India Luxury Car Market Size, Share, Trends and Forecast by Vehicle Type, Fuel Type, Price Range, Engine Capacity, and Region, 2026-2034

India Luxury Car Market Summary:

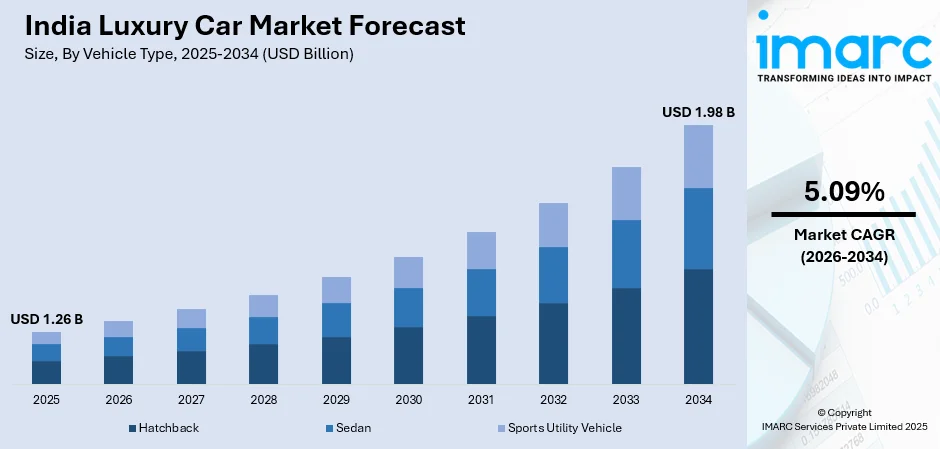

The India luxury car market size was valued at USD 1.26 Billion in 2025 and is projected to reach USD 1.98 Billion by 2034, growing at a compound annual growth rate of 5.09% from 2026-2034.

As rising prosperity and aspirational customer choices influence automotive demand, the luxury car market in India is steadily growing. Adoption is accelerating in both metropolitan and emerging cities due to growing urbanization, technology integration, and brand awareness. In order to meet the increasing demand from professionals, business owners, and high-net-worth individuals across the country, manufacturers are investing in dealership networks and after-sales support while broadening their portfolios with cutting-edge features, hybrid alternatives, and premium services.

Key Takeaways and Insights:

- By Vehicle Type: Sports utility vehicle dominates the market with a share of 57% in 2025, owing to consumer preference for commanding road presence, superior safety features, and versatile cabin space suited to Indian driving conditions. Rising demand from young professionals and corporate buyers seeking practicality alongside luxury is fueling segment expansion.

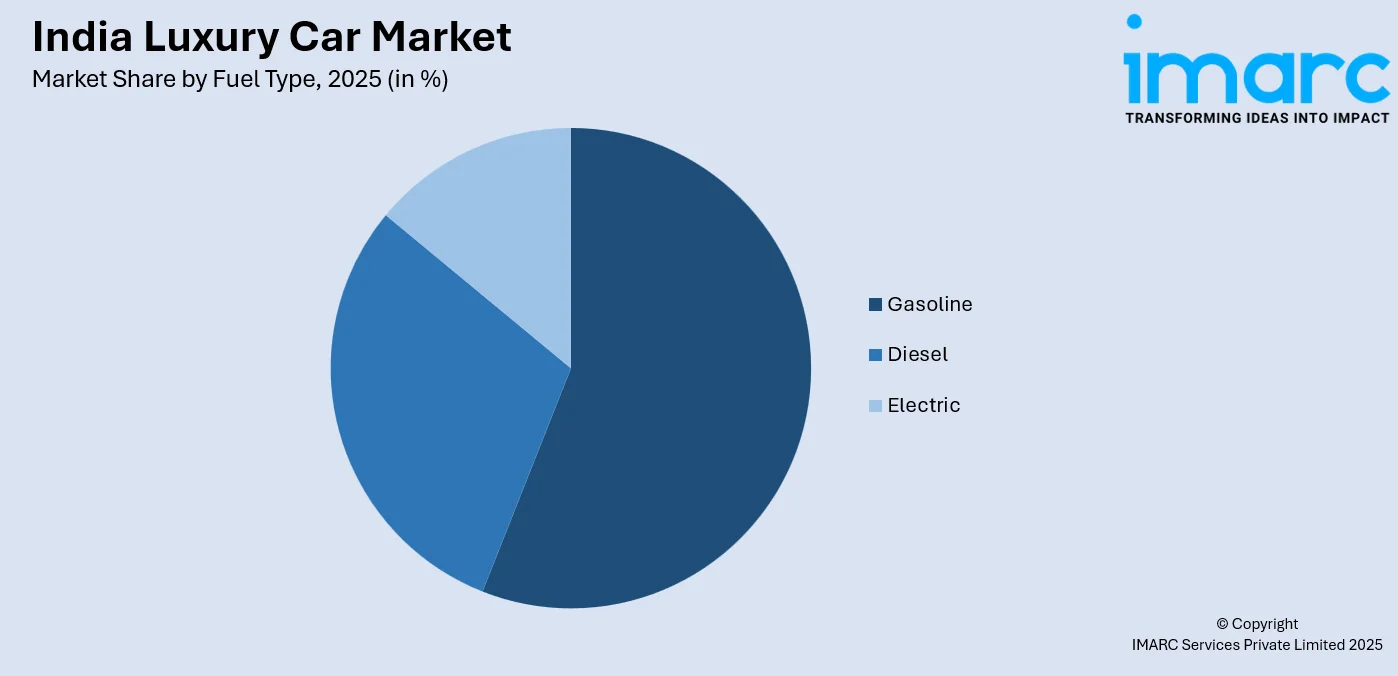

- By Fuel Type: Gasoline leads the market with a share of 56% in 2025. This dominance is driven by refined performance characteristics, smoother driving experience, and wider model availability that align with luxury buyer expectations. Lower maintenance requirements and extensive fuel infrastructure strengthen segment positioning.

- By Price Range: High-end represents the biggest segment with a market share of 40% in 2025, reflecting strong consumer appetite for premium features, advanced technology integration, and exclusive ownership experiences. Locally assembled variants enable competitive pricing while maintaining luxury standards for aspirational buyers.

- By Engine Capacity: Upto 3,000 CC exhibits a clear dominance in the market with 77% share in 2025, owing to optimal balance between performance and fuel efficiency preferred by urban commuters. Tax structure favoring smaller displacement engines and manufacturer focus on turbocharged powertrains enhance segment attractiveness.

- By Region: North India is the largest region with 26% share in 2025, driven by high concentration of affluent consumers in Delhi-NCR, Gurgaon, and Chandigarh metropolitan areas. Extensive dealership networks, corporate headquarters presence, and established luxury retail infrastructure support regional leadership.

- Key Players: Key players drive the India luxury car market by expanding product portfolios, improving technology integration and safety features, and strengthening nationwide distribution networks. Their investments in localized manufacturing, customer experience enhancement, and electric vehicle launches boost awareness, accelerate adoption, and ensure consistent product availability across diverse consumer segments.

To get more information on this market Request Sample

The India luxury car market is advancing as manufacturers strengthen their presence through localized assembly operations and expanded dealership networks targeting affluent consumers in metropolitan and tier-two cities. Rising disposable incomes among professionals, entrepreneurs, and corporate executives are transforming premium vehicles into accessible status symbols that represent success and refined taste. Younger buyers, particularly those under forty-five years, now constitute a significant portion of the customer base, driving demand for technologically advanced models featuring cutting-edge infotainment systems, autonomous driving assistance, and connected car capabilities. In 2024, the Indian luxury car market surpassed 51,000 units for the first time, marking a milestone achievement that underscores growing consumer acceptance of premium automobiles. Brand consciousness and exposure to global automotive trends are reshaping purchase decisions as buyers increasingly prioritize superior craftsmanship, personalized ownership experiences, and comprehensive after-sales support over traditional cost considerations, positioning the segment for sustained expansion across diverse demographic profiles.

India Luxury Car Market Trends:

Accelerating Shift Toward Electric Luxury Mobility

The luxury electric vehicle segment is witnessing remarkable momentum as premium manufacturers expand their zero-emission portfolios. Leading brands are introducing sophisticated electric models featuring extended range capabilities and advanced charging technologies. In January 2025, Mercedes-Benz India announced plans to launch eight new models focusing on battery electric vehicles and allocated INR 450 crore for dealership transformation and installation of over 100 DC fast chargers nationwide. Affluent consumers increasingly view electric luxury vehicles as symbols of environmental consciousness combined with technological sophistication.

Expansion into Tier-Two and Tier-Three Cities

Luxury carmakers are strategically expanding beyond traditional metropolitan strongholds to capture emerging demand in smaller cities. Rising wealth creation among entrepreneurs and professionals in cities like Indore, Surat, Lucknow, and Coimbatore is attracting significant manufacturer attention. Brand showrooms in tier-two hubs are now witnessing double the footfall compared to previous years. In March 2025, BMW Group India opened a Retail.NEXT showroom in Central Delhi, blending immersive digital tools with concierge-style customer engagement to enhance retail experiences.

Growing Demand for Top-End Ultra-Luxury Vehicles

As affluent customers desire exclusivity and a customized ownership experience, the super-luxury market is expanding at an extraordinary rate. Customers that value both advanced engineering and reputation are drawn to performance variants and flagship models. Concierge-led sales journeys, limited editions, and customisation programs are driving demand. Customers anticipate strong brand legacy, state-of-the-art drivetrains, and handcrafted interiors. In response, high-net-worth urban buyers demanding discretion, service, and control are responding with exclusive previews, invitation-only launches, and customized financing that reinforce status, comfort, and long-term brand loyalty.

Market Outlook 2026-2034:

The India luxury car market is positioned for sustained growth as macroeconomic fundamentals and consumer demographics continue favoring premium automobile adoption. Manufacturers are intensifying product offensives with diverse model introductions spanning sedans, sports utility vehicles, and electric variants to capture evolving preferences. Strategic investments in localized assembly operations enable competitive pricing while maintaining brand exclusivity across target segments. The market generated a revenue of USD 1.26 Billion in 2025 and is projected to reach a revenue of USD 1.98 Billion by 2034, growing at a compound annual growth rate of 5.09% from 2026-2034. Expanding high-net-worth population, improved financing accessibility, and enhanced dealership experiences are expected to drive consistent volume growth as luxury brands deepen penetration across metropolitan and emerging urban markets.

India Luxury Car Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Vehicle Type |

Sports Utility Vehicle |

57% |

|

Fuel Type |

Gasoline |

56% |

|

Price Range |

High-End |

40% |

|

Engine Capacity |

Upto 3,000 CC |

77% |

|

Region |

North India |

26% |

Vehicle Type Insights:

- Hatchback

- Sedan

- Sports Utility Vehicle

Sports utility vehicle dominates with market share of 57% of the total India luxury car market in 2025.

Sports utility vehicles have established commanding leadership in the India luxury car market through their compelling combination of versatility, safety perception, and aspirational appeal. The segment addresses diverse consumer requirements spanning urban commuting, family transportation, and occasional long-distance travel across varied road conditions prevalent throughout the country. Premium SUVs offer elevated seating positions, spacious interiors with multiple configuration options, and robust build quality that resonates with status-conscious buyers seeking vehicles that project success and lifestyle sophistication.

Manufacturers are responding to surging SUV demand through expanded model portfolios featuring diverse size categories from compact crossovers to full-size flagships. Technology integration including advanced driver assistance systems, panoramic sunroofs, and connected car features enhances segment attractiveness among tech-savvy consumers prioritizing digital connectivity and safety innovations. Local assembly operations enable competitive pricing for entry-level luxury SUVs while maintaining premium positioning and brand exclusivity. The segment particularly appeals to younger affluent professionals and first-generation entrepreneurs who value the combination of practicality and prestige that luxury SUVs uniquely deliver within the Indian automotive landscape.

Fuel Type Insights:

Access the comprehensive market breakdown Request Sample

- Gasoline

- Diesel

- Electric

Gasoline leads with a share of 56% of the total India luxury car market in 2025.

Gasoline-powered luxury vehicles maintain market leadership through refined performance characteristics, smoother power delivery, and quieter operation that align precisely with premium buyer expectations for sophisticated driving experiences. The segment benefits from extensive fuel infrastructure availability across urban and semi-urban territories, ensuring convenient ownership without range limitations affecting electric alternatives. Stricter emission regulations and gradual diesel phase-out in metropolitan areas have accelerated consumer migration toward cleaner gasoline powertrains. BMW launched its 3 Series Long Wheelbase in February 2025 featuring the most powerful petrol engine in its segment, locally produced at Chennai manufacturing facility.

Luxury manufacturers continue to emphasize gasoline portfolios, offering far more variants than alternative fuel options. Buyers can choose across engine outputs, body styles, drivetrains, and pricing tiers without compromising brand identity. Gasoline powertrains also benefit from easier servicing, widespread technician familiarity, and consistent long-term reliability. For Indian luxury buyers who value convenience, refinement, and everyday usability, turbocharged gasoline engines provide smooth power delivery, responsive acceleration, and efficiency that aligns well with frequent city use and occasional highway travel.

Price Range Insights:

- Entry-Level

- Mid-Level

- High-End

- Ultra

High-end exhibits a clear dominance with 40% share of the total India luxury car market in 2025.

The high-end price segment appeals to consumers seeking a comprehensive luxury experience without stepping into the ultra-premium territory that demands substantially higher financial investment. This segment allows manufacturers to integrate sophisticated technology packages, including advanced infotainment systems, premium audio setups, adaptive safety suites, and driver-assistance features, all while maintaining pricing that remains accessible to aspirational luxury buyers. Locally assembled variants within this range benefit from reduced import duties, enabling automakers to offer competitive pricing relative to international benchmarks.

Many manufacturers focus on completely knocked-down (CKD) assembly operations, which help maintain attractive pricing without diluting the perceived luxury and exclusivity of the brand. The primary buyers in this segment are often first-generation entrepreneurs and senior corporate professionals, who view premium vehicles as visible markers of success and meaningful lifestyle investments. Additionally, enhanced dealership experiences, including personalized sales consultations, extensive vehicle customization options, and comprehensive warranty coverage, further strengthen the segment’s appeal, ensuring that buyers not only purchase a car but also engage with a full-service luxury ownership experience that aligns with their status and aspirations.

Engine Capacity Insights:

- Upto 3,000 CC

- Above 3,000 CC

Upto 3,000 CC represents the leading segment with 77% share of the total India luxury car market in 2025.

Vehicles with engine displacement up to 3,000 cubic centimeters continue to dominate the luxury automotive market by offering an optimal balance between performance capabilities and operational efficiency, which discerning consumers increasingly demand. This engine category encompasses most popular luxury sedans, compact SUVs, and entry-level performance variants, all of which contribute significantly to overall national sales volumes. The favorable taxation framework, which imposes lower duties on smaller displacement engines compared to larger powertrains, further enhances the segment’s competitiveness and accessibility.

Advances in turbocharging and engine management technologies allow manufacturers to extract premium performance from smaller engines, delivering acceleration, refinement, and driving dynamics that meet the high expectations associated with luxury vehicles. Urban commuting trends prevalent among Indian luxury consumers further reinforce the appeal of these powertrains, as they provide sufficient power for city driving while maintaining fuel efficiency on longer highway journeys. Additionally, growing environmental awareness among younger buyers strengthens demand for efficient engines that combine luxury features with reduced carbon footprints, supporting sustainable mobility and responsible consumption without compromising comfort or style.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India holds the largest share with 26% of the total India luxury car market in 2025.

North India continues to maintain its leadership in the luxury automotive market, driven primarily by the substantial concentration of affluent consumers, corporate headquarters, and government officials in key metropolitan areas such as Delhi-NCR, Gurgaon, and Chandigarh. These cities serve as hubs for high-net-worth individuals who prioritize premium mobility solutions as part of their lifestyle and professional image. The region also benefits from an extensive network of luxury car dealerships that provide not only comprehensive sales services but also personalized after-sales support, ensuring a seamless and satisfying ownership experience.

High disposable incomes, rapid urbanization, and the presence of established luxury retail infrastructure further reinforce the region’s attractiveness for both domestic and international automotive brands. Professionals, business owners, and senior executives increasingly seek vehicles that combine performance, technological sophistication, and premium comfort, contributing to sustained demand growth. Additionally, the culture of early adoption of premium products and lifestyle-driven consumption patterns in North India positions it as a strategic market for luxury manufacturers looking to expand sales while enhancing brand visibility and customer engagement in India.

Market Dynamics:

Growth Drivers:

Why is the India Luxury Car Market Growing?

Rising Affluence and Expanding High-Net-Worth Population

The expanding upper-middle class and growing number of high-net-worth individuals are fundamentally reshaping luxury automobile demand across India. Rising disposable incomes among professionals, entrepreneurs, and corporate executives are transforming premium vehicles from aspirational possessions into accessible lifestyle investments reflecting success and refined taste. Younger demographics, particularly professionals in their prime earning years, now constitute significant buyer proportions, driven by earlier wealth accumulation compared to previous generations and willingness to spend future earnings on immediate lifestyle upgrades. Affluent households are forecast to increase substantially over the coming years, laying a broad foundation for sustained luxury car market expansion. India is projected to experience among the largest global increases in ultra-high-net-worth individuals, with numbers expected to rise significantly over the forecast period. This demographic transformation materially enlarges the addressable consumer base while supporting premium pricing strategies as buyers prioritize brand prestige, advanced technology, and exclusive ownership experiences over cost optimization, driving consistent growth momentum despite broader economic fluctuations.

Localized Manufacturing and Competitive Pricing Strategies

Strategic expansion of completely knocked-down assembly operations enables luxury manufacturers to bypass steep import duties while offering competitive pricing without compromising brand exclusivity. Local production of sedans, sports utility vehicles, and increasingly electric models allows optimal pricing within key market segments, particularly the INR 50-80 lakh bracket capturing aspirational first-time luxury buyers. Tailored product adaptations including long-wheelbase variants, enhanced rear-seat cooling systems, and India-specific suspension calibrations demonstrate commitment to local market requirements beyond simple price optimization. Manufacturer investments extend beyond assembly operations to encompass supplier ecosystem development, service network expansion, and workforce training programs. These comprehensive localization strategies accelerate model refresh cycles, reduce delivery timelines, and strengthen after-sales support capabilities, collectively enhancing customer value propositions that support sustained market growth across diverse geographic and demographic segments.

Expanding Electric Vehicle Portfolio and Charging Infrastructure

The accelerating transition toward electric mobility is creating substantial growth opportunities within the luxury segment as manufacturers introduce sophisticated zero-emission models combining environmental consciousness with premium positioning. Government incentives including reduced goods and services tax rates, state-level registration benefits, and favorable import policies for electric vehicles are strengthening consumer adoption momentum. Premium electric vehicles address range anxiety concerns through advanced battery technologies delivering extended driving distances suitable for Indian travel patterns. Infrastructure expansion through manufacturer-installed fast chargers and third-party charging networks is progressively addressing accessibility constraints that previously limited electric adoption, positioning the segment for accelerated growth as charging convenience improves across metropolitan and emerging urban markets.

Market Restraints:

What Challenges the India Luxury Car Market is Facing?

High Taxation and Import Duty Burden

Combined goods and services tax and compensation cess charges can inflate ex-showroom prices, significantly increasing acquisition costs and constraining total addressable demand despite rising affluence. Import duties on completely built units remain among the highest globally, with effective levies reaching substantial levels following recent budget modifications that adjusted basic customs duty structures while introducing additional cess components. This taxation volatility complicates manufacturer pricing strategies and restricts market expansion potential.

Limited Charging Infrastructure for Electric Vehicles

Despite ongoing infrastructure development, many regions continue facing insufficient charging station availability, particularly in rural and semi-urban territories where luxury consumers increasingly reside. Range anxiety and inconvenient charging access discourage potential electric vehicle adopters, affecting luxury electric segment penetration rates. The absence of comprehensive, reliable fast-charging networks impedes seamless long-distance travel capabilities that luxury consumers expect, limiting electric adoption primarily to metropolitan areas with developed infrastructure ecosystems.

Underdeveloped Certified Pre-Owned Networks

The certified pre-owned luxury segment lacks scale especially outside the top ten metropolitan cities, constraining trade-in liquidity and suppressing upgrade cycles that support new vehicle purchases. Without comprehensive brand-backed refurbishment, financing, and warranty frameworks, affluent buyers remain wary of secondary market transactions, dampening resale values that underpin new car purchase decisions.

Competitive Landscape:

The India luxury car market features intensifying competition among established German manufacturers and emerging British, Japanese, and American brands seeking market share expansion. Leading companies are diversifying model portfolios, enhancing technology integration, and strengthening dealership networks to capture evolving consumer preferences across metropolitan and tier-two cities. Strategic investments in localized manufacturing operations enable competitive pricing while maintaining brand exclusivity essential for luxury positioning. Electric vehicle introductions, personalized ownership experiences, and comprehensive after-sales services are emerging as key competitive differentiators. Manufacturers are increasingly focusing on digital retail channels, subscription models, and certified pre-owned programs to broaden market access while fostering customer loyalty across vehicle ownership lifecycles.

India Luxury Car Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchback, Sedan, Sports Utility Vehicle |

| Fuel Types Covered | Gasoline, Diesel, Electric |

| Price Ranges Covered | Entry-Level, Mid-Level, High-End, Ultra |

| Engine Capacities Covered | Upto 3,000 CC, Above 3,000 CC |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India luxury car market size was valued at USD 1.26 Billion in 2025.

The India luxury car market is expected to grow at a compound annual growth rate of 5.09% from 2026-2034 to reach USD 1.98 Billion by 2034.

Sports utility vehicle dominated the market with a share of 57%, owing to consumer preference for versatile vehicles offering commanding road presence, superior safety features, and spacious interiors suited to Indian driving conditions and family requirements.

Key factors driving the India luxury car market include rising number of high-net-worth individuals, increasing disposable incomes, growing urbanization, localized manufacturing enabling competitive pricing, and expanding electric vehicle portfolios with improved charging infrastructure.

Major challenges include high taxation and import duty burden inflating vehicle prices, limited charging infrastructure for electric vehicles in non-metropolitan areas, underdeveloped certified pre-owned networks constraining trade-in liquidity, and foreign exchange volatility affecting pricing strategies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)