India Insurance Third Party Administrator Market Size, Share, Trends and Forecast Insurance Type and Region, 2025-2033

India Insurance Third Party Administrator Market Overview:

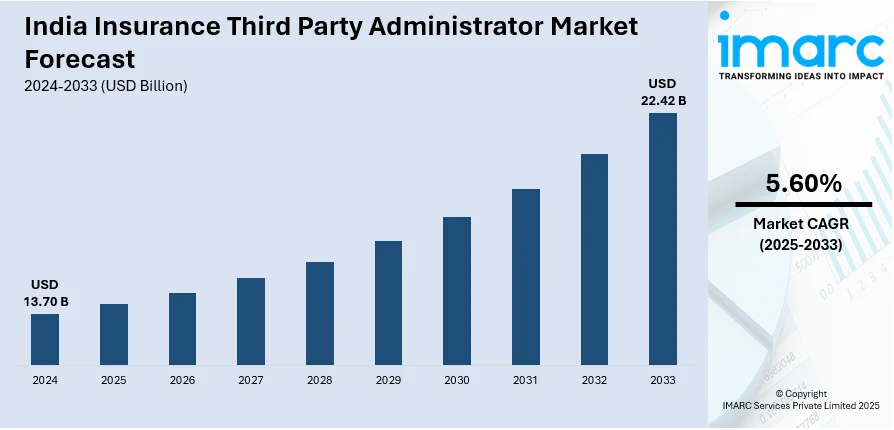

The India insurance third party administrator market size reached USD 13.70 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 22.42 Billion by 2033, exhibiting a growth rate (CAGR) of 5.60% during 2025-2033. The market in India is expanding due to increasing health insurance penetration, digital claim processing, and regulatory reforms. Insurers are leveraging TPAs for automation, fraud detection, and efficient policy management, driving demand for tech-driven solutions and improving service quality.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.70 Billion |

| Market Forecast in 2033 | USD 22.42 Billion |

| Market Growth Rate (2025-2033) | 5.60% |

India Insurance Third Party Administrator Market Trends:

Advancements in Automated Construction Technology

Increasing Consolidation in the TPA Sector

The Third Party Administrator (TPA) market in India is witnessing increased consolidation as companies seek to expand their market presence, improve operational efficiency, and enhance claims management capabilities. Larger TPAs are acquiring smaller or mid-sized firms to strengthen their insurer partnerships, integrate advanced technology, and improve service delivery. This trend is driven by the need for streamlined claims processing, reduced administrative costs, and enhanced automation, allowing TPAs to offer more efficient healthcare insurance services. In August 2024, Medi Assist Insurance TPA acquired Paramount Health Services & Insurance TPA for INR 311.18 Crore, expanding its market share in group premiums to 36.6%. This acquisition marks one of India’s largest TPA deals and positions Medi Assist as a dominant player in the sector. The impact of such consolidations is significant, as they lead to scalability, better insurer collaborations, and improved policyholder experience. By integrating digital processes and automation, larger TPAs can offer faster claim settlements, fraud detection, and seamless interoperability with insurers and healthcare providers. As competition grows, further mergers and acquisitions in the Indian TPA sector are expected, driving market efficiency and transforming the health insurance ecosystem.

To get more information of this market, Request Sample

Rising Demand for Digital TPA Services

Indian insurance sees an increased appetite for digital Third-Party Administrator (TPA) services mainly due to the policyholders' desire for claims to be easily processed. The insurers are trusting TPAs with more responsibilities, leveraging automated settlements of claims and digital documentation as a way of improving the experience of the customer. Mobile app and cloud platform adoption are consolidating policy handling, lowering the paperwork load, and cutting the turnaround time. Another important determinant of the sector is the regulatory effort in the direction of significant transparency and efficiency. The Insurance Regulatory and Development Authority of India (IRDAI) is implementing reforms to promote digitization and tighter compliance, driving TPAs to enhance their tech capabilities. Furthermore, these factors promote a competitive scenario where the speed and quality of service contribute greatly to TPA choice. Additionally, the growth of health insurance coverage, especially under government-sponsored programs, is boosting TPAs' workloads and prompting investments in AI-based automation. This transformation minimizes delays in claim processing and ensures accurate settlements. As insurance companies aim to enhance customer retention, the role of TPAs in providing seamless, technology-enabled services becomes increasingly important. Also, digital integration is poised to revolutionize the TPA sector with increased operational effectiveness and policyholder satisfaction.

India Insurance Third Party Administrator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on insurance type.

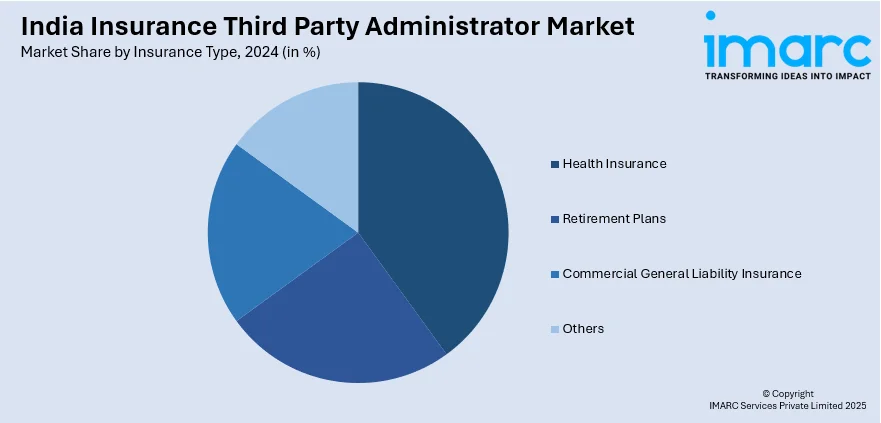

Insurance Type Insights:

- Health Insurance

- Retirement Plans

- Commercial General Liability Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes health insurance, retirement plans, commercial general liability insurance, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Insurance Third Party Administrator Market News:

- November 2024: MDIndia Health Insurance TPA integrated with the National Health Claims Exchange (NHCX), enhancing digital claims processing, interoperability, and transparency. This advancement accelerates health insurance claim settlements, reduces operational costs, and strengthens India’s Third Party Administrator (TPA) sector through automation and standardized data exchange.

- June 2024: Bajaj Allianz General Insurance conducted a workshop in Pune to promote hospital integration with the National Health Claims Exchange (NHCX). This initiative enhances digital claims processing, fraud reduction, and transparency, strengthening India’s Third Party Administrator (TPA) industry by improving efficiency in health insurance settlements.

India Insurance Third Party Administrator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Health Insurance, Retirement Plans, Commercial General Liability Insurance, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India insurance third party administrator market performed so far and how will it perform in the coming years?

- What is the breakup of the India insurance third party administrator market on the basis of insurance type?

- What are the various stages in the value chain of the India insurance third party administrator market?

- What are the key driving factors and challenges in the India insurance third party administrator market?

- What is the structure of the India insurance third party administrator market and who are the key players?

- What is the degree of competition in the India insurance third party administrator market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India insurance third party administrator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India insurance third party administrator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India insurance third party administrator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)