India Liquid Detergent Market Size, Share, Trends and Forecast by Product Type, Sales Channel, End User, and Region, 2025-2033

India Liquid Detergent Market Overview:

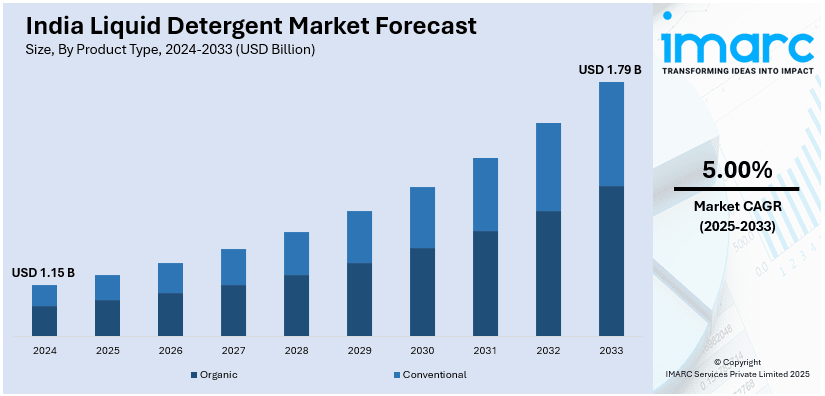

The India liquid detergent market size reached USD 1.15 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.79 Billion by 2033, exhibiting a growth rate (CAGR) of 5.00% during 2025-2033. The market is fueled by rapid urbanization, growing disposable incomes, and shifting consumer trends toward convenience. Rising hygiene and cleanliness awareness, coupled with online shopping growth and brand accessibility, and green formulations are also increasing the India liquid detergent market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.15 Billion |

| Market Forecast in 2033 | USD 1.79 Billion |

| Market Growth Rate 2025-2033 | 5.00% |

India Liquid Detergent Market Trends:

Shift Toward Eco-Friendly and Sustainable Products

Over the past few years, the India liquid detergent market outlook has witnessed a major shift toward sustainable and environmentally friendly products. As environmental awareness grows, Indian consumers are becoming increasingly aware of the planet's impact of their shopping. Most brands are answering this call by creating biodegradable, phosphate-free, and cruelty-free liquid detergents. Environmentally friendly packaging, including recyclable or biodegradable bottles, is also trending. Consumers are looking for products that not only clean well but also have a lower carbon footprint. This is also supported by government programs encouraging sustainability and environmental stewardship. Recently, Hindustan Unilever, the largest consumer goods company in India, revealed that it is testing a new technology to produce essential raw materials for detergents, such as Soda Ash and Silicate, which will greatly cut down greenhouse gas emissions. HUL strives to develop products that are high-quality, cost-effective, and eco-friendly, while maintaining their effectiveness. The organization has established specific goals to reach zero emissions in its activities by 2030 and net zero emissions throughout the value chain by 2039. With India's growing middle class and more consumers embracing eco-friendly lifestyles, the market for green, eco-friendly detergents is bound to grow further. Brands emphasizing sustainability, in addition to product effectiveness, will likely lead the market in the future.

To get more information on this market, Request Sample

Rise in Demand for Specialized and Premium Products

The need for premium and specialty liquid detergents is growing in India, led by consumers demanding improved cleaning power and extra benefits. Premium liquid detergents tend to have advanced formulations that address specific requirements, like stain removal, fabric care, or skin sensitivity. They are positioned as delivering superior wash performance and long-lasting freshness, targeting a growing group of urban, quality-driven consumers. Specialized versions, including delicate fabrics or natural ingredients like essential oils, are also becoming popular. In addition, the convenience of online shopping has enabled consumers to have greater access to a variety of premium products. According to industry reports, the popularity of liquid cleaners in India's market has risen, fueled by the growth of ecommerce and competition among leading brands such as HUL, ITC, and Colgate. The move toward high-end, unique products signify shifting consumer desires and goals. With rising disposable incomes, Indian consumers are ready to spend on premium cleaning products that provide superior performance and address their specific requirements. This phenomenon is likely to increase as an increasing number of individuals value quality and convenience in their daily spending.

Growth of Multi-Purpose and Convenient Products

Convenience is a major growth driver of the India liquid detergent market, with consumers progressively seeking multi-purpose and easy-to-use products. Liquid detergents that offer comprehensive cleaning solutions for multiple laundry types, including handwashing, machine washing, and even multi-surface cleaning, are becoming increasingly popular. These products give consumers the convenience of a single detergent that can tackle multiple washing requirements, saving time and effort. The market is also witnessing growing demand for liquid detergent pods pre-dosed and ready to use, as these provide accurate dosing and end the mess from traditional liquid detergents. Further, trends such as built-in liquid detergents with fabric softener and fragrances are also popular, giving customers a one-shot solution. It goes in tune with the life of urban India, which has a fast-moving lifestyle with increased preference for convenient and time-saving products. Therefore, multi-purpose liquid detergents are likely to maintain dominance in the market for the foreseeable future.

India Liquid Detergent Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, sales channel, and end user.

Product Type Insights:

- Organic

- Conventional

The report has provided a detailed breakup and analysis of the market based on the product type. This includes organic and conventional.

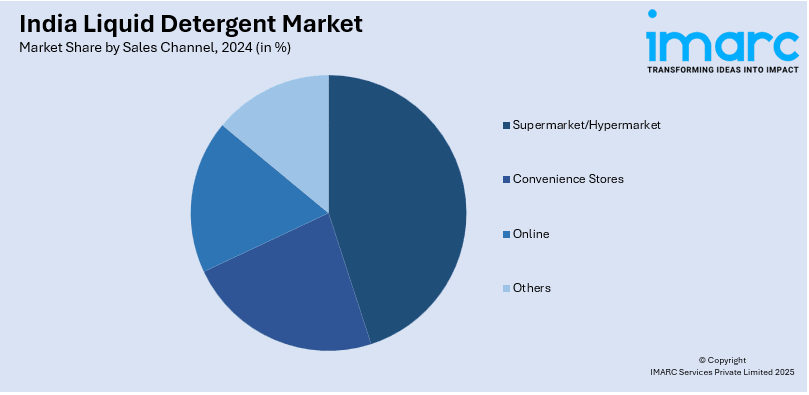

Sales Channel Insights:

- Supermarket/Hypermarket

- Convenience Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes supermarket/hypermarket, convenience stores, online, and others.

End User Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Liquid Detergent Market News:

- In June 2024, Whirlpool of India, a washing machine manufacturer, and Hindustan Unilever Ltd (HUL) revealed a new marketing partnership for Surf Excel, the laundry brand of the prominent FMCG company. According to the partnership, the two brands will engage in collaborative marketing efforts. A joint statement indicates that the combination of cutting-edge technologies from both brands will aid in providing better fabric care, streamlining the everyday laundry routine, and ultimately leading to an improved customer experience.

India Liquid Detergent Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Organic, Conventional |

| Sales Channels Covered | Supermarket/Hypermarket, Convenience Stores, Online, Others |

| End Users Covered | Residential, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India liquid detergent market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India liquid detergent market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India liquid detergent industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India liquid detergent market was valued at USD 1.15 Billion in 2024.

The India liquid detergent market is projected to exhibit a CAGR of 5.00% during 2025-2033, reaching a value of USD 1.79 Billion by 2033.

The India liquid detergent market is driven by rising consumer preference for convenient, efficient cleaning solutions, increasing disposable income, and urbanization. Growing awareness about hygiene, expanding middle class, and marketing by major brands also boost demand. Shift from traditional powders to liquids and e-commerce availability further accelerate market growth nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)