India Industrial Safety Gloves Market Size, Share, Trends, and Forecast by Product Type, End User, and Region, 2025-2033

India Industrial Safety Gloves Market Overview:

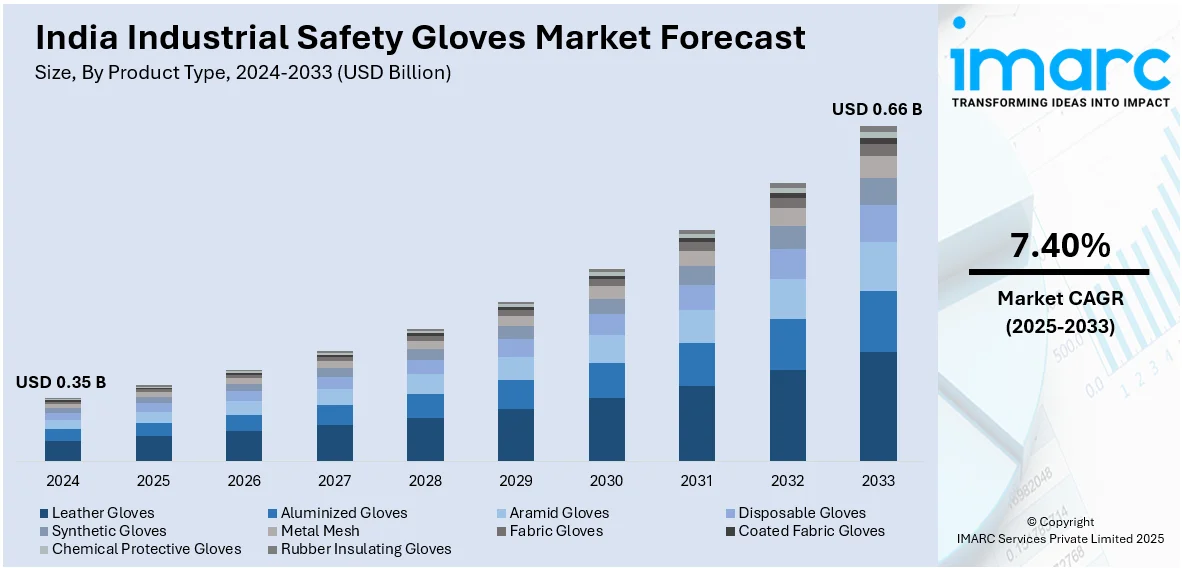

The India industrial safety gloves market size reached USD 0.35 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.66 Billion by 2033, exhibiting a growth rate (CAGR) of 7.40% during 2025-2033. The market is expanding due to increasing workplace safety regulations across sectors like manufacturing, construction, and chemicals. Rising awareness of worker protection, coupled with the growth of industries, is driving the demand for high-quality gloves offering durability, comfort, and enhanced protection.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.35 Billion |

| Market Forecast in 2033 | USD 0.66 Billion |

| Market Growth Rate 2025-2033 | 7.40% |

India Industrial Safety Gloves Market Trends:

Rising Adoption of Industrial Safety Gloves Across High-Risk Sectors

India's industrial safety gloves market is experiencing a growing demand, mainly from high-risk sectors like construction, automotive, chemicals, manufacturing, and oil & gas. For instance, as per industry reports, Kolkata is a key hub for India's industrial glove industry, contributing over 90% of domestic exports. These industries expose employees to a variety of risks such as cuts, abrasions, chemicals, heat, and electrical hazards, which are leading companies to implement safety practices that minimize workplace injury. Government emphasis on enhancing occupational health and safety laws, along with more stringent labor legislation, has also contributed to the use of protective gear. Additionally, as Indian industries expand rapidly, worker protection has become a top priority, especially in the wake of increased industrialization and global safety standards. The automobile industry, with its intricate assembly lines and machinery, is particularly in need of gloves that provide high protection against sharp edges and chemical exposure. Chemical plants and refineries, on the other hand, need gloves that can resist harsh chemicals and extreme temperatures. This increasing demand for safety gloves specializing in high-risk industries, in addition to mounting emphasis on promoting safety awareness across employees and employers, is an important driver in the Indian market for industrial gloves.

To get more information of this market, Request Sample

Growing Demand for Sustainable and Eco-Friendly Gloves

Sustainability is becoming an emerging trend in India's industrial safety gloves market. With environmental concerns on the rise, manufacturers as well as consumers are now more inclined toward sustainable alternatives for the conventional synthetic-material-based gloves. Manufacturers are turning their attention to biodegradable or recyclable glove materials that include natural latex, which has a lower environmental footprint than petroleum-based polymers. The move towards environmentally friendly solutions is also being compelled by India's focus on environmental sustainability and green manufacturing practices. For instance, in August 2023, Dow announced a partnership with Ecoplast in India to develop sustainable glove packaging using REVOLOOP™ recycled resins, incorporating 30% post-consumer recycled content, meeting export standards, and promoting circular packaging solutions in the global plastics industry. Additionally, several industries are exploring reusable gloves that can be washed and used multiple times, thus reducing waste generated by disposable options. Moreover, the rise of consumer awareness regarding eco-friendly practices has led to a greater demand for gloves made from renewable resources or recyclable components. Furthermore, this increasing shift towards sustainability is expected to continue driving the market in India, as more industries prioritize reducing their carbon footprints while ensuring worker protection.

India Industrial Safety Gloves Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Leather Gloves

- Aluminized Gloves

- Aramid Gloves

- Disposable Gloves

- Synthetic Gloves

- Metal Mesh

- Fabric Gloves

- Coated Fabric Gloves

- Chemical Protective Gloves

- Rubber Insulating Gloves

The report has provided a detailed breakup and analysis of the market based on the product type. This includes leather gloves, aluminized gloves, aramid gloves, disposable gloves, synthetic gloves, metal mesh, fabric gloves, coated fabric gloves, chemical protective gloves, and rubber insulating gloves.

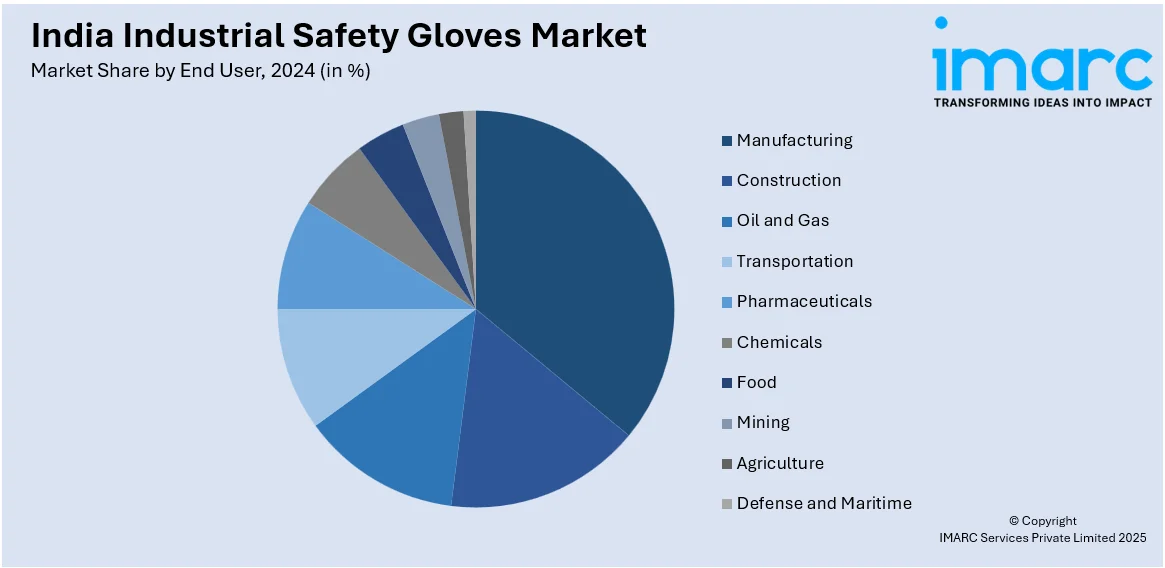

End User Insights:

- Manufacturing

- Construction

- Oil and Gas

- Transportation

- Pharmaceuticals

- Chemicals

- Food

- Mining

- Agriculture

- Defense and Maritime

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes manufacturing, construction, oil and gas, transportation, pharmaceuticals, chemicals, food, mining, agriculture, and defense and maritime.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Safety Gloves Market News:

- • In August 2023, the Indian Rubber Gloves Manufacturers Association (IRGMA) announced its continual support to the government’s 2023 regulation to prevent substandard glove imports. This regulation also ensures BIS compliance, promotes Made-in-India nitrile gloves, reduces illegal dumping, strengthens domestic manufacturing, boosts exports, and creates jobs.

India Industrial Safety Gloves Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Leather Gloves, Aluminized Gloves, Aramid Gloves, Disposable Gloves, Synthetic Gloves, Metal Mesh, Fabric Gloves, Coated Fabric Gloves, Chemical Protective Gloves, Rubber Insulating Gloves |

| End Users Covered | Manufacturing, Construction, Oil and Gas, Transportation, Pharmaceuticals, Chemicals, Food, Mining, Agriculture, Defense and Maritime |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India industrial safety gloves market performed so far and how will it perform in the coming years?

- What is the breakup of the India industrial safety gloves market on the basis of product type?

- What is the breakup of the India industrial safety gloves market on the basis of end user?

- What is the breakup of the India industrial safety gloves market on the basis of region?

- What are the various stages in the value chain of the India industrial safety gloves market?

- What are the key driving factors and challenges in the India industrial safety gloves market?

- What is the structure of the India industrial safety gloves market and who are the key players?

- What is the degree of competition in the India industrial safety gloves market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial safety gloves market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial safety gloves market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial safety gloves industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)