India Liquid Soap Market Size, Share, Trends and Forecast by Product Type, Packaging Type, Nature, Application, Sales Channel, and Region, 2025-2033

India Liquid Soap Market Overview:

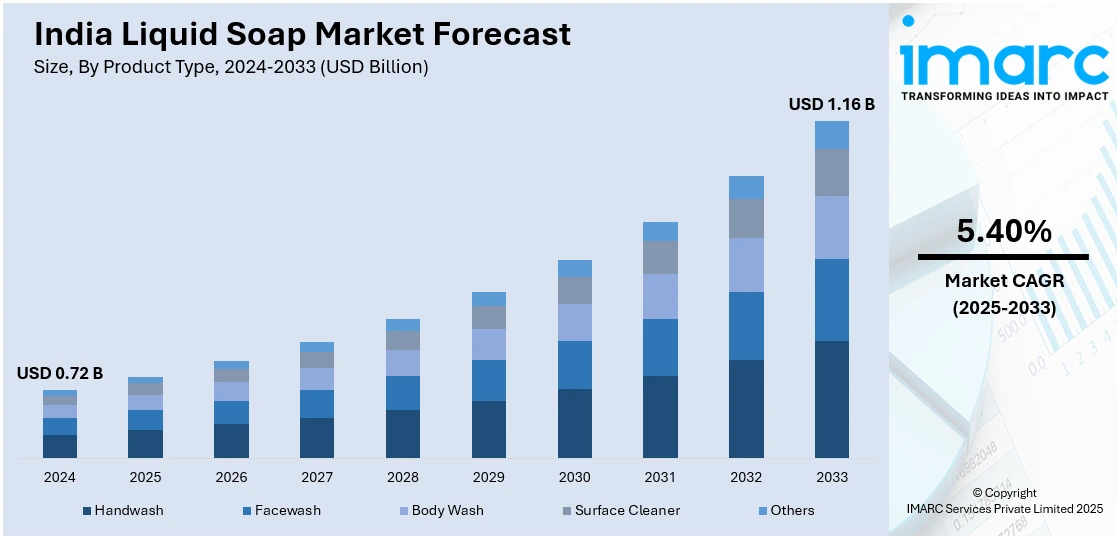

The India liquid soap market size reached USD 0.72 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.16 Billion by 2033, exhibiting a growth rate (CAGR) of 5.40% during 2025-2033. The market is experiencing significant growth mainly due to rising hygiene awareness, urbanization and increased product innovation. Demand for antibacterial, moisturizing and eco-friendly variants along with the expansion of e-commerce and commercial applications is driving significant market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.72 Billion |

| Market Forecast in 2033 | USD 1.16 Billion |

| Market Growth Rate 2025-2033 | 5.40% |

India Liquid Soap Market Trends:

Urbanization and Changing Lifestyles

Urbanization and changing lifestyles are significantly driving the demand for liquid soap products in India. The growing urban population with an increasing number of working professionals and nuclear families is contributing to the expansion of the India liquid soap market share. Consumers are opting for liquid soaps due to their convenience, hygiene benefits and ease of use compared to traditional bar soaps. Additionally, modern retail channels and e-commerce platforms are making liquid soap products more accessible across urban and semi-urban regions. The preference for antibacterial and moisturizing liquid soaps is also rising especially in households with children and elderly members. Premium and specialized variants offering skincare benefits are gaining popularity among urban consumers. For instance, in September 2024, Dusky India launched two Ayurvedic face washes: Delay Ageing Face Wash enriched with Gotu Kola and designed to combat aging and a Tea Tree Face Wash for oily and acne-prone skin. Both products are 100% Ayurvedic, cruelty-free and free from harmful chemicals catering to modern skincare needs while honoring traditional principles. As urbanization continues this shift toward liquid soap products is expected to remain a major growth driver, shaping the India liquid soap market outlook.

To get more information on this market, Request Sample

Expansion of Product Variants

The expansion of product variants is a significant factor contributing to the growth of the liquid soap market in India. Manufacturers are introducing specialized formulations to cater to the diverse needs and preferences of consumers. Antibacterial liquid soaps remain in high demand especially for their hygiene benefits in households, workplaces and public spaces. Moisturizing liquid soaps enriched with ingredients like aloe vera, shea butter and glycerin are preferred by consumers seeking skincare benefits. For instance, in May 2024, Orgatre launched a Vitamin C Foaming Face Wash blending five organic essential oils and vitamins to nourish and rejuvenate the skin. Suitable for all skin types it targets signs of aging and enhances radiance. Herbal and organic liquid soaps infused with neem, turmeric and tea tree oil are also gaining popularity due to growing awareness of natural and chemical-free products. Brands are further offering scented and premium variants to appeal to niche markets. This continuous product innovation coupled with effective marketing strategies is expected to drive India liquid soap market growth.

India Liquid Soap Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, packaging type, nature, application, and sales channel.

Product Type Insights:

- Handwash

- Facewash

- Body Wash

- Surface Cleaner

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes handwash, facewash, body wash, surface cleaner and others.

Packaging Type Insights:

- Pouch

- Bottle

- Tube

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes pouch, bottle and tube.

Nature Insights:

- Organic

- Synthetic

A detailed breakup and analysis of the market based on the nature have also been provided in the report. This includes organic and synthetic.

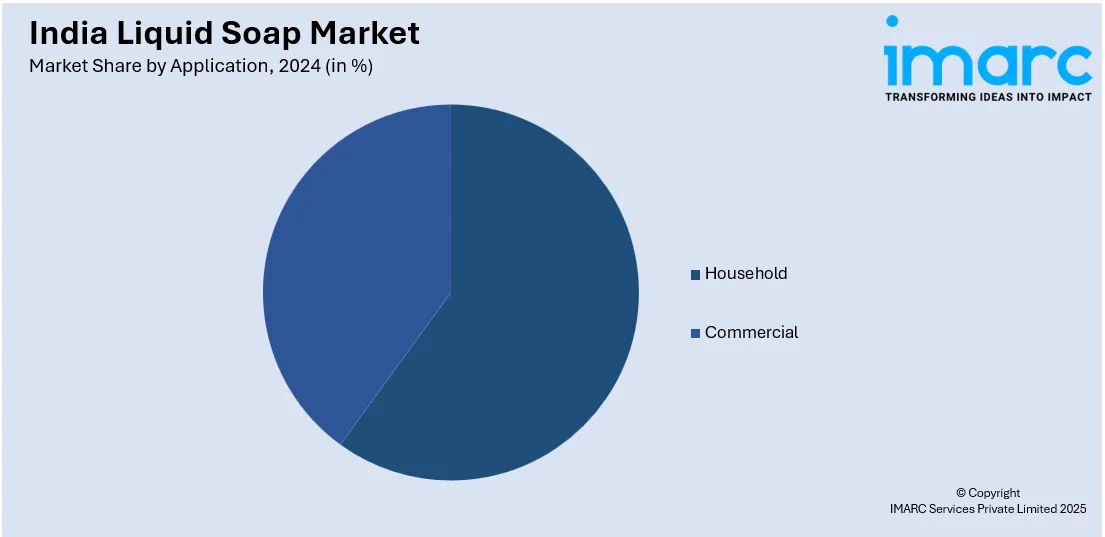

Application Insights:

- Household

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes household and commercial.

Sales Channel Insights:

- Departmental Stores

- Supermarket/Hypermarket

- Pharmaceutical Stores

- Online

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes departmental stores, supermarket/hypermarket, pharmaceutical stores, online and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Liquid Soap Market News:

- In July 2024, Cinthol announced the launch of a new body wash range featuring an automatic foamer, making it easier to wash off than traditional products. Available in Lime and Original variants the launch is backed by a 30-second ad campaign. The Indian body wash market is growing, but bar soaps still dominate usage.

- In January 2024, VLCC launched India's first serum facewash range featuring eight variants infused with Salicylic Acid, Vitamin C and Hyaluronic Acid. This innovative formula combines cleansing with serum benefits addressing various skincare needs.

India Liquid Soap Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Handwash, Facewash, Body Wash, Surface Cleaner, Others |

| Packaging Types Covered | Pouch, Bottle, Tube |

| Natures Covered | Organic, Synthetic |

| Applications Covered | Household, Commercial |

| Sales Channels Covered | Departmental Stores, Supermarket/Hypermarket, Pharmaceutical Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India liquid soap market performed so far and how will it perform in the coming years?

- What is the breakup of the India liquid soap market on the basis of product type?

- What is the breakup of the India liquid soap market on the basis of packaging type?

- What is the breakup of the India liquid soap market on the basis of nature?

- What is the breakup of the India liquid soap market on the basis of application?

- What is the breakup of the India liquid soap market on the basis of sales channel?

- What is the breakup of the India liquid soap market on the basis of region?

- What are the various stages in the value chain of the India liquid soap market?

- What are the key driving factors and challenges in the India liquid soap?

- What is the structure of the India liquid soap market and who are the key players?

- What is the degree of competition in the India liquid soap market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India liquid soap market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India liquid soap market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India liquid soap industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)