India Inflight Catering Market Size, Share, Trends and Forecast by Food Type, Flight Service Type, and Aircraft Seating Class, and Region, 2025-2033

India Inflight Catering Market Overview:

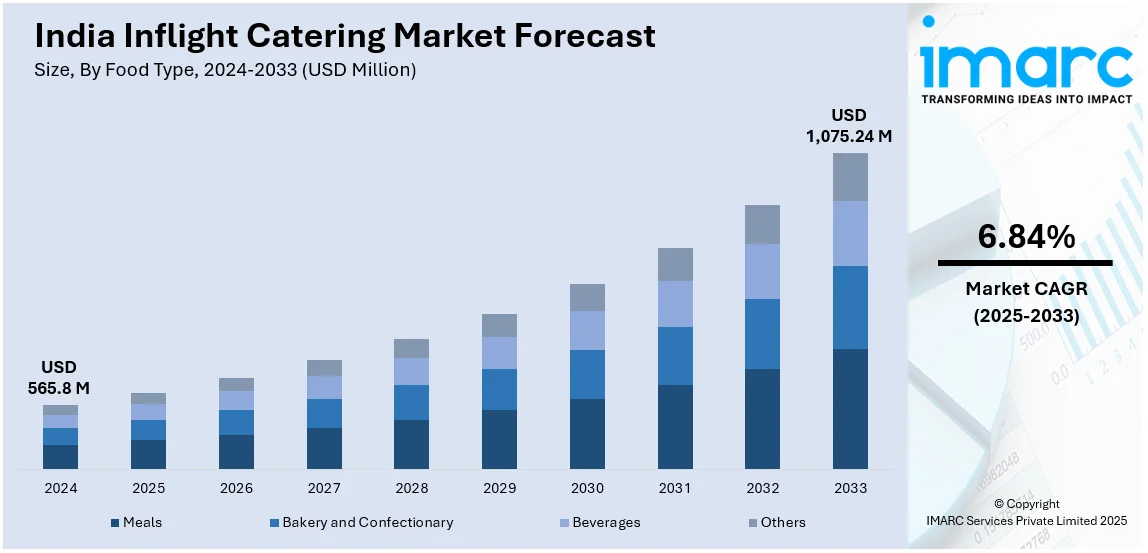

The India inflight catering market size reached USD 565.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,075.24 Million by 2033, exhibiting a growth rate (CAGR) of 6.84% during 2025-2033. Growing air passenger traffic, enhancing demand for premium and customized meal options, expansion of low-cost carriers, and greater focus on hygiene and food safety regulations are driving the market. Furthermore, airlines are integrating sustainable packaging and collaborating with reputed catering firms to elevate onboard dining experiences, which, in turn, is supporting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 565.8 Million |

| Market Forecast in 2033 | USD 1,075.24 Million |

| Market Growth Rate 2025-2033 | 6.84% |

India Inflight Catering Market Trends:

Food Safety and Transparency

Ensuring food safety and transparency represents a crucial factor in India’s inflight catering market. Airlines and catering providers are implementing stringent hygiene protocols, ingredient traceability, and clear labeling to enhance passenger trust. They are increasingly incorporating detailed nutritional information, allergen disclosures, and sourcing details to help travelers make informed choices. Besides this, advanced food safety technologies like cold chain logistics and automated quality checks are being integrated to maintain high standards. Digital tracking systems are also being employed to monitor food preparation and distribution processes. These measures not only improve customer confidence but also ensure compliance with global aviation food safety standards. For instance, in June 2024, the Food Safety and Standards Authority of India (FSSAI) directed airline caterers to comply with food safety regulations and provide detailed labeling for inflight meals. FSSAI also emphasized menu transparency, grievance handling, and specialized training for catering staff to uphold high food safety standards.

To get more information of this market, Request Sample

Increasing Adoption of AI and Automation in Meal Planning and Logistics

With AI-driven meal planning and automated food processing systems guaranteeing efficiency and uniformity, technological breakthroughs are revolutionizing in-flight catering operations. In order to minimize food waste and enhance meal inventory management, airlines are using AI algorithms to forecast passenger meal choices based on route, demographic information, and previous orders. Robotics-assisted food preparation in automated catering units is simplifying production and allowing for quicker turnaround times for large meal deliveries. The freshness and quality of meals supplied onboard are improved by improved coordination between airlines and catering companies made possible by real-time tracking of food logistics. The future of in-flight catering services in India is anticipated to be significantly shaped by AI-powered technologies as airlines prioritize operational efficiency. For instance, in October 2023, Noida International Airport partnered with TajSATS to establish a state-of-the-art inflight kitchen under a 37-year concession agreement. The 40,000-square-foot facility will produce over 15,000 meals daily for passengers, crew, lounges, and airport dining outlets. TajSATS will design, build, and operate the facility, strengthening its presence in Delhi NCR.

India Inflight Catering Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on food type, flight service type, and aircraft seating class.

Food Type Insights:

- Meals

- Bakery and Confectionary

- Beverages

- Others

The report has provided a detailed breakup and analysis of the market based on the food type. This includes meals, bakery and confectionary, beverages, and others.

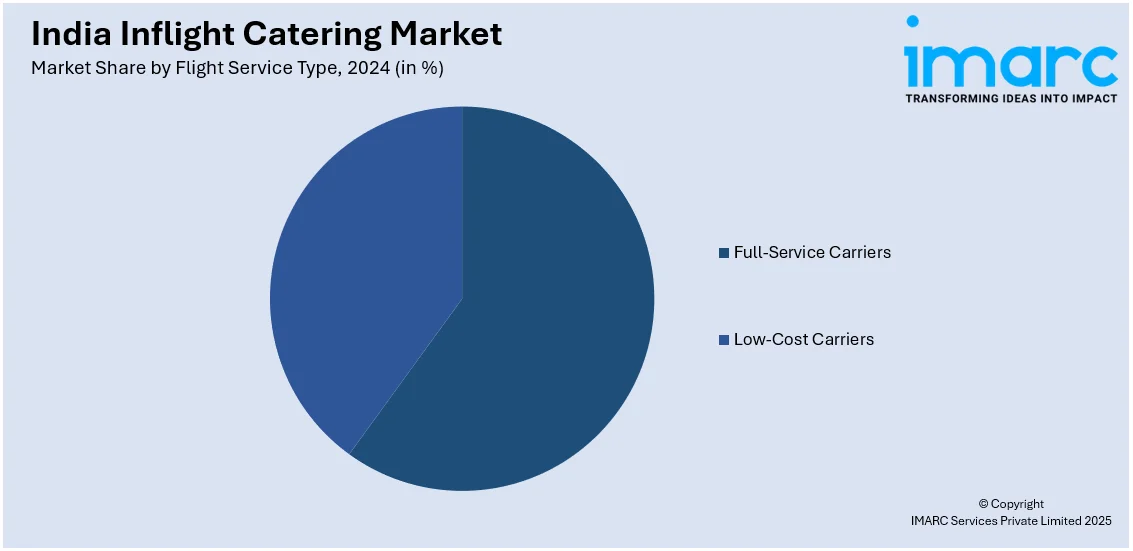

Flight Service Type Insights:

- Full-Service Carriers

- Low-Cost Carriers

A detailed breakup and analysis of the market based on the flight service type have also been provided in the report. This includes full-service carriers and low-cost carriers.

Aircraft Seating Class Insights:

- Economy Class

- Business Class

- First Class

A detailed breakup and analysis of the market based on the aircraft seating class have also been provided in the report. This includes economy class, business class, and first class.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Inflight Catering Market News:

- In August 2023, TajSATS launched a new flight kitchen at Manohar International Airport, Mopa, Goa, expanding its presence beyond Dabolim Airport. The 45,000-square-foot facility can serve over 20,000 meals daily, catering to both commercial and private aviation. Equipped with advanced culinary technology, it includes ‘The Atelier’ for gourmet menu curation. This marks TajSATS’ eighth flight kitchen across major Indian cities, reinforcing its leadership in airline catering. The expansion aligns with Goa’s growing tourism and aviation market demand.

India Inflight Catering Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Food Types Covered | Meals, Bakery and Confectionary, Beverages, Others |

| Flight Service Types Covered | Full-Service Carriers, Low-Cost Carriers |

| Aircraft Seating Classes Covered | Economy Class, Business Class, First Class |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India inflight catering market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India inflight catering market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India inflight catering and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India inflight catering market was valued at USD 565.8 Million in 2024.

The India inflight catering market is projected to exhibit a CAGR of 6.84% during 2025-2033, reaching a value of USD 1,075.24 Million by 2033.

The market is driven by growing air passenger traffic, increasing demand for premium and customized meal options, expansion of low-cost carriers, greater focus on hygiene and food safety regulations, and the integration of sustainable packaging. Airlines are also collaborating with reputed catering firms to elevate onboard dining experiences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)