India Insomnia Market Size, Share, Trends and Forecast by Therapy Type, Drug Class, Distribution Channel and Region, 2025-2033

India Insomnia Market Overview:

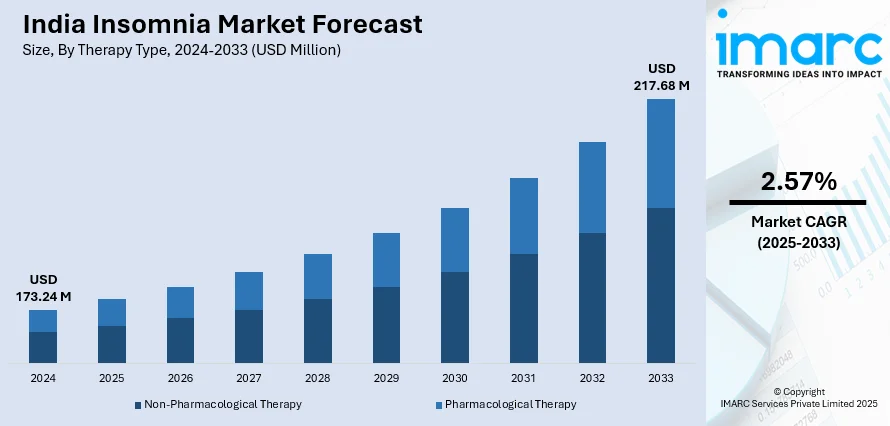

The India insomnia market size reached USD 173.24 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 217.68 Million by 2033, exhibiting a growth rate (CAGR) of 2.57% during 2025-2033. The market is driven by the increasing level of stress, growing awareness about sleep disorders, and lifestyle, and rising digital screen time, workplace stress and bad sleeping habits. Apart from this, increasing access to health care and technology is propelling the India insomnia market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 173.24 Million |

| Market Forecast in 2033 | USD 217.68 Million |

| Market Growth Rate (2025-2033) | 2.57% |

India Insomnia Market Trends:

Rising Awareness and Diagnosis of Insomnia

The India insomnia market outlook is witnessing expansion with high recognition and better diagnosis of sleep disorders. With the advent of the fast-paced lifestyle and the increasing stress factor, more and more people are understanding the necessity of sleep and how it contributes to total well-being. The number of visits to medical professionals has, therefore, risen, and thus the higher rates of insomnia diagnosis. A study involving 100 sleep research projects in India found that 1 in 4 Indians experienced insomnia, and almost half of the Indian population dealt with sleep problems. Education campaigns and education about sleep hygiene are de-stigmatizing sleep disorders. Additionally, newer diagnostic technologies like sleep studies and polysomnography have helped diagnose insomnia with relative ease in people. Increasing awareness along with access to medical care is opening demand for traditional as well as complementary insomnia treatments. With increasing awareness about the need for good sleep, the Indian insomnia market will continue to expand.

To get more information of this market, Request Sample

Growth of Digital Health Solutions for Insomnia

The India insomnia market share is propelling due to a shift toward the uptake of digital health products to manage sleep disorders. In a study conducted in 2024 by Indian D2C sleep and home solutions company Wakefit, which looked at the sleeping patterns of more than 10,000 individuals across various cities in India, nearly half of the participants reported waking up feeling fatigued. Wearable devices, mobile apps, and internet platforms with features for sleep tracking and management are becoming increasingly popular. These technologies enable users to track their sleep patterns, understand possible causes of insomnia, and obtain personalized solutions for better sleep quality. Popular sleep-tracking apps give insights into sleep cycles, suggest relaxation methods, and provide cognitive behavioral therapy (CBT) for insomnia. Additionally, online sleep specialist consultations and virtual therapy sessions are now readily available. As digital health platforms gain popularity, people are now able to manage their sleep health themselves, giving them an alternative to conventional practices such as medication. As the younger, technology-savvy population is increasingly likely to adopt digital solutions, this trend is likely to have a considerable influence on India's insomnia treatment market.

India Insomnia Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on therapy type, drug class, and distribution channel.

Therapy Type Insights:

- Non-Pharmacological Therapy

- Hypnotherapy

- Cognitive Behavioral Therapy

- Medical Devices

- Others

- Pharmacological Therapy

- Prescription Sleep Aids

- Over-The-Counter Sleep Aids

The report has provided a detailed breakup and analysis of the market based on the therapy type. This includes non -pharmacological therapy (hypnotherapy, cognitive behavioral therapy, medical devices, and others), pharmacological therapy (prescription sleep aids, over-the-counter sleep aids).

Drug Class Insights:

- Antidepressants

- Melatonin Antagonist

- Benzodiazepines

- Nonbenzodiazepines

- Orexin Antagonist

- Others

The report has provided a detailed breakup and analysis of the market based on the drug class. This includes antidepressants, melatonin antagonist, benzodiazepines, nonbenzodiazepines, orexin antagonist, and others.

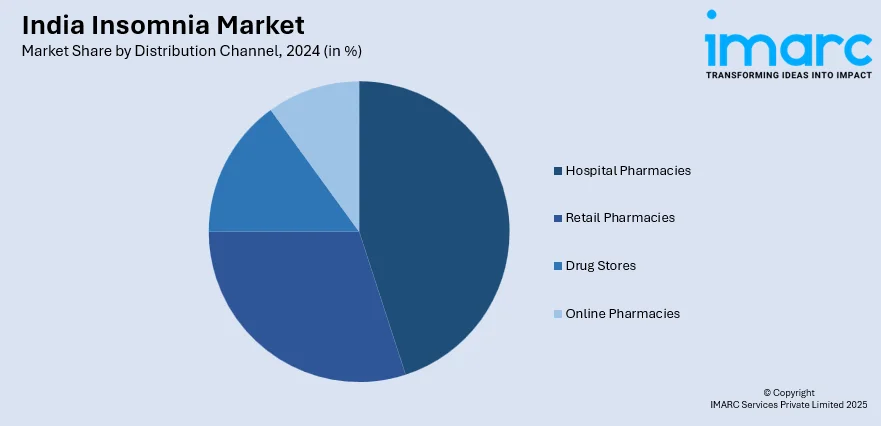

Distribution Channel Insights:

- Hospital Pharmacies

- Retail Pharmacies

- Drug Stores

- Online Pharmacies

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hospital pharmacies, retail pharmacies, drug stores, and online pharmacies.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Insomnia Market News:

- In March 2024, Vanda Pharmaceuticals Inc. announced that it received a Complete Response Letter (CRL) from the U.S. Food and Drug Administration (FDA) regarding its ongoing assessment of Vanda's supplemental New Drug Application (sNDA) for HETLIOZ (tasimelteon) aimed at treating insomnia marked by trouble initiating sleep.

India Insomnia Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapy Types Covered |

|

| Drug Classes Covered | Antidepressants, Melatonin Antagonist, Benzodiazepines, Nonbenzodiazepines, Orexin Antagonist, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Drug Stores, Online Pharmacies |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India insomnia market performed so far and how will it perform in the coming years?

- What is the breakup of the India insomnia market on the basis of therapy type?

- What is the breakup of the India insomnia market on the basis of drug class?

- What is the breakup of the India insomnia market on the basis of distribution channel?

- What is the breakup of the India insomnia market on the basis of region?

- What are the various stages in the value chain of the India insomnia market?

- What are the key driving factors and challenges in the India insomnia market?

- What is the structure of the India insomnia market and who are the key players?

- What is the degree of competition in the India insomnia market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India insomnia market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India insomnia market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India insomnia industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)