India Juicer Market Size, Share, Trends and Forecast by Product, Technology, Distribution Channel, and Region, 2025-2033

India Juicer Market Overview:

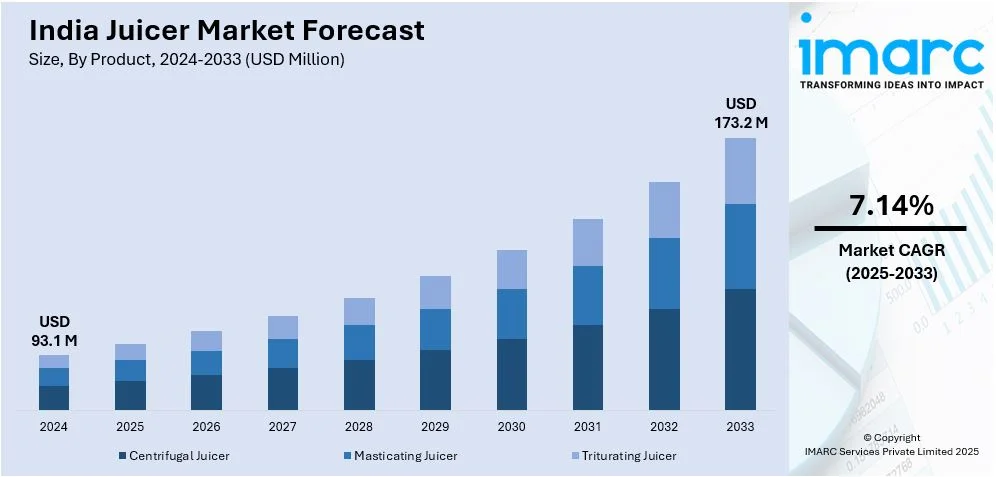

The India juicer market size reached USD 93.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 173.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.14% during 2025-2033. The market is driven by the rising health consciousness, demand for fresh juices and expanding online sales. Moreover, e-commerce platforms, smart features and sustainability trends, increasing urbanization, lifestyle changes and premiumization are also contributing positively to the India juicer market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 93.1 Million |

| Market Forecast in 2033 | USD 173.2 Million |

| Market Growth Rate 2025-2033 | 7.14% |

India Juicer Market Trends:

Growing Preference for Compact and Portable Models

Urban consumers are increasingly opting for compact and portable juicers due to space constraints in modern kitchens and the demand for convenience. With smaller apartments and modular kitchen designs, bulky appliances are becoming less desirable. Consumers prefer lightweight, easy-to-store, and low-maintenance juicers that can fit seamlessly into limited kitchen spaces. Portable models with cordless functionality, USB charging, and travel-friendly designs are gaining popularity among busy professionals, fitness enthusiasts, and frequent travelers. For instance, in February 2025, Yuone Lifestyle launched the Gallery 1000 and Gallery 2000 portable blender juicers designed for health enthusiasts on the go. These stylish, easy-to-use blenders feature powerful motors, rechargeable batteries and intuitive one-button operation. Affordable and versatile they aim to make healthy living accessible anytime, anywhere. Additionally, the rise of single-serve juicers catering to individuals and small families is driving innovation in this segment. Many brands are introducing multipurpose juicers that double as blenders or smoothie makers further enhancing utility. The shift toward on-the-go nutrition is also fueling demand for compact designs that allow users to prepare fresh juices effortlessly reinforcing the preference for space-saving and user-friendly juicing solutions in urban households. These trends are creating a positive India juicer market outlook driving growth through innovation, convenience and increasing consumer demand for portable and multifunctional juicing solutions.

To get more information of this market, Request Sample

E-Commerce Growth

The expansion of online sales channels is significantly driving growth in the India juicer market with e-commerce platforms becoming the preferred shopping destination. According to the report published by IBEF, India's e-commerce sector is projected to grow at a CAGR of 27% reaching US$ 163 billion by 2026 and US$ 325 billion by 2030. The market's GMV hit US$ 14 billion during the 2024 festive season a 12% increase while achieving US$ 60 billion in FY 2023 a 22% rise. Consumers are increasingly turning to Amazon, Flipkart, Tata Cliq and brand websites for their purchases due to greater product variety, competitive pricing and doorstep delivery. Online platforms offer seasonal discounts, exchange offers and no-cost EMI options making juicers more accessible to a wider audience. Detailed product descriptions, customer reviews and video demonstrations help buyers make informed decisions. Additionally, many brands are launching exclusive online models to tap into digital-first consumers. The rise of D2C (Direct-to-Consumer) brands is further intensifying competition, leading to innovations in design, functionality and affordability. With growing internet penetration and smartphone usage online juicer sales are expected to continue rising boosting India juicer market share as digital platforms drive higher sales volumes, wider reach and increased consumer engagement.

India Juicer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product, technology, and distribution channel.

Product Insights:

- Centrifugal Juicer

- Masticating Juicer

- Triturating Juicer

The report has provided a detailed breakup and analysis of the market based on the product. This includes centrifugal juicer, masticating juicer and triturating juicer.

Technology Insights:

- Electric

- Manual

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes electric and manual.

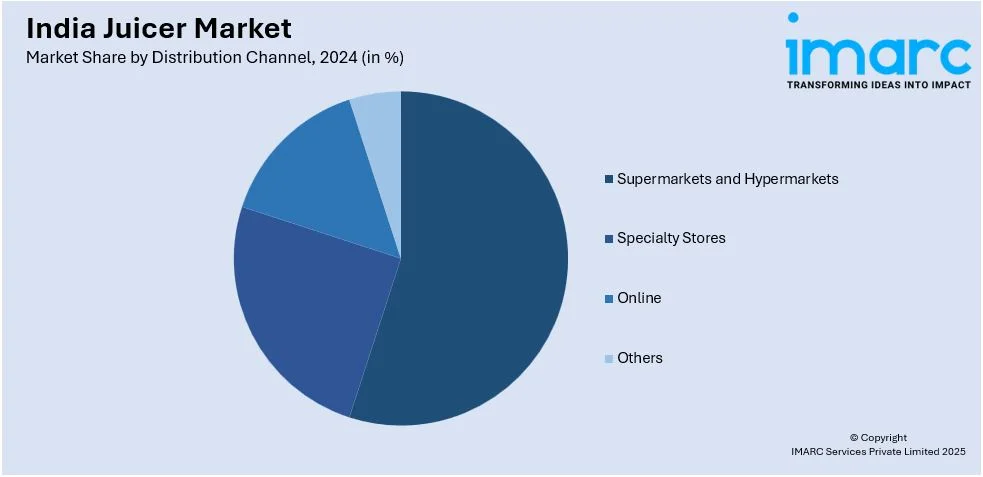

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Juicer Market News:

- In March 2025, Versuni India announced its plans to increase its made-in-India portfolio from 70% to 90% within two years, with plans for future expansion to 100%. The company focuses on juicers for the upcoming summer season, emphasizing innovation and user experience, while targeting greater household penetration for its products.

- In June 2024, Bengaluru-based Atomberg known for its premium fans, is entering the kitchen appliance market with plans to launch juicers and food processors within 12-15 months. Co-founder Shivam Das highlights a lack of innovation in kitchen appliances, showcasing their advanced mixer grinder with a versatile BLDC motor offering speeds from 2,000-20,000 RPM.

India Juicer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Centrifugal Juicer, Masticating Juicer, Triturating Juicer |

| Technologies Covered | Electric, Manual |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India juicer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India juicer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India juicer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India juicer market was valued at USD 93.1 Million in 2024.

The juicer market in India is projected to exhibit a CAGR of 7.14% during 2025-2033, reaching a value of USD 173.2 Million by 2033.

The juicer market in India thrives on rising health consciousness and wellness trends, especially among millennials. Urbanization and changing lifestyles boost demand for kitchen convenience. Technological innovation like smart, efficient juicers enhances user experience, supported by expanding e-commerce and modern retail channels.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)