India Iron Ore Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

India Iron Ore Market Overview:

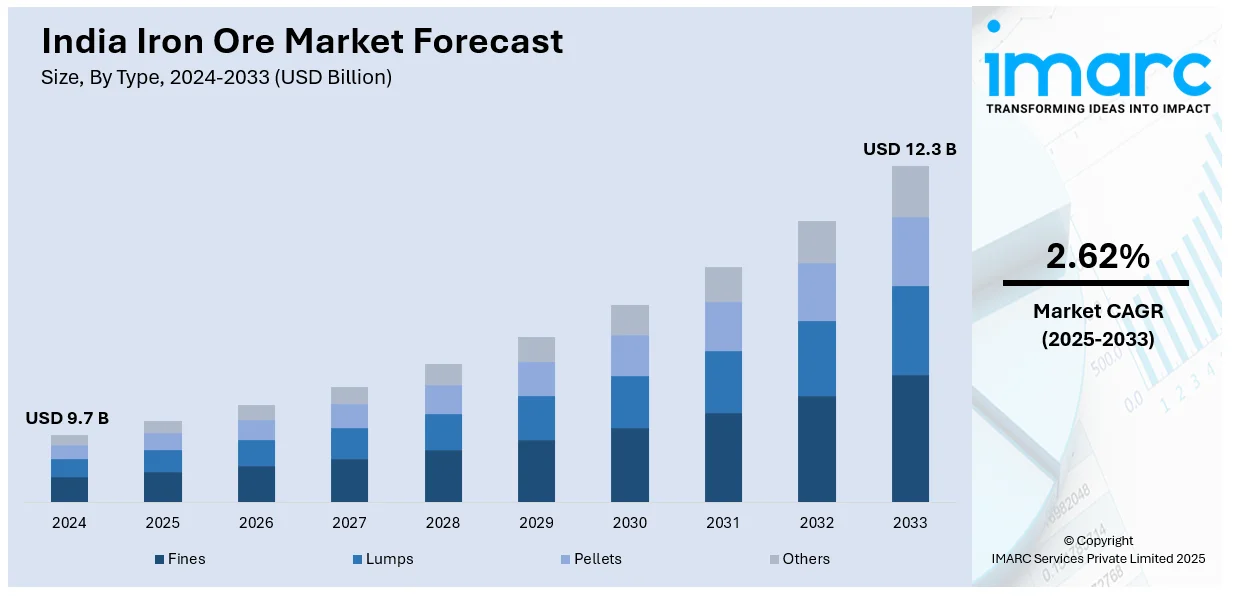

The India iron ore market size reached USD 9.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.3 Billion by 2033, exhibiting a growth rate (CAGR) of 2.62% during 2025-2033. The market is fueled by growing domestic steel production, expanding infrastructure projects, and strong export demand, especially from China, while government policies, new reserve auctions, and enhanced logistics support supply, with environmental regulations and price fluctuations shaping market dynamics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.7 Billion |

| Market Forecast in 2033 | USD 12.3 Billion |

| Market Growth Rate (2025-2033) | 2.62% |

India Iron Ore Market Trends:

Rising Domestic Demand from Steel Sector

India's expanding steel industry remains a key driver for iron ore demand, fueled by government-led infrastructure projects, urbanization, and industrial growth. The National Steel Policy aims for 300 million tonnes of steel production by 2030, significantly increasing the need for high-grade iron ore. Large steel producers are expanding capacity, which results in higher domestic raw material procurement. Also, policies like "Make in India" and the Production Linked Incentive (PLI) scheme induce production of steel, strengthening iron ore consumption. Supply chain efficiency and policy change in the mining sector also aid in the growth of the sector. However, regulatory barriers and environment issues create challenges, which affect pricing and production trends in the long term.

To get more information of this market, Request Sample

Export Growth Amidst Global Demand Shifts

India's exports of iron ore have grown, with China and other Asian buyers dominated by strong demand. Indian miners continue to gain from periodic government actions notwithstanding, following supply disruptions globally in Australia and Brazil. The global move towards emerging economies in steel production has provided new export markets, with demand increasing for low-alumina and high-grade iron ore fines. Domestic supply deficiencies and seasonal fluctuations affect trade flows, though. In November 2024, exports fell 20% month-on-month to 1.53 million tonnes from 1.97 million tonnes in October, mainly because of softer demand from China. Geopolitical trade policies and volatile freight rates also affect export competitiveness, but cost-efficient mining operations in India support its global presence. With optimized beneficiation and processing capacities, the industry continues to ride market fluctuations while holding a strong position in global trade.

Policy Reforms and Mining Sector Developments

Government initiatives aimed at streamlining mining operations have significantly improved transparency and efficiency in India’s iron ore sector. The introduction of auction-based allocation for mineral blocks has boosted production, with provisional iron ore output reaching approximately 275 million tonnes in FY 2023-24, reflecting a 7.5% annual increase. The abolition of export duties on poor-grade ore and relaxation of restriction on mining in important states such as Odisha and Karnataka further tightened supply. Further, the National Mineral Policy and changes made to the Mines and Minerals (Development and Regulation) Act favored foreign investment and private sector involvement, maximizing use of resources. Eco-friendly practices in mining with newer techniques for beneficiation are on the rise for minimizing waste generation and maximizing the yield. Yet, environmental laws and land acquisition issues remain obstacles to massive projects, affecting long-term production and market stability.

India Iron Ore Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Fines

- Lumps

- Pellets

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes fines, lumps, pellets, and others.

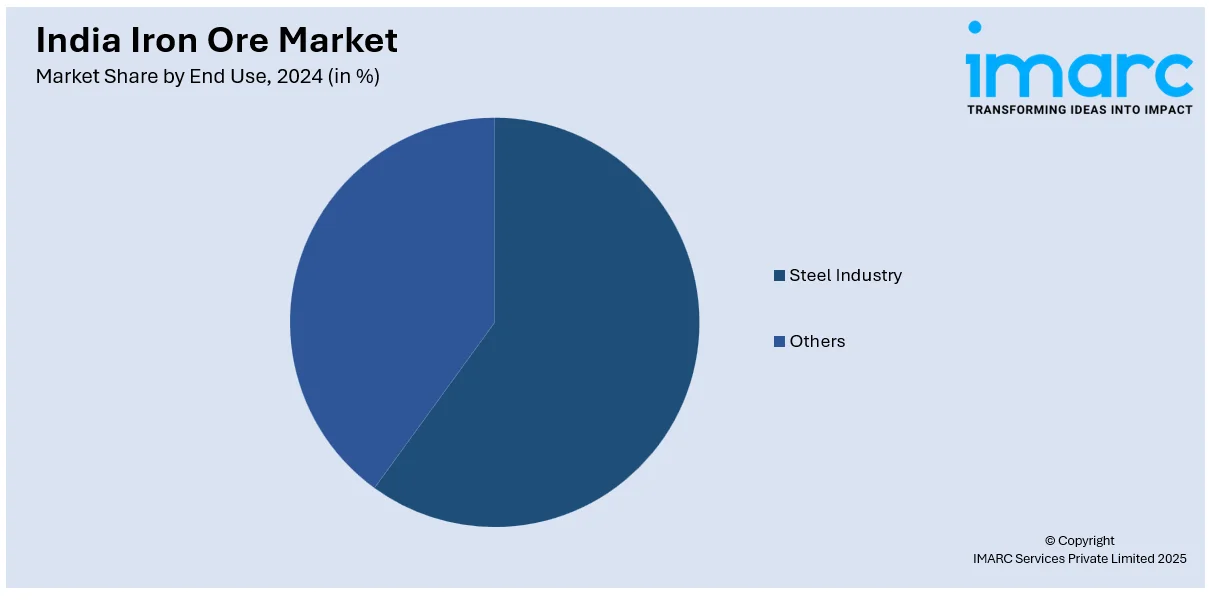

End Use Insights:

- Steel Industry

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes steel industry, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Iron Ore Market News:

- In December 2024, Tata Steel introduced an all-women shift at its Noamundi Iron Mine in Jharkhand. This initiative challenges industry norms, enabling women to operate heavy machinery and supervise shifts. Following the 2019 amendment to the Mines Act of 1952, Tata Steel has championed gender diversity through its Women@Mines initiative. Deputy Director General of Mines Safety, Shyam Sundar Prasad, hailed it as a transformative step.

- In November 2024, Kazakhstan plans to launch the Lomonosovske iron ore project in Kostanay by 2027, with 74 million tons of high-grade reserves (Fe 67%). Mining will last 20 years, initially reaching 600 meters deep. The project supports green steel production but faces challenges like financing and excavation of an 80-meter-thick rock layer. CEO of Kazax Minerals Inc., Mohamad Shafiq, confirmed approvals are underway, with work already begun on drainage.

India Iron Ore Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fines, Lumps, Pellets, Others |

| End Uses Covered | Steel Industry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India iron ore market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India iron ore market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India iron ore industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India iron ore market was valued at USD 9.7 Billion in 2024.

The India Iron Ore market is projected to exhibit a CAGR of 2.62% during 2025-2033, reaching a value of USD 12.3 Billion by 2033.

The market is fueled by growing domestic steel production, expanding infrastructure projects, strong export demand (especially from China). Additionally, introduction of favorable government policies regarding ore mining, new reserve auctions, and enhanced logistics support is fueling the market. Environmental regulations and price fluctuations shape market dynamics as well.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)