India Luggage and Suitcases Market Size, Share, Trends and Forecast by Product Type, Material, Price Range, Distribution Channel, and Region, 2026-2034

India Luggage and Suitcases Market Overview:

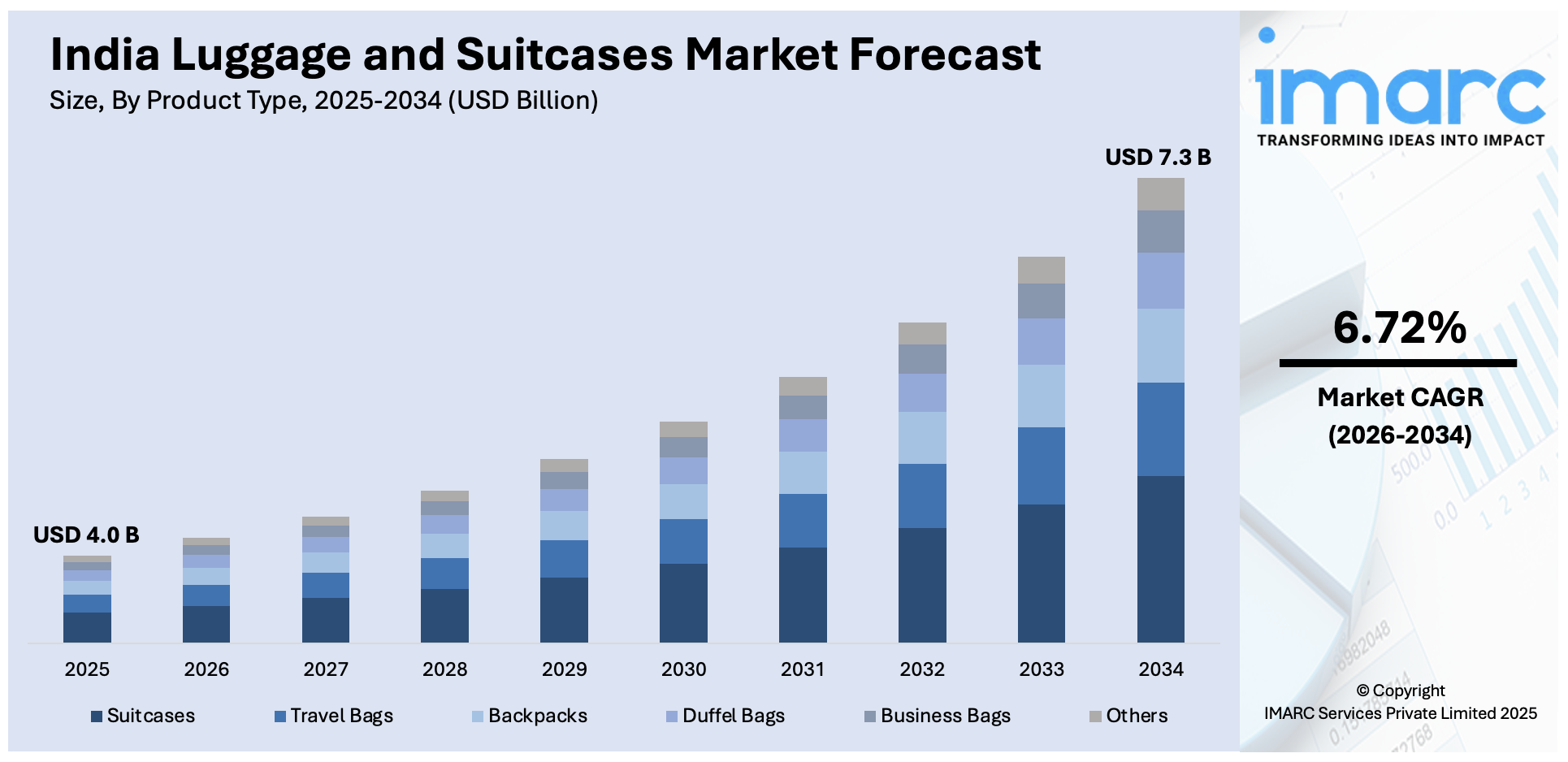

The India luggage and suitcases market size reached USD 4.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 7.3 Billion by 2034, exhibiting a growth rate (CAGR) of 6.72% during 2026-2034. The market is witnessing steady growth due to the rising domestic travel, shifting consumer preferences toward hard-shell and lightweight products, and increasing demand from Tier-II and Tier-III cities. Additionally, expanding online retail, coupled with premiumization and evolving travel habits, is further shaping product innovation and influencing purchase behavior.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.0 Billion |

| Market Forecast in 2034 | USD 7.3 Billion |

| Market Growth Rate 2026-2034 | 6.72% |

India Luggage and Suitcases Market Trends:

Rising Adoption of Hard-Shell and Lightweight Luggage

The market is experiencing a clear shift from traditional soft-sided suitcases to hard-shell alternatives, driven by increasing awareness of durability, security, and weather resistance. The growing preference for cabin-size trolley bags, primarily due to the rise in domestic air travel, is further catalyzing the demand for lightweight and impact-resistant materials such as polycarbonate and polypropylene. For instance, in November 2023, IndiGo announced a partnership with Mokobara to launch the Moko 6E luggage collection, featuring cabin and check-in bags in IndiGo blue. The range features German polycarbonate shells and Hinomoto wheels, which is designed to deliver smooth and reliable travel performance. However, travelers are increasingly investing in luggage that ensures protection during air travel while also offering sleek designs and vibrant color options. Moreover, manufacturers are prioritizing weight optimization to meet airline baggage restrictions without compromising structural integrity. Furthermore, this shift is reshaping product portfolios, influencing design strategies, and establishing new standards for performance and appeal across India’s luggage industry.

To get more information on this market Request Sample

Growth of Online-First and Direct-to-Consumer Luggage Brands

India’s luggage industry is reshaped by the rise of online-first and direct-to-consumer (D2C) players. These brands are rethinking traditional retail by building digital-first business models that prioritize speed, efficiency, and direct consumer engagement. By leveraging e-commerce platforms and social media channels, they are gathering real-time feedback, adapting product designs quickly, and offering a personalized customer experience. Additionally, a key advantage lies in their control over the entire supply chain, which reduces operational costs and allows them to maintain competitive pricing while delivering premium quality. For instance, in May 2024, ICON, a D2C luggage and travel accessories startup, announced a USD 1.2 Million seed funding round led by DSG Consumer Partners. The company also announced its plans to expand its product range, grow its team, and scale distribution to serve India’s mass premium segment amid rising travel demand. These brands also stand out by offering generous return policies, extended warranties, and responsive customer support. Furthermore, the shift in buying luggage from digital platforms, particularly among younger, urban populations, is accelerating this trend.

India Luggage and Suitcases Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, material, price range, and distribution channel.

Product Type Insights:

- Suitcases

- Travel Bags

- Backpacks

- Duffel Bags

- Business Bags

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes suitcases, travel bags, backpacks, duffel bags, business bags, and others.

Material Insights:

- Hard-Sided

- Soft-Sided

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes hard-sided and soft-sided.

Price Range Insights:

- Premium

- Mid-Range

- Economy

The report has provided a detailed breakup and analysis of the market based on the price range. This includes premium, mid-range, and economy.

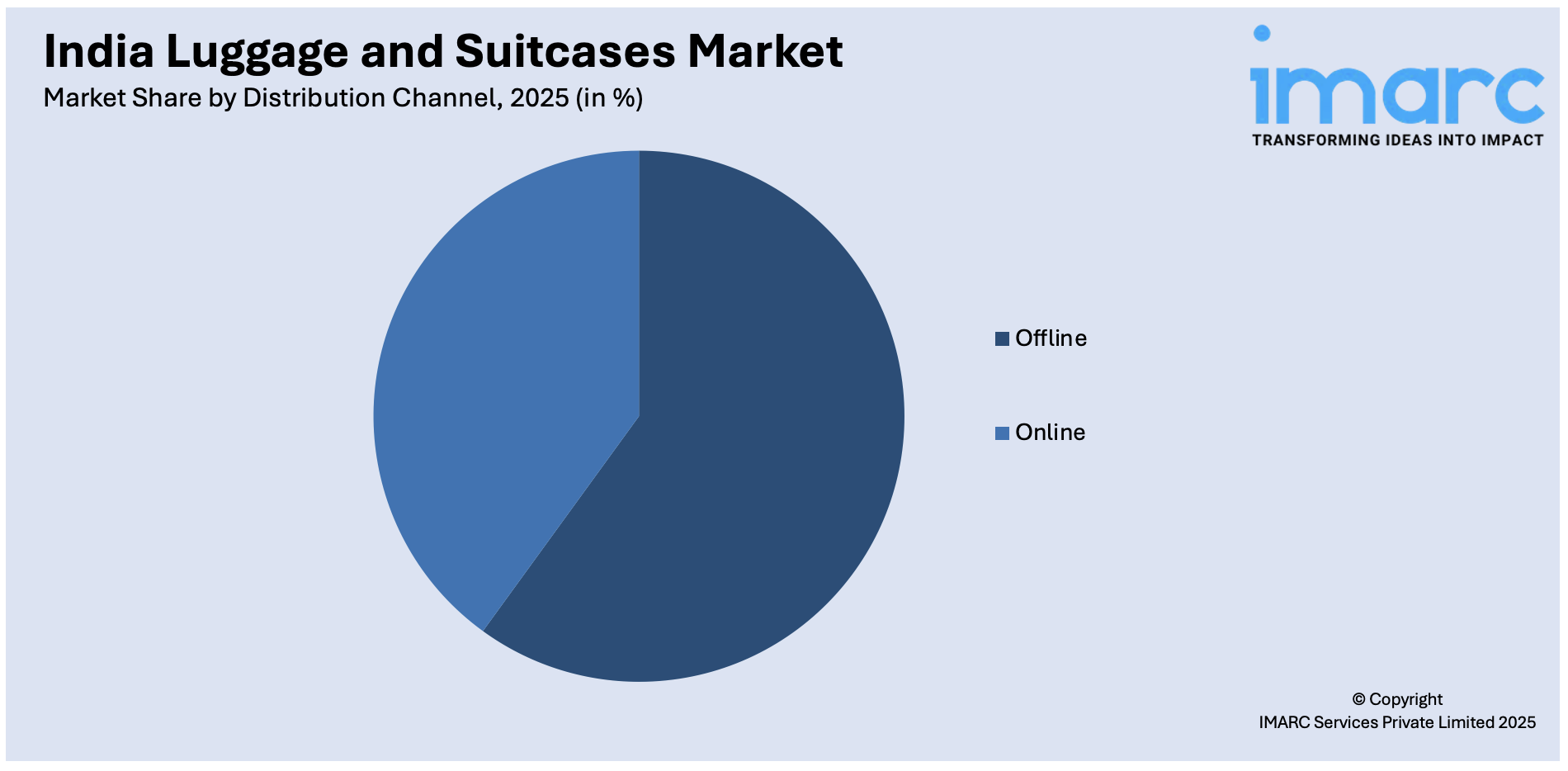

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Luggage and Suitcases Market News:

- In January 2024, Chumbak announced a partnership with Assembly Luggage to launch its first limited-edition luggage collection. The collaboration aims to combine functional travel solutions with distinctive design, marking Chumbak’s entry into the luggage segment for style-conscious modern travelers.

- In August 2024, Samsonite announced a partnership with BOSS to launch a limited-edition luggage collection in India, featuring aluminum construction, signature monogram design, and premium interiors. The range aims to redefine travel gear by blending style with functionality and is available online and at select stores.

India Luggage and Suitcases Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Suitcases, Travel Bags, Backpacks, Duffel Bags, Business Bags, Others |

| Materials Covered | Hard-Sided, Soft-Sided |

| Price Ranges Covered | Premium, Mid-Range, Economy |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India luggage and suitcases market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India luggage and suitcases market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India luggage and suitcases industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India luggage and suitcases market was valued at USD 4.0 Billion in 2025.

The India luggage and suitcases market is projected to exhibit a CAGR of 6.72% during 2026-2034, reaching a value of USD 7.3 Billion by 2034.

India's luggage and suitcases market is driven by increased domestic and business travel, fueled by tourism, weddings, MICE events, and industrial development. Customers increasingly demand hard-shell designs that are lightweight and durable and have technology-backed features. Organized retail expansion, e-commerce, premiumization, gains in disposable incomes, and Tier II/III city demand drive the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)