India IoT Sensors Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

India IoT Sensors Market Size and Share:

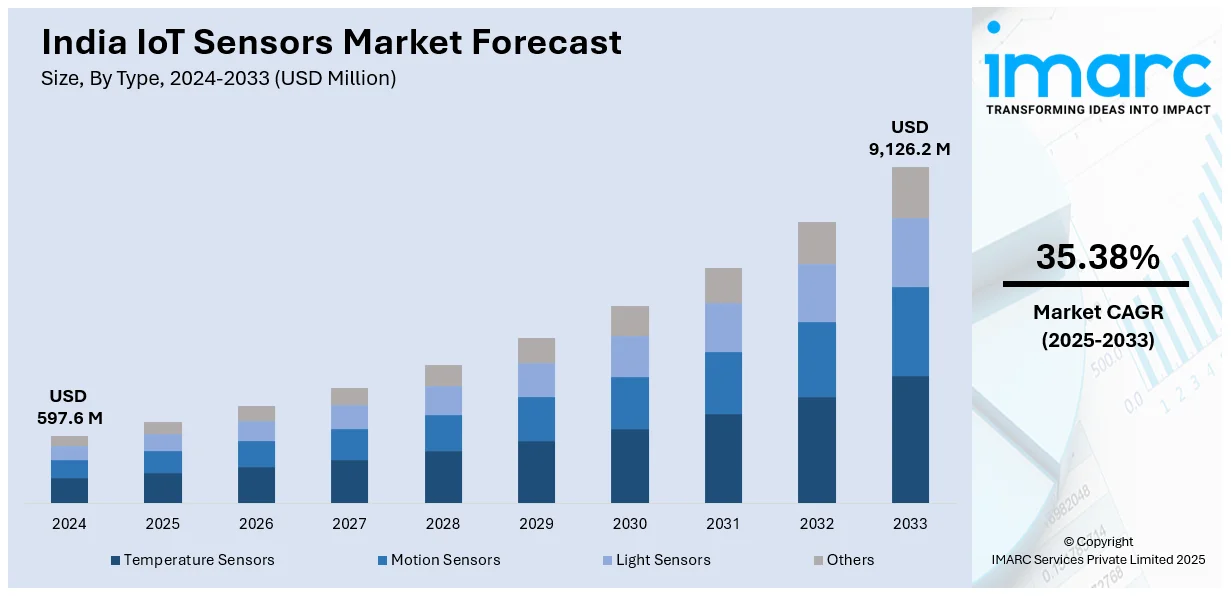

The India IoT sensors market size reached USD 597.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 9,126.2 Million by 2033, exhibiting a growth rate (CAGR) of 35.38% during 2025-2033. The market is driven by rapid industrial automation, increasing adoption of IoT in smart devices, and growing demand for automotive safety systems. Expanding healthcare applications, rising consumer electronics penetration, and government initiatives promoting digitalization further propel market growth. Advancements in MEMS technology and smart city projects also contribute significantly.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 597.6 Million |

| Market Forecast in 2033 | USD 9,126.2 Million |

| Market Growth Rate (2025-2033) | 35.38% |

India IoT Sensors Market Trends:

Rising Adoption of IoT and Industrial Automation

Rising adoption of IoT in industrial and consumer segments is a key trend behind sensor growth in India. As the Industry 4.0 era expands, manufacturing plants are quickly embracing intelligent sensors to achieve efficiency in operations, predictive maintenance, and real-time monitoring. Applications in automotive, healthcare, and logistics are using sensor-based IoT solutions to drive performance and minimize downtime. Also, the Indian government's "Make in India" initiative and programs driving digital transformation are fueling domestic sensor manufacturing and usage. The spread of smart homes, IoT devices, and autonomous systems also boosts sensor deployment, driving innovation in wireless and AI-based sensor technologies for various applications across sectors.

To get more information of this market, Request Sample

Surging Demand for Automotive Sensors

India's automotive sector is witnessing a sharp rise in sensor adoption, driven by stricter safety regulations and growing consumer demand for advanced driver-assistance systems (ADAS). The implementation of Bharat New Car Assessment Programme (Bharat NCAP) in 2023 has further accelerated this trend by assigning 'Star Ratings' based on crash test performance. By 2027, Bharat NCAP is set to include ADAS technology assessments, aligning with global safety standards and pushing automakers to integrate LiDAR, radar, and pressure sensors for enhanced vehicle safety and efficiency. The expansion of electric vehicles (EVs) is also fueling demand for sensor-based battery management, temperature monitoring, and smart braking solutions. Additionally, the rise of connected car ecosystems and autonomous vehicle development in India is driving continuous innovation in automotive sensor technologies.

Expanding Role of Sensors in Healthcare and Wearables

India's healthcare sector is witnessing a surge in sensor-based medical devices and wearable technology, driven by rising health awareness and the need for remote diagnostics. Smart wearables, including fitness trackers, continuous glucose monitors, and ECG patches, are increasingly integrating sensors for personalized healthcare. In 2023, India’s wearable device market saw record shipments of 134.2 million units, reflecting a 34% year-over-year growth. However, in 2024, the market experienced its first decline, with an 11.3% drop in shipments. Despite this, the adoption of biosensors in hospitals and diagnostic centers for real-time monitoring continues to rise. Telemedicine and home healthcare solutions are further fueling demand for smart sensors. Advancements in miniaturization and wireless connectivity are enhancing sensor efficiency, making healthcare more accessible.

India IoT Sensors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Temperature Sensors

- Motion Sensors

- Light Sensors

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes temperature sensors, motion sensors, light sensors, and others.

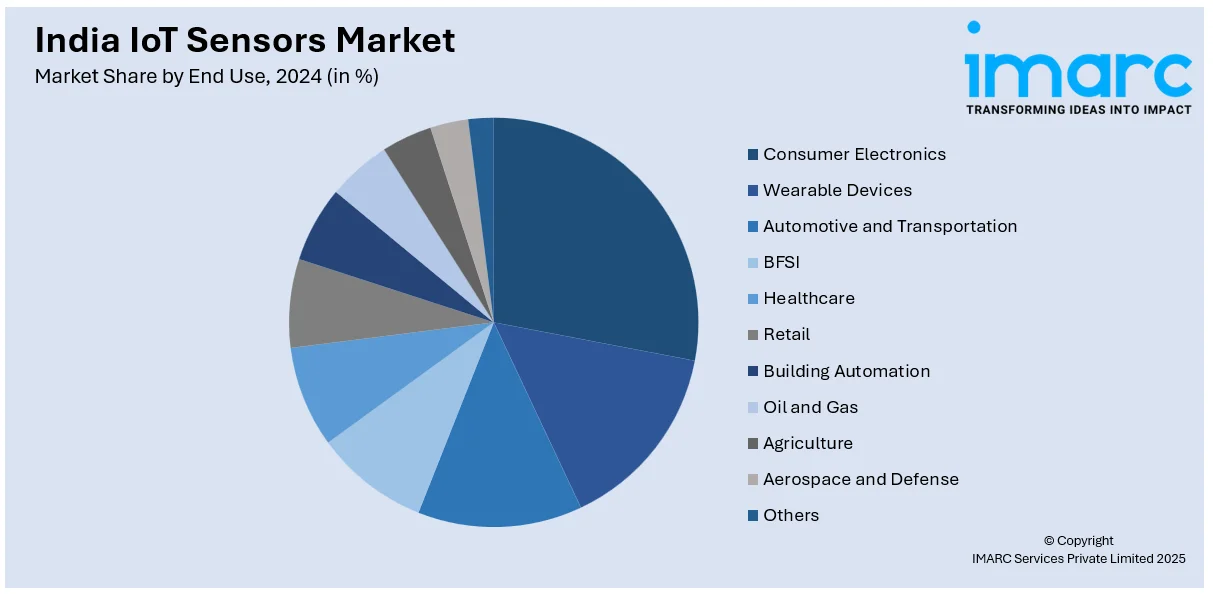

End Use Insights:

- Consumer Electronics

- Wearable Devices

- Automotive and Transportation

- BFSI

- Healthcare

- Retail

- Building Automation

- Oil and Gas

- Agriculture

- Aerospace and Defense

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes consumer electronics, wearable devices, automotive and transportation, BFSI, healthcare, retail, building automation, oil and gas, agriculture, aerospace and defense, and others

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India IoT Sensors Market News:

- In February 2025, MediBuddy partnered with Japanese electronics firm ELECOM to launch smart health IoT devices in India. This collaboration aims to enhance healthcare access by providing digital health tools, addressing the shortage of professionals. The initial phase will focus on integrated healthcare solutions using ELECOM's technology to manage lifestyle-related diseases effectively.

- In January 2025, The Ministry of Electronics and Information Technology (MeitY) launched a Centre of Excellence for Intelligent IoT Sensors and an India Innovation Centre for Graphene. These initiatives aim to drive innovation, enhance research, and support industry growth in advanced sensor technology and graphene applications, strengthening India's position in cutting-edge electronics and material science.

India IoT Sensors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Temperature Sensors, Motion Sensors, Light Sensors, Others |

| End Uses Covered | Consumer Electronics, Wearable Devices, Automotive and Transportation, BFSI, Healthcare, Retail, Building Automation, Oil and Gas, Agriculture, Aerospace and Defense, Others. |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India IoT sensors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India IoT sensors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India IoT sensors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The IoT sensors market in India was valued at USD 597.6 Million in 2024.

The India IoT sensors market is projected to exhibit a CAGR of 35.38% during 2025-2033, reaching a value of USD 9,126.2 Million by 2033.

The India IoT sensors market is propelled by booming adoption of smartphones, wearables, and smart-home devices; rapid growth in industrial automation and automotive applications like ADAS and EVs; government initiatives promoting domestic electronics and semiconductor manufacturing; and falling sensor costs with enhanced miniaturization.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)