India Logistics Automation Market Size, Share, Trends and Forecast by Component, Function, Vertical, and Region, 2025-2033

India Logistics Automation Market Size and Share:

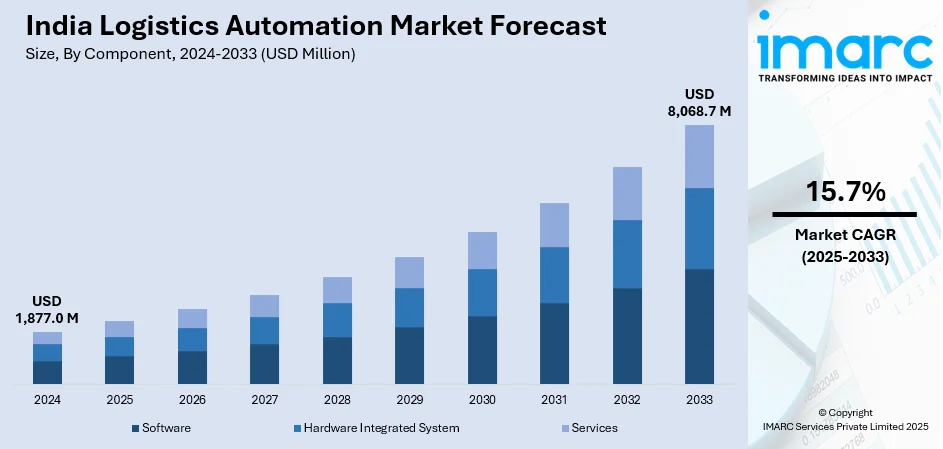

The India logistics automation market size was valued at USD 1,877.0 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,068.7 Million by 2033, exhibiting a CAGR of 15.7% during 2025-2033. West India currently dominates the market, holding a significant market share of 35.0% in 2024. The market is driven by growing e-commerce demand, necessitating faster and more efficient supply chains. Rising labor costs and the need for error-free operations push companies toward automation, including robotics and AI-powered systems. Additionally, Industry 4.0 advancements, IoT integration, and real-time tracking enhance logistics efficiency. Foreign investments and technological innovations are further expanding the India logistics automation market share, making automation essential for competitive logistics operations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,877.0 Million |

| Market Forecast in 2033 | USD 8,068.7 Million |

| Market Growth Rate (2025-2033) | 15.7% |

The market is driven by the rapid growth of the e-commerce market, which requires faster supply chain operations. With the rise in online shopping, companies are investing in automatic solutions such as warehouse robotics, automated guided vehicles, and AI-powered sorting systems to improve speed and accuracy. According to an industry report published on April 2025, the demand for effective logistics automation is increasing due to the addition of 125 million online customers over the past three years and the anticipated 80 million more by 2025. Pioneering developments, including hyper-local logistics and digital payment platforms, are expected to further drive growth in the market. In addition, automation is also promoted further by initiatives such as the "Make in India" initiative and smart city initiative. Pressure to cut costs, eliminate human error risk, and increase scale only propels automation proliferation further. Companies have every motive in the world to innovate and optimize delivery times and quality, as they need to cope with customers' needs for speedier and superior delivery.

To get more information on this market, Request Sample

In addition, the growth of retail and rapid manufacturing, requiring advanced logistics solutions to power complex supply chains, is propelling the India logistics automation market growth. The transformation of Industry 4.0 and the adoption of IoT technologies are compelling organizations to utilize automation for real-time visibility and predictive analytics. Labor shortages and increasing wages are other motivations for companies to automate manual tasks, enhancing productivity. India's manufacturing sector is undergoing a significant change due to Industry 4.0 technologies, including artificial intelligence, the Internet of Things, and automation, which are estimated to account for 40% of manufacturing expenditure by 2025. The industrial automation industry will reach USD 29.43 Billion by 2029 with AI-driven robots, smart sensors, and enterprise resource planning solutions enhancing production and logistics. These technologies are streamlining operations, reducing downtimes, and enhancing supply chain effectiveness in industries such as automotive, electronics, and textiles. Along with this, with improved AI and machine learning, inventory management and route optimization become more intelligent, and delays decrease. Due to more foreign investment and collaborations with international logistics players, India's logistics automation market is on the rise, fueled by technology and changing industry requirements.

India Logistics Automation Market Trends:

Rise in Warehouse Demand Driving Automation

Logistics automation in India has a direct connection to the expansion of warehousing space. According to an industry report, the warehousing demand in India is projected to grow to 1.2 Billion sq. ft. by 2027 by all grades. With increasing numbers of logistics and warehousing firms emerging, they are eyeing automation to accelerate operations. Since they want to lower overheads and accelerate the supply chain, automation becomes inevitable. This is creating a demand for systems that can process high volumes of products efficiently and precisely, thereby propelling the growth of automation in Indian logistics. As warehousing networks expand into new regions, scalable automation solutions are becoming critical to meet diverse operational needs and ensure consistency.

E-Commerce Growth Fueling Logistics Automation Adoption

India’s booming e-commerce sector plays a crucial role in driving the India logistics automation market demand. India's e-commerce is projected to grow at an 18% growth rate per annum to reach USD 325 Billion by the year 2030, as per Invest India. This rapid growth is generating the need for more efficient logistics solutions, particularly in warehouses and storage facilities. E-commerce players opening express delivery has also spurred investment in automated systems as consumers want delivery to be faster and more accurate. This digital commerce expansion is propelling adoption, and logistics automation will be the future growth driver. To keep pace with rising order volumes and customer expectations, companies are increasingly integrating robotics, AI, and IoT into their logistics infrastructure.

Integration of AI and Advanced Technologies Enhancing Efficiency

The integration of advanced technologies, such as artificial intelligence (AI), global positioning systems (GPS), biometrics, and real-time tracking, is significantly enhancing the operational efficiency of logistics in India. Therefore, this is creating a positive India logistics automation market outlook. AI, as a cutting-edge technology, is turning out to be useful for supply chain operations, with early technology adopters of such use experiencing a 65% enhancement in performance and a 15% drop in logistics costs, and inventory levels decreased by 35%. The application of AI in logistics is changing the handling of logistics operations and supply chains by eliminating mistakes and enhancing real-time decision-making, among other factors. Therefore, greater adoption of AI and allied technologies in a wide range of industries is the growth driver of the market.

India Logistics Automation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India logistics automation market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, function, and vertical.

Analysis by Component:

- Software

- Hardware Integrated System

- Services

Hardware integrated systems stand as the largest component in 2024, holding around 52.2% of the market, driven by the increasing adoption of advanced automation equipment such as automated guided vehicles (AGVs), robotic arms, conveyor systems, and sorting machines. These systems improve the efficiency of operations by minimizing human intervention, lowering errors, and speeding up order processing, which is essential for e-commerce and manufacturing industries. The need for scalable and dependable hardware solutions is also driven by increasing labor costs and the necessity for 24/7 warehouse operations. According to the India logistics automation market forecast, initiatives to drive smart manufacturing and Industry 4.0 are driving investment in hardware automation. Since businesses are becoming focused on coupling hardware with software for the real-time monitoring of production and analytics, the market is likely to keep growing.

Analysis by Function:

- Warehouse and Storage Management

- Transportation Management

Transportation management leads the market in 2024, driven by the need for efficient fleet operations, route optimization, and real-time tracking amid rising e-commerce and supply chain complexities. Firms are embracing transportation management systems (TMS) automation to verify fuel by-products, reduce delivery delays, and enhance destination precision using artificial intelligence (AI), internet of things (IoT), and global positioning system (GPS) technologies that engage dynamic route planning, loading, and predictive analysis to contribute to greater effectiveness. The "FastTag" and Goods and Services Tax (GST) reforms also support a rise in the demand for transportation automation. Most customers currently desire quicker deliveries and cheaper transport services, which most organizations are already achieving by automating their transport services to reduce costs, rationalize the services, and remain competitive with their industry rivals.

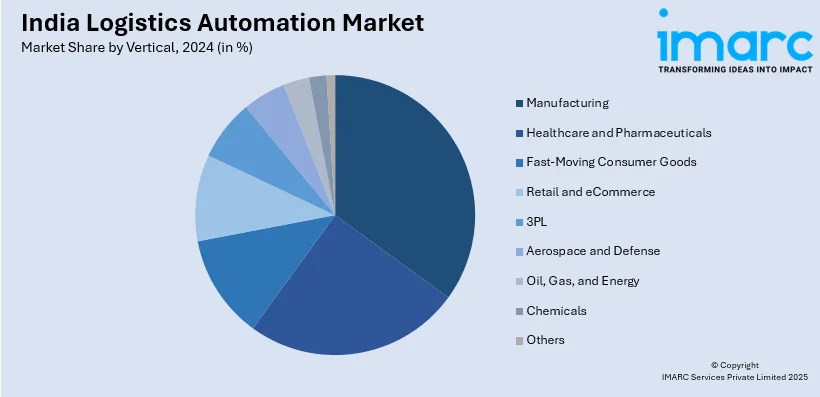

Analysis by Vertical:

- Manufacturing

- Healthcare and Pharmaceuticals

- Fast-Moving Consumer Goods

- Retail and eCommerce

- 3PL

- Aerospace and Defense

- Oil, Gas, and Energy

- Chemicals

- Others

Manufacturing leads the market in 2024, driven by the industry's growing emphasis on efficiency, cost reduction, and supply chain optimization. Manufacturing firms are going for completely automated logistics technology to facilitate the mass production of commodities for local and international markets. Automated palletizers, automated stores, retrieval systems, and AGVs for material handling and work in warehouses are some of the technologies picked by the largest logistics firms. The Make in India initiative and the drive towards smart factories and Industry 4.0 are two of the government's initiatives that are driving companies to automate manufacturing and logistics to the maximum extent possible. The need for faster turnaround times, as well as increased precision and the hope to eliminate unnecessary overhead, are the reasons manufacturers are turning towards automated storage and retrieval systems. Manufacturing, which is a high-paying career in the IT sector and also employs AI algorithms and the Internet of Things, has an immense advantage over other careers.

Regional Analysis:

- North India

- West and Central India

- East India

- South India

In 2024, West and Central India accounted for the largest market share of over 35.0%, driven by the concentration of industrial hubs, thriving ports, and robust manufacturing activity in states including Maharashtra, Gujarat, and Madhya Pradesh. JNPT of Mumbai and Gujarat Mundra Port of Mumbai, among industrial corridors of majors such as DMIC, are some of the drivers for automation warehousing and material handling solutions. The solid logistics infrastructure complemented by policies of the government that focus on EoDB draws heavy automation system investments. Key e-commerce fulfillment hubs, as well as automotive clusters, also make a significant contribution to the technology adoption. With the demand for effective last-mile deliveries, rapid urbanization, technological progress, strategic geographical location, and longer supply chains, West and Central Indian regions are leading the way in logistics automation.

Competitive Landscape:

The industry competition is driven by competitors in the market adopting a variety of strategies that encompass heavy investment in automation technologies as well as expansion of their networks of service providers. Moreover, firms are coming up with new ways of blending IoT, robotics, and AI to improve warehousing and inventory management services. There is a new and robust trend of market players investing in developing customized solutions for manufacturing and e-commerce industries, which will be able to address the problems of last-mile delivery and inventory management. Firms are also focusing on investing in research and development (R&D) activities in order to work on effective logistics system technology for automation, which can be affordable for the Indian market. Additionally, the players are using the large number of programs that the Indian government is launching, such as smart city projects, to implement automation technologies and also enhance their after-sale services in order to beat the competition in the market.

The report provides a comprehensive analysis of the competitive landscape in the India logistics automation market with detailed profiles of all major companies, including:

- ABB India Ltd. (ABB Ltd.)

- Beumer India Pvt Ltd. (Beumer Group)

- Daifuku Co. Ltd

- Falcon Autotech Private Limited

- Future Supply Chain Solutions Ltd

- Hinditron Group of Companies

- Inspirage

- Mahindra Logistics Ltd.

- Muratec Machinery Ltd.

- SSI Schaefer AG. (Fritz Schäfer GmbH)

- TCI Express Limited

Latest News and Developments:

- April 2025: Daifuku Intralogistics India, a wholly-owned subsidiary of Japan's Daifuku, inaugurated its new INR 227 crore facility at Hyderabad, Telangana. The facility will meet the increased demand for automation in industries such as e-commerce, retail, automotive, pharma, and FMCG.

- April 2025: Bosch Mobility Platform and Solutions unveiled Supply Chain Studio, a cloud-based platform to revolutionize India's transportation, warehousing and B2B trade. The launch took place at the first-ever Mobility Platform and Solutions (MPS) Summit 2025.

- December 2024: FedEx is planning to establish the company's first complete automated air cargo hub in India. It will increase global connectivity as well as enhance e-commerce, pharma, and auto exports. This is a significant leap towards making India a logistics power center in the region as the world is becoming increasingly supply chain-sensitive.

- October 2024: Godrej & Boyce acquired Bengaluru-based Armes Maini to augment its intralogistics capabilities. The move expands shelving production by 35%, addressing rising demand from India’s fast-growing logistics sector. The acquisition supports sustainable storage solutions as e-commerce and quick commerce drive warehousing infrastructure upgrades nationwide.

- August 2024: Om Logistics acquired ICD Bawal in Haryana for INR 110 Crore to strengthen pan-India operations. The multimodal hub, located on the DMIC, offers advanced automation, rail lines, and EXIM cargo capacity, aiming to reduce transit times and enhance supply chain efficiency across major ports and airports.

India Logistics Automation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Hardware Integrated System, Services |

| Functions Covered | Warehouse and Storage Management, Transportation Management |

| Verticals Covered | Manufacturing, Healthcare and Pharmaceuticals, Fast-Moving Consumer Goods, Retail and eCommerce, 3PL, Aerospace and Defense, Oil, Gas, and Energy, Chemicals, Others |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | ABB India Ltd. (ABB Ltd.), Beumer India Pvt Ltd. (Beumer Group), Daifuku Co. Ltd, Falcon Autotech Private Limited, Future Supply Chain Solutions Ltd, Hinditron Group of Companies, Inspirage, Mahindra Logistics Ltd., Muratec Machinery Ltd., SSI Schaefer AG. (Fritz Schäfer GmbH) and TCI Express Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India logistics automation market from 2019-2033.

- The India logistics automation market research report provides the latest information on the market drivers, challenges, and opportunities in the market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India logistics automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India logistics automation market was valued at USD 1,877.0 Million in 2024.

The growth of the market is driven by rising e-commerce demand, which requires faster and more efficient supply chains. Additionally, increasing labor costs, the need for error-free operations, and advancements in Industry 4.0, IoT, and AI-powered systems are pushing companies towards automation. Technological innovations and foreign investments are further expanding market opportunities.

The India logistics automation market is projected to exhibit a CAGR of 15.7% during 2025-2033, reaching a value of USD 8,068.7 Million by 2033.

The hardware integrated systems segment accounted for the largest market share in 2024, holding approximately 52.2% of the market, driven by the widespread adoption of advanced automation equipment such as automated guided vehicles (AGVs), robotic arms, conveyor systems, and sorting machines.

Major players in the India logistics automation market include ABB India Ltd. (ABB Ltd.), Beumer India Pvt Ltd. (Beumer Group), Daifuku Co. Ltd, Falcon Autotech Private Limited, Future Supply Chain Solutions Ltd, Hinditron Group of Companies, Inspirage, Mahindra Logistics Ltd., Muratec Machinery Ltd., SSI Schaefer AG. (Fritz Schäfer GmbH) and TCI Express Limited, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)