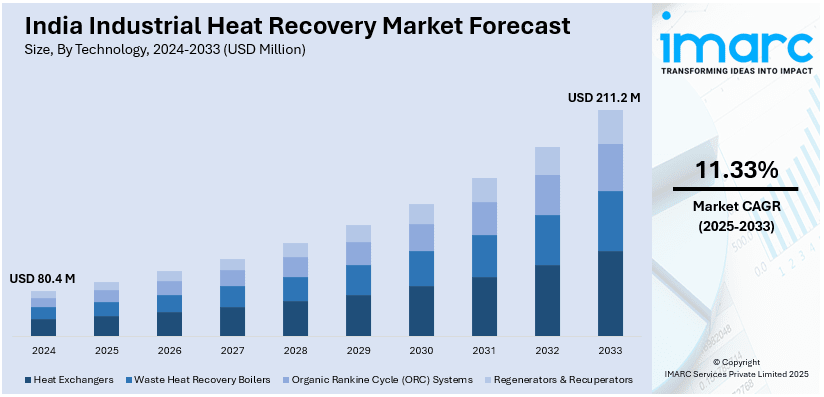

The India industrial heat recovery market size reached USD 80.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 211.2 Million by 2033, exhibiting a growth rate (CAGR) of 11.33% during 2025-2033. The market is driven by increasing energy prices, tightening efficiency standards, and increasing initiatives for sustainability. Rising use of waste heat recovery in industry, government incentives on cogeneration, and technological development in combined heat and power (CHP) and artificial intelligence (AI) energy management also contributing to market growth, making operations more efficient and lowering carbon footprints.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 80.4 Million |

| Market Forecast in 2033 | USD 211.2 Million |

| Market Growth Rate 2025-2033 | 11.33% |

India Industrial Heat Recovery Market Trends:

Growing Adoption of Waste Heat Recovery Systems in Manufacturing

Indian industries are increasingly adopting waste heat recovery systems to enhance energy efficiency and minimize operating expenses. Cement, steel, and petrochemicals sectors are using sophisticated heat exchangers and organic Rankine cycle (ORC) technology to harness and recover thermal energy. Increasing electricity tariffs and the central government's incentives for energy conservation are fueling the trend. Also, strict energy efficiency standards and sustainability objectives are forcing industries to implement these systems, further driving the market growth. Adoption rates are being driven by improvements in heat exchanger efficiency and high-temperature heat recovery. The convergence of AI and Internet of Things (IoT) for real-time monitoring and optimization is also driving the growth in the adoption of heat recovery solutions in different industry segments.

To get more information of this market, Request Sample

Integration of Renewable Energy with Industrial Heat Recovery

In India too, the use of renewable energy integrated into industrial waste heat recovery systems is emerging as a trend. Firms are integrating solar thermal and biomass-fired boiler with waste heat recovery systems in order to improve sustainability and lesser dependence on fossil fuel. Incentives by the government on renewable energy and hybrid systems are also boosting uptake. Developments in thermal energy storage and hybrid heat recovery processes facilitate this transition. Notably, industries are also leveraging AI-driven energy management systems, with 52% of organizations in India adopting AI technologies, including 35% in pilot phases. These systems optimize energy use, combining recovered heat with renewable sources. This trend is especially prominent in energy-intensive sectors like food processing, textiles, and pharmaceuticals, where process heating constitutes a significant operational cost.

Increased Investment in Combined Heat and Power (CHP) Systems

Industries are more and more turning to CHP systems as a cost-efficient option for joint electricity and heat generation. Increased demand for cost-efficient energy solutions, particularly in the chemical, food processing, and metal industries, is responsible for increasing the volume of CHP units. The industry is expanding as a result of government programs supporting energy-efficient technologies and providing incentives for cogeneration projects. Energy conversion efficiency is rising thanks to technological advancements in gas turbines and steam-based combined heat and power (CHP) systems. Moreover, the influence of decarbonization and reduced greenhouse gas (GHG) emissions is driving industries to adopt CHP solutions, minimizing the dependency on traditional energy resources. Increased deployment of distributed networks and microgrid integration is also boosting the market for CHP-based heat recovery in India.

India Industrial Heat Recovery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on technology, application, and end use sector.

Technology Insights:

- Heat Exchangers

- Waste Heat Recovery Boilers

- Organic Rankine Cycle (ORC) Systems

- Regenerators & Recuperators

The report has provided a detailed breakup and analysis of the market based on the technology. This includes heat exchangers, waste heat recovery boilers, organic Rankine cycle (ORC) systems, and regenerators & recuperators.

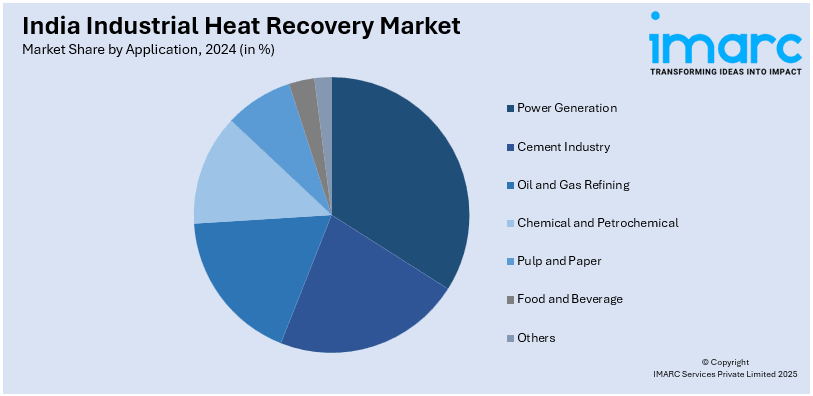

Application Insights:

- Power Generation

- Cement Industry

- Oil and Gas Refining

- Chemical and Petrochemical

- Pulp and Paper

- Food and Beverage

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes power generation, cement industry, oil and gas refining, chemical and petrochemical, pulp and paper, food and beverage, and others.

End Use Sector Insights:

- Heavy Industries

- Manufacturing & Processing

- Utilities

The report has provided a detailed breakup and analysis of the market based on the end use sector. This includes heavy industries, manufacturing & processing, and utilities.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Heat Recovery Market News:

- In November 2024, Eastern Recuperators, a global leader in waste heat recovery, will showcase its latest energy-efficient solutions at METEC India 2024 from November 27-29 at the Bombay Exhibition Centre, Mumbai (Hall 2, Stall D35). With over 4,500 installations worldwide, the company continues to drive sustainability through high-efficiency recuperators. Managing Director Vikas Agrawal highlighted their commitment to innovative, cost-effective Indian engineering in advancing global energy conservation efforts.

- In November 2024, GEA is supporting Asahi India Glass Limited (AIS) in its sustainability efforts by providing waste heat recovery (WHR) systems for two glass manufacturing plants in Rajasthan and Uttarakhand. Each plant, with a 1.8 MWel capacity, will generate 15,500 MWh of electricity annually, reducing carbon emissions by 13,000 tons per year. The Rajasthan plant will utilize 94% of its required power through WHR, enhancing energy efficiency.

- In September 2024, Thermax partnered with Ceres Power to advance green hydrogen technology using solid oxide electrolysis cell (SOEC) technology. Under the agreement, Thermax will manufacture and commercialize high-efficiency electrolyser modules, leveraging its expertise in waste heat recovery. This collaboration aims to enhance hydrogen production efficiency by 25%, supporting industrial decarbonization in sectors like steel, refineries, and chemicals while positioning Thermax as a key global player in large-scale SOEC systems.

India industrial heat recovery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Heat Exchangers, Waste Heat Recovery Boilers, Organic Rankine Cycle (ORC) Systems, Regenerators & Recuperators |

| Applications Covered | Power Generation, Cement Industry, Oil and Gas Refining, Chemical and Petrochemical, Pulp and Paper, Food and Beverage, Others |

| End Use Sectors Covered | Heavy Industries, Manufacturing & Processing, Utilities |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India industrial heat recovery market performed so far and how will it perform in the coming years?

- What is the breakup of the India industrial heat recovery market on the basis of technology?

- What is the breakup of the India industrial heat recovery market on the basis of application?

- What is the breakup of the India industrial heat recovery market on the basis of end use sector?

- What is the breakup of the India industrial heat recovery market on the basis of region?

- What are the various stages in the value chain of the India industrial heat recovery market?

- What are the key driving factors and challenges in the India industrial heat recovery market?

- What is the structure of the India industrial heat recovery market and who are the key players?

- What is the degree of competition in the India industrial heat recovery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial heat recovery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial heat recovery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial heat recovery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)