India Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2026-2034

India Logistics Market Summary:

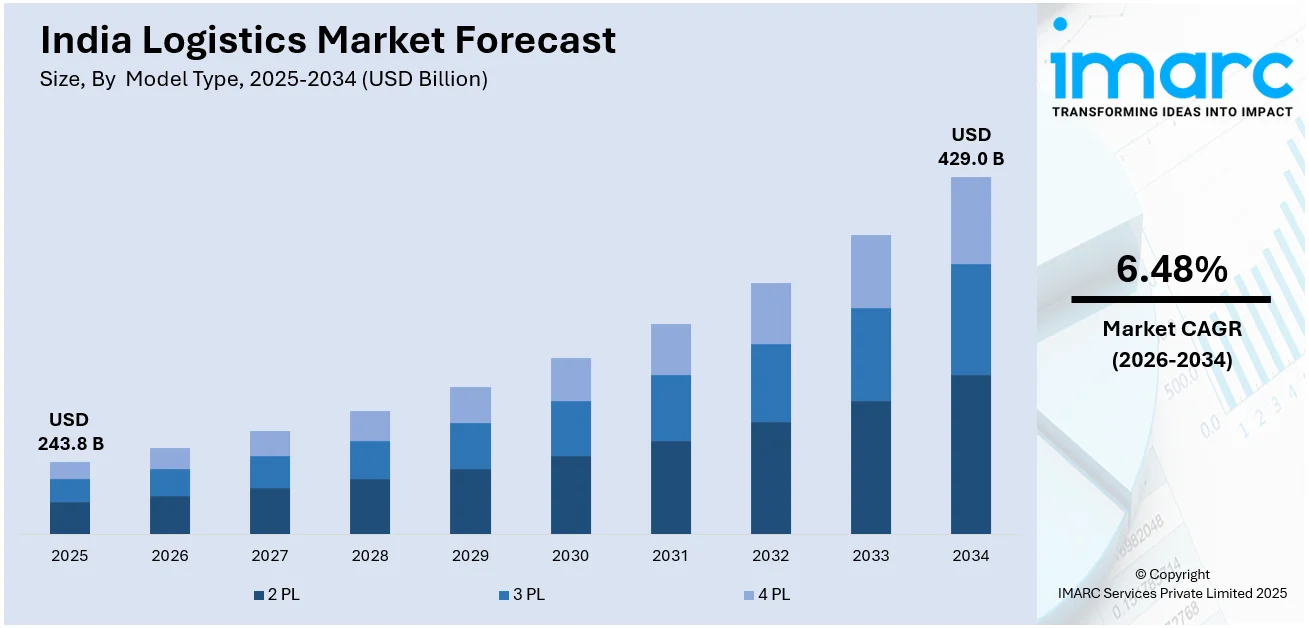

The India logistics market size was valued at USD 243.82 Billion in 2025 and is projected to reach USD 429.02 Billion by 2034, growing at a compound annual growth rate of 6.48% from 2026-2034.

The India logistics market is being propelled by the swift growth of e‑commerce platforms, supportive government infrastructure initiatives, and rising reliance on third‑party logistics services, alongside expansion in the manufacturing sector under favorable industrial policies. Growing demand for faster deliveries, digitalized supply chains, and improved connectivity are further driving growth. Additionally, the development of freight corridors and modern warehousing facilities is enhancing operational efficiency, significantly strengthening the market’s share.

Key Takeaways and Insights:

- By Model Type: 3 PL dominates the market with a share of 48% in 2025, fueled by the increasing outsourcing of logistics functions by companies seeking cost efficiencies and specialized expertise.

- By Transportation Mode: Roadways lead the market with a share of 55% in 2025, supported by extensive highway networks, the flexibility of road transport, and the expansion of expressway infrastructure.

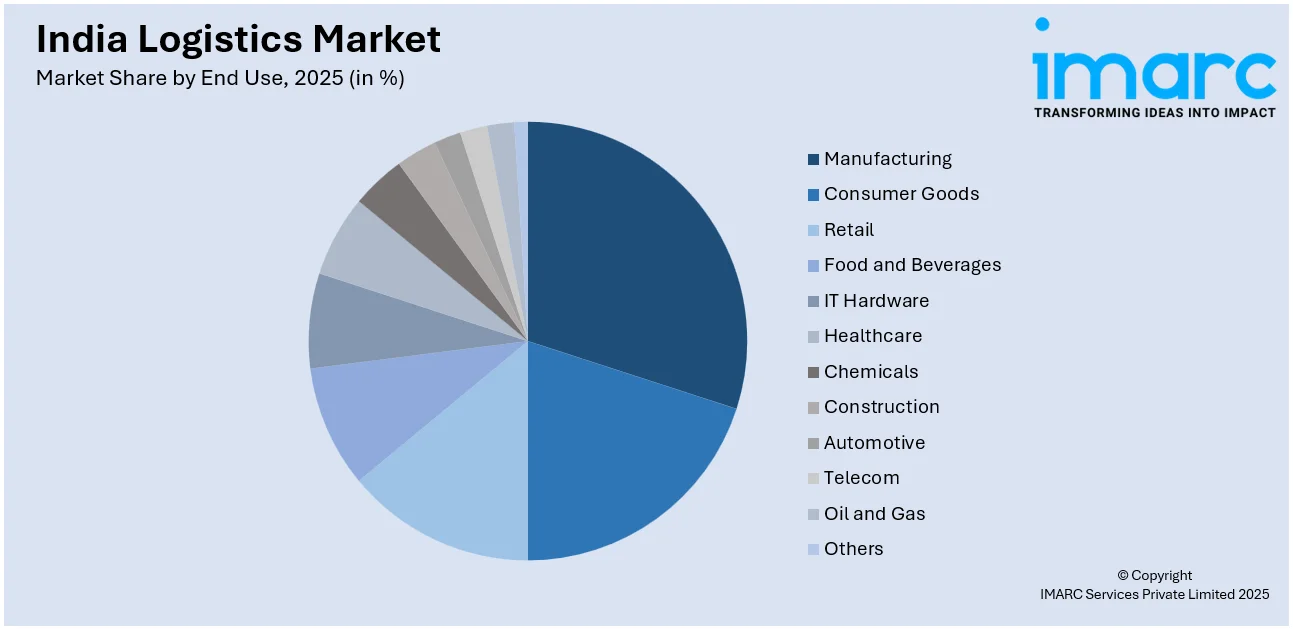

- By End Use: Manufacturing represents the largest segment with a market share of 18% in 2025, propelled by robust industrial production, advancements in the automobile and pharmaceutical sectors, and strong export demand.

- By Region: North India leads the market with a share of 30% in 2025, attributable to its strategic geographical location, the presence of industrial clusters in the Delhi‑NCR region, and well-established multimodal connectivity infrastructure.

- Key Players: The India logistics market exhibits a fragmented competitive structure, with domestic enterprises competing alongside global corporations. Players are focusing on technology integration, network expansion, and strategic partnerships. Some of the key players operating in the market include Aegis Logistics Ltd, Allcargo Logistics Ltd, Apollo LogiSolutions, Aramex, Blue Dart Express Limited, C.H. Robinson Worldwide, Inc., DB Schenker, Delhivery, GEODIS India Pvt. Ltd, Kuehne+Nagel, Nippon Express Holdings, and Yusen Logistics (India) Private Limited.

To get more information on this market Request Sample

The India logistics market is experiencing robust growth, driven by multiple factors transforming the supply chain ecosystem. Rapid expansion of e‑commerce platforms has heightened demand for efficient last‑mile delivery and advanced warehousing across urban and rural areas. Government initiatives, including dedicated freight corridors, multimodal logistics parks, and improved port connectivity, are streamlining nationwide goods movement. A revival in manufacturing, supported by favorable industrial policies and production-linked incentive schemes, is boosting logistics demand in the automotive, pharmaceutical, and electronics sectors. Rising foreign direct investment, expanding international trade, and increased supply chain digitalization are further creating a conducive environment for sustained growth.

India Logistics Market Trends:

Digital Transformation and Technology Integration

The logistics sector is witnessing accelerated adoption of advanced technologies including artificial intelligence, Internet of Things, and blockchain solutions to enhance operational efficiency. In January 2025, OfBusiness reported its AI-powered logistics network connected 4,000 transporters, moved 7 Million Tonnes, and delivered 1.7 Lakh consignments across India, improving real-time visibility, routing efficiency, and service reliability. Fleet management systems equipped with real-time tracking capabilities are enabling better visibility across supply chains. Automated warehouses incorporating robotics and conveyor systems are optimizing storage and retrieval operations. Predictive analytics tools are helping logistics providers anticipate demand fluctuations and optimize route planning, reducing operational costs while improving service quality.

Expansion of Multimodal Logistics Infrastructure

India is witnessing significant development of integrated logistics infrastructure connecting roadways, railways, waterways, and airways for seamless freight movement. The establishment of multimodal logistics parks across strategic locations is creating efficient transshipment hubs reducing transit times. According to reports, in April 2025, the Multi-Modal Logistics Park (MMLP) at Nagpur commenced commercial operations under the PM Gati Shakti initiative, offering warehousing, cold storage, and intermodal transfer facilities to streamline freight logistics nationally. Moreover, dedicated freight corridors are enhancing rail cargo capacity while inland waterway development is providing cost-effective transportation alternatives. Port modernization programs are improving cargo handling capabilities and transforming freight movement efficiency nationwide.

Growth of Specialized Logistics Services

The logistics industry is experiencing rising demand for specialized services catering to specific industry requirements and cargo characteristics. Cold chain logistics is expanding rapidly to serve pharmaceutical distribution, fresh produce supply chains, and processed food delivery needs. In August 2025, Celcius Logistics launched its specialised pharmaceutical logistics vertical ‘Celcius+’ with a ₹50 Crore investment, deploying dedicated reefer vehicles and tech-enabled services to improve temperature-controlled deliveries for vaccines and medicines. Furthermore, hazardous materials logistics is evolving with enhanced safety protocols and specialized handling equipment. Express delivery services and white-glove logistics for high-value consumer electronics are enabling providers to differentiate services and capture premium market segments.

Market Outlook 2026-2034:

The India logistics market is projected to experience substantial revenue growth during the forecast period, driven by sustained economic expansion and evolving supply chain requirements. Revenue generation is expected to accelerate as e-commerce penetration deepens across tier-two and tier-three cities, manufacturing activities intensify under favorable industrial policies, and international trade volumes expand. Infrastructure investments in expressways, dedicated freight corridors, and logistics parks will enhance operational efficiency and reduce transit costs. The market generated a revenue of USD 243.82 Billion in 2025 and is projected to reach a revenue of USD 429.02 Billion by 2034, growing at a compound annual growth rate of 6.48% from 2026-2034.

India Logistics Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Model Type |

3 PL |

48% |

|

Transportation Mode |

Roadways |

55% |

|

End Use |

Manufacturing |

18% |

|

Region |

North India |

30% |

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

3 PL dominates with a market share of 48% of the total India logistics market in 2025.

3 PL maintains its leading position in the India logistics market, driven by increasing recognition among enterprises regarding the strategic benefits of outsourcing logistics functions. Organizations across manufacturing, retail, and healthcare sectors are partnering with specialized logistics providers to access advanced infrastructure, technology platforms, and expertise without substantial capital investments. In January 2026, Shadowfax Technologies launched a ₹650.64 Crore IPO, operating across 14,758 pin codes with over 205,864 delivery partners, underscoring rising investor confidence and scale expansion within India’s technology-led 3PL segment (ScanX). Further, the 3PL model enables businesses to convert fixed logistics costs into variable expenses while maintaining service quality, operational scalability, and competitive advantage.

The segment's dominance is further strengthened by the evolving capabilities of logistics service providers offering integrated solutions encompassing transportation, warehousing, inventory management, and value-added services. Growing complexity in supply chain operations, rising customer expectations for faster deliveries, and increasing regulatory compliance requirements are encouraging enterprises to leverage specialized 3PL expertise. The segment continues attracting substantial domestic and international investments focused on network expansion, technology enhancement, and service capability development across diverse industry verticals.

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

Roadways lead with a share of 55% of the total India logistics market in 2025.

Roadways maintain overwhelming dominance in India's logistics transportation landscape, supported by extensive highway infrastructure spanning across the nation connecting major economic centers. The flexibility offered by road transport for door-to-door connectivity, particularly for last-mile deliveries, makes it indispensable for diverse cargo types and delivery timelines. According to reports, Union Budget 2026–27 increased roads and highways allocation to ₹3.10 Lakh Crore, strengthening expressway development, national highway expansion, and freight connectivity supporting India’s road-dominated logistics network.

The segment's continued leadership reflects the adaptability of road transport to varying shipment sizes, from small parcels to full truckload consignments across distances. Improvements in vehicle technology, including adoption of fuel-efficient trucks and GPS-enabled fleet tracking systems, are enhancing operational reliability and efficiency. The expanding hub-and-spoke distribution models adopted by e-commerce and retail sectors rely heavily on road transportation for connecting warehouses with delivery destinations across urban and rural territories.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

Manufacturing exhibits a clear dominance with a 18% share of the total India logistics market in 2025.

The manufacturing represents the largest end-use segment in India's logistics market, driven by the nation's emergence as a significant global production hub attracting substantial investments. Automotive, pharmaceutical, chemical, and consumer goods manufacturing industries generate substantial logistics demand for raw material procurement, inter-plant transfers, finished goods distribution, and export shipments. According to reports, the government reported 806 approved production‑linked incentive (PLI) projects across 14 key sectors with over ₹21,689 Crore in incentives disbursed, strengthening manufacturing output and associated logistics activity.

The segment's prominence reflects the critical role of efficient supply chain management in maintaining manufacturing competitiveness and meeting delivery commitments to customers. Just-in-time production models adopted by automotive and electronics manufacturers require precise logistics coordination minimizing inventory holding costs and ensuring production continuity. Export-oriented manufacturing units depend on reliable logistics connectivity to ports and airports for accessing international markets effectively. The continued industrial expansion under Make in India initiatives ensures sustained logistics demand.

Regional Insights:

North India

- West and Central India

- South India

- East India

North India dominates with a market share of 30% of the total India logistics market in 2025.

North India commands the leading regional share in the logistics market, benefiting from strategic geographic positioning and well-developed infrastructure connectivity across multiple transportation modes. The National Capital Region serves as a major consumption market and distribution hub, while states including Punjab, Haryana, and Uttar Pradesh host significant manufacturing and agricultural activities generating substantial freight volumes. Proximity to land borders facilitating trade with neighbouring countries including Nepal and Bangladesh further enhances the region's logistics significance.

The region's dominance is supported by extensive highway networks, dedicated freight corridor connectivity, and multiple inland container depots facilitating international trade movements efficiently. The concentration of automobile manufacturing clusters, textile production units, and food processing facilities creates diverse logistics requirements across the region. Upcoming multimodal logistics parks and expressway projects are expected to further strengthen North India's position as a preferred logistics hub connecting production centers with consumption markets nationwide.

Market Dynamics:

Growth Drivers:

Why is the India Logistics Market Growing?

Rapid E-commerce Expansion and Evolving Consumer Expectations

The exponential growth of electronic commerce platforms is fundamentally transforming logistics requirements across India, creating unprecedented demand for efficient fulfillment solutions. Rising internet penetration, smartphone adoption, and digital payment acceptance are enabling consumers across urban and rural markets to embrace online shopping enthusiastically. In 2025, Amazon announced a $233 million (₹2,000 Crore) investment in India to expand fulfillment centers and upgrade logistics infrastructure, accelerating faster deliveries and network capacity to meet surging e‑commerce and quick‑commerce demand. Furthermore, consumer expectations for faster deliveries, including same-day and next-day options, are compelling retailers and logistics providers to establish extensive fulfillment networks nationwide.

Government Infrastructure Development Initiatives

Government commitment to logistics infrastructure modernization is creating favorable conditions for sector growth and efficiency improvement across transportation networks. Major programs focused on highway construction, port modernization, dedicated freight corridor development, and inland waterway enhancement are strengthening multimodal connectivity nationwide. As per sources, the Union Budget announced a new Dedicated Freight Corridor from Dankuni to Surat, operationalising 20 new national waterways, enhancing multimodal logistics, and reducing freight costs nationwide. Moreover, the establishment of logistics parks integrating warehousing, transportation, and value-added services at strategic locations is optimizing supply chain operations substantially.

Manufacturing Sector Growth and Industrial Expansion

India's emergence as a preferred manufacturing destination is generating substantial and sustained logistics demand across multiple industry segments requiring efficient supply chains. Government incentive schemes attracting investments in electronics, pharmaceuticals, automotive components, and textiles are creating new production capacities requiring raw material supplies and finished goods distribution networks. As per sources, India’s electronics exports hit a record $47 Billion in 2025, driven largely by Production‑Linked Incentive (PLI) schemes, highlighting the expanding role of Indian manufacturing and associated logistics for global supply chains. Moreover, the shift toward China-plus-one sourcing strategies among global corporations is benefiting Indian manufacturers expanding production capabilities significantly.

Market Restraints:

What Challenges the India Logistics Market is Facing?

Fragmented Industry Structure and Unorganized Operations

The Indian logistics sector remains significantly fragmented with numerous small operators lacking scale economies and standardized service capabilities. Unorganized transportation providers operating outdated vehicle fleets and manual processes contribute to inefficiencies and service inconsistencies. Limited technology adoption among smaller players restricts real-time visibility and coordination across supply chains, creating challenges in maintaining consistent service quality standards.

Infrastructure Gaps and Connectivity Challenges

Despite significant infrastructure investments, gaps persist in logistics connectivity particularly in remote and rural regions across India. Inadequate road quality in certain areas increases transit times and vehicle maintenance costs. Limited railway freight capacity constrains modal shift opportunities from road transportation. Port congestion during peak seasons and insufficient cold storage infrastructure impact overall logistics efficiency.

Skilled Workforce Shortage and Talent Retention

The logistics industry faces persistent challenges in attracting and retaining skilled workforce across operational and managerial roles. Driver shortages affecting trucking operations are compounded by demanding work conditions and compensation concerns. Limited availability of professionals trained in modern logistics technologies including warehouse automation and transportation management systems constrains digital transformation efforts across the sector.

Competitive Landscape:

The India logistics market exhibits a fragmented competitive structure characterized by the presence of numerous domestic enterprises and international logistics corporations operating across various service segments. Established players are pursuing organic expansion strategies including network development, fleet augmentation, and warehouse capacity additions to strengthen market presence. Strategic acquisitions and partnerships are facilitating rapid capability enhancement and geographic reach expansion. Technology investments focusing on automation, artificial intelligence, and digital platforms are becoming critical competitive differentiators. Service specialization in areas including cold chain logistics, express delivery, and project cargo is enabling providers to capture premium market segments.

Some of the key players include:

- Aegis Logistics Ltd

- Allcargo Logistics Ltd

- Apollo LogiSolutions

- Aramex

- Blue Dart Express Limited

- C.H. Robinson Worldwide, Inc.

- DB Schenker

- Delhivery

- GEODIS India Pvt. Ltd

- Kuehne+Nagel

- Nippon Express Holdings

- Yusen Logistics (India) Private Limited

Recent Developments:

- In December 2025, Delhivery launched Delhivery International, an Economy Air Parcel service for Indian MSMEs, enabling affordable, reliable global exports. Leveraging AI tools, global partnerships, and its domestic network, the platform provides end-to-end visibility, multiple shipping options, and simplified cross-border logistics, supporting SMEs in reaching international markets efficiently.

India Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Aegis Logistics Ltd, Allcargo Logistics Ltd, Apollo LogiSolutions, Aramex, Blue Dart Express Limited, C.H. Robinson Worldwide, Inc., DB Schenker, Delhivery, GEODIS India Pvt. Ltd, Kuehne+Nagel, Nippon Express Holdings, Yusen Logistics (India) Private Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India logistics market size was valued at USD 243.82 Billion in 2025.

The India logistics market is expected to grow at a compound annual growth rate of 6.48% from 2026-2034 to reach USD 429.02 Billion by 2034.

3 PL held the largest share in the India logistics market, driven by increasing outsourcing of logistics functions by enterprises seeking cost optimization, specialized expertise, and operational flexibility without substantial capital investments in infrastructure.

Key factors driving the India logistics market include rapid e-commerce expansion, government infrastructure development initiatives, manufacturing sector growth, increasing adoption of digital technologies, expanding international trade, and rising demand for specialized logistics services.

Major challenges include fragmented industry structure with numerous unorganized operators, infrastructure gaps in remote regions, skilled workforce shortages, high logistics costs relative to developed economies, limited cold chain infrastructure, and coordination challenges across multimodal transportation networks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)