India Industrial Rubber Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2025-2033

India Industrial Rubber Market Overview:

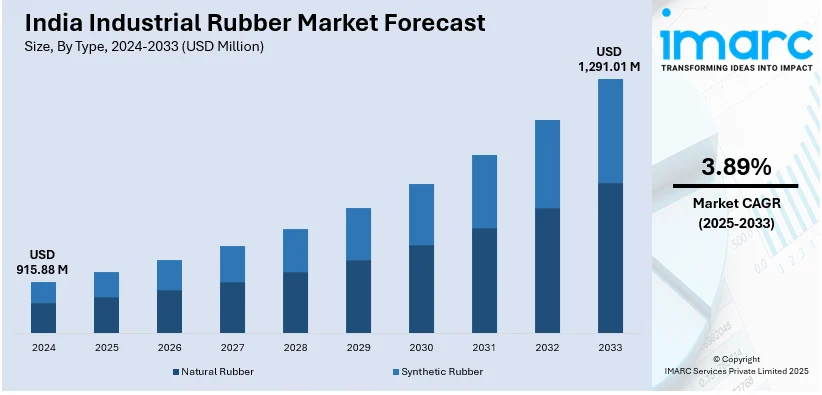

The India industrial rubber market size reached USD 915.88 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,291.01 Million by 2033, exhibiting a growth rate (CAGR) of 3.89% during 2025-2033. The market is propelled by rising automotive production, demand for high-performance tires, and implementation of government initiatives supporting EV adoption and BS-VI norms. Additionally, infrastructure growth, sustainability trends, and the shift toward eco-friendly rubber products are key drivers. Investments in synthetic and recycled rubber further augment the India industrial rubber market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 915.88 Million |

| Market Forecast in 2033 | USD 1,291.01 Million |

| Market Growth Rate (2025-2033) | 3.89% |

India Industrial Rubber Market Trends:

Rising Demand for Industrial Rubber in the Automotive Sector

The expanding automotive industry is significantly supporting the India industrial rubber market growth. With India emerging as a global hub for automobile manufacturing, the demand for rubber products such as tires, hoses, seals, and gaskets is on the rise. The government’s push for electric vehicles (EVs) and stricter emission norms (BS-VI) further accelerates rubber consumption, as EVs require specialized rubber components for battery insulation and vibration damping. India is leading the electric vehicle revolution in emerging Asia, creating a USD 1.3 Trillion investment opportunity by 2030 as electric two- and three-wheelers proliferate. In the year 2023, India emerged as a world leader in electric three-wheeler sales with 580,000 units and 60 percent market share and totaled 880,000 e-scooter sales for second place globally. The rise of electric vehicles is driving the need for precision components and is thus complementing India's flourishing investment casting market and its manufacturing industry. Additionally, the increasing production of commercial and passenger vehicles is enhancing tire demand, with major players expanding their manufacturing capacities. The rise in infrastructure projects and logistics activities is also contributing to higher demand for industrial rubber in heavy-duty vehicle components. As a result, manufacturers are investing in high-performance synthetic rubber to meet durability and sustainability requirements, positioning the market for steady growth in the coming years.

To get more information of this market, Request Sample

Shift Towards Sustainable and Eco-Friendly Rubber Products

Environmental concerns and regulatory pressures are driving the market toward sustainable alternatives. Traditional rubber production, reliant on synthetic polymers, is being challenged by bio-based and recycled rubber solutions. For instance, researched developed a reprocess-able bio-based rubber using epoxidized natural rubber (ENR) and hierarchical hydrogen bonding with high strength and up to 1190% elongation. This rubber is recyclable without a significant reduction of mechanical quality, with a 99% recovery of tensile strength. This development provides a sustainable option for the industrial rubber industry in India, addressing waste challenges and promoting eco-friendly manufacturing practices. Companies are adopting eco-friendly materials such as natural rubber, reclaimed rubber, and biodegradable compounds to reduce carbon footprints. Furthermore, the government’s initiatives, such as the Extended Producer Responsibility (EPR) policy, are encouraging manufacturers to adopt greener practices. Additionally, the construction and infrastructure sectors are increasingly using recycled rubber in flooring, roofing, and vibration control applications. Leading manufacturers are also investing in research and development (R&D) activities to develop sustainable rubber products without compromising performance. With growing consumer awareness and corporate sustainability goals, the demand for eco-friendly rubber is rising, thereby positively impacting India industrial rubber market outlook.

India Industrial Rubber Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, product, and application.

Type Insights:

- Natural Rubber

- Synthetic Rubber

The report has provided a detailed breakup and analysis of the market based on the type. This includes natural rubber and synthetic rubber.

Product Insights:

- Mechanical Rubber Good

- Rubber Belt

- Rubber Hose

- Rubber Roofing

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes mechanical rubber good, rubber belt, rubber hose, rubber roofing, and others.

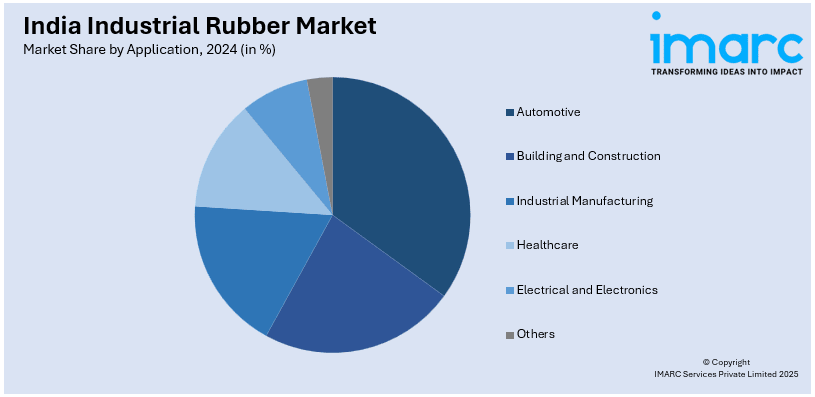

Application Insights:

- Automotive

- Building and Construction

- Industrial Manufacturing

- Healthcare

- Electrical and Electronics

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive, building and construction, industrial manufacturing, healthcare, electrical and electronics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Rubber Market News:

- February 10, 2025: TRST01, along with the India Rubber Board, launched the iSNR initiative to promote traceable and sustainable natural rubber production that addresses the EUDR and makes India a leader in global supply chains. In addition to strengthening its position in the industrial rubber sector as the world's second-largest consumer of the commodity, India is also enhancing the capabilities of smallholder farmers. This project sets a new benchmark for global ethical trade according to environmental laws, facilitating economic growth.

- September 12, 2024: Gravita India Limited, a leadership company in the recycling business, announced plans to acquire a waste tire recycling facility in Romania, its first installation in Europe. With a capacity of 17,000 MTPA, the plant will be operated by a special purpose vehicle (SPV) where Gravita Netherlands BV has an 80% equity interest with an investment of INR 40 Crore (approximately USD 4.8 Million). This step is part of Gravita's plan to strengthen its presence in the industrial rubber waste recycling space across Europe, complementing its businesses in Africa and Asia.

India Industrial Rubber Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Natural Rubber, Synthetic Rubber |

| Products Covered | Mechanical Rubber Good, Rubber Belt, Rubber Hose, Rubber Roofing, Others |

| Applications Covered | Automotive, Building and Construction, Industrial Manufacturing, Healthcare, Electrical and Electronics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial rubber market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial rubber market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial rubber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial rubber market in India was valued at USD 915.88 Million in 2024.

The India industrial rubber market is projected to exhibit a (CAGR) of 3.89% during 2025-2033, reaching a value of USD 1,291.01 Million by 2033.

Growing industrialization, expansion in the automobile and construction industries, and rising demand for rubber-derived products like belts, hoses, and gaskets are major drivers. Railway, mining, and oil & gas industry expansions also contribute to growth. Local rubber manufacturing and processing are facilitated by growing manufacturing investments and government policy support.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)