India Insurance Software Market Size, Share, Trends and Forecast by Type, Deployment Mode, End User, and Region, 2025-2033

India Insurance Software Market Overview:

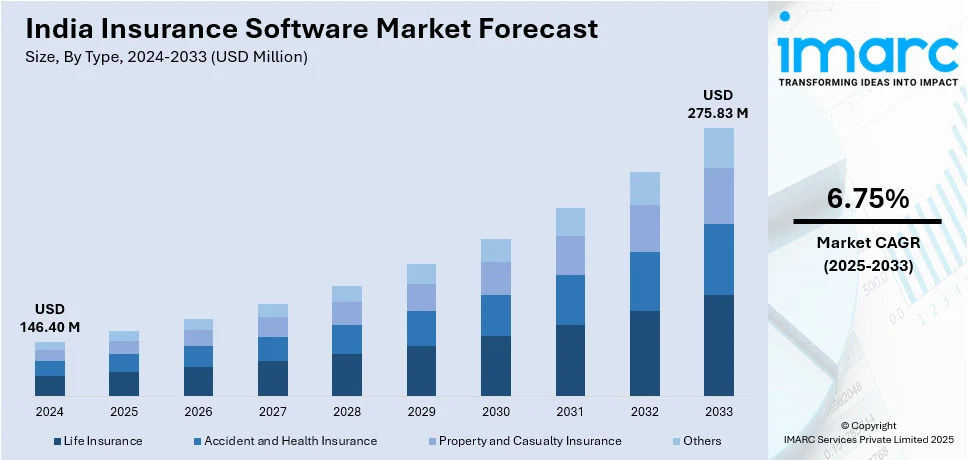

The India insurance software market size reached USD 146.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 275.83 Million by 2033, exhibiting a growth rate (CAGR) of 6.75% during 2025-2033. The market is driven by increasing digitalization, rising demand for operational efficiency, and the need for personalized customer experiences. Cloud adoption, AI integration, and regulatory compliance requirements are key factors. Growing internet penetration, InsurTech innovations, and government initiatives for digital transformation further propel the India insurance software market share, enabling insurers to enhance scalability and competitiveness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 146.40 Million |

| Market Forecast in 2033 | USD 275.83 Million |

| Market Growth Rate 2025-2033 | 6.75% |

India Insurance Software Market Trends:

Increasing Adoption of Cloud-Based Insurance Software Solutions

The significant shift toward cloud-based solutions is majorly driving the Indian insurance software market growth. Insurers are increasingly adopting cloud platforms to enhance operational efficiency, scalability, and cost-effectiveness. Cloud-based software enables seamless data integration, real-time analytics, and remote accessibility, which are crucial for insurers to stay competitive in a rapidly evolving market. Additionally, the growing demand for digital transformation and the need to streamline complex processes, such as policy management, claims processing, and customer engagement, are driving this trend. On 28th January 2025, Godrej Enterprises Group announced plans to invest INR 1,200 Crore (approximately USD 146.34 Million) over the next three years in digital transformation and artificial intelligence initiatives for enhancing customer experience across its log of business sectors. This includes investments in AI-powered personalization, advanced data analytics, and an organization-wide reskilling initiative that will deliver 600,000 hours of training to employees. This strategy formation comes as a reaction to the growing demand for digital solutions in India, most notably impacting markets such as those for software sectors driven by AI-embedded customer interaction and automation. In addition to this, the emergence of InsurTech companies and their focus on new-age, cloud-native products is further speeding up this adoption. Coupled with the Indian government's emphasis on digitalization and rising internet services penetration, cloud insurance software is set to rule the market, giving insurers the flexibility to respond to evolving customer demands and regulatory conditions.

To get more information of this market, Request Sample

Integration of Artificial Intelligence and Machine Learning in Insurance Software

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the India insurance software market outlook by enabling smarter decision-making and personalized customer experiences. Insurers are leveraging AI-powered tools for underwriting, fraud detection, risk assessment, and claims management, which significantly reduces manual intervention and improves accuracy. Chatbots and virtual assistants powered by AI are enhancing customer service by providing instant support and resolving queries efficiently. According to a research report published by IMARC Group, the India chatbot market was valued at USD 243.3 Million in 2024. The market is also expected to cross USD 1,465.2 Million by 2033, growing at a CAGR of 20.43% from 2025 to 2033. Moreover, ML algorithms are being used to analyze vast amounts of data to predict customer behavior, optimize pricing models, and identify potential risks. This trend is gaining momentum as insurers aim to enhance operational efficiency and deliver tailored products to meet the diverse needs of Indian consumers. The integration of AI and ML is not only improving business outcomes but also helping insurers comply with regulatory standards by ensuring transparency and data security.

India Insurance Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, deployment mode, and end user.

Type Insights:

- Life Insurance

- Accident and Health Insurance

- Property and Casualty Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes life insurance, accident and health insurance, property and casualty insurance, and others.

Deployment Mode Insights:

- Cloud-Based

- On-premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premises.

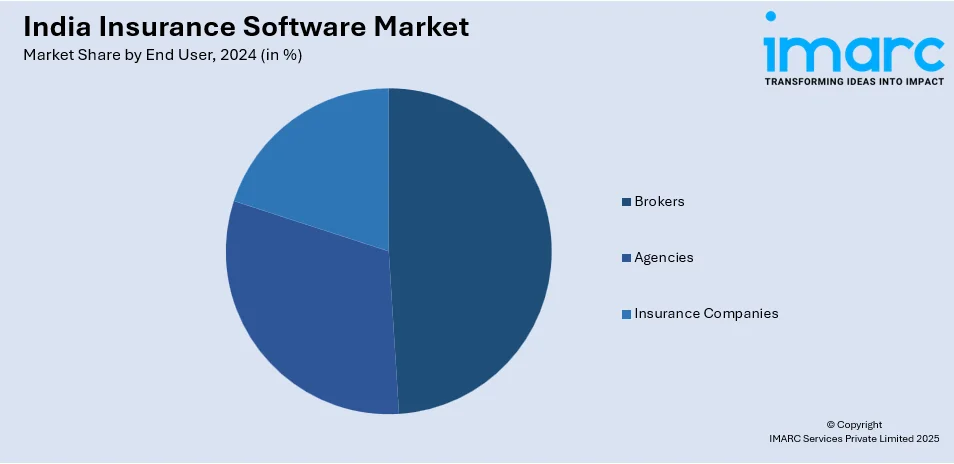

End User Insights:

- Brokers

- Agencies

- Insurance Companies

The report has provided a detailed breakup and analysis of the market based on the end user. This includes brokers, agencies, and insurance companies.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Insurance Software Market News:

- December 04, 2024: Neysa, along with Data Science Wizards (DSW), launched a one-stop Insurance AI Cloud Platform to help accelerate artificial intelligence adoption in the Indian insurance sector. This can reduce the cost by 60-80% and deploy the AI solutions within 3-4 weeks. It comes with improved fraud detection, claims processing, and policy recommendations due to advanced AI and GenAI tools integrated into the platform. This novel and path-breaking development strengthens the Insurance Software market in India by digitizing the processes and thereby improving operational efficiency.

- May 29, 2024: MIC Global, along with New India Assurance, launched MiIdentity, India's first digital identity monitoring and insurance solution that offers protection against identity theft and fraud. It enables users to track their personal information, alerts for suspicious activities, and financial aid, all covered by NIA with reinsurance from GIC Re. This breakthrough supports the insurance software in India, helping to improve both cybersecurity and digital risk management.

India Insurance Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Life Insurance, Accident and Health Insurance, Property and Casualty Insurance, Others |

| Deployment Modes Covered | Cloud-Based, On-premises |

| End Users Covered | Brokers, Agencies, Insurance Companies |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India insurance software market performed so far and how will it perform in the coming years?

- What is the breakup of the India insurance software market on the basis of type?

- What is the breakup of the India insurance software market on the basis of deployment mode?

- What is the breakup of the India insurance software market on the basis of end user?

- What is the breakup of the India insurance software market on the basis of region?

- What are the various stages in the value chain of the India insurance software market?

- What are the key driving factors and challenges in the India insurance software?

- What is the structure of the India insurance software market and who are the key players?

- What is the degree of competition in the India insurance software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India insurance software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India insurance software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India insurance software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)