India Industrial Robotics for Assembly Lines Market Size, Share, Trends and Forecast by Robot Type, Payload Capacity, Application, End-User Industry, and Region, 2025-2033

India Industrial Robotics for Assembly Lines Market Overview:

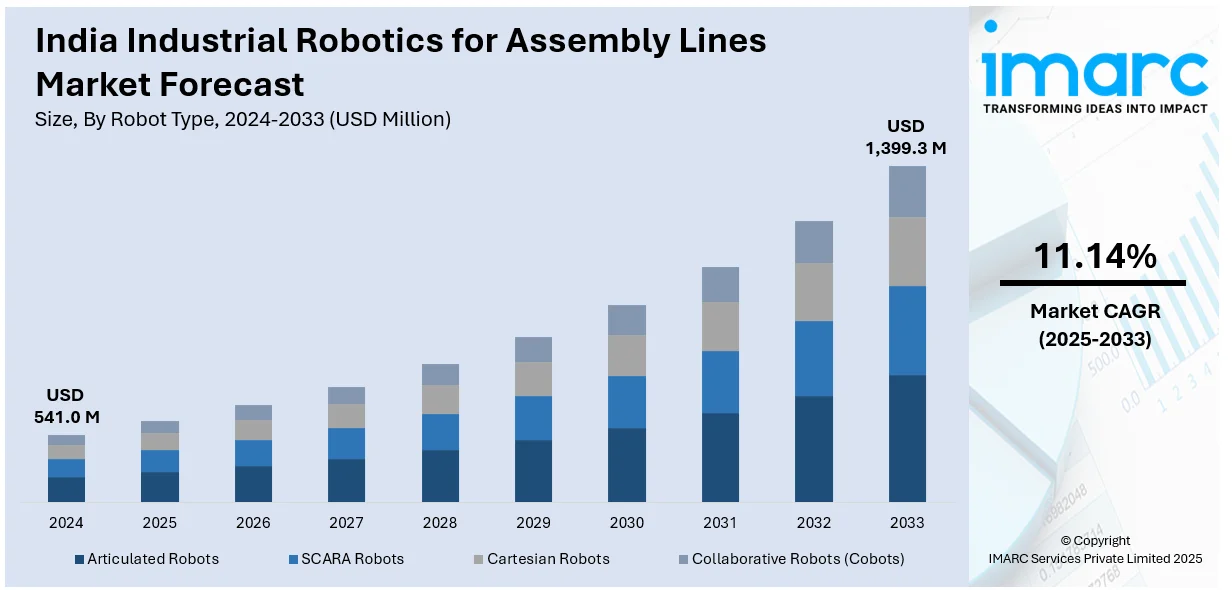

The India industrial robotics for assembly lines market size reached USD 541.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,399.3 Million by 2033, exhibiting a growth rate (CAGR) of 11.14% during 2025-2033. The increasing employment of industry 4.0 technologies, improvements in artificial intelligence (AI), machine learning (ML), and sensor technology, along with the growing use of collaborative robots, are driving the growth of industrial robotics for assembly lines in India, enhancing operational efficiency, production flexibility, and overall manufacturing productivity.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 541.0 Million |

| Market Forecast in 2033 | USD 1,399.3 Million |

| Market Growth Rate 2025-2033 | 11.14% |

India Industrial Robotics for Assembly Lines Market Trends:

Advent of Industry 4.0 Technologies

The growing implementation of industry 4.0 technologies is greatly enhancing the utilization of industrial robotics in assembly lines throughout India. Industry 4.0 encompasses the combination of cyber-physical systems, Internet of Things (IoT), and sophisticated robotics to establish intelligent factories that enable automated processes, real-time data sharing, and predictive decision-making. Industrial robots fitted with sensors and linked to IoT platforms can interact with other machines, enabling smooth production optimization, predictive maintenance, and effective material flow management. This networked setting boosts efficiency, reduces mistakes, and guarantees quicker manufacturing workflows. Moreover, robotic systems can swiftly adjust to fluctuations in production needs, facilitating quicker time-to-market for new products. Businesses in the automotive, electronics, and consumer goods sectors are utilizing these innovations to stay competitive. In 2025, Mahindra launched a specialized electric vehicle (EV) manufacturing and battery assembly plant at its Chakan location. The facility boasts completely automated assembly lines, featuring an AI-powered body shop and one of India’s most advanced robotic painting facilities. Mahindra will manufacture the BE 6 and XEV 9e electric SUVs utilizing cutting-edge robotic systems and Industry 4.0 technology to guarantee optimal efficiency and quality. With an increasing number of industries adopting smart factory solutions, the need for industrial robotics is anticipated to grow, solidifying their status as an essential element of contemporary manufacturing in India.

To get more information of this market, Request Sample

Technological Advancements in Robotics

The ongoing development of robotics technology is significantly strengthening the growth of the market in India. Advancements in artificial intelligence (AI), machine learning (ML), and advanced sensors are enhancing the adaptability of robots and their ability to perform intricate assembly tasks accurately. These technologies improve the adaptability of robots, allowing them to transition between various tasks, operate in changing settings, and work efficiently alongside human operators. Collaborative robots (cobots), equipped with enhanced safety systems, allow humans and robots to operate together without the requirement for imposing safety barriers, optimizing manufacturing processes. Moreover, the incorporation of AI-driven vision technologies and predictive analytics enhances quality inspection methods, decreasing defects and boosting operational efficiency. As these advancements render robotic systems more affordable, small and medium-sized businesses are likewise adopting automation to boost efficiency and stay competitive. In 2024, at LogiMAT India 2024, Addverb launched India’s first robot dog, designed to assist with tasks like order picking, inventory management, and warehouse automation. The robot’s capabilities extended to improving productivity on assembly lines, helping with repetitive tasks and quality inspection in manufacturing. With advanced sensors, AI, and a durable design, the robot was set to transform various industries, including logistics, healthcare, and education. With ongoing technological progress, the integration of robotics in Indian assembly lines is anticipated to speed up, transforming industrial processes.

India Industrial Robotics for Assembly Lines Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on robot type, payload capacity, application, and end-user industry.

Robot Type Insights:

- Articulated Robots

- SCARA Robots

- Cartesian Robots

- Collaborative Robots (Cobots)

The report has provided a detailed breakup and analysis of the market based on the robot type. This includes articulated robots, SCARA robots, cartesian robots, and collaborative robots (cobots).

Payload Capacity Insights:

- Up to 5 Kg

- 5 to 10 Kg

- 10 to 20 Kg

- Above 20 Kg

A detailed breakup and analysis of the market based on the payload capacity have also been provided in the report. This includes up to 5 Kg, 5 to 10Kg, 10 to 20 Kg, and above 20 Kg.

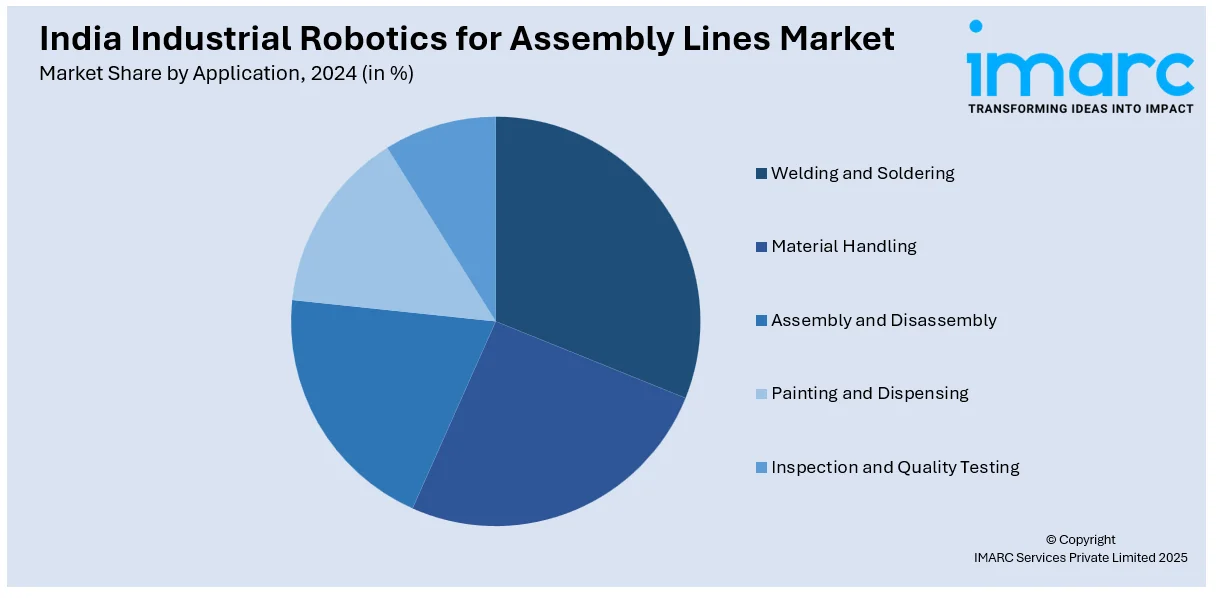

Application Insights:

- Welding and Soldering

- Material Handling

- Assembly and Disassembly

- Painting and Dispensing

- Inspection and Quality Testing

The report has provided a detailed breakup and analysis of the market based on the application. This includes welding and soldering, material handling, assembly and disassembly, painting and dispensing, and inspection and quality testing.

End-User Industry Insights:

- Automotive

- Electronics and Semiconductor

- Metal and Machinery

- Plastics and Chemicals

- Food and Beverage

- Others

A detailed breakup and analysis of the market based on the end-user industry have also been provided in the report. This includes automotive, electronics and semiconductor, metal and machinery, plastics and chemicals, food and beverage, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Robotics for Assembly Lines Market News:

- In February 2025, at ELECRAMA 2025, Delta Electronics unveiled its D-Bot series Collaborative Robots for assembly line operations, ideal for tasks like electronics assembly and welding. The company also introduced a 240kW DC Fast EV Charger, supporting India’s sustainable cities initiative. Delta highlighted its innovations in industrial automation, EV charging, and energy infrastructure at the event.

- In June 2024, Collaborate INDIA 2024, organized by Universal Robots, brought together over 700 professionals to explore the role of collaborative automation in India’s manufacturing sector, particularly in assembly lines. The event highlighted how cobots and AI enhanced productivity, safety, and efficiency in tasks like assembly, with the launch of UR20 and UR30 cobots. Industry leaders discussed the future of automation, moving towards Industry 5.0.

India Industrial Robotics for Assembly Lines Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Robot Types Covered | Articulated Robots, SCARA Robots, Cartesian Robots, Collaborative Robots (Cobots) |

| Payload Capacities Covered | Up to 5 Kg, 5 to 10Kg, 10 to 20 Kg, Above 20 Kg |

| Applications Covered | Welding and Soldering, Material Handling, Assembly and Disassembly, Painting and Dispensing, Inspection and Quality Testing |

| End-User Industries Covered | Automotive, Electronics and Semiconductor, Metal and Machinery, Plastics and Chemicals, Food and Beverage, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial robotics for assembly lines market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial robotics for assembly lines market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial robotics for assembly lines industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial robotics for assembly lines market in India was valued at USD 541.0 Million in 2024.

The India industrial robotics for assembly lines market is projected to exhibit a (CAGR) of 11.14% during 2025-2033, reaching a value of USD 1,399.3 Million by 2033.

The market is driven by automation uptake in the automotive, electronics, and manufacturing industries to drive efficiency, accuracy, and productivity. Increasing costs of labor, governmental initiatives towards smart factories, and greater adoption of collaborative and AI-based robots further spur deployment in assembly lines in India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)