India Lightweight Building Materials Market Size, Share, Trends and Forecast by Type of Material, Density, Application, End-User, and Region, 2025-2033

India Lightweight Building Materials Market Overview:

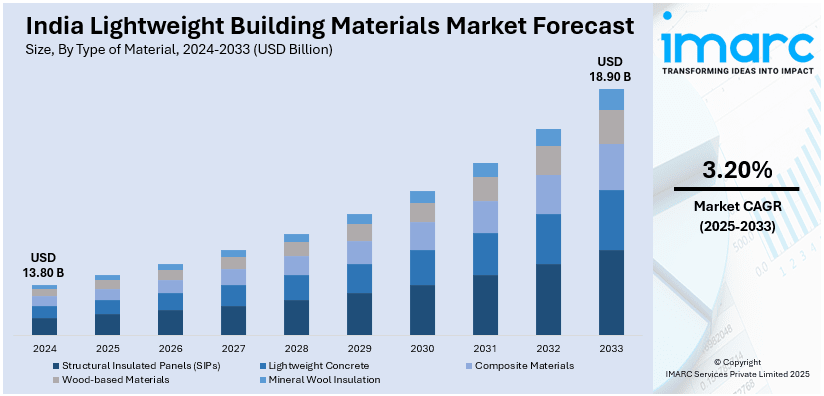

The India lightweight building materials market size reached USD 13.80 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 18.90 Billion by 2033, exhibiting a growth rate (CAGR) of 3.20% during 2025-2033. The market is driven by rising demand for sustainable construction, government green building initiatives, and rapid urbanization. Prefabricated and modular construction methods are gaining traction due to cost and time efficiency. Additionally, the need for energy-efficient, durable materials and affordable housing projects further augments the India lightweight building materials market share. Technological advancements in lightweight materials also play a key role.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.80 Billion |

| Market Forecast in 2033 | USD 18.90 Billion |

| Market Growth Rate (2025-2033) | 3.20% |

India Lightweight Building Materials Market Trends:

Rising Demand for Sustainable and Eco-Friendly Lightweight Materials

The rise in demand for sustainable and eco-friendly solutions, driven by increasing environmental awareness and stringent government regulations is facilitating the India lightweight building materials market growth. Builders and developers are shifting toward materials such as autoclaved aerated concrete (AAC) blocks, fly ash bricks, and lightweight steel frames, which reduce carbon footprints and enhance energy efficiency. These materials lower construction weight and minimize waste and improve thermal insulation, leading to long-term cost savings. Additionally, the government’s push for green building certifications including LEED and GRIHA is accelerating adoption. On 4th February 2025, Renny Strips Pvt. Ltd. launched a 22MW solar power plant on 100 acres, emphasizing sustainable manufacturing and environmentally friendly steel for the Indian construction industry. This program aims to be 50% less carbon intensive (with a target of 75%) than international standards for sustainable living and to cut energy costs by 33%. Renny Strips is set to lead the way in sustainable scaffolding solutions through this strategic move, which promises to reinvigorate India's positioning in green energy and set fresh benchmarks in construction practices. With rapid urbanization and the need for affordable housing, manufacturers are investing in research and development (R&D) activities to develop innovative, recyclable materials that meet sustainability standards while maintaining structural integrity. As a result, the market is poised for steady growth, with eco-conscious consumers and developers prioritizing green construction practices.

To get more information on this market, Request Sample

Growth in Prefabricated and Modular Construction Driving Market Expansion

The rising popularity of prefabricated and modular construction techniques are positively impacting India lightweight building materials market outlook. These methods rely on lightweight materials such as gypsum boards, fiber cement panels, and structural insulated panels (SIPs) to enable faster, cost-effective, and high-quality construction. The demand is further fueled by infrastructure development, urbanization, and the need for quick project completion in residential, commercial, and industrial sectors. Prefabrication reduces labor costs, minimizes on-site waste, and ensures precision, making it ideal for India’s fast-growing real estate market. The implementation of Government initiatives such as "Housing for All" and smart city projects further enhance demand, as developers seek efficient construction solutions. On 3rd July 2024, the deadline for India’s Smart Cities Mission was extended to March 2025 to allow for the completion of 830 pending projects worth INR 19,926 crore (approximately USD 2.43 Billion), while 90% of projects have already been completed. Urban infrastructure development continues to be a priority, with INR 46,585 crore (approximately USD 5.68 Billion) (97% of allocated funds) released and 93% utilized. With construction gaining pace in India, the demand for lightweight building materials in smart city initiatives is rising. With advancements in material technology, lightweight prefabricated components are becoming more durable and fire-resistant, enhancing their appeal. As a result, the market is expected to expand significantly, driven by the shift toward modern, efficient, and scalable construction practices.

India Lightweight Building Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type of material, density, application, and end-user.

Type of Material Insights:

- Structural Insulated Panels (SIPs)

- Lightweight Concrete

- Composite Materials

- Wood-based Materials

- Mineral Wool Insulation

The report has provided a detailed breakup and analysis of the market based on the type of material. This includes structural insulated panels (SIPs), lightweight concrete, composite materials, wood-based materials, and mineral wool insulation.

Density Insights:

- Low-density

- Medium-density

- High-density

- Ultra-lightweight

A detailed breakup and analysis of the market based on the density have also been provided in the report. This includes low-density, medium-density, high-density, and ultra-lightweight.

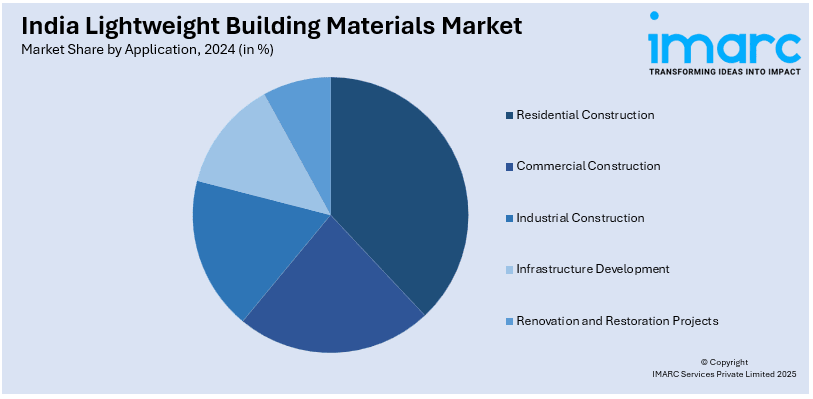

Application Insights:

- Residential Construction

- Commercial Construction

- Industrial Construction

- Infrastructure Development

- Renovation and Restoration Projects

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential construction, commercial construction, industrial construction, infrastructure development, and renovation and restoration projects.

End-User Insights:

- Contractors

- Construction Companies

- Architects and Designers

- Homeowners

- Real Estate Developers

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes contractors, construction companies, architects and designers, homeowners, and real estate developers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Lightweight Building Materials Market News:

- June 11, 2024: SCG International and BigBloc Construction, under a joint venture, launched India's first AAC Wall manufacturing facility in Kheda, Gujarat, with an investment of INR 65 Crore (approximately USD 7.8 Million). The greenfield plant with a capacity to manufacture 2.5 lakh cu.m per annum of sustainable and lightweight ACC Walls and Blocks. The plant will create 250 jobs and aim to reach an annual revenue of INR 100 Crore (approximately USD 12 Million). This collaboration aims to disrupt the lightweight building materials industry in India by offering sustainable, fire-retardant, and cost-effective building solutions.

India Lightweight Building Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Materials Covered | Structural Insulated Panels (SIPs), Lightweight Concrete, Composite Materials, Wood-based Materials, Mineral Wool Insulation |

| Densities Covered | Low-density, Medium-density, High-density, Ultra-lightweight |

| Applications Covered | Residential Construction, Commercial Construction, Industrial Construction, Infrastructure Development, Renovation and Restoration Projects |

| End-Users Covered | Contractors, Construction Companies, Architects and Designers, Homeowners, Real Estate Developers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India lightweight building materials market performed so far and how will it perform in the coming years?

- What is the breakup of the India lightweight building materials market on the basis of type of material?

- What is the breakup of the India lightweight building materials market on the basis of density?

- What is the breakup of the India lightweight building materials market on the basis of application?

- What is the breakup of the India lightweight building materials market on the basis of end-user?

- What is the breakup of the India lightweight building materials market on the basis of region?

- What are the various stages in the value chain of the India lightweight building materials market?

- What are the key driving factors and challenges in the India lightweight building materials market?

- What is the structure of the India lightweight building materials market and who are the key players?

- What is the degree of competition in the India lightweight building materials market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India lightweight building materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India lightweight building materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India lightweight building materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)