India Industrial Specialty and Shielding Gases Market Size, Share, Trends and Forecast by Application, Mode of Distribution, and Region, 2025-2033

India Industrial Specialty and Shielding Gases Market Overview:

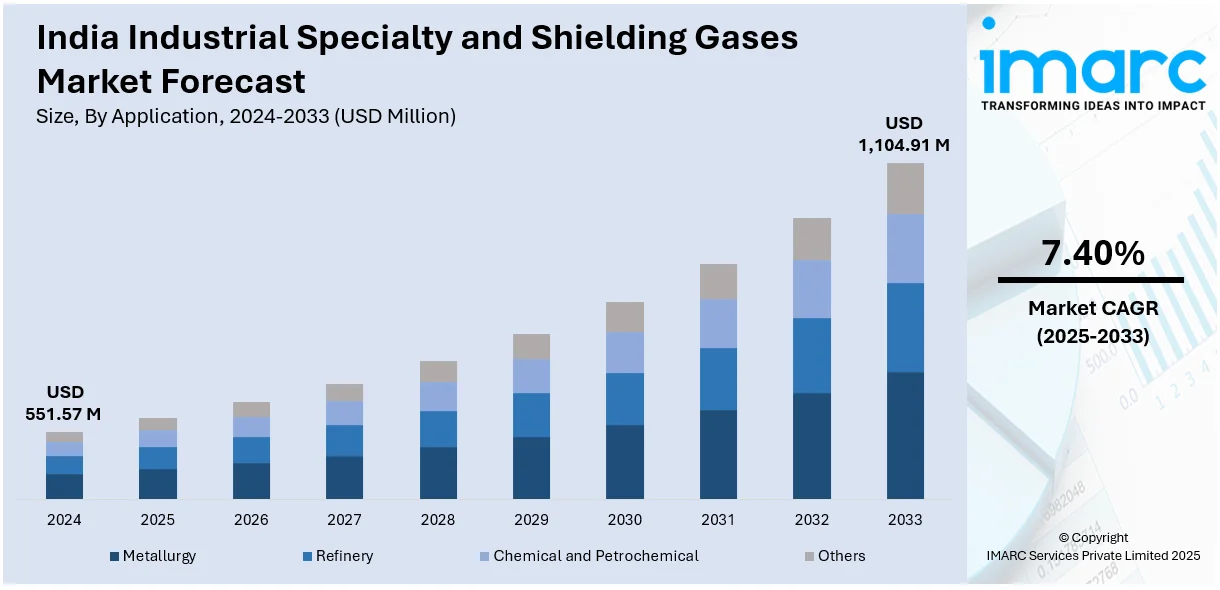

The India industrial specialty and shielding gases market size reached USD 551.57 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,104.91 Million by 2033, exhibiting a growth rate (CAGR) of 7.40% during 2025-2033. The market is expanding due to the rising demand from manufacturing, electronics, and healthcare sectors. Companies are also investing in high-purity gas production, advanced delivery systems, and localized supply chains to support process efficiency and regulatory compliance, thereby enhancing market presence.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 551.57 Million |

| Market Forecast in 2033 | USD 1,104.91 Million |

| Market Growth Rate 2025-2033 | 7.40% |

India Industrial Specialty and Shielding Gases Market Trends:

Expansion of Manufacturing and Metal Fabrication Sectors

India’s industrial specialty and shielding gases market is growing steadily due to the rising demand from manufacturing and metal fabrication industries. With the government's focus on initiatives like Make in India and Production Linked Incentive (PLI) schemes, investments in sectors, such as automotive, heavy machinery, defense, and electronics manufacturing are increasing. For instance, as per industry reports, the PLI scheme for automobiles and components has attracted ₹67,690 crore in proposed investments, with ₹14,043 crore invested by March 2024. Moreover, these industries rely heavily on shielding gases like argon, carbon dioxide, and helium for welding and cutting applications, where gas quality directly affects output precision and product durability. Fabrication shops and OEMs are upgrading to automated welding technologies, which require consistent shielding gas compositions to maintain arc stability and reduce spatter. Furthermore, there is an enhanced focus on quality assurance and adherence to global welding standards, particularly for export-oriented manufacturing. This is prompting gas suppliers to offer high-purity, application-specific shielding gases, along with customized delivery solutions like cylinder banks and bulk supply. As domestic manufacturing gains pace and shifts toward advanced processes, the role of specialty gases in ensuring process efficiency and consistency is becoming more critical.

To get more information of this market, Request Sample

Widespread Adoption of Specialty Gases in Electronics and Semiconductor Applications

The growth of India's electronics and semiconductor sectors is creating strong demand for high-purity specialty gases used in etching, deposition, and cleaning processes. Gases such as nitrogen trifluoride, silane, and sulfur hexafluoride are essential in semiconductor fabrication, display manufacturing, and advanced electronic component assembly. With the government’s push to localize electronics production under the PLI scheme and recent announcements of semiconductor fabs, gas suppliers are witnessing growing interest in precision gas delivery systems and ultra-high-purity (UHP) grades. The industry is shifting toward more stringent quality and safety standards, requiring tighter control over gas purity, contamination levels, and packaging. Multinational gas suppliers are forming technical partnerships with Indian firms to expand purification and distribution capabilities. For instance, in October 2024, Linde announced agreements for the acquisition of two ASUs and expand gas supply to Tata Steel in Odisha, doubling on-site capacity. The new units aim to serve local markets and run on renewable energy to meet emissions targets. Simultaneously, domestic players are investing in production and storage infrastructure to meet the expected surge in demand. As India's electronic manufacturing ecosystem becomes more sophisticated, specialty gases are becoming a strategic input, and suppliers who offer process integration, analytics, and contamination control services are gaining a competitive edge.

India Industrial Specialty and Shielding Gases Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on application and mode of distribution.

Application Insights:

- Metallurgy

- Refinery

- Chemical and Petrochemical

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes metallurgy, refinery, chemical and petrochemical, and others.

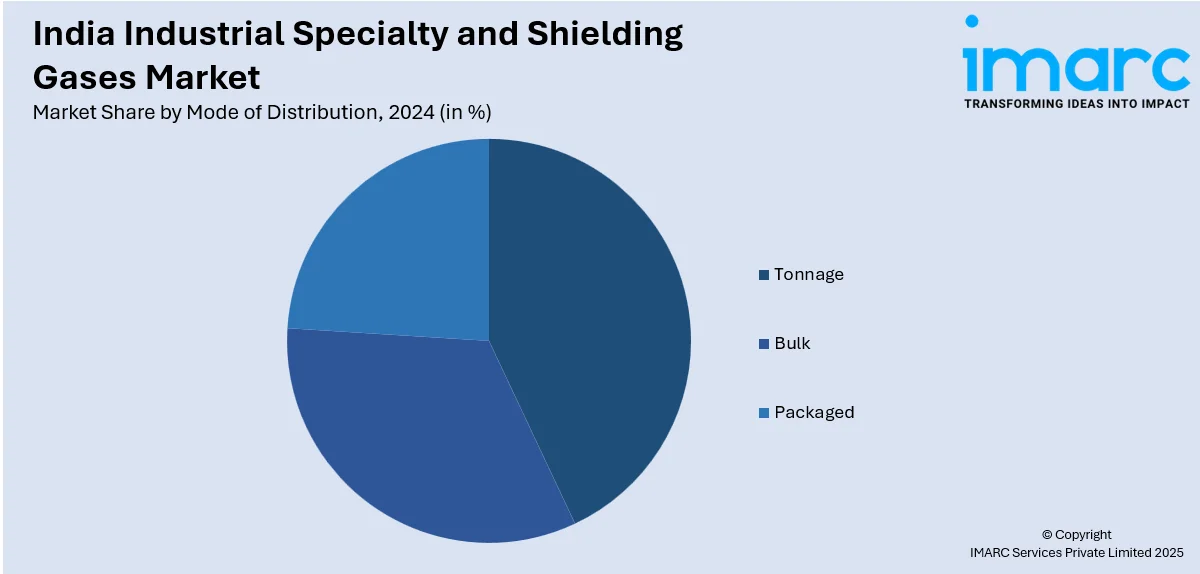

Mode of Distribution Insights:

- Tonnage

- Bulk

- Packaged

A detailed breakup and analysis of the market based on the mode of distribution have also been provided in the report. This includes tonnage, bulk, and packaged.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Specialty and Shielding Gases Market News:

- In November 2024, INOX Air Products announced a partnership to supply specialty gases to ReNew’s solar PV cell manufacturing facility in Dholera, Gujarat. The long-term agreement includes silane, ammonia, and nitrous oxide delivery, along with complete gas management. The partnership supports sustainable solar manufacturing through advanced logistics and emission-reducing, safety-focused supply systems.

India Industrial Specialty and Shielding Gases Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Metallurgy, Refinery, Chemical and Petrochemical, Others |

| Mode of Distributions Covered | Tonnage, Bulk, Packaged |

| Regions Covered | North India, South India, East India, West India |

|

Customization Scope |

10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India industrial specialty and shielding gases market performed so far and how will it perform in the coming years?

- What is the breakup of the India industrial specialty and shielding gases market on the basis of application?

- What is the breakup of the India industrial specialty and shielding gases market on the basis of mode of distribution?

- What is the breakup of the India industrial specialty and shielding gases market on the basis of region?

- What are the various stages in the value chain of the India industrial specialty and shielding gases market?

- What are the key driving factors and challenges in the India industrial specialty and shielding gases market?

- What is the structure of the India industrial specialty and shielding gases market and who are the key players?

- What is the degree of competition in the India industrial specialty and shielding gases market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial specialty and shielding gases market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial specialty and shielding gases market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial specialty and shielding gases industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)