India Instant Soups Market Size, Share, Trends and Forecast by Nature, Form, Source, Distribution Channel, End Use, and Region, 2025-2033

India Instant Soups Market Overview:

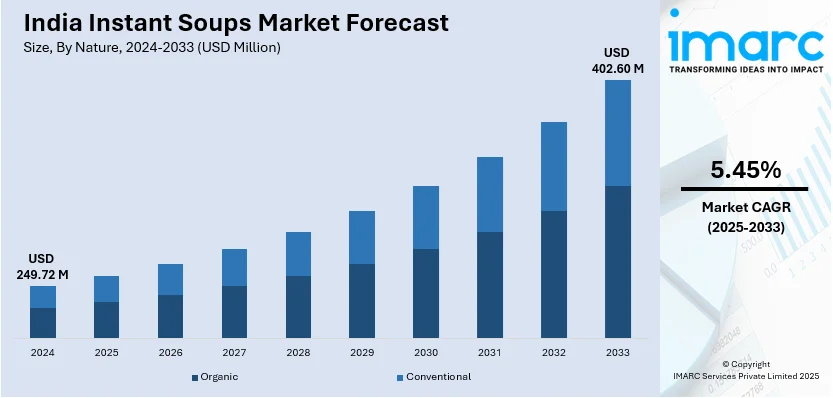

The India instant soups market size reached USD 249.72 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 402.60 Million by 2033, exhibiting a growth rate (CAGR) of 5.45% during 2025-2033. Busy lifestyles, urbanization, and rising convenience demand are driving the India instant soups market share. Besides this, increasing work hours, dual-income households, and on-the-go (OTG) consumption catalyzes the overall demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 249.72 Million |

| Market Forecast in 2033 | USD 402.60 Million |

| Market Growth Rate 2025-2033 | 5.45% |

India Instant Soups Market Trends:

Expanding Retail and E-commerce Channels

Expanding retail and e-commerce channels are significantly propelling the India instant soups market growth. Supermarkets and hypermarkets are increasing shelf space for instant soups, enhancing consumer visibility and accessibility. Organized retail chains are offering promotional deals and discounts, encouraging higher consumer purchases and brand trials. Convenience stores in urban and semi-urban areas are stocking instant soups, meeting rising demand effectively. The rapid expansion of e-commerce is further fueling the market growth, with the Indian e-commerce sector projected to grow from US$ 123 billion in 2024 to US$ 292.3 billion in 2028, registering a CAGR of 18.7%, according to IBEF. E-commerce platforms are providing doorstep delivery, enabling consumers to buy instant soups with minimal effort. Online retailers are offering bulk purchase discounts and subscription models, making instant soups more affordable. Digital marketing and targeted advertisements are increasing consumer awareness, influencing instant soup sales across various demographics. E-commerce giants are introducing regional flavors and niche products, catering to diverse consumer preferences in India. The proliferation of food delivery services is complementing instant soup sales, encouraging consumers to try different varieties.

To get more information of this market, Request Sample

Growing Busy Lifestyles and Convenience Demand

Busy lives and convenience needs are key drivers of the India instant soups market outlook. Urban students and professionals opt for convenient meal solutions, and instant soups are in high demand. Longer working hours and busy lives are cutting down on time for cooking, fueling instant soup consumption. Dual-income families are looking for easy-to-cook meals, which is driving demand for instant soup products. Instant soups need little preparation time, providing an easy solution for busy households and individuals. As per the Economic Survey 2023-24, more than 40% of India's population is expected to live in urban areas by 2030, increasing migration to cities is also increasing demand for ready-to-eat (RTE) food. Preferences for RTE foods are on the rise, making instant soups a convenient choice for instant hunger satisfaction. Late-night shift work and irregular eating patterns are prompting consumers to choose instant soups more and more. Convenient packaging for travel and single-serve formats are turning instant soups into an easy option for OTG consumers. Cup-based and microwavable instant soups' availability is adding to consumer convenience and ease of use. As urbanization intensifies and the pace of daily life quickens, instant soups are gaining popularity as an easy, time-saving meal option.

India Instant Soups Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on nature, form, source, distribution channel, and end use.

Nature Insights:

- Organic

- Conventional

The report has provided a detailed breakup and analysis of the market based on the nature. This includes organic and conventional.

Form Insights:

- Dry

- Liquid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes dry and liquid.

Source Insights:

- Animal-based

- Plant-based

The report has provided a detailed breakup and analysis of the market based on the source. This includes animal-based and plant-based.

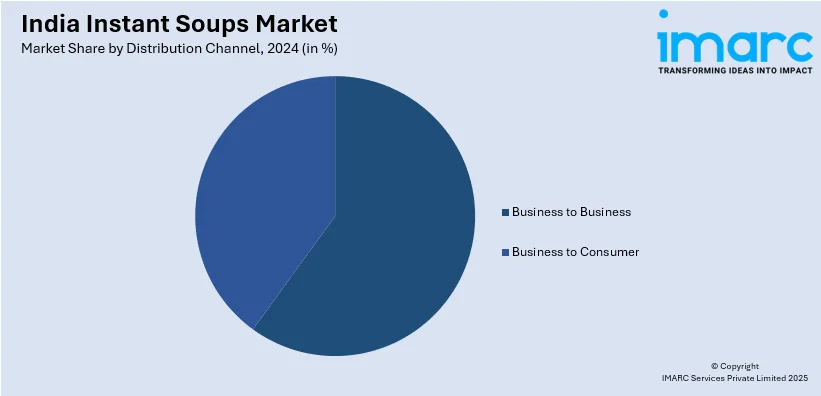

Distribution Channel Insights:

- Business to Business

- Business to Consumer

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes business to business and business to consumer.

End Use Insights:

- Foodservice

- Retail/Household

The report has provided a detailed breakup and analysis of the market based on the end use. This includes foodservice and retail/household.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Instant Soups Market News:

- In January 2025, Ching's Secret elevated the experience for millions of pilgrims by offering free Desi Chinese cuisine and hosting lively performances, at the Maha Kumbh Mela 2025 in Prayagraj. From two stalls at the Parade Ground, the brand served flavorful dishes like noodles, pasta, and fried rice. To keep attendees warm during the chilly winter, Ching’s also provided hot soup. Additionally, the brand enhanced the cultural vibrancy of the event by organizing dhol performances during the Ganga Aarti, adding to the festive spirit.

- In October 2024, Tata Consumer Products expanded its Tata MyBistro vending machine lineup by adding Ching's Secret soups and Organic India teas. This enhancement offered a wider variety of beverages and snacks, including coffee, tea, soups, lemon and organic teas, and milk drinks. The initiative underscores Tata Consumer Products' dedication to provide a premium hot beverage experience in workplaces and recreational spaces.

- In November 2023, the Peninsular Export Company introduced SAARRU, India's first native soup brand, offering three regional flavors, like Mutton Soup Masala, Chicken Soup Masala, and Chicken Coriander Rasam Masala. Priced at ₹50 each, these soup mixes are available across Tamil Nadu in B2C and B2B markets, as well as online through SAARRU's e-commerce website, Flipkart, and Jiomart.

India Instant Soups Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Natures Covered | Organic, Conventional |

| Forms Covered | Dry, Liquid |

| Sources Covered | Animal-based, Plant-based |

| Distribution Channels Covered | Business to Business, Business to Consumer |

| End Uses Covered | Foodservice, Retail/Household |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India instant soups market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India instant soups market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India instant soups industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India instant soups market was valued at USD 249.72 Million in 2024.

The India instant soups market is projected to exhibit a CAGR of 5.45% during 2025-2033, reaching a value of USD 402.60 Million by 2033.

The India instant soups market is fueled by busy urban lifestyles, growing consumer focus on health-conscious convenience foods, expanding modern retail and e-commerce reach, and rising demand for innovative flavors and single-serve formats that cater to quick, easy meal occasions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)