India Industrial Paints & Coatings Market Size, Share, Trends and Forecast by Product Type, Type, Application, End User, and Region, 2025-2033

India Industrial Paints & Coatings Market Overview:

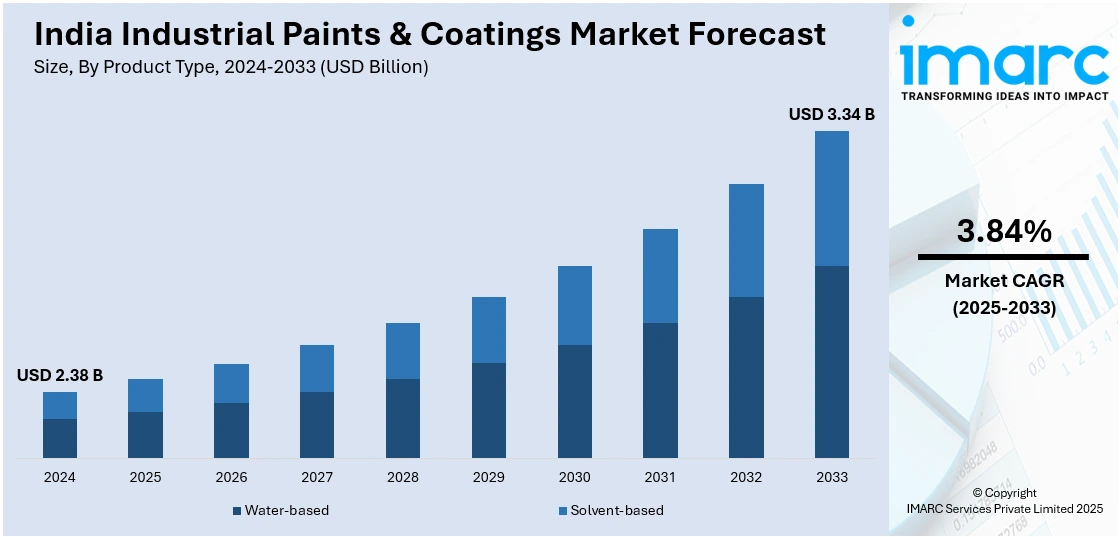

The India industrial paints & coatings market size reached USD 2.38 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.34 Billion by 2033, exhibiting a growth rate (CAGR) of 3.84% during 2025-2033. The market is primarily driven by rapid industrialization, infrastructural development, and increasing demand for durable and high-performance coatings across various industries like automotive, construction, and manufacturing. Rising awareness about corrosion protection, stringent environmental regulations, and growth in the automotive sector further fuel India industrial paints & coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.38 Billion |

| Market Forecast in 2033 | USD 3.34 Billion |

| Market Growth Rate 2025-2033 | 3.84% |

India Industrial Paints & Coatings Market Trends:

Growth in Infrastructure Development

The growing investment in infrastructure development, including roads, bridges, and government buildings, is one of the major trends of India's industrial paints and coatings market. With schemes like "Smart Cities" and "Atal Mission for Rejuvenation and Urban Transformation (AMRUT)," the demand for coatings that provide durability, protection, and aesthetics has grown. Industrial coatings and paints are today essential for the durability and strength of infrastructure and buildings. Further, coatings are applied to improve the surface finish, corrosion resistance, and provide weather protection. This market trend is a manifestation of an increased dependence on cutting-edge products and technologies, especially in commercial and public markets, fueling consistent growth in the industry. For instance, in March 2025, Birla Opus Paints, a part of Grasim Industries under the Aditya Birla Group, opened its first Birla Opus Paint Studio in Gurugram. Featuring over 170 products, the center offers exclusive options for consumers. This initiative is part of their expansion plan to increase retail presence across India. Birla Opus aims to become India’s second-largest decorative paints brand by opening more centers in cities like New Delhi, Mumbai, and Bangalore.

To get more information of this market, Request Sample

Shift Towards Eco-friendly and Sustainable Coatings

The growing emphasis on sustainability and eco-friendly practices is reshaping the India industrial paints and coatings market growth. With the implementation of stringent regulations regarding volatile organic compound (VOC) emissions and environmental impact, manufacturers are increasingly focusing on producing low-VOC and water-based coatings. These products not only align with global environmental standards but also cater to consumers' rising demand for greener alternatives. Additionally, the rise in eco-conscious construction projects and demand for sustainable manufacturing processes in industries like automotive and textiles is contributing to this shift. Manufacturers are investing in R&D to develop innovative coatings that ensure superior performance while being environmentally responsible, which is a significant trend in the industry. For instance, at Paint India 2024, Arkema showcased its innovative technologies for sustainable paints and coatings, focusing on circularity, energy efficiency, and decarbonization. The company highlighted bio-based, low-carbon solutions such as waterborne resins and cool roofing technologies. Arkema also emphasized its commitment to sustainability through partnerships and mass balance approaches, aiming to reduce carbon emissions. With products like Synaqua® and Crayvallac®, Arkema is supporting the transition towards eco-friendly, high-performance coatings in response to growing consumer demands for sustainability in construction.

India Industrial Paints & Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, type, application, and end user.

Product Type Insights:

- Water-based

- Solvent-based

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes water-based and solvent-based.

Type Insights:

- Automotive and Refinish Coating

- Protective Coating

- Powder Coating

- General Industrial Coating

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes automotive and refinish coating, protective coating, powder coating, general industrial coating, and others.

Application Insights:

- OEM and Special Purpose

- Architectural

- Others

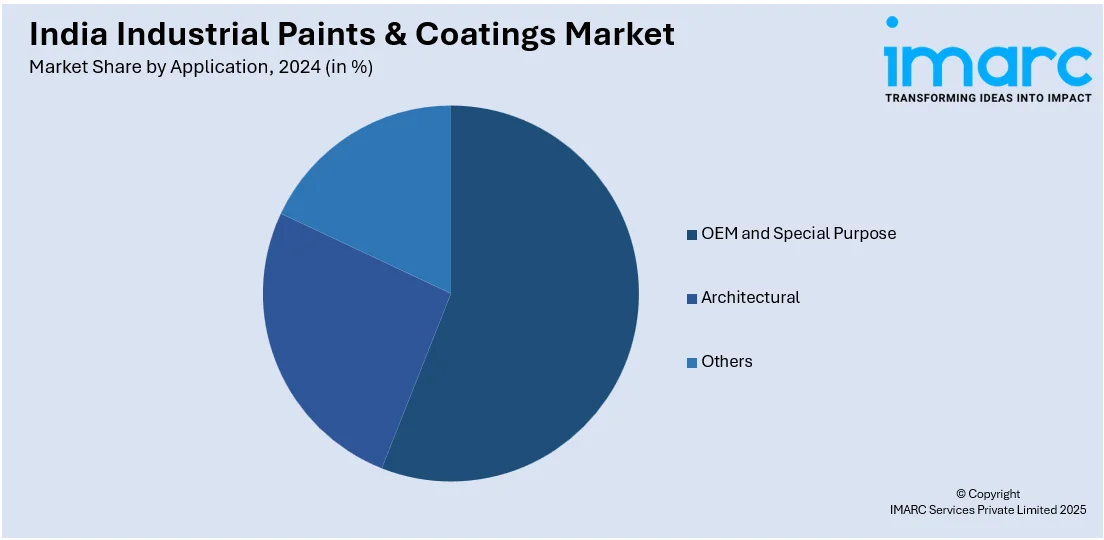

The report has provided a detailed breakup and analysis of the market based on the application. This includes OEM and special purpose, architectural, and others.

End User Insights:

- Automotive

- Marine

- General Industries

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive, marine, general industries, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Paints & Coatings Market News:

- In February 2025, Akzo Nobel India agreed to sell its powder coatings business and international research centre to its parent company, Akzo Nobel NV, for ₹2,073 crore and ₹70 crore, respectively. Additionally, Akzo Nobel NV will transfer intellectual property rights for its decorative paints business in India, Bangladesh, Bhutan, and Nepal to Akzo Nobel India for ₹1,152 crore. These transactions aim to streamline Akzo Nobel India's focus on liquid paints and coatings, enhancing its brand and technology independence. The deals are subject to approval from Akzo Nobel India's shareholders and Akzo Nobel NV's supervisory board.

- In November 2024, Birla Opus Paints, a subsidiary of Grasim Industries, inaugurated its fourth manufacturing plant in Chamarajnagar, Mysore, enhancing its total production capacity to 866 million litres per annum (MLPA). This expansion is part of an ambitious plan to establish six plants with a combined capacity of 1,332 MLPA, representing a 40% increase in India's paint industry capacity. The company has invested ₹8,470 crore of its ₹10,000 crore target for the paints business. The new facility will produce water-based, enamel, and wood finish paints, contributing to Birla Opus's goal of achieving ₹10,000 crore in revenue within three years of full-scale operations.

- In July 2024, Asian Paints invested ₹1,305 crore to double the production capacity at its Mysuru plant to 6,00,000 KL per annum. This expansion increases the company's total annual capacity to 21,50,000 KL. In addition to Mysuru, Asian Paints is enhancing production capacities at its Ankleshwar, Kasna, and Khandala plants. These initiatives are expected to raise the company's total production capacity to 22,70,000 KL per annum.

- In February 2024, Aditya Birla Group's Grasim Industries launched Birla Opus, marking its entry into the Indian decorative paints sector. The company aims to become the second-largest player in the industry, targeting a gross revenue of ₹10,000 crore within three years. Grasim plans to achieve this by leveraging its existing distribution network and focusing on innovation and sustainability. The move intensifies competition with established brands like Asian Paints and Berger Paints.

India Industrial Paints & Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Water-Based, Solvent-Based |

| Types Covered | Automotive and Refinish Coating, Protective Coating, Powder Coating, General Industrial Coating, Others |

| Applications Covered | OEM and Special Purpose, Architectural, Others |

| End Users Covered | Automotive, Marine, General Industries, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial paints & coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial paints & coatings market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial paints & coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial paints & coatings market in India was valued at USD 2.38 Billion in 2024.

The India industrial paints & coatings market is projected to exhibit a CAGR of 3.84% during 2025-2033, reaching a value of USD 3.34 Billion by 2033.

The market is driven by rapid industrialization, infrastructure development, and growing demand for high-performance coatings in industries like automotive and construction. Increasing awareness of corrosion protection, stringent environmental norms, and sustainable innovations are further accelerating market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)