India Industrial Safety Equipment Market Size, Share, Trends and Forecast by Product Type, End-User Industry, and Region, 2025-2033

India Industrial Safety Equipment Market Overview:

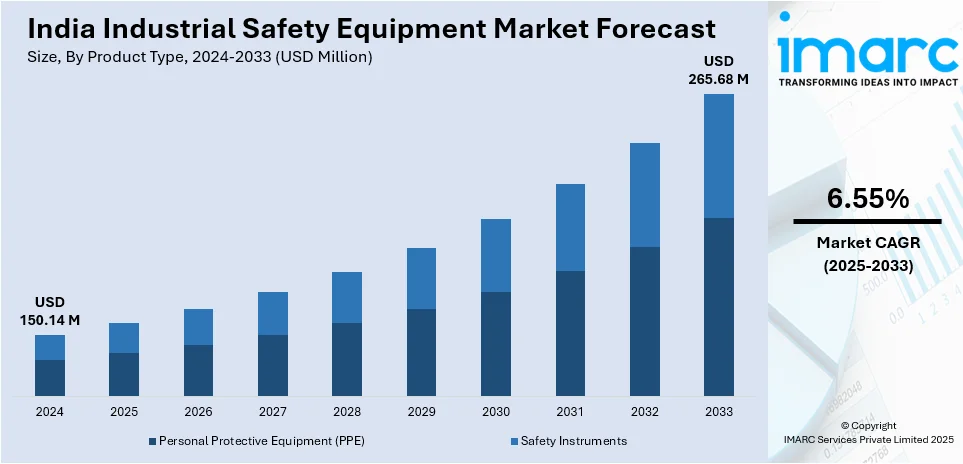

The India industrial safety equipment market size reached USD 150.14 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 265.68 Million by 2033, exhibiting a growth rate (CAGR) of 6.55% during 2025-2033. Regulatory compliance, government initiatives, and technological advancements in safety equipment are supporting the market growth by enforcing safety standards, enhancing worker protection, and fostering innovation through smart, data-driven solutions, ensuring better operational efficiency and adherence to national and international safety requirements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 150.14 Million |

| Market Forecast in 2033 | USD 265.68 Million |

| Market Growth Rate 2025-2033 | 6.55% |

India Industrial Safety Equipment Market Trends:

Regulatory Compliance and Government Initiatives

With the rise in industrial accidents and fatalities, the Government of India has introduced stringent regulations mandating the use of safety equipment across various sectors, such as construction, manufacturing, and chemicals. These regulations aim to guarantee that organizations focus on the health and safety of their workers, thereby increasing the need for innovative and dependable safety equipment. The growing awareness about employee rights and legal responsibilities are further encouraging businesses to invest in protective gear, as noncompliance can result in fines, lawsuits, and harm to reputation. In addition, the rising efforts of the governing body to enhance working conditions and protect employee welfare are profoundly influencing the market dynamics, catalyzing the demand for high-quality, compliant safety solutions that adhere to both national and international standards. For instance, in 2025, the Government of India issued 187 Quality Control Orders (QCOs) requiring BIS certification for 769 products, including electrical appliances and industrial equipment, to ensure safety and compliance with national standards. These QCOs, issued under the BIS Act, 2016, aim to protect public safety, promote fair trade, and enhance national security. Moreover, BIS conducted safety awareness sessions in different cities to foster workplace safety standards, reinforcing the government's dedication to enhancing industrial safety and adherence.

To get more information of this market, Request Sample

Technological Advancements in Safety Equipment

Improvements in industrial safety equipment are pivotal in the market growth, significantly enhancing both safety and operational efficiency. The incorporation of cutting-edge technologies like Internet of Things (IoT), sensors, and artificial intelligence (AI) into safety devices is transforming their capabilities. Contemporary safety gear, such as intelligent helmets, wearable devices, and sophisticated fire detection systems, provides real-time surveillance, predictive analytics, and automated notifications. These technologies enhance worker safety while also optimizing operations through data-driven insights that can avert accidents prior to their happening. As sectors such as oil and gas, chemicals, and manufacturing encounter increased risks, the need for advanced and dependable safety solutions is growing drastically. Businesses are progressively putting money into these advanced technologies to reduce risks in the workplace. In line with this trend, in 2025, Proxgy launched the Hat+ Band and ProHat Band, transforming standard industrial helmets into air-conditioned and smart helmets. These products enhance worker comfort and safety, featuring cooling and communication features for industries in harsh environments. Priced under ₹9,990, they provide affordable, adaptable solutions for blue-collar workers. This move highlights how technological advancements are revolutionizing safety equipment, offering better protection and comfort while reducing risks in high-risk sectors.

India Industrial Safety Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type and end-user industry.

Product Type Insights:

- Personal Protective Equipment (PPE)

- Head Protection

- Eye and Face Protection

- Hearing Protection

- Respiratory Protection

- Hand Protection

- Protective Clothing

- Foot Protection

- Safety Instruments

- Safety Sensors

- Safety Controllers/Relays

- Safety Valves

- Emergency Shutdown Systems (ESD)

- Fire and Gas Monitoring Systems

- High Integrity Pressure Protection Systems (HIPPS)

- Burner Management Systems (BMS)

The report has provided a detailed breakup and analysis of the market based on the product type. This includes personal protective equipment (PPE) (head protection, eye and face protection, hearing protection, respiratory protection, hand protection, protective clothing, and foot protection) and safety instruments (safety sensors, safety controllers/relays, safety valves, emergency shutdown systems (ESD), fire and gas monitoring systems, high integrity pressure protection systems (HIPPS), and burner management systems (BMS)).

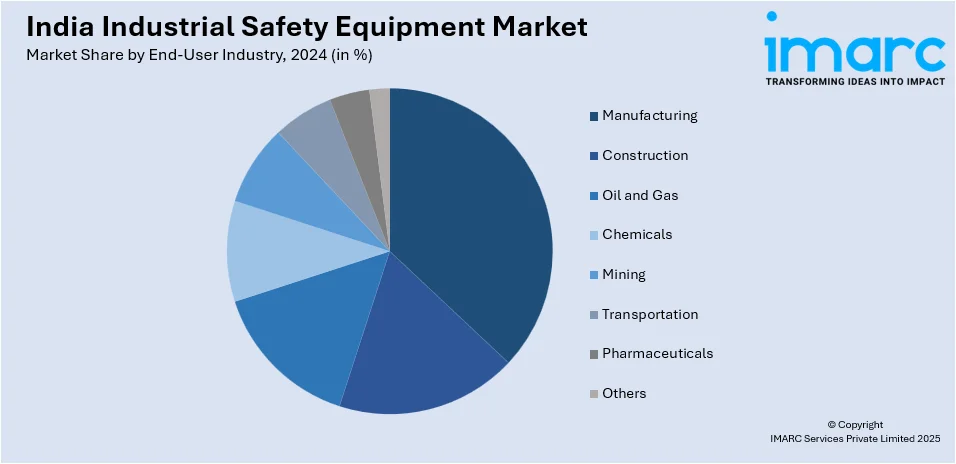

End-User Industry Insights:

- Manufacturing

- Construction

- Oil and Gas

- Chemicals

- Mining

- Transportation

- Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the end-user industry have also been provided in the report. This includes manufacturing, construction, oil and gas, chemicals, mining, transportation, pharmaceuticals, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Safety Equipment Market News:

- In November 2024, Jarsh Safety raised $500,000 in seed funding to advance workplace safety through innovative smart solutions. The funding supported the development of their flagship product, the ActivCooling helmet, which provided portable cooling for workers in challenging environments. The company planned to expand its market reach and enhance product development with this investment.

- In May 2024, KARAM Safety revealed the acquisition of Midas Safety India to strengthen its leadership in the personal protective equipment (PPE) industry. This strategic move combined KARAM's expertise in fall protection with Midas's hand protection products, expanding their offerings and market reach. The acquisition aimed to drive growth in India's rapidly growing PPE market.

India Industrial Safety Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| End-User Industries Covered | Manufacturing, Construction, Oil and Gas, Chemicals, Mining, Transportation, Pharmaceuticals, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India industrial safety equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India industrial safety equipment market on the basis of product type?

- What is the breakup of the India industrial safety equipment market on the basis of end-user industry?

- What is the breakup of the India industrial safety equipment market on the basis of region?

- What are the various stages in the value chain of the India industrial safety equipment market?

- What are the key driving factors and challenges in the India industrial safety equipment?

- What is the structure of the India industrial safety equipment market and who are the key players?

- What is the degree of competition in the India industrial safety equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial safety equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial safety equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial safety equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)