India Kidswear Market Size, Share, Trends and Forecast by on Gender, Category, Season, Sector, Sales Channel, and Region, 2026-2034

India Kidswear Market Overview:

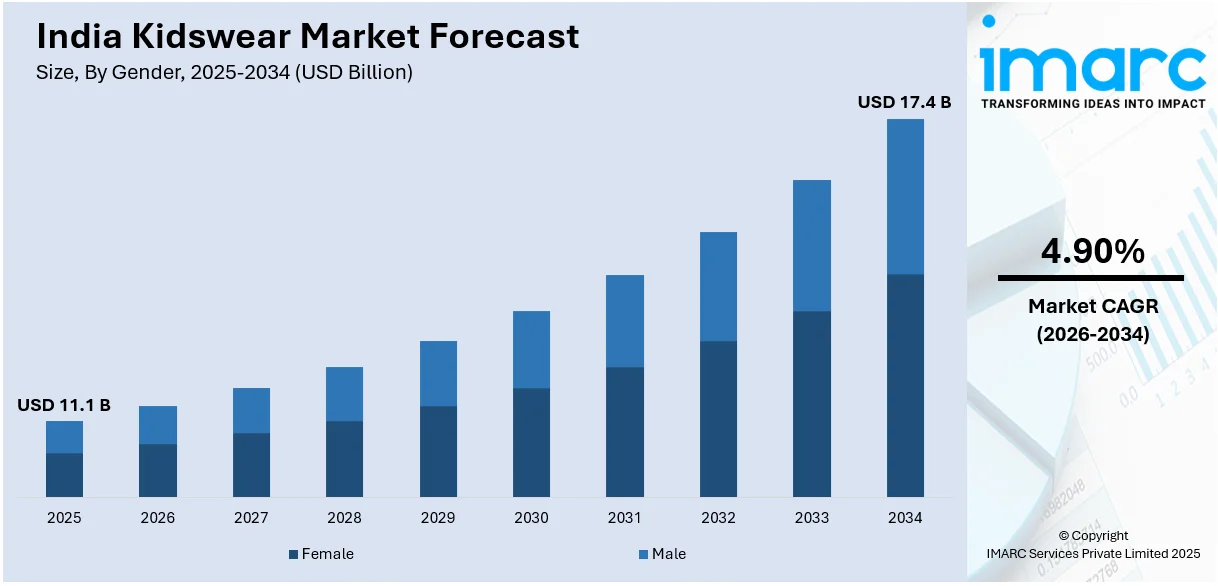

The India kidswear market size reached USD 11.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 17.4 Billion by 2034, exhibiting a growth rate (CAGR) of 4.90% during 2026-2034. The market is expanding due to rising disposable income, brand-conscious parenting and growing demand for premium and sustainable clothing. Increasing urbanization and evolving consumer preferences are fueling India kidswear market growth across both organized and unorganized sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 11.1 Billion |

| Market Forecast in 2034 | USD 17.4 Billion |

| Market Growth Rate (2026-2034) | 4.90% |

India Kidswear Market Trends:

Growth of Sustainable and Organic Clothing

The growth of sustainable and organic clothing in India’s kidswear market is driven by increasing awareness of skin-friendly, chemical-free and environmentally responsible fabrics. Parents are prioritizing organic cotton, bamboo fiber and plant-dyed fabrics due to concerns over synthetic materials causing skin irritation or allergies. The rising influence of eco-conscious parenting and global sustainability movements is encouraging brands to adopt non-toxic dyes, biodegradable textiles and ethical production methods. For instance, in September 2024, PILOLO, a new organic kidswear brand launched in India during Junior’s Fashion Week in Mumbai. Targeting children aged 4 to 9 PILOLO emphasizes creativity and joy with its tagline "Stay Silly." The brand aims to expand into toys and experiences that inspire childlike wonder.Government initiatives promoting sustainable textiles and the ban on hazardous chemicals in children’s apparel further support this trend. Many homegrown and international brands are launching exclusive organic kidswear collections, emphasizing comfort, breathability and durability. The growing demand for GOTS (Global Organic Textile Standard) certified clothing reflects consumer preference for verified organic products. With sustainability becoming a lifestyle choice the market for organic and ecofriendly kidswear is set to expand rapidly, boosting India kidswear market share as more brands adopt sustainable practices, driving consumer demand and industry growth.

To get more information of this market Request Sample

Rising Demand for Branded and Premium Apparel

The rising demand for branded and premium kidswear in India is driven by increasing disposable income, urbanization, and brand-conscious parenting. Parents are prioritizing high-quality, durable, and stylish apparel for their children, often opting for established domestic and international brands. For instance, in March 2025, Jacadi Paris the French luxury children's wear brand launched its first store in Mumbai with plans for a Bengaluru location. Company highlights India's growing luxury market and aims to cater to local tastes while maintaining French elegance. Sustainability and timeless design are central to the brand’s philosophy.The growing influence of social media, celebrity endorsements, and aspirational lifestyles has further fueled the demand for designer and luxury kidswear. Many brands are expanding their product lines with exclusive collections, festive wear, and premium fabrics to cater to this segment. E-commerce growth has also made premium kidswear more accessible, offering discounts, personalization, and exclusive online launches. With evolving fashion preferences and a willingness to spend on trendy, comfortable, and safe clothing, the premium kidswear segment is witnessing rapid growth in India’s fashion market, creating a positive India kidswear market outlook as demand for luxury, sustainable and high-quality apparel continues to rise across urban and aspirational consumers.

India Kidswear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on gender, category, season, sector and sales channel.

Gender Insights:

- Female

- Male

The report has provided a detailed breakup and analysis of the market based on the gender. This includes female and male.

Category Insights:

- Uniforms

- T-Shirts/Shirts

- Bottom Wear

- Ethnic Wear

- Dresses

- Denims

- Others

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes uniforms, t-shirts/shirts, bottom wear, ethnic wear, dresses, denims and others.

Season Insights:

- Summer Wear

- Winter Wear

- All Season Wear

A detailed breakup and analysis of the market based on the season have also been provided in the report. This includes summer wear, winter wear and all season wear.

Sector Insights:

- Organized Sector

- Unorganized Sector

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes organized and unorganized.

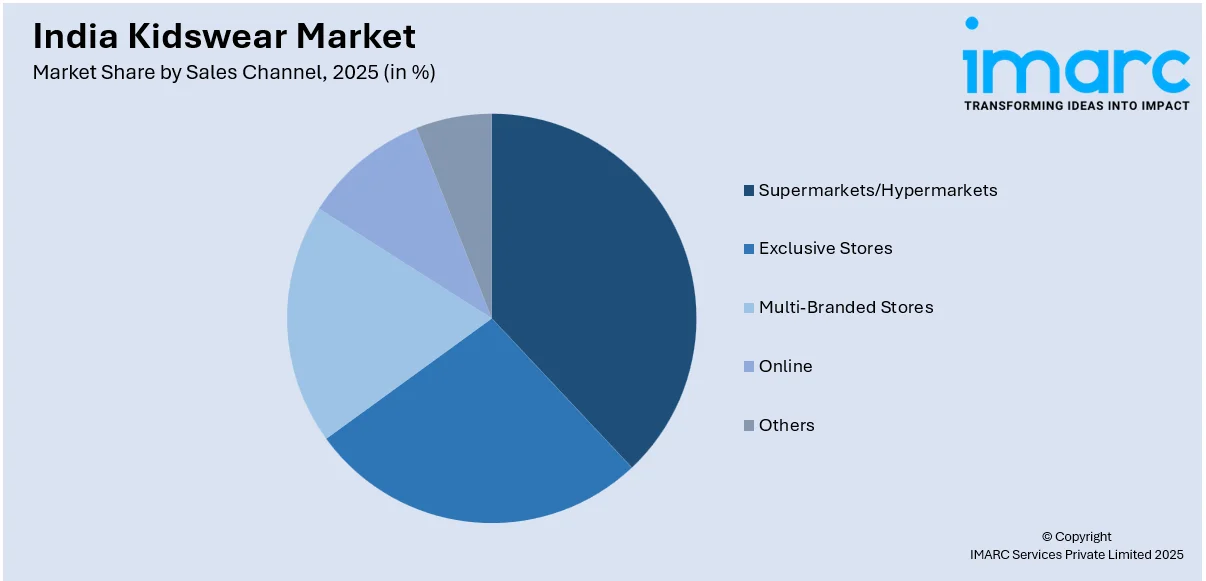

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Exclusive Stores

- Multi-Branded Stores

- Online

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes supermarkets/hypermarkets, exclusive stores, multi-branded stores, online and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Kidswear Market News:

- In January 2025, Kidbea, an eco-friendly kids' clothing brand, aims to achieve a revenue of Rs 100 crore by the end of FY26. The company plans to expand its presence to 100 multi-brand outlets and open 20 exclusive stores in major cities. After generating Rs 30 crore by December 2024, Kidbea is targeting Rs 45 crore in FY25. Additionally, the brand has partnered with ten Indian TV actors to serve as brand ambassadors.

- In February 2024, Premium kidswear brand Kate and Oscar opened its sixth store in Gurgaon, enhancing its presence in North India. The store features a diverse range of stylish apparel for children aged 2 to 14. The brand plans to establish 30 stores across major metro cities within three years.

India Kidswear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Genders Covered | Female, Male |

| Categories Covered | Uniforms, T-Shirts/Shirts, Bottom Wear, Ethnic Wear, Dresses, Denims, Others |

| Seasons Covered | Summer Wear, Winter Wear, All Season Wear |

| Sectors Covered | Organized, Unorganized |

| Sales Channels Covered | Supermarkets/Hypermarkets, Exclusive Stores, Multi-Branded Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India kidswear market performed so far and how will it perform in the coming years?

- What is the breakup of the India kidswear market on the basis of gender?

- What is the breakup of the India kidswear market on the basis of category?

- What is the breakup of the India kidswear market on the basis of season?

- What is the breakup of the India kidswear market on the basis of sector?

- What is the breakup of the India kidswear market on the basis of sales channel?

- What is the breakup of the India kidswear market on the basis of region?

- What are the various stages in the value chain of the India kidswear market?

- What are the key driving factors and challenges in the India kidswear market?

- What is the structure of the India kidswear market and who are the key players?

- What is the degree of competition in the India kidswear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India kidswear market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India kidswear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India kidswear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)