India Liquid Chlorine Market Size, Share, Trends and Forecast by Sales Channel, Application, and Region, 2025-2033

India Liquid Chlorine Market Overview:

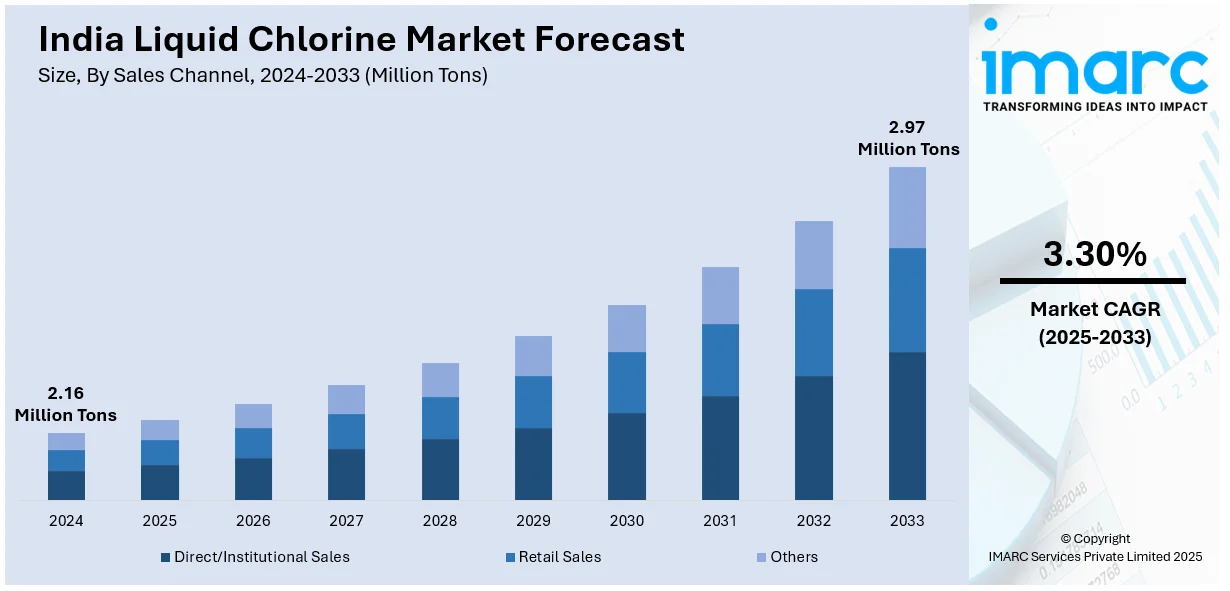

The India liquid chlorine market size reached 2.16 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 2.97 Million Tons by 2033, exhibiting a growth rate (CAGR) of 3.30% during 2025-2033. The market is driven by rising demand from water treatment, pharmaceuticals, and agrochemical sectors. The implementation of government initiatives for clean water, urbanization, and industrial expansion are further expanding India liquid chlorine market share. Increasing PVC production and stringent environmental regulations also contribute to sustained market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 2.16 Million Tons |

| Market Forecast in 2033 | 2.97 Million Tons |

| Market Growth Rate 2025-2033 | 3.30% |

India Liquid Chlorine Market Trends:

Rising Demand from the Water Treatment Sector

The increasing demand from the water treatment industry is significantly supporting the India liquid chlorine market growth. Rapid urbanization, coupled with stringent government regulations on clean water supply, has driven municipalities and industries to adopt effective disinfection methods. According to an industry report, groundwater pollution impacted over two Million individuals in India in 2024, with the major pollutants being groundwater sources contaminated by heavy metals and arsenic. The bulk of pollution comes from the agricultural industry and the release of industrial wastewater, leading to a migration from rural areas to urban centers. Liquid chlorine is widely used in water purification due to its cost-effectiveness and high efficiency in eliminating pathogens. Additionally, the expansion of wastewater treatment plants under initiatives such as the Namami Gange project is further enhancing consumption. Industrial sectors, including textiles, pharmaceuticals, and chemicals, also rely on liquid chlorine for effluent treatment, ensuring compliance with environmental norms. However, challenges such as transportation hazards and the availability of alternatives, including UV treatment, could restrain growth. Despite this, the market is expected to grow steadily, supported by rising awareness of waterborne diseases and the need for sustainable water management solutions.

To get more information on this market, Request Sample

Shift Towards Safer Alternatives and Storage Solutions

The growing preference for safer storage and handling alternatives is creating a positive India liquid chlorine market outlook. Due to its highly corrosive and toxic nature, industries are increasingly adopting advanced storage solutions, such as fiber-reinforced plastic (FRP) tanks, to minimize leakage risks. Additionally, companies are exploring substitutes such as sodium hypochlorite and chlorine dioxide, which offer similar disinfection benefits with lower hazards. Government regulations mandating stricter safety protocols in chemical handling are also influencing this shift. Furthermore, continual technological advancements in chlorine production, such as membrane cell technology, are enhancing operational safety and efficiency. A research study published in October 2024 emphasizes that chlor-alkali membrane cell technology could hold great potential for materially utilizing industrial waste salt to produce high-purity chlorine and have lower environmental impacts. The establishment of circular economy innovations can provide value-added benefits to India's liquid chlorine industry by facilitating the adoption of zero-liquid discharge (ZLD) practices and driving domestic chlorine production. While liquid chlorine remains dominant in applications, including PVC manufacturing and agrochemicals, the market is gradually adapting to safer practices to mitigate risks. This trend is expected to continue as industries prioritize worker safety and environmental sustainability.

India Liquid Chlorine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for2025-2033. Our report has categorized the market based on sales channel and application.

Sales Channel Insights:

- Direct/Institutional Sales

- Retail Sales

- Others

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes direct/institutional sales, retail sales, and others.

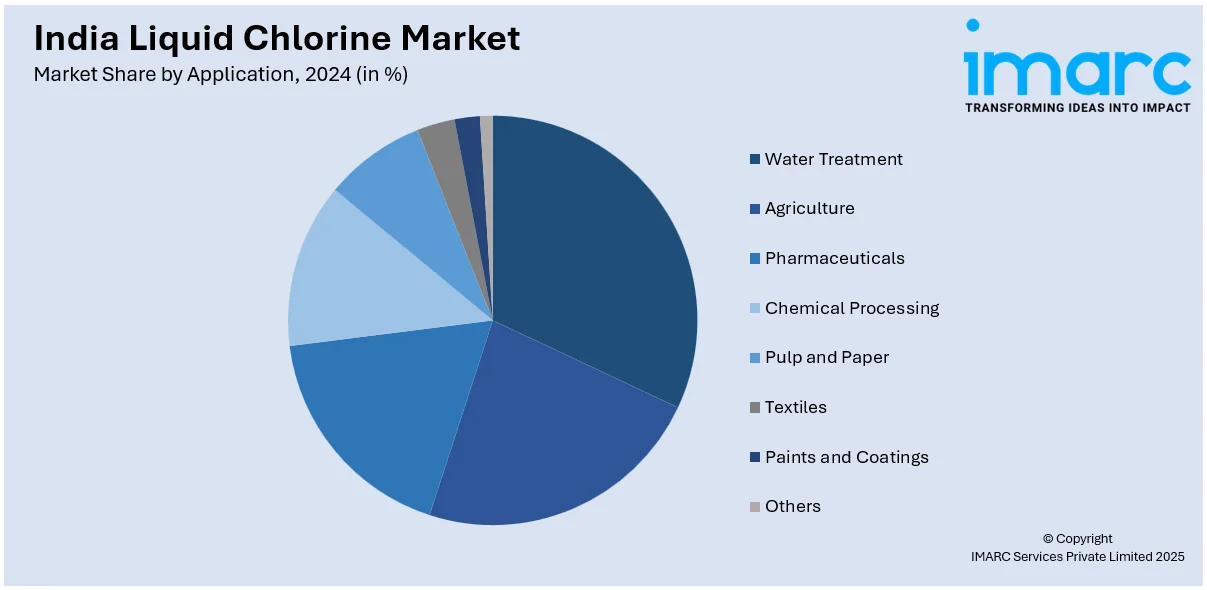

Application Insights:

- Water Treatment

- Agriculture

- Pharmaceuticals

- Chemical Processing

- Pulp and Paper

- Textiles

- Paints and Coatings

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes water treatment, agriculture, pharmaceuticals, chemical processing, pulp and paper, textiles, paints and coatings, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Liquid Chlorine Market News:

- April 12, 2024: Mundra Petrochemical Ltd. (MPL), a subsidiary of Adani Enterprises, commissioned Nuberg EPC for the largest Chlor-Alkali project in India with a capacity of 2,200 TPD. Located in Gujarat, this facility will produce liquid chlorine, caustic soda, and other chemicals, allowing for the development of India's liquid chlorine market and supporting MPL's Green PVC Project.

India Liquid Chlorine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sales Channels Covered | Direct/Institutional Sales, Retail Sales, Others |

| Applications Covered | Water Treatment, Agriculture, Pharmaceuticals, Chemical Processing, Pulp and Paper, Textiles, Paints and Coatings, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India liquid chlorine market performed so far and how will it perform in the coming years?

- What is the breakup of the India liquid chlorine market on the basis of sales channel?

- What is the breakup of the India liquid chlorine market on the basis of application?

- What is the breakup of the India liquid chlorine market on the basis of region?

- What are the various stages in the value chain of the India liquid chlorine market?

- What are the key driving factors and challenges in the India liquid chlorine market?

- What is the structure of the India liquid chlorine market and who are the key players?

- What is the degree of competition in the India liquid chlorine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India liquid chlorine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India liquid chlorine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India liquid chlorine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)