India Lip Care Products Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

India Lip Care Products Market Overview:

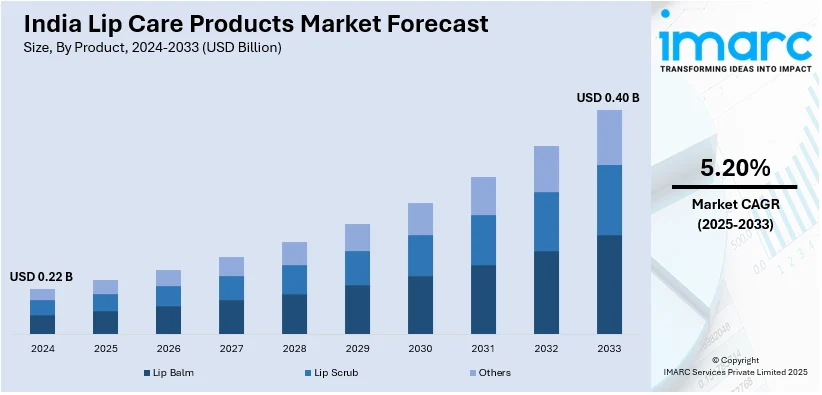

The India lip care products market size reached USD 0.22 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.40 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The India lip care products market is driven by rising consumer awareness of personal grooming, increasing demand for natural and organic ingredients, expanding e-commerce accessibility, growing popularity of beauty influencers, and the entry of international brands, all contributing to higher adoption of premium and specialized lip care solutions across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.22 Billion |

| Market Forecast in 2033 | USD 0.40 Billion |

| Market Growth Rate 2025-2033 | 5.20% |

India Lip Care Products Market Trends:

Increasing Consumer Awareness about Personal Grooming

Over the last few years, there has been a significant change in Indian consumer behavior, with people focusing more on grooming and personal appearance. This is primarily due to the growing power of social media networks, where beauty tips and grooming habits are freely exchanged and adopted. This has made consumers better informed and aware of the products they consume, hence demanding more specialized lip care products. This expansion marks the increasing consumer spending on beauty and personal care items, a reflection of the overall trend towards self-care and personal grooming. Beauty influencers and online tutorials have also spread education among consumers on how essential lip care is, pushing people toward adopting products like lip balms, scrubs, and conditioners. Further, the growth of e-commerce websites has led to the rise in the availability of these products, making it easier for customers from different geographic locations to shop for and purchase a variety of lip care products. This inflated awareness and ease of accessibility have together fueled the market growth of lip care products in India.

To get more information on this market, Request Sample

Growing Preference for Natural and Organic Products

The growing consumer preference for organic and natural products is another major driver of the Indian lip care market. As consumers become more aware of the possible side effects of chemical ingredients, they are looking for safer and greener options. This trend can be seen in the demand for lip care products containing natural ingredients such as shea butter, cocoa butter, and essential oils. Indian consumers have become more critical of product labels and are choosing brands that cater to their health and environmentally friendly values. This has encouraged existing brands and new players to innovate and provide lip care products that are free from toxic chemicals and naturally rich ingredients. In addition, the government's focus on propagating Ayurveda and herbal products has increased consumer trust in conventional and natural products. The intersection of these factors has not only made the product offerings in the lip care category more diversified but also strengthened the market's growth pattern in India.

India Lip Care Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, and distribution channel.

Product Insights:

- Lip Balm

- Lip Scrub

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes lip balm, lip scrub, and others.

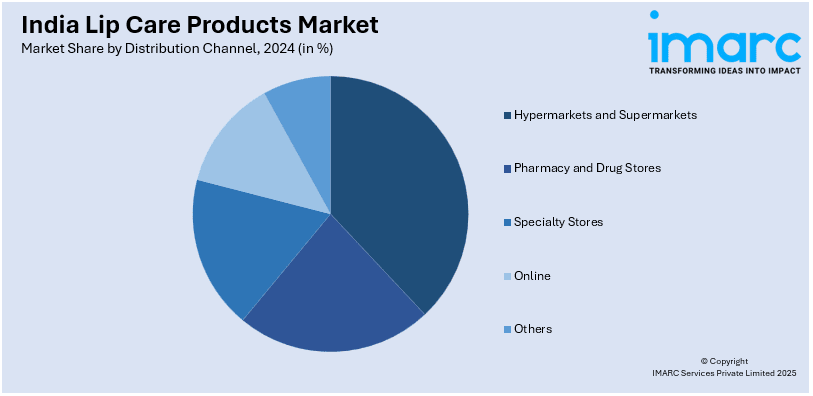

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Pharmacy and Drug Stores

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, pharmacy and drug stores, specialty stores, online, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Lip Care Products Market News:

- October 2024: Nivea India launched its 3-in-1 Caring Beauty Lip & Cheek Tint, which delivers hydration, color, and care in one. This product caters to the growing need for multi-functional, natural lip care products in India. The increasing choice for easy and skincare-enriched lip products is fueling innovation in the India lip care products market.

- September 2024: Brinton Pharmaceuticals introduced UV Doux Lip Lightening Balm in India with a focus on issues such as lip coloration and sun care. The formulation features dermatologically tested ingredients and addresses the emerging consumer need for specialty lip care products. The introduction propels the India lip care products market through expanded product range and appeal to the growing demand for functional skincare.

India Lip Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Lip Balm, Lip Scrub, Others |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Pharmacy and Drug Stores, Specialty Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India lip care products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India lip care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India lip care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The lip care products market in India was valued at USD 0.22 Billion in 2024.

The India lip care products market is projected to exhibit a CAGR of 5.20% during 2025-2033, reaching a value of USD 0.40 Billion by 2033.

The India lip care products market is shaped by growing consumer awareness about personal grooming and lip health, rising need for natural/organic products, and expanding e-commerce accessibility. The impact of beauty trends and social media, along with concerns about environmental factors like pollution and UV radiation, also significantly contributes to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)