India Loan Against Property Market Size, Share, Trends and Forecast by Property Type, Interest Rate, Tenure, and Region, 2026-2034

India Loan Against Property Market Summary:

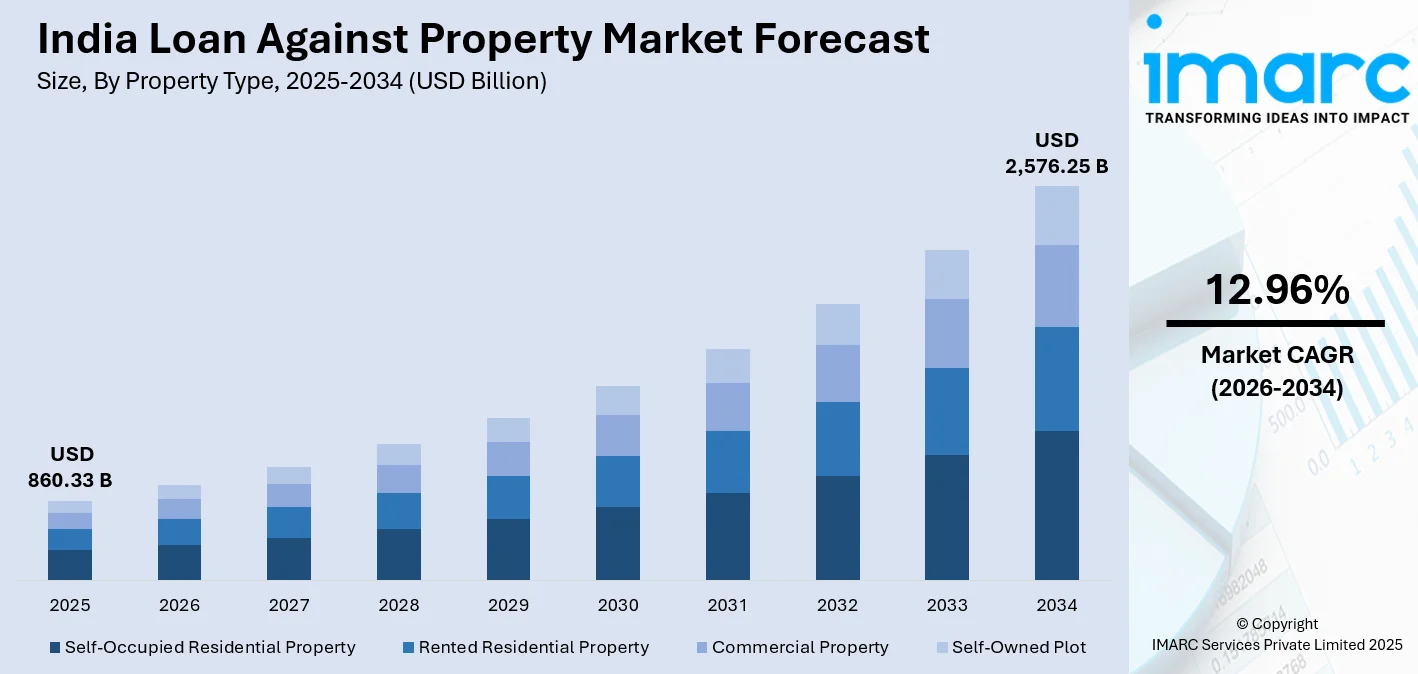

The India loan against property market size was valued at USD 860.33 Billion in 2025 and is projected to reach USD 2,576.25 Billion by 2034, growing at a compound annual growth rate of 12.96% from 2026-2034.

The India loan against property market is expanding, as borrowers increasingly leverage real estate assets for diverse financing needs. Secured lending through property mortgages provides accessible credit solutions for business expansion, personal requirements, and working capital management. Digital lending platforms and streamlined approval processes enhance accessibility across metropolitan and emerging urban centers, strengthening the India loan against property market share.

Key Takeaways and Insights:

- By Property Type: Self-occupied residential property dominates the market with a share of 43% in 2025, owing to widespread home ownership preferences among Indian households, established property valuation frameworks, and borrower comfort with mortgaging primary residences. Rising urban property values and accessible financing terms continue to propel segment expansion.

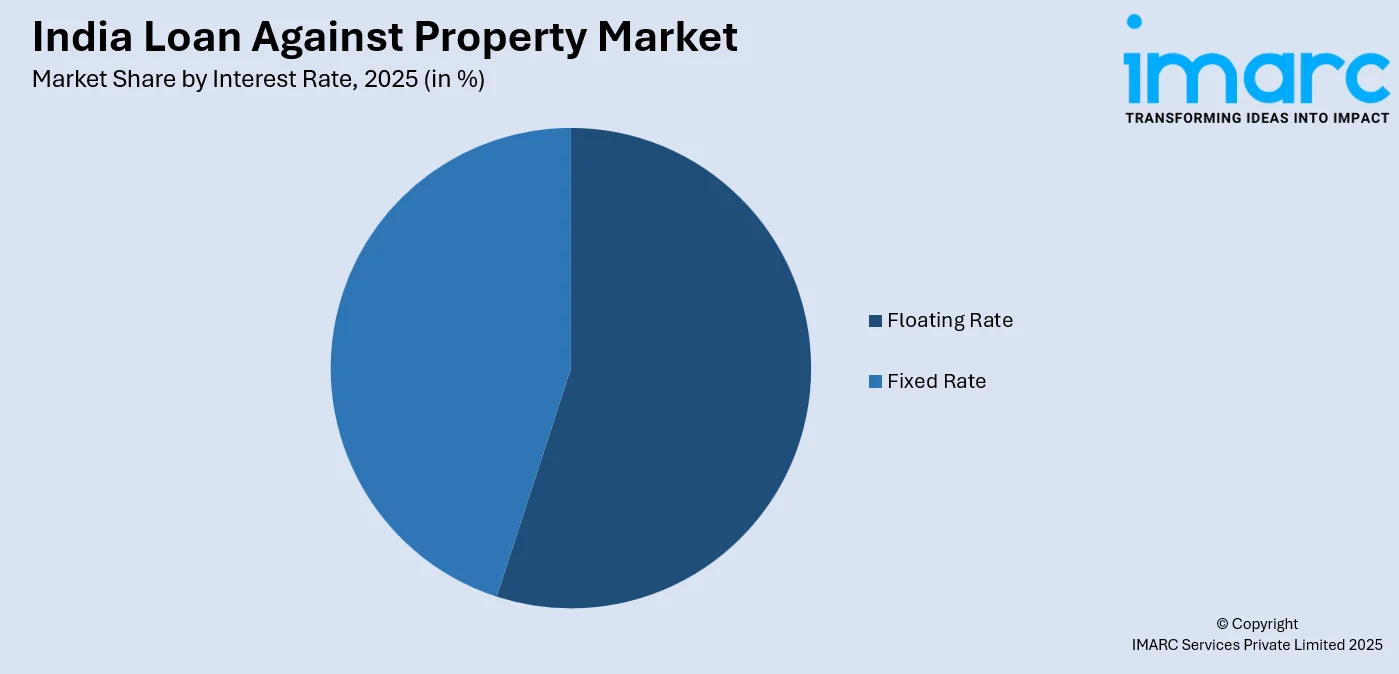

- By Interest Rate: Floating rate leads the market with a share of 55% in 2025. This dominance reflects borrower preference for interest rate flexibility aligned with Reserve Bank monetary policy movements, enabling potential savings during rate reduction cycles while maintaining competitive borrowing costs.

- By Tenure: 11-24 years comprise the largest segment with a market share of 35% in 2025, reflecting borrower inclination towards medium-term repayment frameworks that balance feasible monthly commitments with reasonable total interest outflows across the loan lifecycle.

- By Region: North India represents the largest region with 31% share in 2025, driven by the concentration of commercial activity in Delhi-NCR, substantial property ownership among business communities, and robust financial infrastructure supporting secured lending operations.

- Key Players: Key players drive the India loan against property market by expanding product portfolios, enhancing digital disbursement capabilities, and strengthening nationwide distribution networks. Their investments in technology-driven underwriting, competitive pricing, and partnerships with fintech platforms boost accessibility and accelerate adoption across diverse borrower segments.

To get more information on this market Request Sample

The India loan against property market demonstrates sustained expansion, driven by multiple converging factors that enhance credit accessibility and borrower participation. Increasing awareness among self-employed professionals and small business owners regarding property-backed financing options has significantly broadened the addressable market. According to SIDBI's MSME Pulse Report released in May 2025, the commercial credit portfolio in India reached INR 35.2 Lakh Crore as of March 2025. Financial institutions are strategically diversifying their lending portfolios by allocating greater resources towards non-housing secured loans, recognizing the segment's attractive risk-adjusted returns. Technological advancements in property valuation, digital documentation verification, and automated credit assessment have substantially reduced loan processing timelines, enhancing customer experience. The regulatory environment continues to support transparent lending practices while enabling product innovations.

India Loan Against Property Market Trends:

Digital Transformation Accelerating Loan Origination Processes

The India loan against property market is witnessing accelerated adoption of digital lending platforms that streamline application submission, document verification, and disbursement workflows. In India, financial institutions are integrating account aggregator frameworks and artificial intelligence (AI)-powered credit assessment tools to expedite underwriting decisions while maintaining robust risk management protocols. This technological evolution enables lenders to extend services into previously underserved semi-urban markets, broadening customer accessibility while reducing operational costs.

Emergence of Small-Ticket Loan Against Property Products

Financial institutions are increasingly launching specialized small-ticket loan against property schemes targeting micro and small enterprises (SMEs) requiring modest funding amounts. In October 2024, Arka Fincap introduced its 'Uday' Small Ticket Loan Against Property (STLAP) scheme with loan amounts ranging from INR 10 Lakh to INR 30 Lakh, initially deployed across five cities in Tamil Nadu. These targeted products address funding gaps among smaller businesses in tier-two and tier-three cities, promoting economic inclusion while expanding lender portfolios.

Hybrid Interest Rate Structures Gaining Borrower Preference

Hybrid interest rate structures are gaining borrower preference in the India loan against property market by offering a balance between stability and flexibility. These structures typically provide an initial fixed-rate period that protects borrowers from short-term rate volatility, followed by a floating rate that allows benefit from future rate cuts. This combination improves affordability predictability during early repayment years, supporting better cash flow planning. As interest rate uncertainty persists, borrowers increasingly view hybrid options as a risk-mitigation tool, encouraging higher loan against property adoption among self-employed individuals and small businesses.

Market Outlook 2026-2034:

The India loan against property market outlook remains robustly positive, underpinned by favorable macroeconomic conditions, supportive regulatory frameworks, and expanding financial inclusion initiatives. The market generated a revenue of USD 860.33 Billion in 2025 and is projected to reach a revenue of USD 2,576.25 Billion by 2034, growing at a compound annual growth rate of 12.96% from 2026-2034. Continued urbanization, rising property values across metropolitan corridors, and increasing formalization of small businesses are expected to sustain credit demand throughout the forecast period. Financial institutions are anticipated to further enhance product customization, introduce competitive pricing structures, and expand geographic coverage into emerging urban centers. The Reserve Bank of India's monetary policy stance supports borrower affordability while stimulating lending activity across secured loan categories.

India Loan Against Property Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Property Type |

Self-Occupied Residential Property |

43% |

|

Interest Rate |

Floating Rate |

55% |

|

Tenure |

11-24 Years |

35% |

|

Region |

North India |

31% |

Property Type Insights:

- Self-Occupied Residential Property

- Rented Residential Property

- Commercial Property

- Self-Owned Plot

Self-occupied residential property dominates with a market share of 43% of the total India loan against property market in 2025.

Self-occupied residential properties constitute the preferred collateral category among Indian borrowers seeking loan against property financing. Borrowers demonstrate strong preference for mortgaging primary residences due to established legal frameworks, streamlined title verification processes, and favorable loan-to-value ratios offered by financial institutions. Additionally, emotional attachment to primary homes increases repayment discipline, further reducing credit risk for lenders. Clear ownership structures and consistent utility usage also simplify due diligence and valuation assessments.

The segment benefits from borrower familiarity with their properties' market valuations and documentation requirements, facilitating smoother application processes. Financial institutions prioritize self-occupied residential properties due to lower default risks associated with borrowers maintaining their primary dwelling as collateral. Rising residential property values across tier-one and tier-two cities enhance borrowing capacity, enabling customers to access larger loan amounts for business expansion, education financing, and personal requirements while retaining property occupancy throughout the loan tenure.

Interest Rate Insights:

Access the comprehensive market breakdown Request Sample

- Fixed Rate

- Floating Rate

Floating rate leads with a share of 55% of the total India loan against property market in 2025.

Floating rate dominates the India loan against property market, as borrowers seek alignment with Reserve Bank of India monetary policy movements and potential interest cost savings during rate reduction cycles. The RBI minimized the repo rate by 25 basis points since the beginning of 2025, bringing it to 5.25% as of December 2025, directly benefiting floating rate borrowers through reduced equated monthly instalment (EMI) obligations. This regulatory environment encourages borrower preference for market-linked interest structures that automatically transmit policy rate changes.

Financial institutions structure floating rate products linked to external benchmarks, such as the repo rate, ensuring transparent and timely rate adjustments that enhance borrower confidence. The segment attracts cost-conscious borrowers anticipating favorable interest rate trajectories over extended loan tenures spanning ten to twenty years. Additionally, floating rate products typically offer lower initial interest rates compared to fixed rate alternatives, reducing upfront borrowing costs and improving loan affordability for first-time borrowers and small business owners requiring working capital.

Tenure Insights:

- Up to 5 Years

- 6-10 Years

- 11-24 Years

- 25-30 Years

11-24 years exhibit a clear dominance with a 35% share of the total India loan against property market in 2025.

11-24 years represent the optimal balance between manageable monthly installments and reasonable total interest expenditure for most borrowers. This tenure bracket enables borrowers to spread repayment obligations across productive earning years while avoiding excessive interest accumulation associated with longer tenures. It also provides flexibility to absorb income fluctuations without significantly straining household cash flows. Borrowers can combine this tenure with step-up or part-prepayment options to optimize interest outgo. This balance makes the 11–24 year range particularly attractive in a rising cost-of-living environment.

In India, financial institutions actively promote 11-24 years tenure options as they align with borrower lifecycle considerations, property appreciation trajectories, and risk management frameworks. The segment attracts diverse borrower profiles, including salaried professionals, self-employed business owners, and small enterprise proprietors seeking predictable repayment structures. Lenders benefit from sustained customer relationships, regular interest income streams, and reduced prepayment risks compared to shorter tenure products, creating mutually beneficial lending arrangements.

Regional Insights:

- North India

- South India

- East India

- West India

North India represents the largest region with a 31% share of the total India loan against property market in 2025.

North India dominates the market, driven by the substantial economic concentration within Delhi-NCR, which accommodates India's foremost urban agglomeration. Delhi's gross state domestic product (GSDP) was projected to attain INR 11,07,746 Crore in 2023-24, supporting robust demand for property-backed financing among businesses and professionals. The region's extensive commercial activities, mature banking infrastructure, and high property ownership rates create favorable conditions for secured lending. Additionally, strong demand from self-employed borrowers seeking long-term, high-value credit further reinforces North India’s leadership in the market.

Beyond Delhi-NCR, strong economic activities across states, such as Haryana, Punjab, Uttar Pradesh, and Rajasthan, further strengthen regional market leadership. These states host a mix of manufacturing clusters, trading hubs, and service-sector enterprises that frequently utilize loan against property products for working capital and expansion needs. High urbanization levels and rising real estate values enhance collateral quality, enabling higher loan eligibility. Additionally, dense branch networks of public and private lenders ensure easy credit access and faster processing. Growing entrepreneurial activities and increasing awareness about secured lending options continue to reinforce North India’s dominance in the market.

Market Dynamics:

Growth Drivers:

Why is the India Loan Against Property Market Growing?

Expanding Credit Demand Among MSMEs in Emerging Urban Centers

The growing need for credit among MSMEs in tier-two, tier-three, and tier-four cities is substantially driving the India loan against property market expansion. As these regions witness accelerating economic activities, small businesses require accessible financing solutions to sustain and expand their operations beyond traditional working capital constraints. Traditional banking channels often maintain stringent lending requirements and collateral demands that exclude smaller enterprises, making loan against property an attractive alternative due to its secured nature, relatively lower interest rates compared to unsecured lending, and higher loan amounts accessible through property collateralization. Government initiatives supporting MSME formalization, combined with financial institution product innovation targeting smaller ticket sizes, are broadening the addressable market and accelerating adoption among previously underserved business segments across the country.

Financial Institutions Diversifying into Non-Housing Secured Loan Portfolios

Housing finance companies and non-banking financial companies are actively expanding their non-housing loan portfolios to enhance profitability, diversify income sources, and reduce overdependence on traditional home loan products. Loan against property offerings have emerged as a strategic focus, as they provide attractive risk-adjusted returns supported by tangible collateral. Financial institutions view property-backed lending as a relatively stable segment, where security coverage lowers credit risk while allowing flexible loan structuring and competitive pricing. Growing demand from MSMEs, self-employed professionals, and small business owners seeking long-term funding for business expansion, working capital, and personal needs further strengthens this segment’s appeal. Many lenders are establishing dedicated verticals and specialized teams to improve underwriting, customer acquisition, and portfolio management for loan against property products. This shift also reflects changing borrower preferences for multipurpose financing options that leverage existing assets.

Rising Property Values Enhancing Collateral Capacity and Loan Accessibility

Sustained appreciation in residential and commercial property values across major Indian cities is enhancing borrower collateral capacity and enabling access to larger loan amounts through property mortgaging. According to the Reserve Bank of India, the All-India House Price Index (HPI) experienced a 3.1% year-on-year rise in Q4 2024-25. Kolkata saw the largest increase at 8.8%. This property value appreciation enables existing property owners to unlock enhanced equity from their assets without liquidating holdings, providing flexible financing options for business expansion, education expenses, and personal requirements. Financial institutions benefit from improved loan-to-value ratios and stronger collateral coverage, enabling them to offer larger loan amounts while maintaining prudent risk management practices. The sustained real estate market momentum, particularly in metropolitan corridors and emerging urban centers, provides a favorable environment for continued loan against property market expansion throughout the forecast period.

Market Restraints:

What Challenges the India Loan Against Property Market is Facing?

Property Documentation and Title Verification Complexities

The India loan against property market faces significant challenges arising from property documentation irregularities, unclear title ownership records, and legal encumbrances that complicate loan processing workflows. Many properties, particularly in older urban areas and semi-urban regions, lack comprehensive documentation including clear title deeds, approved building plans, and occupancy certificates required by lenders for mortgage creation. Financial institutions must conduct extensive legal verification and property valuation assessments that extend processing timelines, increase operational costs, and occasionally result in application rejections due to documentation deficiencies.

Limited Awareness Among Potential Borrowers in Rural Areas

Despite increasing financial inclusion efforts, awareness regarding loan against property products remains limited among potential borrowers in rural and semi-urban areas. Many property owners remain unfamiliar with the concept of mortgaging assets without relinquishing ownership or occupancy rights, leading to underutilization of available financing options. Traditional borrowing preferences and limited exposure to formal financial products create barriers to market penetration beyond metropolitan centers, constraining overall market expansion potential despite substantial property ownership rates in rural India.

Property Market Volatility Affecting Collateral Valuations

Fluctuations in real estate market conditions can adversely impact property valuations and loan-to-value ratios, creating challenges for both borrowers and lenders in the loan against property market. Periods of property price stagnation or decline reduce available borrowing capacity while increasing lender exposure to collateral shortfalls in case of borrower default. Regional variations in property market performance create uneven risk profiles across geographic markets, requiring lenders to implement differentiated underwriting standards and pricing structures that may limit product accessibility in certain locations.

Competitive Landscape:

The India loan against property market exhibits a competitive landscape, characterized by the participation of public sector banks, private sector banks, housing finance companies, and non-banking financial companies offering differentiated product portfolios. Market participants compete on interest rate competitiveness, loan-to-value ratios, processing timelines, and geographic coverage to capture market share across diverse borrower segments. Leading players are investing in digital lending infrastructure, enhancing customer acquisition channels, and developing specialized products targeting specific borrower categories, including self-employed professionals, small business owners, and salaried individuals. Strategic partnerships between traditional lenders and fintech platforms are expanding distribution reach while improving operational efficiency through technology-enabled underwriting and disbursement processes.

India Loan Against Property Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Property Type Covered | Self-Occupied Residential Property, Rented Residential Property, Commercial Property, Self-Owned Plot |

| Interest Rate Covered | Fixed Rate, Floating Rate |

| Tenure Covered | Up to 5 Years, 6-10 Years, 11-24 Years, 25-30 Years |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India loan against property market size was valued at USD 860.33 Billion in 2025.

The India loan against property market is expected to grow at a compound annual growth rate of 12.96% from 2026-2034 to reach USD 2,576.25 Billion by 2034.

Self-occupied residential property dominated the market with a share of 43%, driven by widespread home ownership among Indian households, established valuation frameworks, and borrower preference for mortgaging primary residences.

Key factors driving the India loan against property market include expanding MSME credit demand in tier-two to tier-four cities, financial institutions diversifying into non-housing secured loans, rising property values enhancing collateral capacity, and digital lending platforms improving accessibility.

Major challenges include property documentation and title verification complexities, limited awareness among potential borrowers in rural areas, property market volatility affecting collateral valuations, and stringent eligibility requirements for certain borrower categories.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)