India LED Chip Market Size, Share, Trends, and Forecast by Product, Application, and Region, 2025-2033

India LED Chip Market Overview:

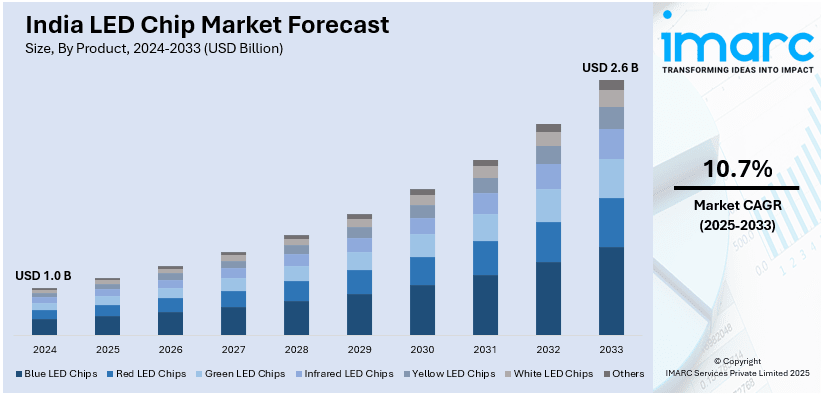

The India LED chip market size reached USD 1.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.6 Billion by 2033, exhibiting a growth rate (CAGR) of 10.7% during 2025-2033. The market is witnessing significant growth, driven by expansion of domestic LED chip manufacturing, favorable government initiatives, and rising demand for high-power and smart LED chips.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.0 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Market Growth Rate (2025-2033) | 10.7% |

India LED Chip Market Trends:

Expansion of Domestic LED Chip Manufacturing Driven by Government Initiatives

The India LED chip market is witnessing significant expansion in domestic manufacturing, propelled by government initiatives such as the Production-Linked Incentive (PLI) scheme and the Make in India program. These policies aim to reduce dependency on imports, enhance local production capacity, and strengthen India’s position in the global LED supply chain. The incentives encourage investments in semiconductor fabrication and LED chip manufacturing, fostering technological advancements and cost efficiencies. For instance, in January 2025, 24 beneficiaries committed ₹3,516 crore under the PLI Scheme to boost AC and LED component production. 9 new LED companies were selected, invested ₹256 crore across LED manufacturing. With a growing focus on self-reliance, several domestic companies and multinational firms are investing in setting up LED chip production facilities. The establishment of semiconductor wafer fabrication units is further boosting the market by improving access to high-quality raw materials. This shift is expected to enhance supply chain resilience and reduce procurement costs for LED manufacturers. Additionally, stringent energy efficiency regulations and import restrictions on key electronic components are accelerating domestic production. The rise of smart lighting solutions, fueled by government-backed infrastructure projects and energy-saving initiatives, is further driving the demand for domestically produced LED chips. As the industry matures, India is expected to become a key hub for LED chip manufacturing, supporting both domestic consumption and export growth.

To get more information on this market, Request Sample

Rising Demand for High-Power and Smart LED Chips

The India LED chip market is experiencing a surge in the demand for high-power and smart LED chips, driven by the widespread adoption of energy-efficient lighting solutions across commercial, industrial, and residential sectors. Advancements in semiconductor technology have enabled the development of LED chips with higher luminous efficacy, lower thermal resistance, and improved longevity, making them a preferred choice for high-performance applications. For instance, in February 2024, at Dholera, Gujarat, the Indian government announced granting Tata Electronics a nod for the ₹91,000 crore semiconductor fab in collaboration with PSMC. It will create over 20,000 jobs, producing chips primarily for automotive, computing, AI, and wireless communication. Smart LED chips, integrated with sensors and wireless connectivity, are gaining traction due to the increasing adoption of Internet of Things (IoT)-enabled lighting systems. These chips enable real-time monitoring, remote control, and energy optimization, making them ideal for smart cities, commercial buildings, and industrial facilities. The Indian government’s initiatives to promote smart infrastructure, such as the Smart Cities Mission, are further accelerating the adoption of intelligent lighting solutions. Moreover, the rise of automotive LED applications, including adaptive headlights and interior lighting, is contributing to the demand for advanced LED chips. The increasing focus on sustainable lighting and carbon footprint reduction is pushing manufacturers to develop high-power LED chips with improved energy efficiency. As a result, the market is witnessing a shift towards technologically advanced and application-specific LED chips that cater to diverse industry needs.

India LED Chip Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Blue LED Chips

- Red LED Chips

- Green LED Chips

- Infrared LED Chips

- Yellow LED Chips

- White LED Chips

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes blue LED chips, red LED chips, green LED chips, infrared LED chips, yellow LED chips, white LED chips, and others.

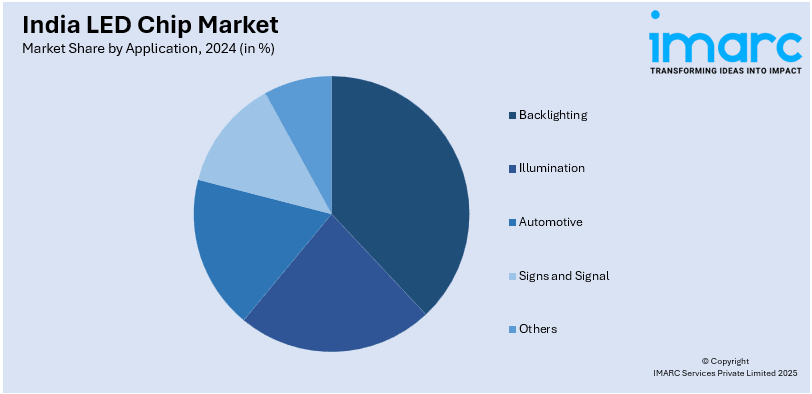

Application Insights:

- Backlighting

- Illumination

- Automotive

- Signs and Signal

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes backlighting, illumination, automotive, signs and signal, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India LED Chip Market News:

- In September 2024, India and Singapore signed an MoU for semiconductor cooperation, followed by an India-US agreement to establish a joint semiconductor fab. Amid rising chip import prices, the government continues positioning India as a global semiconductor hub, reinforcing this vision at SEMICON India 2024.

India LED Chip Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Blue LED Chips, Red LED Chips, Green LED Chips, Infrared LED Chips, Yellow LED Chips, White LED Chips, Others |

| Applications Covered | Backlighting, Illumination, Automotive, Signs and Signal, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India LED chip market performed so far and how will it perform in the coming years?

- What is the breakup of the India LED chip market on the basis of product?

- What is the breakup of the India LED chip market on the basis of application?

- What is the breakup of the India LED chip market on the basis of region?

- What are the various stages in the value chain of the India LED chip market?

- What are the key driving factors and challenges in the India LED chip?

- What is the structure of the India LED chip market and who are the key players?

- What is the degree of competition in the India LED chip market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India LED chip market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India LED chip market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India LED chip industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)