India Intelligent Document Processing Market Size, Share, Trends and Forecast by Component, Technology, Organization Size, Deployment, End Use, and Region, 2025-2033

India Intelligent Document Processing Market Overview:

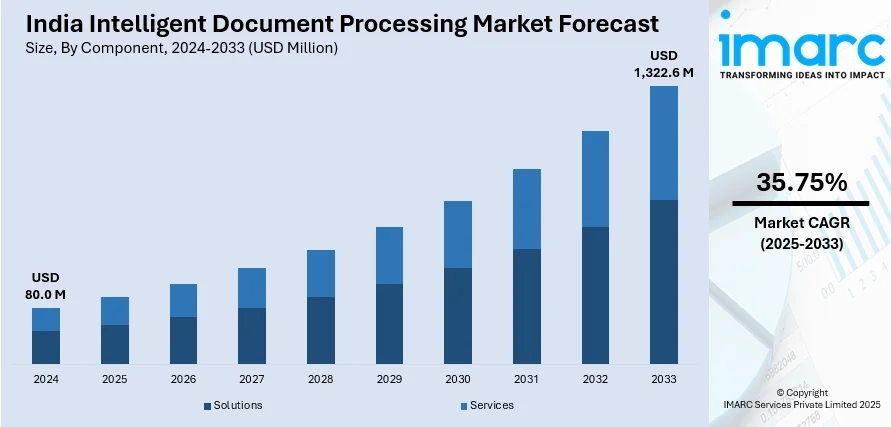

The India intelligent document processing market size reached USD 80.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,322.6 Million by 2033, exhibiting a growth rate (CAGR) of 35.75% during 2025-2033. Intelligent document processing (IDP) is transforming banking, insurance, healthcare, and retail by automating document workflows, improving accuracy, enhancing compliance, enabling fraud detection, and integrating seamlessly with enterprise and financial systems to drive digital transformation and operational efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 80.0 Million |

| Market Forecast in 2033 | USD 1,322.6 Million |

| Market Growth Rate 2025-2033 | 35.75% |

India Intelligent Document Processing Market Trends:

Growing Digital Transformation Initiatives

Organizations in banking, insurance, healthcare, and retail are swiftly advancing digital transformation efforts, leading to the uptake of intelligent document processing (IDP) solutions. Organizations are automating document-centric processes like loan approvals, claims handling, and supplier onboarding to improve efficiency and precision. Banks and non-banking financial institutions (NBFCs) are utilizing IDP to enhance know-your-customer (KYC) verification and fraud identification, minimizing manual mistakes and processing duration. In healthcare, hospitals and insurers are utilizing IDP to manage electronic health records (EHRs) and automate medical billing, enhancing compliance and service efficiency. The expanding e-commerce and logistics industries are boosting the need for automated document handling in invoicing, shipment monitoring, and order completion. Cloud-based IDP platforms are becoming more popular, enabling companies to handle documents remotely and connect effortlessly with enterprise software. In 2025, Deloitte India collaborated with Red Hat India to expedite digital transformation for Indian businesses utilizing hybrid cloud solutions. The partnership aims to upgrade IT infrastructure and facilitate cloud-native development to improve scalability and reduce costs. This change is also accelerating IDP implementation, as companies look for secure and effective cloud-based solutions to streamline document processes. As businesses emphasize digital-first strategies, IDP is becoming an essential tool for enhancing accuracy, operational efficiency, and real-time data processing.

To get more information of this market, Request Sample

Rise in Financial Services and Digital Banking

The swift expansion of financial services and digital banking in India is bolstering the market growth. Banks, NBFCs, and fintech companies are streamlining document-centric processes like loan approvals, KYC checks, fraud identification, and adherence to regulations. The growing dependence on digital lending platforms and mobile banking services is catalyzing the demand for real-time document verification and automated risk evaluation. IDP solutions allow financial organizations to effectively handle significant quantities of client documents, income declarations, and credit records, all while enhancing precision and minimizing operational delays. In 2024, Salesforce introduced its Digital Lending platform in India, simplifying lending processes for banks and lenders by combining financial data and customer details, which greatly cut down loan processing times. The platform facilitates home, auto, and personal loans, highlighting the necessity for IDP in financial processes. As financial institutions keep incorporating IDP with core banking systems, the technology enhances data consistency, reduces errors in financial record maintenance, and boosts compliance. As digital financial services continue to grow, IDP is increasingly vital for enhancing operational efficiency, improving client experience, and ensuring regulatory compliance within India's banking industry.

India Intelligent Document Processing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, technology, organization size, deployment, and end use.

Component Insights:

- Solutions

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions and services.

Technology Insights:

- Natural Language Processing (NLP)

- Optical Character Recognition (OCR)

- Robotic Process Automation (RPA)

- Machine Learning (ML)

- Deep Learning (DL)

- Artificial Intelligence (AI)

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes natural language processing (NLP), optical character recognition (OCR), robotic process automation (RPA), machine learning (ML), deep learning (DL), artificial intelligence (AI), and others.

Organization Size Insights:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium enterprises (SMEs) and large enterprises.

Deployment Insights:

- Cloud

- On-Premises

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes cloud and on-premises.

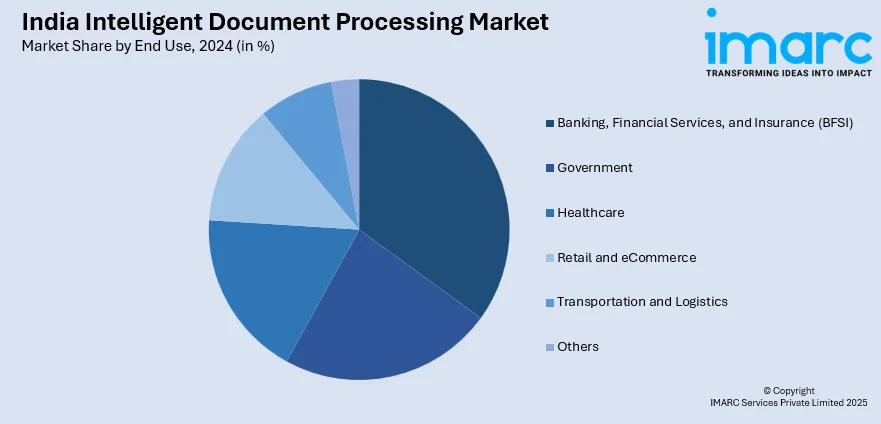

End Use Insights:

- Banking, Financial Services, and Insurance (BFSI)

- Government

- Healthcare

- Retail and eCommerce

- Transportation and Logistics

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes banking, financial services, and insurance (BFSI), government, healthcare. retail and ecommerce, transportation and logistics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Intelligent Document Processing Market News:

- In April 2024, UiPath declared the initiation of two new data centers in Pune and Chennai, enhancing its Automation Cloud services in India. These data centers hosted UiPath services, including Intelligent Document Processing (IDP), AI, and automation solutions. This expansion strengthened UiPath’s commitment to providing local cloud services for Indian businesses and driving digital transformation.

- In June 2023, Datamatics, a company based in India, announced the integration of Generative AI with its TruCap+ Intelligent Document Processing (IDP) solution. This innovation enhanced document processing accuracy and efficiency, enabling organizations to extract insights with improved data querying and multi-language support. The integration was particularly beneficial for industries like BFSI, healthcare, pharma, and logistics.

India Intelligent Document Processing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solutions, Services |

| Technologies Covered | Natural Language Processing (NLP), Optical Character Recognition (OCR), Robotic Process Automation (RPA), Machine Learning (ML), Deep Learning (DL), Artificial Intelligence (AI), Others |

| Organization Sizes Covered | Small and Medium Enterprises (SMEs), Large Enterprises |

| Deployments Covered | Cloud, On-Premises |

| End Uses Covered | Banking, Financial Services, and Insurance (BFSI), Government, Healthcare. Retail and eCommerce, Transportation and Logistics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India intelligent document processing market performed so far and how will it perform in the coming years?

- What is the breakup of the India intelligent document processing market on the basis of component?

- What is the breakup of the India intelligent document processing market on the basis of technology?

- What is the breakup of the India intelligent document processing market on the basis of organization size?

- What is the breakup of the India intelligent document processing market on the basis of deployment?

- What is the breakup of the India intelligent document processing market on the basis of end use?

- What is the breakup of the India intelligent document processing market on the basis of region?

- What are the various stages in the value chain of the India intelligent document processing market?

- What are the key driving factors and challenges in the India intelligent document processing market?

- What is the structure of the India intelligent document processing market and who are the key players?

- What is the degree of competition in the India intelligent document processing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India intelligent document processing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India intelligent document processing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India intelligent document processing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)